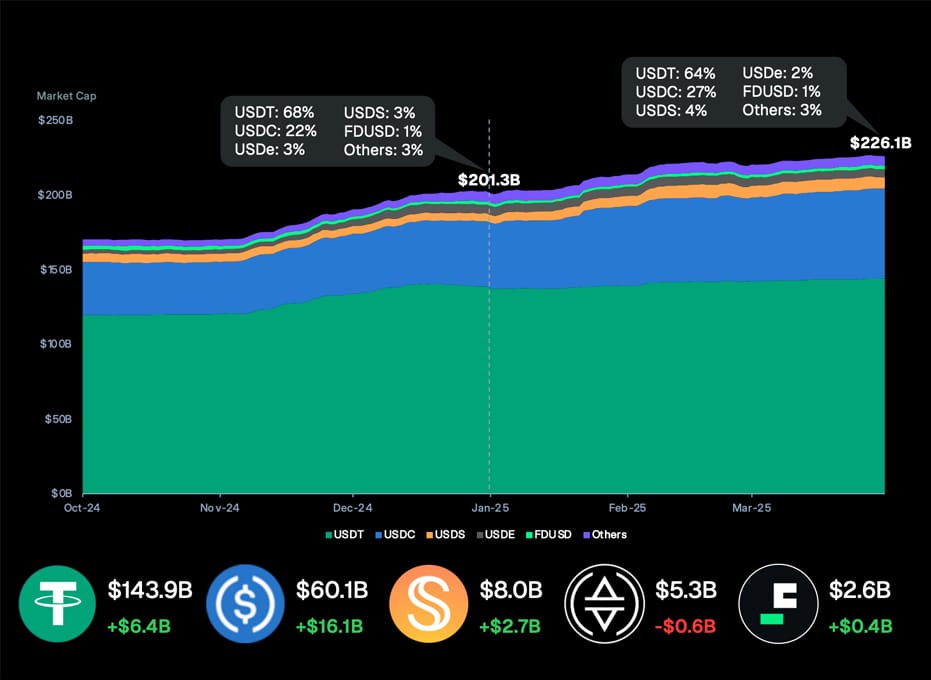

If you thought stablecoins were just another fad in the crypto world, think again. In Q1 2025 alone, the stablecoin market added a staggering $24.5 billion in value, catapulting total capitalization to an all-time high of $226.1 billion.

Behind this explosive growth lies something far more sophisticated than conventional token contracts: programmable stablecoin contracts purpose-built to keep value stable, enforce compliance automatically, and transform how money moves across borders. Today, we’re watching banks, fintech giants, and even conservative institutions ditch outdated payment rails in favor of smart contracts that can mint, burn, and reconcile funds with precision no legacy system can match.

But what exactly makes stablecoin development and contracts different, and why are companies racing to deploy them as the backbone of tomorrow’s programmable money? Let’s break down the hidden mechanics driving this shift and explore how the right development partner can help you build stablecoin solutions that are secure, compliant, and ready to scale in a world that increasingly demands transparency and speed.

What Is a Stablecoin Contract?

At its core, a stablecoin contract is a programmable smart contract deployed on a blockchain to mint, burn, and track stablecoins in circulation. Unlike generic token contracts, stablecoin contracts embed rules around collateralization, compliance, settlement flows, and in some cases, dynamic peg mechanisms. For instance, a contract may programmatically enforce over-collateralization ratios or trigger mint/burn events based on real-time oracle data feeds. A privacy stablecoin contract extends this functionality further by incorporating ZKPs or confidential transactions, enabling secure, private transfers without compromising regulatory oversight.

As more fintech leaders and banks move away from Web2 rails toward Web3 infrastructure, stablecoin contracts have become the backbone of reliable value transfer, transparent auditing, and liquidity assurance, essentials that any top-tier stablecoin development company brings to the table.

The Data Behind Stablecoin’s Rapid Rise

According to Circle’s State of the USDC Economy report, over 70% of institutional treasury managers now consider stablecoins a “strategic priority,” citing benefits ranging from 24/7 settlement and reduced counterparty risk to programmatic compliance. Even traditionally conservative financial institutions have begun to reimagine cash management and cross-border payments with stablecoin rails at their core.

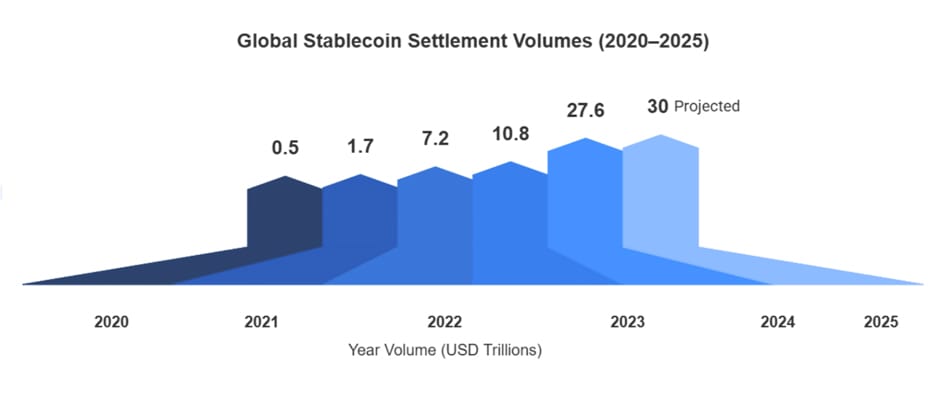

Below is a snapshot illustrating how dramatically stablecoin settlement volumes have grown in just five years:

These milestones demonstrate why governments, venture capital firms, and multinational institutions are accelerating investments in stablecoin development. Stablecoin contracts have swiftly moved beyond experimentation, emerging as the essential infrastructure powering programmable money worldwide.

