Real-World Asset Tokenization Platforms are becoming a regulated financial reality. By 2026, the tokenized assets would cross $25 billion in value, and forecasts from leading financial consultancies anticipate that the market value of asset tokenization could surpass US$10 trillion by 2030. This high demand is driven by factors such as efficiency, fractional ownership, and enhanced liquidity that tokenization platforms bring across global capital markets.

For integration of tokenization in current business processes, compliance with securities law, custody regulations, and cross-border frameworks is non-negotiable. These factors define whether a tokenized ecosystem can operate sustainably.

This guide explores the leading firms offering Tokenized Asset Legal Services in the United States and provides a structured understanding of the services, methodologies, and governance models that underpin legally compliant tokenization infrastructure.

Why Do Businesses Need Legal Consultation for Launching an Asset Tokenization Platform?

Building a tokenization platform requires an integrated legal architecture that aligns with financial regulation, investor rights, asset custody, taxation, and operational compliance. The Legal experts help to ensure that! They classify tokens correctly, determine applicable securities exemptions, and establish compliant entity structures. They draft documentation, align smart contracts with enforceable rights, and manage KYC/AML, tax, and custody obligations.

Without legal oversight, platforms risk violating securities laws, facing regulatory penalties, or invalidating investor protections. The Asset Tokenization Consulting Framework, by experts, transforms tokenization from a technical exercise into a compliant, investor-ready financial framework capable of operating across multiple jurisdictions with confidence and credibility.

Here is What an RWA Tokenization Legal Consulting Firm Must Bring to the Table

The following are the must-haves when hiring your legal advisor for tokenizing the real-world assets:

- Asset-class expertise: Real estate tokenization, fine art tokenization, or commodities tokenization; all are different. Can the firm handle your asset type?

- Securities classification & exemption knowledge: U.S. tokens often hit Securities and Exchange Commission (SEC)/Commodity Futures Trading Commission (CFTC) land. Reg D, A+, S, ATS, etc, must be handled.

- Smart-contract legal alignment: The legal rights must map to code (token logic, permissions, transfer restrictions).

- Cross-border/jurisdictional strength: Much tokenization involves global investors or assets; thus, businesses need counsel who understands U.S. + maybe EU/Asia frameworks.

- Post-issuance governance & secondary-market readiness: Legal work doesn’t stop once tokens are minted. Custody, transferability, reporting, and investor communications matter.

- Due diligence on asset & structure: Are the underlying assets clean? Liens, title, valuations? The legal firm must verify.

- Clear fee structure & deliverables: Tokenization legal services can blow up on time/cost. Pick a firm with clarity.

- Reputation & track record: Partner with RWA Legal Tokenization Consulting Company, which has an excellent track record and reputation.

