Crypto Banking Solutions: A Step to Streamlined Financial Services

With the growing popularity of cryptocurrencies and contactless payments, there is an increasing interest in launching crypto banks for wider reach. Whether you are a bank, a financial institution, a start-up, or a well-established business planning to enter the market with your own crypto bank, we take pride in rendering you with our comprehensive crypto banking solutions.

Antier is a reliable name for its ready-to-use digital banking solution offering a comprehensive range of financial services, including bank accounts, credit/debit cards, trading, and user-friendly payment options. With our expertise, we can enhance your business operations and provide a seamless onboarding experience for your users.

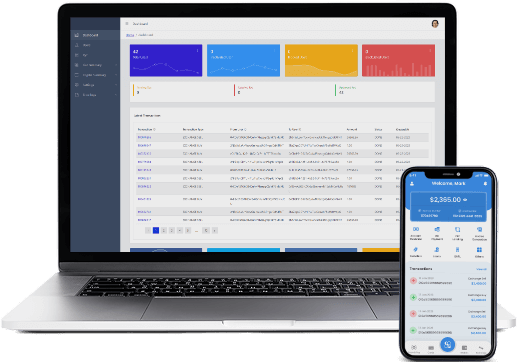

Banking at your Fingertips

Take Your Digital journey to New Heights with White Label Digital Bank Solution

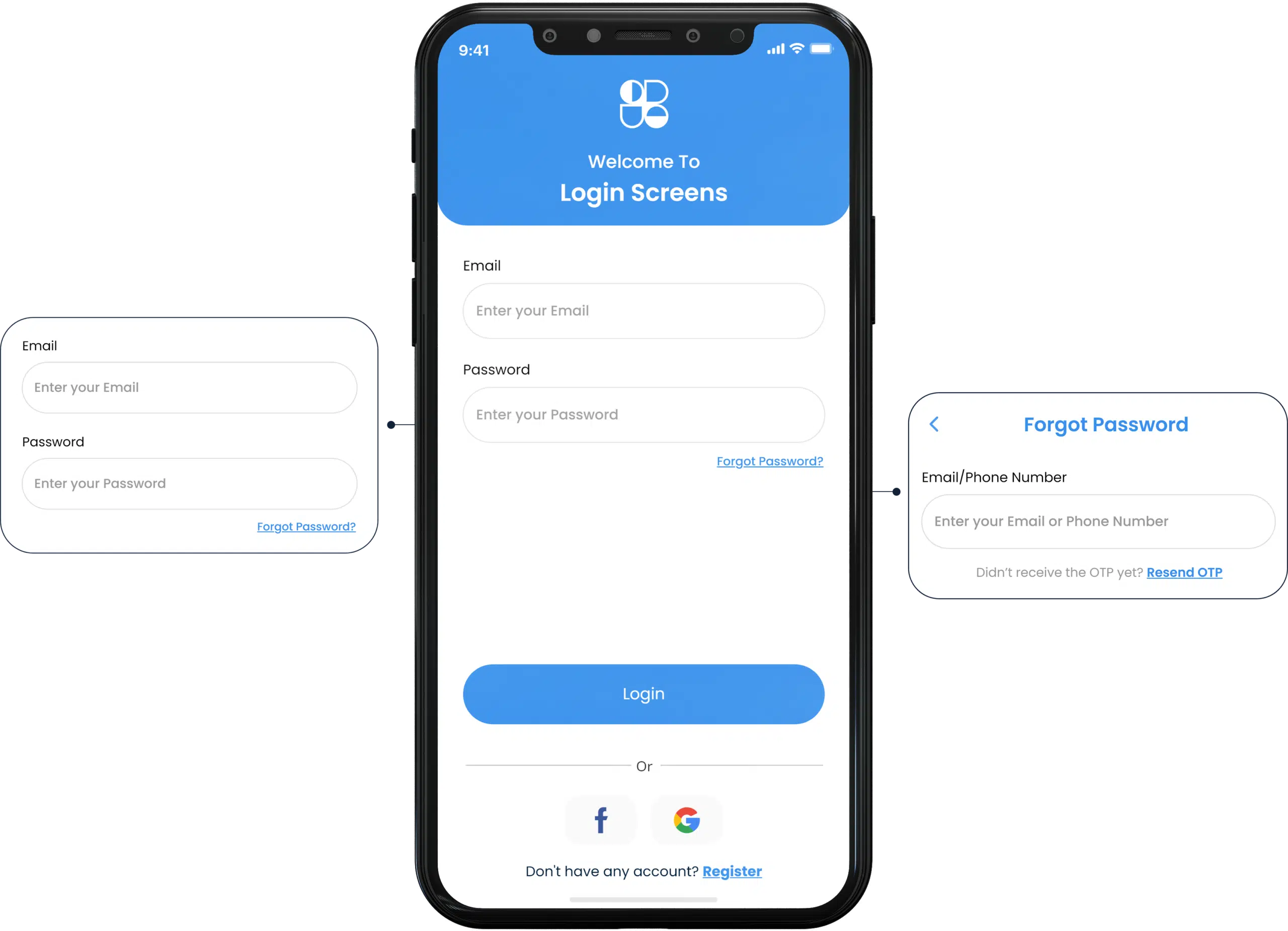

An Insight into White Label Banking Platform

Discover the power of our state-of-the-art white label banking platform and propel your financial institution to new heights. The platform can accelerate your market entry, reduce costs, and provide an exceptional banking experience to your customers with an easy-to-use and mobile-friendly application.

