Meme coins have maintained mass momentum in 2025, fueled by the launch of TRUMP and MELANIA. In January 2025, meme coins pushed DEX volume on Solana to take up to 46% share, surpassing Ethereum’s 15% volume, making meme coins an essential force of the cryptonomy. However, this explosive, hype-driven ascent stands in stark contrast to a persistent and critical challenge: the notorious lack of long-term sustainability. Projects explode into the spotlight with viral dog logos or celebrity tweets, only to vanish when the hype fades. Unlike foundational blockchain protocols or tokens powering specific applications, a meme coin’s value often hinges entirely on market sentiment and community fervor. For meme coin projects aspiring to transcend their speculative genre and launchpads to ensure everlasting success, DEX development emerges as a strategic imperative for a sustainable ecosystem.

Meme Coins Grab Attention, DEX Development Builds Longevity

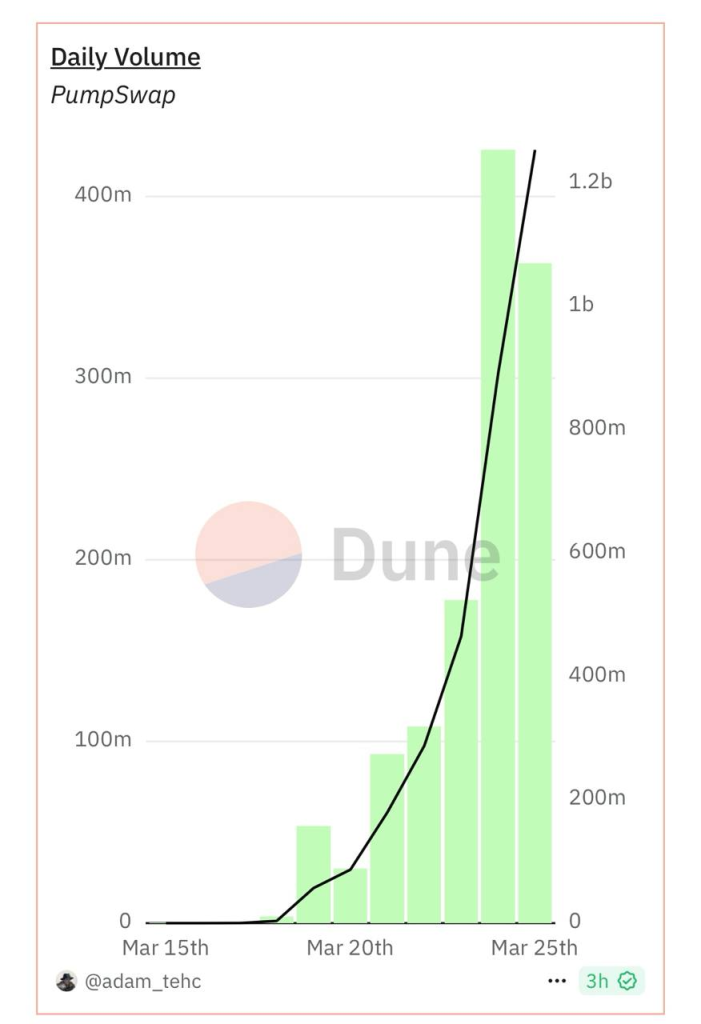

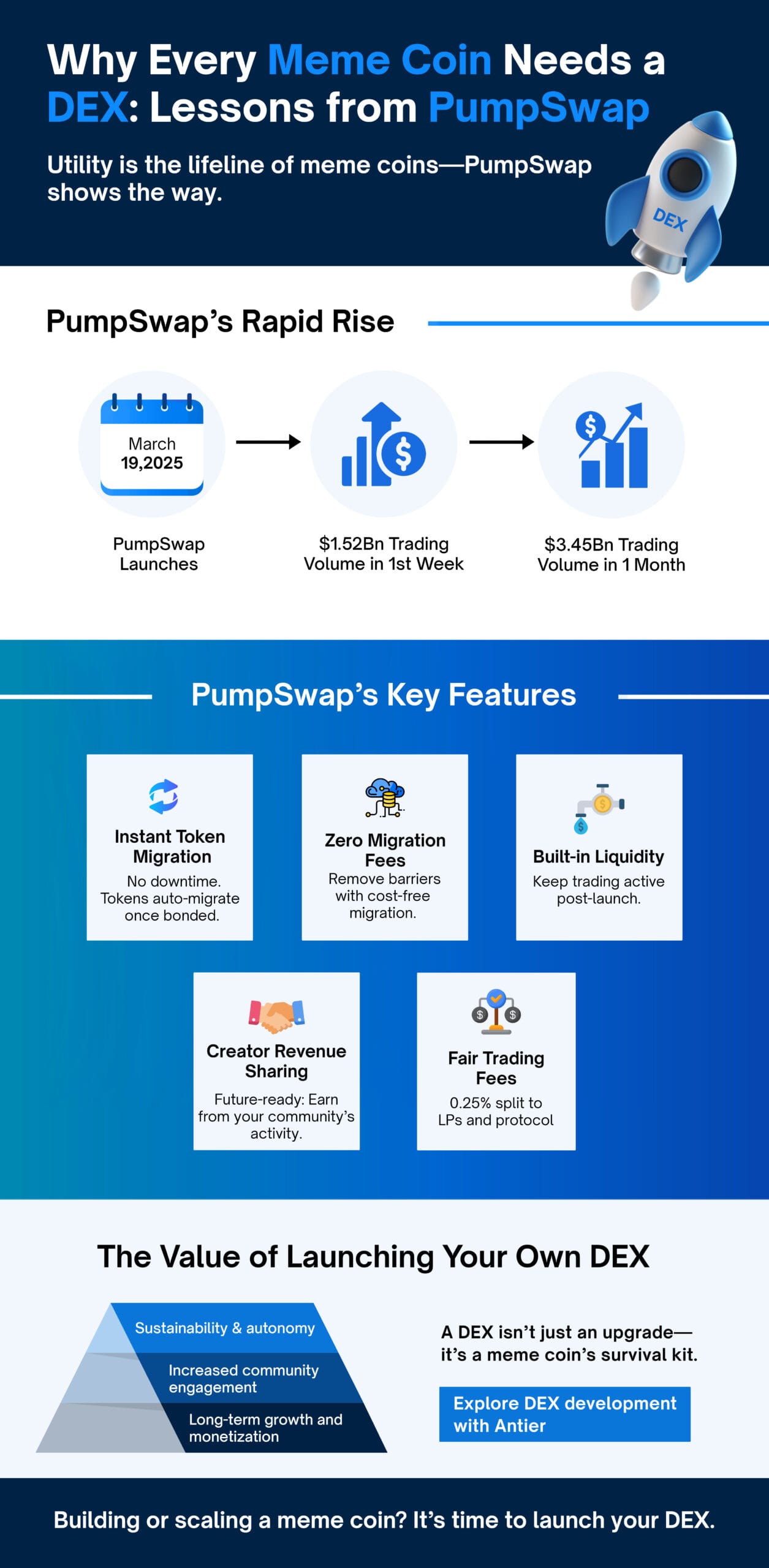

Take PumpSwap, the decentralized exchange software launched by Pump.fun, which hit $1.52 billion in trading volume in its first week. Within a month, the daily trading volume on PumpSwap surged to $3.45 billion, making it the second-largest DEX on Solana after Raydium.

Source: Dune Analytics

This article breaks down how DeFi exchange development, exemplified by PumpSwap, can rescue sinking meme coin launchpad projects, amplify booming ones, and give newcomers a fighting chance.

Its success story unleashes a truth: meme coins need to invest in a robust infrastructure to survive and thrive. This article breaks down how DeFi exchange development, exemplified by PumpSwap, can rescue sinking meme coin projects, amplify booming ones, and give newcomers a fighting chance.

Why Meme Coin Launchpads Can’t Survive Without Their Own DEX?

