Yield Farming in Decentralized Finance

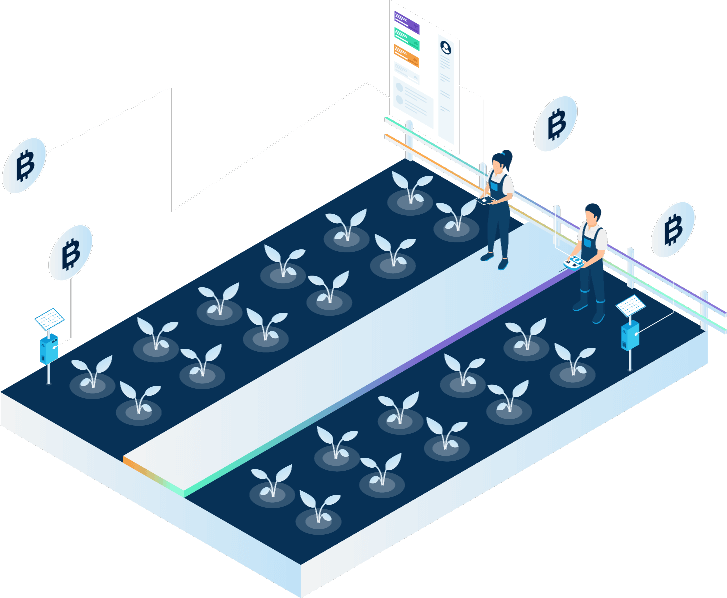

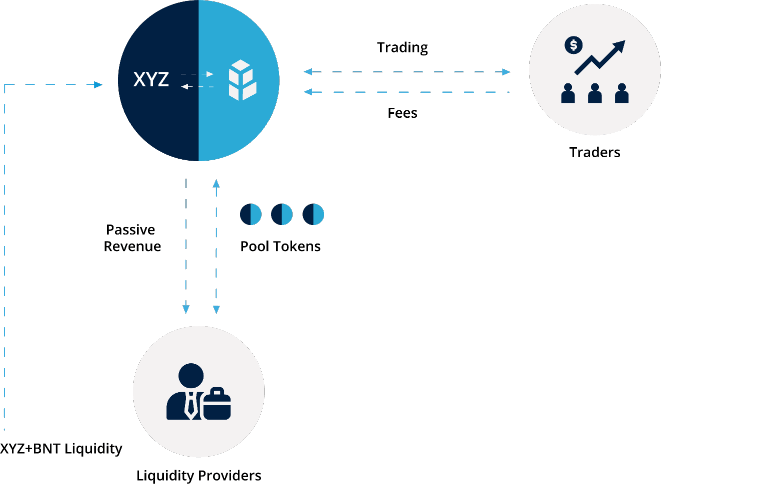

Yield farming refers to the process of earning rewards by staking cryptocurrencies or any other digital assets. It incentivizes liquidity providers to stake or lock up their crypto assets in a smart-contract-based liquidity pool. The higher the number of funds added to the liquidity pool, the higher the rewards.

As an ingenious application of decentralized finance (DeFi), yield farming has acquired significant popularity globally. The yield farming market grew from $500 million to $10 billion in 2020, making it the biggest driver of growth of the still-nascent DeFi sector. Get in touch with our DeFi yield farming development company to know more about our offerings.

Our DeFi Yield Farming Development Services

We are a leading DeFi yield farming development company offering a wide range of services listed below.

Looking forward to Building Your Own Customized DeFi Yield Farming Platform

Including All the Required Features and Functionalities?

Benefits of DeFi Yield Farming Development

Here are a few stunning benefits of yield farming in decentralized finance

Are You Ready to Discuss Your DeFi Yield Farming Development Project with Us?

DeFi Yield Farming Platforms and Protocols

Check out the platforms and protocols for DeFi yield farming.

Why Choose Antier as a DeFi Yield Farming Development Services Company?

Antier is a top-rated DeFi yield farming development company appropriately catering to the varied requirements of different projects, thereby ensuring complete satisfaction among all. Here are a few benefits you get when you choose us to build your DeFi yield farming platform.