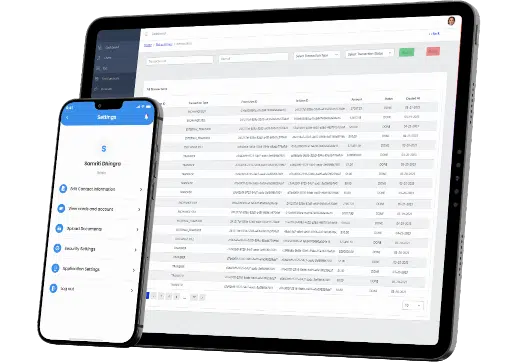

- 01. Login - Seamless Onboarding

- Secure and Convenient

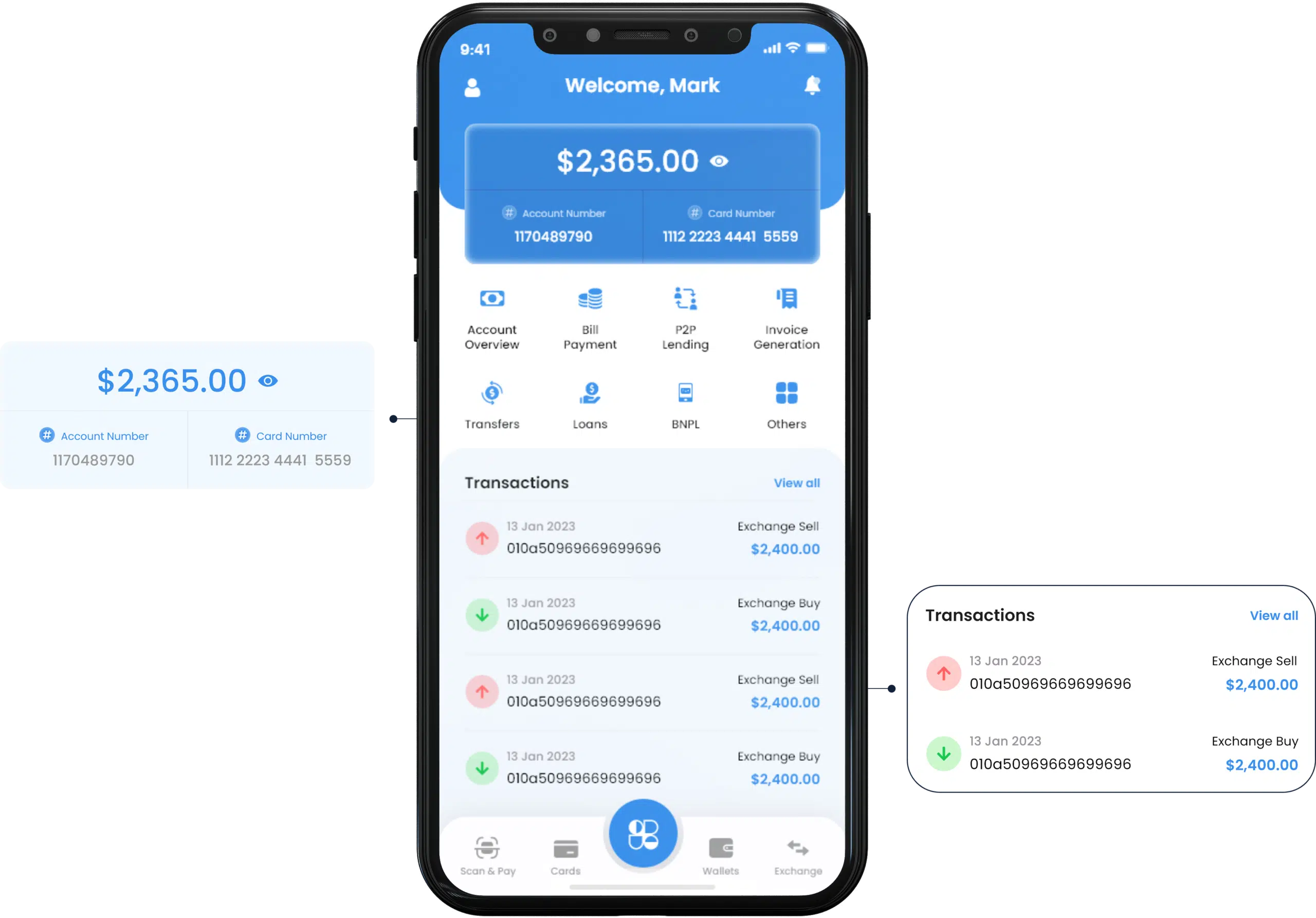

- Hassle-Free Multiple Login - 02. Dashboard - Personalized Dashboard