Meme coin launchpads have unlocked a new creator economy. Fast launches, bonding curves, and viral distribution. Pump.fun turned this into a cultural phenomenon. But here’s the catch: a launchpad alone can’t carry a token beyond its first hype cycle.

That’s exactly why Pump.fun had to ship PumpSwap. Launchpads ignite the spark; a DEX keeps the flame alive. And any meme coin ecosystem serious about long-term traction will eventually follow the same path.

Within its first month, PumpSwap crossed 1.89 million users, proving that the next logical step after launchpad dominance is building a liquidity engine that keeps tokens tradable, relevant, and revenue-generating.

A DEX isn’t an optional add-on anymore. It is the missing economic layer that launchpads depend on. And here’s why.

1. A Launchpad Creates Tokens, But a DEX Creates the Economy

Launchpads help creators go viral. But once the bonding curve ends, tokens need a permanent, predictable trading venue.

Without a native DEX:

- liquidity becomes scattered across third-party platforms,

- price discovery becomes chaotic,

- tokens get vulnerable to delistings,

- and trading activity drops off a cliff.

A private DEX solves this by consolidating liquidity, stabilizing price action, and extending the token’s lifecycle far beyond the initial hype.

2. Direct, Non-Dilutive Revenue

A launchpad alone can’t monetize beyond:

- bonding curve fees

- mint fees

- creator tools

But a DEX unlocks recurring revenue:

- swap fees

- staking fees

- LP incentives

- advanced trading tools

- creator revenue sharing

This gives the platform financial independence instead of relying on dilution-heavy token sales or VC injections.

3. Native Token Utility That Actually Matters

Most meme coins are one-note: hype goes up, hype dies, token dies with it.

A DEX transforms the native token into a working asset:

- Fee token (discounts or mandatory payments)

- Liquidity pair token (required for LP pools)

- Staking token (farm rewards, lockups)

- Governance token (control over pool parameters, fees, listings)

Utility = retention.

Utility = value.

Utility = survivability.

4. Liquidity Control = Narrative Control

Relying on external DEXs means relying on their mercy.

With your own DEX:

- You dictate fee curves

- You dictate liquidity strategy

- You dictate creator incentives

- You dictate how deep liquidity gets

- You dictate how stable the token becomes

This is how Pump.fun turned viral launches into a self-contained economy instead of leaving tokens at the mercy of fragmented pools.

5. A Community Hub With Actual Stickiness

A DEX gives your users something more meaningful than “launch and leave”:

- staking

- LP rewards

- governance

- creator analytics

- trending pools

- token dashboards

This transforms a meme coin community from spectators to active participants, a major factor behind Pump.fun’s absurd retention.

PumpSwap’s DeFi Exchange Development Playbook: 7 Features to Steal

PumpSwap’s success isn’t accidental; it’s a masterclass in decentralized exchange development. Here’s what your project can learn:

- Permissionless Pool Creation

PumpSwap allows users to create new liquidity pools or add liquidity to existing ones freely, facilitating decentralized trading for any token listed on PumpSwap. Any meme coin project planning to launch their DEX must also allow anyone to launch liquidity pools with no upfront fees. This drives organic growth, letting even micro-cap tokens bootstrap liquidity. - Creator-Centric Fee Sharing

Pump.fun announced plans to implement a creator revenue-sharing model, where a portion of the protocol fees generated from trading a specific token would be distributed back to the token’s creator. Upcoming launchpad+DEX development projects can also reward token creators with a cut of trading fees (e.g., 0.05% of volume). This aligns incentives, turning creators into long-term stakeholders, a key retention tactic in launchpad+DEX ecosystems. - Native Token Migration

This was arguably PumpSwap’s most impactful innovation. Tokens completing their bonding curve on Pump.fun were now migrated instantly and automatically to PumpSwap for trading. Existing launchpads can integrate such a feature; those seeking DEX development can partner with existing token launchpads to auto-migrate tokens to the DEX and upcoming launchpad+DEXs can follow this strategy. - Concentrated Liquidity Design