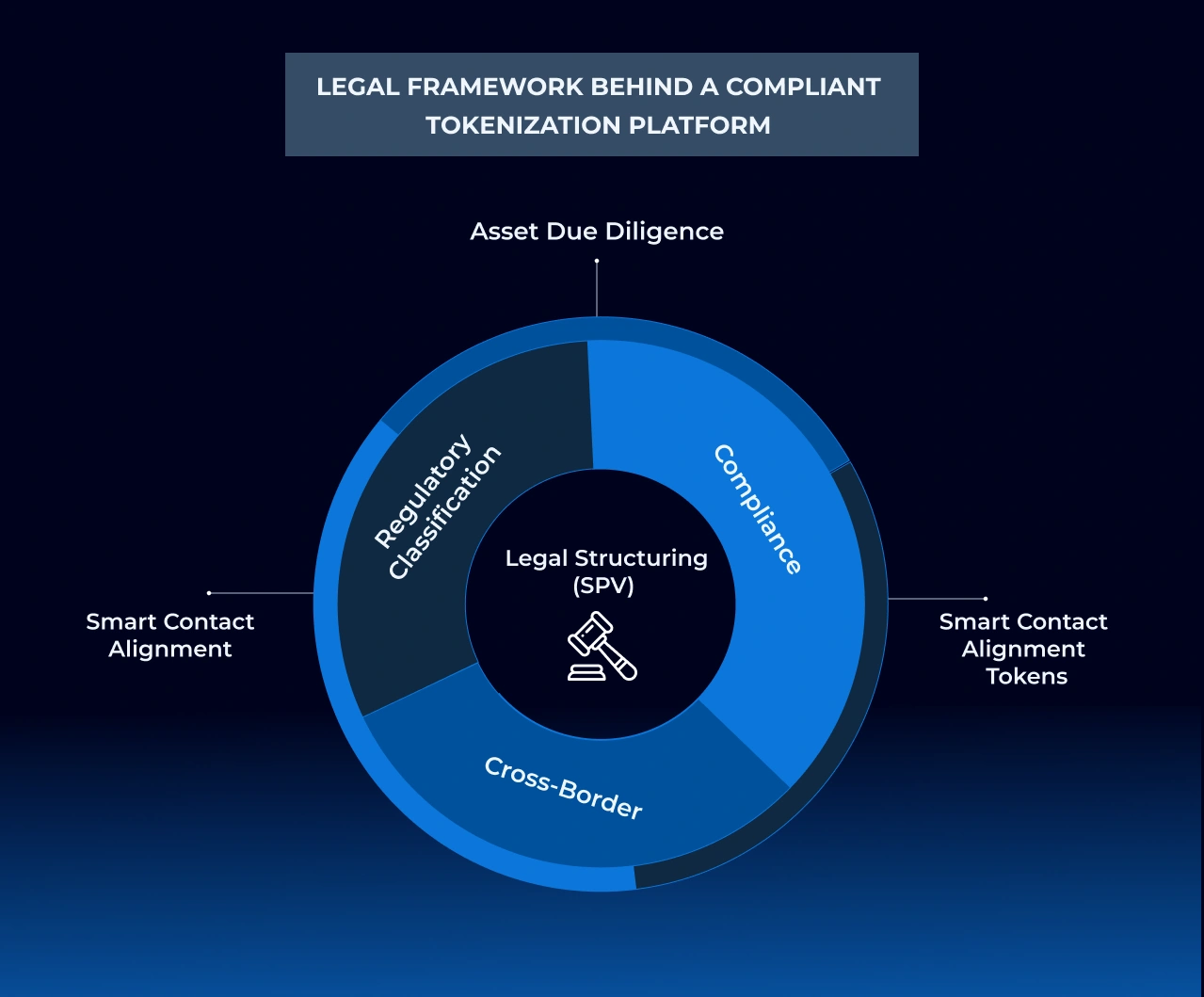

The Legal Architecture Behind the Real-World Asset Tokenization, and The Role of the RWA Legal Consulting Firm in It

1. Regulatory Classification and Licensing

Each tokenized asset must be correctly classified as a security, commodity, or utility token according to jurisdictional definitions. Misclassification can expose issuers to enforcement actions, trading restrictions, or invalidation of investor claims. Legal consultants interpret and apply exemptions such as Regulation D, Regulation A+, or Regulation S under the U.S. Securities Act and ensure filings comply with the Securities and Exchange Commission (SEC) and the Commodity Futures Trading Commission (CFTC).

2. Legal Structuring of the Issuer and the Asset

A compliant tokenization structure requires the creation of special-purpose vehicles (SPVs), trusts, or limited partnerships that legally hold the underlying assets. Consultants draft the governing documentation-subscription agreements, private placement memoranda, risk disclosures, investor rights, and distribution policies, so that on-chain tokens represent enforceable ownership interests.

3. Integration of Legal Obligations into Smart Contracts

For institutional platforms, the principle of “code = law” cannot operate without legal oversight. Token logic must reflect the contractual conditions governing ownership, transferability, redemptions, and voting rights. Consulting firms coordinate with developers to review and validate the smart-contract layer, ensuring that compliance rules are implemented directly in code.

4. Cross-Border Compliance

Global investors demand access to tokenized products across multiple jurisdictions. Legal advisors coordinate the interplay between U.S. regulations and regimes such as the EU Markets in Crypto-Assets Regulation (MiCA), Singapore MAS guidelines, and other regional frameworks. This coordination allows issuers to operate under legally harmonized offerings and avoid regulatory overlap.

5. Taxation, Custody, and Post-Issuance Governance

The taxation of tokenized assets differs across jurisdictions and asset classes. Legal consulting teams structure projects to optimize tax exposure while remaining compliant. They also advise on digital-asset custody licensing, insurance, and governance policies that define how issuers manage KYC/AML, reporting, and secondary-market activity after issuance.

Launch a Legally Compliant Asset Tokenization Platform with Antier

Here Are the Top RWA Legal Consulting Companies in the USA

1. Dilendorf Law Firm

Dilendorf Law Firm has earned recognition for its comprehensive approach to Tokenized Asset Legal Services. The firm specializes in structuring digital offerings under Regulations D and S, ensuring full compliance with the Securities Act of 1933. It has successfully advised issuers of tokenized real estate and private-equity funds on investor qualification, offering memoranda, and secondary-market restrictions.

For platform developers, Dilendorf provides the depth required to navigate U.S. federal and state regulations, including blue-sky laws and FINRA considerations.

Their experience makes them an appropriate choice for projects prioritizing legal defensibility and investor protection.

Core Expertise: U.S. securities law, Reg D/Reg S offerings, RWA structuring

Geographic Reach: United States

2. Antier

Antier approaches tokenization as a combined legal and technological endeavor. Its legal consulting division works in concert with blockchain architects to deliver “compliance by design” infrastructure. This RWA Tokenization Legal Consulting Company has advised financial institutions and issuers on projects ranging from tokenized real estate and private credit instruments to multi-asset platforms serving global investors.

Antier’s methodology incorporates regulatory analysis, smart-contract review, KYC/AML frameworks, investor accreditation systems, and ongoing compliance monitoring. By embedding legal logic directly into platform architecture, Antier reduces the gap between legal documentation and operational execution. This approach is especially relevant for banks and fintechs planning to launch white-label tokenization solutions without building infrastructure from scratch.

