Digital Banking App Case Study

An All-In-One Digital Banking Solution: A Banking Case Study For Simplified Experience

Client Background

The client is a forward-thinking FinTech company established as a trusted name in the modern financial industry.

With a strong emphasis on innovation and customer-centric solutions, the company recognized the growing demand for crypto banking solution and planned to tap into this thriving digital world with digital asset support.

With a strong emphasis on innovation and customer-centric solutions, the company recognized the growing demand for crypto banking solution and planned to tap into this thriving digital world with digital asset support.

What we did

SOLUTION

Banking App

DEMOGRAPHICS

UK

INDUSTRY

Fintech

- Discuss Your Ideas

Business Requirement

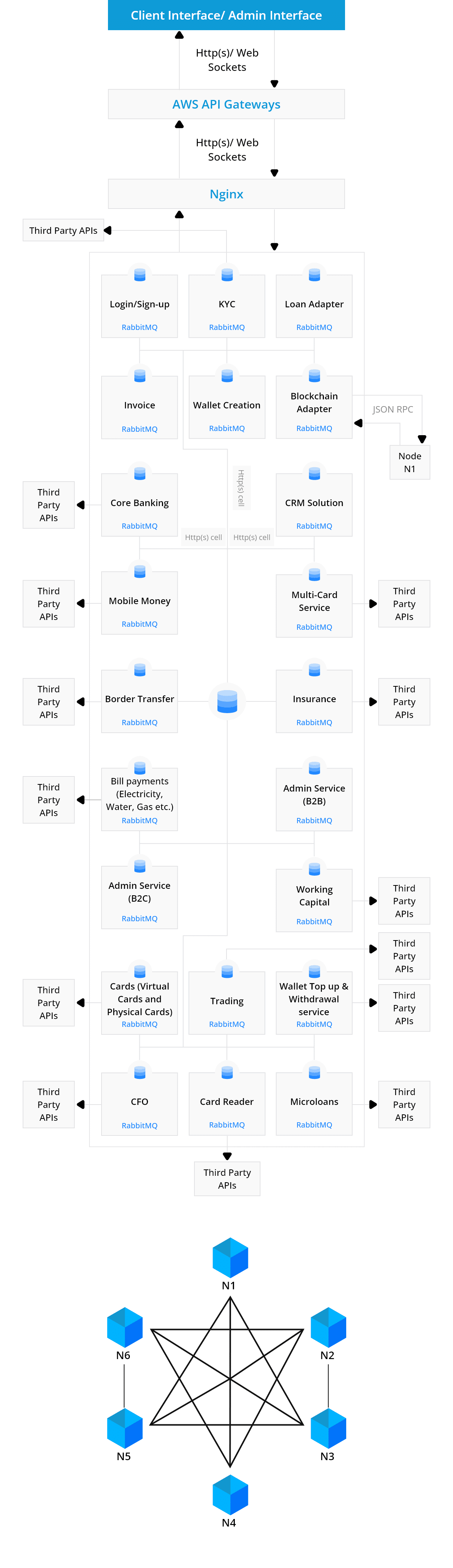

The company devised a vision of crafting a one-stop banking solution that could cater to the unique needs of its diverse customer base and approached Antier. Together we come up with a revolutionary idea to develop a white label ready, API-enabled application module for digital mobile and web banking application. The agenda is to render an easy, secure, and compliant open banking platform to traditional financial institutions (dealing in fiat money) and modern next-gen financial institutions (dealing in crypto assets).

Major challenges and concerns of the client included:

- No streamlined process for banking services

- Integrate crypto services for expanded financial offerings

- Address security concerns and prevent fraud in online transactions

Analysis & Approach

This banking app case study will take through the agile methodology and roadmap we followed to deliver exceptional services. On the receival of requirements from the client, we thoroughly analyzed the market trends and client business model to frame and work through a development lifecycle seamlessly focusing on rendering a comprehensive solution leveraging unparalleled skills and technical prowess.

Solution

The client of this digital banking case study intends to create a solution that will bring together banking, centralized exchange, and wallet features in a single platform. Considering the requisites, we brought the proposal of this all-in-one banking solution to give the easiest and safest modes to manage banking finance and cryptocurrencies.

The users can save their bank accounts and cards, check their account balances, and make their day-to-day bill payments. Users can transfer the money via bank account, registered phone number, or by using their QR code wherein every transaction will be recorded. The app provides access to centralized exchanges for buying and selling cryptocurrencies and also compares the rates of multiple cryptocurrencies. The price listing will be automatically updated using third-party integrations. Not just this, the users can even store their funds in the wallet, and swap them with other coins.

An exclusive feature is that platform will help users to apply for loans in a few quick and easy steps based on their account performance/scorecard eligibility. Customers will enjoy the flexibility to repay their loans before tenure closure as well. The web-based admin panel is also developed where the admin will manage the content, users, KYC, transactions, and reports/statistics.

The users can save their bank accounts and cards, check their account balances, and make their day-to-day bill payments. Users can transfer the money via bank account, registered phone number, or by using their QR code wherein every transaction will be recorded. The app provides access to centralized exchanges for buying and selling cryptocurrencies and also compares the rates of multiple cryptocurrencies. The price listing will be automatically updated using third-party integrations. Not just this, the users can even store their funds in the wallet, and swap them with other coins.

An exclusive feature is that platform will help users to apply for loans in a few quick and easy steps based on their account performance/scorecard eligibility. Customers will enjoy the flexibility to repay their loans before tenure closure as well. The web-based admin panel is also developed where the admin will manage the content, users, KYC, transactions, and reports/statistics.

Key Differentiators

Build a Similar Feature-Packed Digital Banking Solution

Features

A Visual Journey Through Our Trailblazing Project

Final Outcome

31%

Higher User Retention

50%

More Repeat Transactions

30%

Higher Transaction Value

200%

Higher Download Rate

100%

Higher Revenue Per User

40%

User Sign-Up Conversion Rates

True North Achieved

Implementing the digital crypto banking solution provided by Antier was a game-changer for our business. Their digital crypto friendly banking solution not only met our specific requirements but exceeded our expectations in terms of functionality and reliability.

Build a Similar Feature-Packed Digital Banking Solution

Choose Our Crypto Friendly Digital Banking Solution to Transform the Way You Bank, Save, and Invest. Approach Antier and Forget your Worries!