- Intuitive Account Overview

- Easy to Use

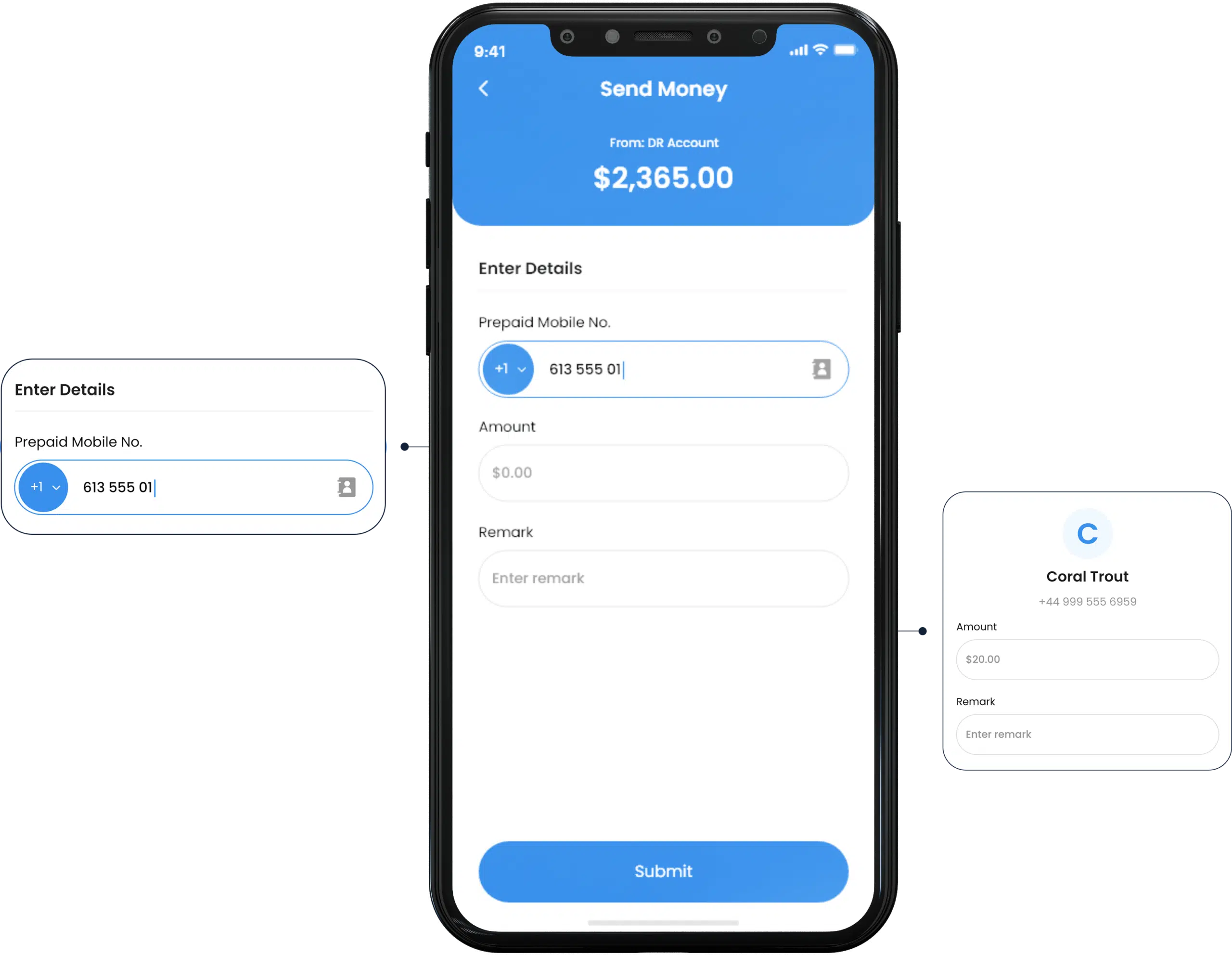

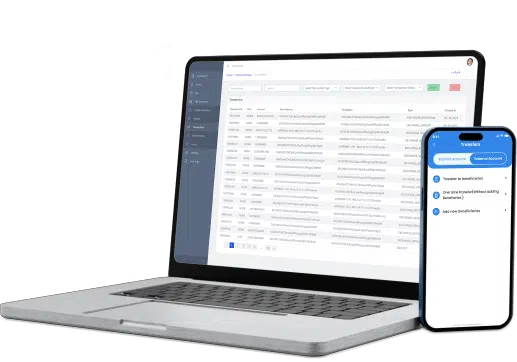

- Transaction History - 03. Payment