Like PumpSwap, upcoming DEXs can enable meme coin creators to set custom price ranges, maximizing capital efficiency. This reduces slippage for traders, a critical edge in volatile meme markets. - Competitive Fee Structures

Like PumpSwap, Launchpad+DEX ecosystems can undercut giants like Uniswap with lower fees (e.g., 0.25% per swap). To attract more projects and LPs, DeFi exchange development projects can also allocate fees to LPs and protocol treasuries to sustain growth. This strategy prioritizes volume over margins and is great for initial execution when platforms need attention. - Cross-Chain Ambitions

Decentralized exchanges derived from meme coin projects must also plan early multi-chain expansion with Ethereum L2s, TRON, etc. Interoperability broadens liquidity access, a DeFi exchange development must in a fragmented blockchain landscape. - Security-First Architecture

At last, it is essential to conduct multiple audits (PumpSwap had nine) and commit to open-source code. Trust is the bedrock of any Web3 project that plans to sustain—without it, even viral tokens fail.

Building Your DEX: A Roadmap for Meme Coin Projects

1. Define Core Objectives

Clarify whether the decentralized exchange software is meant to support your token ecosystem exclusively or also serve third-party tokens. This defines your infrastructure scope and user expectations.

2. Choose the Blockchain Infrastructure

Select a blockchain that aligns with your project’s goals—Solana for speed, Ethereum for reach, or a Layer 2 like Arbitrum for optimized gas and scalability.

3. Smart Contract Architecture

Develop and audit smart contracts for token swaps, liquidity pools, trading fees, and staking mechanisms.

4. Integrate Wallet & Liquidity Support

Seamless wallet integration (like MetaMask, Phantom, etc.) is critical for your DeFi exchange development. Kickstart liquidity by incentivizing LPs or launching with protocol-owned liquidity.

5. User Interface Design

Build a clean, intuitive, mobile-friendly UI that reflects the meme coin brand while making trading effortless even for non-technical users.

6. Testing and Security Audits

Conduct rigorous internal and external audits. A single smart contract flaw can devastate both your project and its reputation.

7. Launch, Monitor, Iterate

Go live with a community-focused launch strategy. Post-launch, continuously monitor performance and integrate features like AI-powered analytics dashboards, governance tools, etc.

Conclusion: DEX Development Is the Ultimate Meme Coin Utility

PumpSwap’s $1.5B lesson is clear: meme coins that treat DEX development as an afterthought will fade. Those embracing it will outlast the hype cycles. Whether you’re reviving a stagnant project or launching a new one, decentralized exchange development isn’t optional but a foundation for relevance in a market that’s growing smarter, faster, and more demanding.

Stop relying on memes alone; launch Your Decentralized Exchange Software

Whether you’re launching the next viral meme coin or reinvigorating an existing token, Antier delivers full-spectrum decentralized exchange development. From smart contract creation and cross-chain compatibility to custom UI/UX and post-launch support—we architect scalable, secure, and community-powered DEX solutions tailored for meme coin ecosystems.

Partner with Antier and secure your ecosystem with DeFi exchange development or watch your token join the 99% that vanish before their first anniversary.

The revolution is here already. But the question is-Will You FOLLOW or FORGE the path?

Frequently Asked Questions

01. What are meme coins and why are they significant in 2025?

Meme coins are cryptocurrencies that gained popularity due to viral trends and community engagement. In 2025, they significantly impacted the crypto market, with DEX volume on Solana reaching 46%, surpassing Ethereum's 15%, highlighting their importance in the cryptonomy.

02. What role does DEX development play in the sustainability of meme coins?

DEX development is crucial for meme coins as it provides the necessary infrastructure for long-term success. It helps maintain trading volume and relevance beyond the initial hype, ensuring that meme coin projects can thrive and generate revenue.

03. How did PumpSwap contribute to the success of meme coins?

PumpSwap, launched by Pump.fun, achieved $1.52 billion in trading volume in its first week and became the second-largest DEX on Solana. Its success demonstrates how a decentralized exchange can rescue struggling meme coin projects and support new ones by providing a stable trading platform.