Core Expertise:

- Global RWA legal consulting and multi-jurisdictional compliance architecture

- Token classification and securities law alignment (SEC, MiCA, DFSA, ESMA)

- Smart-contract legal audit and compliance-by-design implementation

- Entity structuring, investor accreditation, and secondary-market governance

- Custody evaluation, tax advisory, and KYC/AML framework integration

- Legal consulting for white-label tokenization platforms and exchanges

Geographic Reach: United States, United Kingdom, Europe (EU), UAE (Dubai), MENA Region, Singapore, and Asia-Pacific

3. Prokopiev Law Group

Prokopiev Law Group has developed expertise in cross-border tokenization where assets or investors span multiple jurisdictions. The firm advises on setting up offshore SPVs that interface with U.S. securities exemptions and provides governance frameworks for DAO-based tokenized platforms. Its advisory extends to custody licensing, FATF compliance, and digital-asset risk management.

For projects with international investor bases or hybrid legal structures, Prokopiev offers pragmatic solutions that balance regulatory compliance with operational agility.

Core Expertise: Cross-border RWA structuring, DAO governance, custody licensing, FATF and AML compliance, tokenized SPV design

Geographic Reach: United States, European Union, Asia

4. Aurum Law

Aurum Law focuses on the tokenization of niche and tangible assets such as fine art, commodities, and carbon credits. Its attorneys combine intellectual-property, commercial, and securities law to structure token offerings that preserve ownership integrity and revenue distribution rights. The firm has supported issuers in fractionalizing high-value artworks and establishing audit-ready token registries for sustainable assets.

This specialization makes Aurum an effective partner for enterprises tokenizing assets that require provenance tracking and complex licensing models.

Core Expertise: Art and commodity tokenization, IP and licensing frameworks, ESG and carbon-credit tokenization, fractional ownership, provenance verification

Geographic Reach: United States and Europe

5. Baker McKenzie

Baker McKenzie remains a leader in institutional-level legal services for tokenization. With offices in over 90 jurisdictions, the firm provides cross-border coordination for banks and funds introducing digital asset products. Its digital asset practice covers tax advisory, data privacy, employment, and governance issues in addition to securities law.

The firm has advised on digital-bond issuances, tokenized loan syndications, and institutional stablecoin projects. It is best suited for enterprises requiring extensive jurisdictional coverage and regulatory certainty across multiple markets.

Core Expertise: Institutional RWA compliance, cross-border coordination, digital-bond and security-token structuring, tax and governance advisory, multinational legal harmonization

Geographic Reach: Global – North America, Europe, Asia, the Middle East, Latin America

Comparative Strengths and Strategic Fit

| Criterion | Dilendorf | Antier | Prokopiev | Aurum | Baker McKenzie |

|---|---|---|---|---|---|

| U.S. Securities Compliance | Excellent | Excellent | Strong | Moderate | Excellent |

| Cross-Border Capability | Limited | Global | Extensive | Moderate | Global |

| Technology Integration | Limited | Comprehensive | Moderate | Limited | Moderate |

| Asset-Class Breadth | Real estate, funds | Real estate, equity, commodities | Credit, hybrid | Art, commodities | multi-sector |

| Institutional Focus | Mid-market | Banks, fintechs, proptechs, real estate supply chain | Start-ups, cross-border issuers | Boutique client’s | large enterprises |

| Cost Efficiency | Moderate | Competitive | Competitive | Moderates | High |

Key checklist for issuers: Ask these before you sign on for RWA Legal Consulting Company

- Have you tokenized RWAs before? What asset classes? What jurisdictions?

- Will you advise on whether the token is a security/commodity/utility in my jurisdiction(s)?

- Can you structure the legal entity (SPV/trust/fund) that will hold the asset, issue tokens, and manage rights?

- Will you map KYC/AML, custody, transfer restrictions, and secondary-market rules?

- How will you ensure smart-contract logic aligns with legal terms? Will you review or collaborate on the tech/legal interface?

- Do you offer ongoing compliance and governance support (and not just “issue and walk away”)?

- What are the fees, timeline, and deliverables? Who owns the documentation, who retains rights?

- What is your experience with investor onboarding, marketing, and regulatory filings (if any)?

- Do you provide a jurisdictional strategy: e.g., U.S. for issuer + EU for investment + Asia for market access?

- What happens if regulations change mid-project? Is there flexibility built in?

If any of these items trigger a “we don’t do that” from the legal firm, proceed with caution.

Ensure your platform aligns with SEC, MiCA, and DFSA Standards through Expert RWA Legal Consulting

Takeaway

For enterprises and financial institutions planning to develop tokenization platforms, the Asset Tokenization Consulting Framework works as a strategic pillar. The integration of law, technology, and compliance will determine whether a platform achieves regulatory approval, institutional trust, and market liquidity. While partnering with a Legal firm for Tokenized Asset Legal Services, check real asset-class experience, insist on legal + tech fit, ensure the roadmap covers beyond issuance, and pick someone who will walk the entire journey.

Antier is a leading RWA tokenization legal consulting company and compliance partner, assisting issuers across real estate, private equity, fine art, art, and commodities to build secure, compliant tokenized offerings. Our team combines asset law, securities law, and smart-contract expertise to deliver end-to-end tokenization advisory.