Which Stablecoin Contracts vs. Traditional Token Contracts: What’s Different?

Stablecoin contracts aren’t just upgraded token contracts; they’re purpose-built systems with unique capabilities. Here’s how they differ at a glance:

These differences explain why serious enterprises rely on expert stablecoin development services to build scalable, compliant solutions. Businesses can lay the groundwork for robust smart contracts that align with regulatory expectations and support seamless integrations by engaging experienced partners early in the process. This proactive approach not only accelerates time to market but also unlocks strategic advantages, as we’ll explore in the key benefits of deploying stablecoin contracts from the outset.

Key Advantages of Deploying Stablecoin Contracts Early On

Embedding stablecoin contracts early in your stablecoin development process offers powerful benefits that shape long-term success across industries.

- Predictable Value Management: Contracts automate minting and redemption, maintaining a consistent peg and reducing volatility from the outset—a core pillar of effective stablecoin development services.

- Built-In Compliance: Integrating KYC and AML controls early ensures regulatory frameworks are embedded rather than retrofitted, helping enterprises avoid costly delays.

- Transparent Audit Trails: A well-designed stablecoin contract provides immutable records, allowing banks, regulators, and auditors to verify activity in real time.

- Faster Settlement: Early deployment supports programmable workflows, enabling instant cross-border clearing and liquidity for fintech innovators.

- Scalability: Designing contracts at the start helps projects handle higher transaction volumes and complex logic as adoption grows, a reason many enterprises choose a trusted, stablecoin development company.

- Enhanced Security: Early-stage auditing and formal verification strengthen resilience against exploits, protecting sensitive data within privacy-stablecoin contracts.

- Seamless Web2 Integration: Embedding contracts early simplifies connecting legacy payment infrastructure with Web3 capabilities, reducing friction in settlement processes.

By prioritizing robust contract deployment from day one, organizations can launch secure, compliant solutions that scale confidently in the evolving digital economy.

What Role Will Stablecoin Contracts Play in the Web2 to Web3 Transition?

As organizations move beyond legacy payment systems, stablecoin contracts are quickly becoming the essential infrastructure enabling a smooth transition from Web2 to Web3. Unlike traditional transaction workflows, these contracts support programmable settlement logic, automatic reconciliation, and real-time compliance, all critical capabilities for enterprises that operate at scale. For instance, a multinational retailer can deploy a privacy-stablecoin contract to process cross-border payments securely while preserving customer confidentiality. Airlines and e-commerce platforms can integrate stablecoin settlement layers to automate refunds, loyalty programs, and supplier payouts without intermediaries. This level of efficiency simply isn’t possible on conventional rails.

To navigate this complexity, companies increasingly rely on a trusted stablecoin development company to design, implement, and audit solutions that align with global regulations and enterprise treasury requirements. These specialists ensure contracts are rigorously tested, resilient against security threats, and fully customized to support each organization’s unique business model. With adoption rising, stablecoin development is set to power programmable money, making it easier for institutions to deliver quicker, clearer transactions. These contracts act as the bridge between traditional infrastructure and modern Web3 networks.

The Recent Case Study

One notable example that underscores this trend comes from Europe, where leading banking institutions collaborated to launch a private stablecoin contract. This initiative demonstrated how permissioned minting mechanisms, integrated compliance workflows, and programmable settlement windows can all operate seamlessly at scale.

While the pilot showcased the transformative potential of enterprise-grade stablecoin frameworks, it also underscored the pressing need for customizable development approaches that reflect each organization’s regulatory obligations, treasury strategies, and technology landscape. For this reason, businesses searching for a reliable stablecoin development company increasingly prioritize partners who can adapt proven architectures into purpose-built solutions tailored for their specific markets and compliance standards.

Stablecoin Development Company Checklist for Success

When choosing a stablecoin development company, follow this checklist for success:

- Proven experience in stablecoin projects across major blockchains.

- Strong understanding of compliance (KYC, AML, audits).

- Expertise in secure smart contract development and testing.

- Flexible architecture for fiat-backed, crypto-backed, or algorithmic models.

- Positive client references and relevant case studies.

- End-to-end support, including maintenance and upgrades.

Achieve 100x Impact Through Antier’s Stablecoin Solutions

As stablecoin adoption accelerates past $226 billion, the organizations making their move now are the ones set to lead tomorrow’s financial landscape. From programmable settlement to real-time compliance, deploying advanced stablecoin development contracts is no longer optional; it’s the cornerstone of scalable, secure, and transparent finance.

When you partner with a trusted stablecoin development company like Antier, you gain access to proven expertise, end-to-end stablecoin development services, and deep technical capabilities that transform ideas into fully compliant, enterprise-grade solutions. Whether you’re exploring fiat-backed models, privacy-focused frameworks, or complex collateralization strategies, we deliver tailored stablecoin development that keeps you ahead of the curve and 100x closer to your goals.