Process - Quick Payment Options

- Multi-currency Support

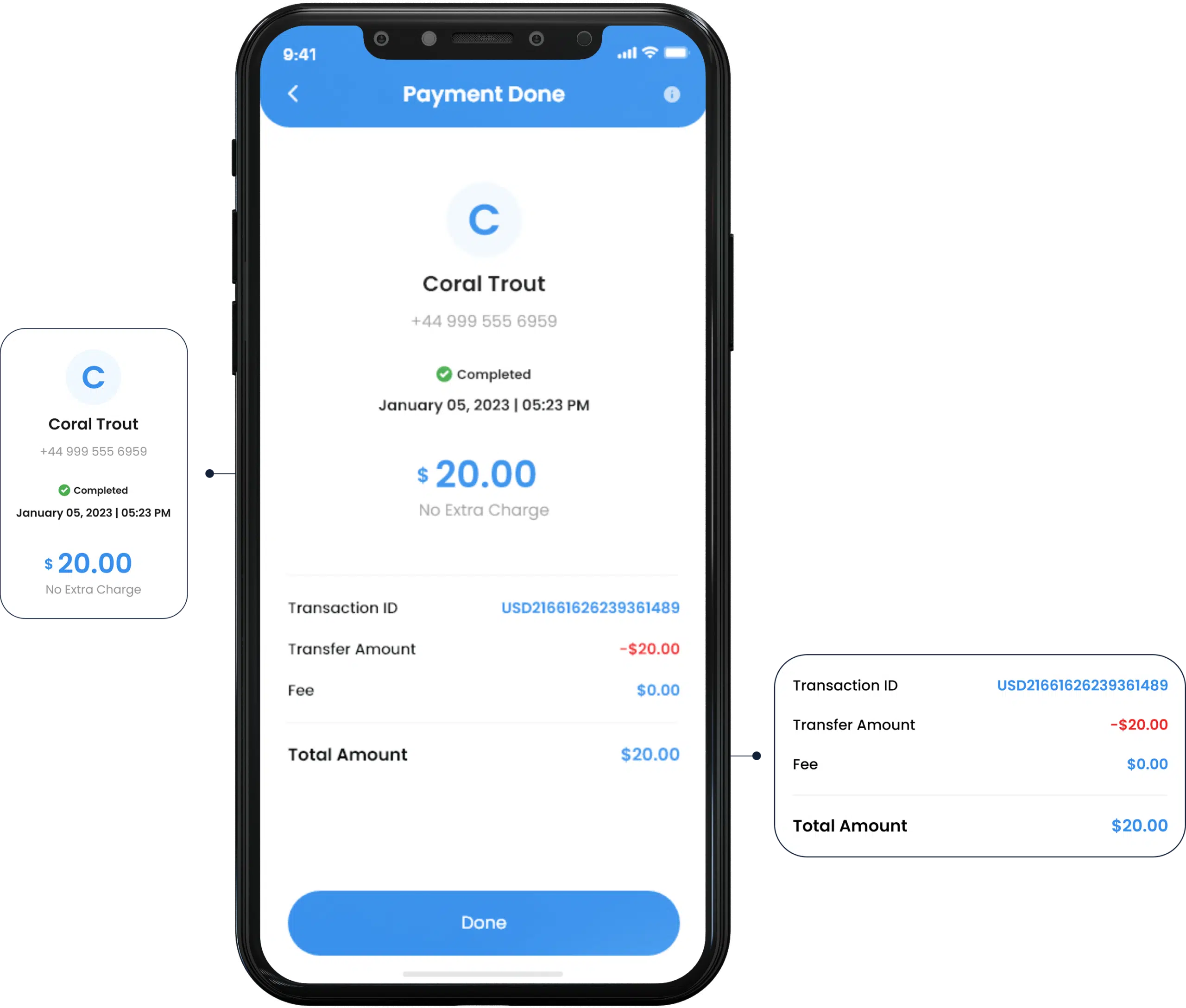

- Secure Payment Processing - 04. Transaction Completion - Detailed Payment Breakdown

- Real-Time Payment Confirmation

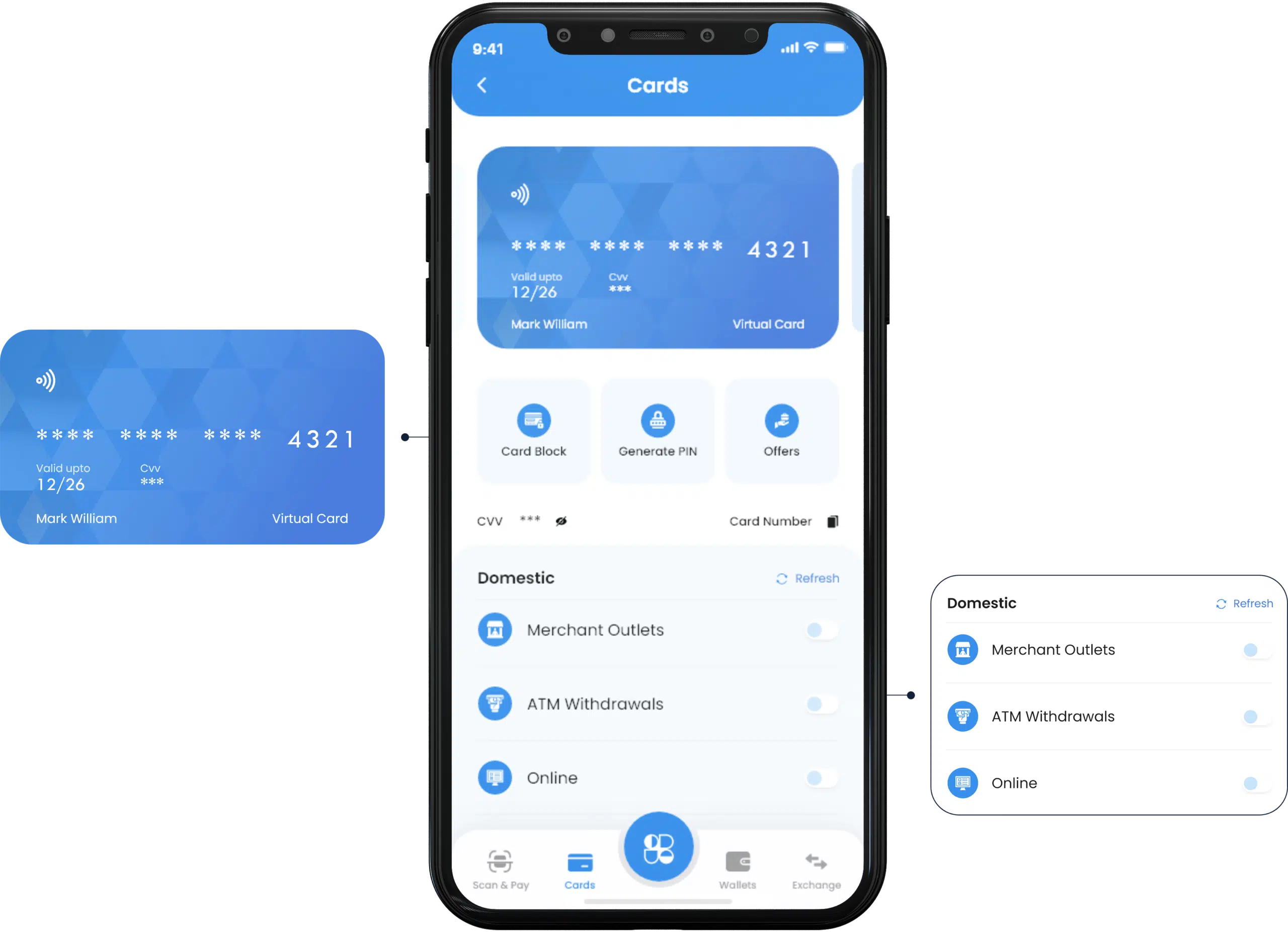

- Transparent Payment History - 05. Virtual cards - Mobile Virtual Card Accessibility

- Secure Virtual Card CVV Codes

- Privacy Features

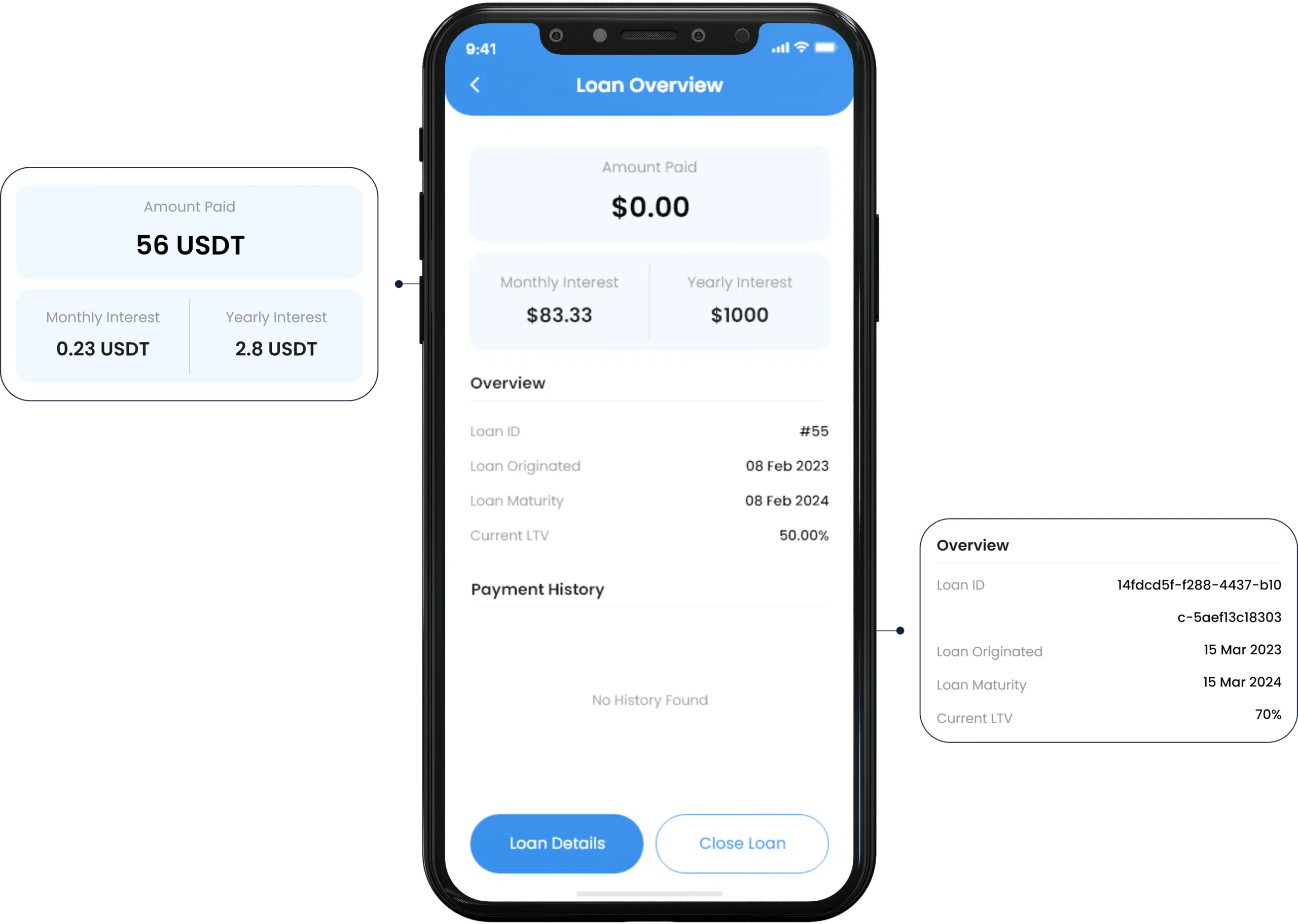

- Locking and Unlocking Capability - 06. Loan Management - Comprehensive Loan Overview

- Personalized Loan Offeringst

- Flexible Loan Repayment

- Hassle-Free Status Tracking

Building Blocks of Our Powerful Crypto Banking App Development

Go beyond your customers’ expectations by providing a feature-rich crypto banking app built on top of state-of-the-art infrastructure. At Antier, we offer a crypto banking application that suits both Android and iOS systems with easy-to-use features for admin as well as users.

Intuitive front-end

- Easy-to-operate dashboard

- Visual hierarchy of options

- Immersive user experience

- Clutter-free navigation

- Easy to understand visual cues

- Quick access on frequent usage

Secure APIs

- Smooth third-party connection

- Seamless and secured integration

- Frictionless data transmission

- Regular updates

- Compliance with standards

Banking modules

- Comprehensive banking functionalities

- Seamless finance management

- Smooth and secure transfers

- Customizable alerts/notifications

- Customer support with chatbots

- Personalized banking tools

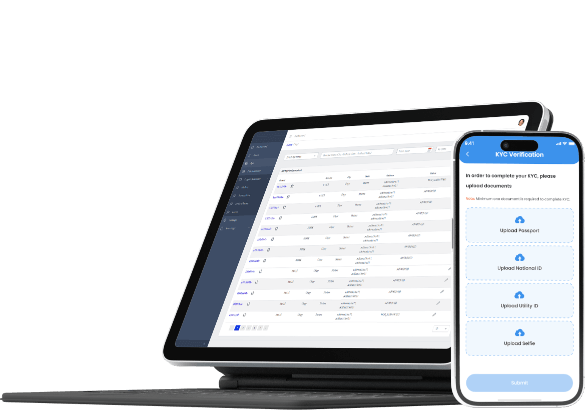

Robust Security

- Cutting-edge security protocols

- Multi-factor authentication

- Safeguard user data

- Secure Password Policies

- QR Code Authentication

- Biometric Identification

- Document Authentication

Discover the Joy of Easy-Peasy Banking With Robust Solutions

Get Your Bespoke Digital Banking Solutions to Simplify Your Financial Journey

What Our Crypto Digital Banking Solution Serves?

The one-stop solution for all your digital banking needs

As the pioneer of digital innovations, we are working with cutting-edge blockchain technology to comprise our scalable crypto banking solution with

Level up your Banking with White Label Neo Banking Platform

Bringing your neobank to life is easy and quick at Antier with a high-end white label neo banking platform. Harness the potential of our pre-designed white label neo banking solution with a customizable feature to offer your customers a comprehensive suite of digital financial services that fit their lifestyles and modify the way they bank.

Attract and retain customers with our white label neo banking platform and stay ahead of the competition with next-gen features:

- Value-added tools

- User-friendly interface

- Real-time tracking

- Hassle-free operations

- Virtual Financial Assistant

- Smart Savings Goals

- Multi-Language Support

- Autonomous nature

Say goodbye to long waiting times!

Accelerate your banking operations with instant transactions using our neo-banking solution.

Why choose us for Crypto Banking Solution?

By partnering with Antier, you can rely on a team of seasoned finance and technical experts with real-world experience creating countless crypto banking success stories.