Decentralized Finance (DeFi) has rapidly evolved into one of the most influential forces in global finance, growing from a niche concept into a market exceeding $71 billion and projected to reach $457 billion by 2032. Built on Bitcoin’s vision of eliminating intermediaries, DeFi now gives users worldwide open access to financial tools once restricted to institutions.

At the center of this momentum is DeFi staking development, offering competitive passive income, such as Ethereum’s 3–5% APY, while reinforcing blockchain security. With over $140 billion in assets now staked, confidence in staking continues to surge in 2025.

This guide explores why DeFi staking is accelerating and how modern staking models unlock safe, predictable passive income opportunities.

What is DeFi Staking?

Solely based and operated on smart contracts, DeFi staking provides great incentives for crypto enthusiasts staking their assets and participating in a proactive presence in the network. DeFi staking involves locking crypto assets, including fungible or non-fungible tokens (NFTs), in a smart contract in return for rewards while earning passive income.

DeFi staking development turns out to be an ideal way to incentivize cryptocurrency investors for holding their assets and further earn high interest. Beyond individual gains, this model strengthens protocol liquidity, enhances network resilience, and promotes long-term ecosystem stability. As more users stake their assets, DeFi platforms can grow sustainably, distribute rewards more efficiently, and unlock new opportunities for decentralized participation and revenue generation.

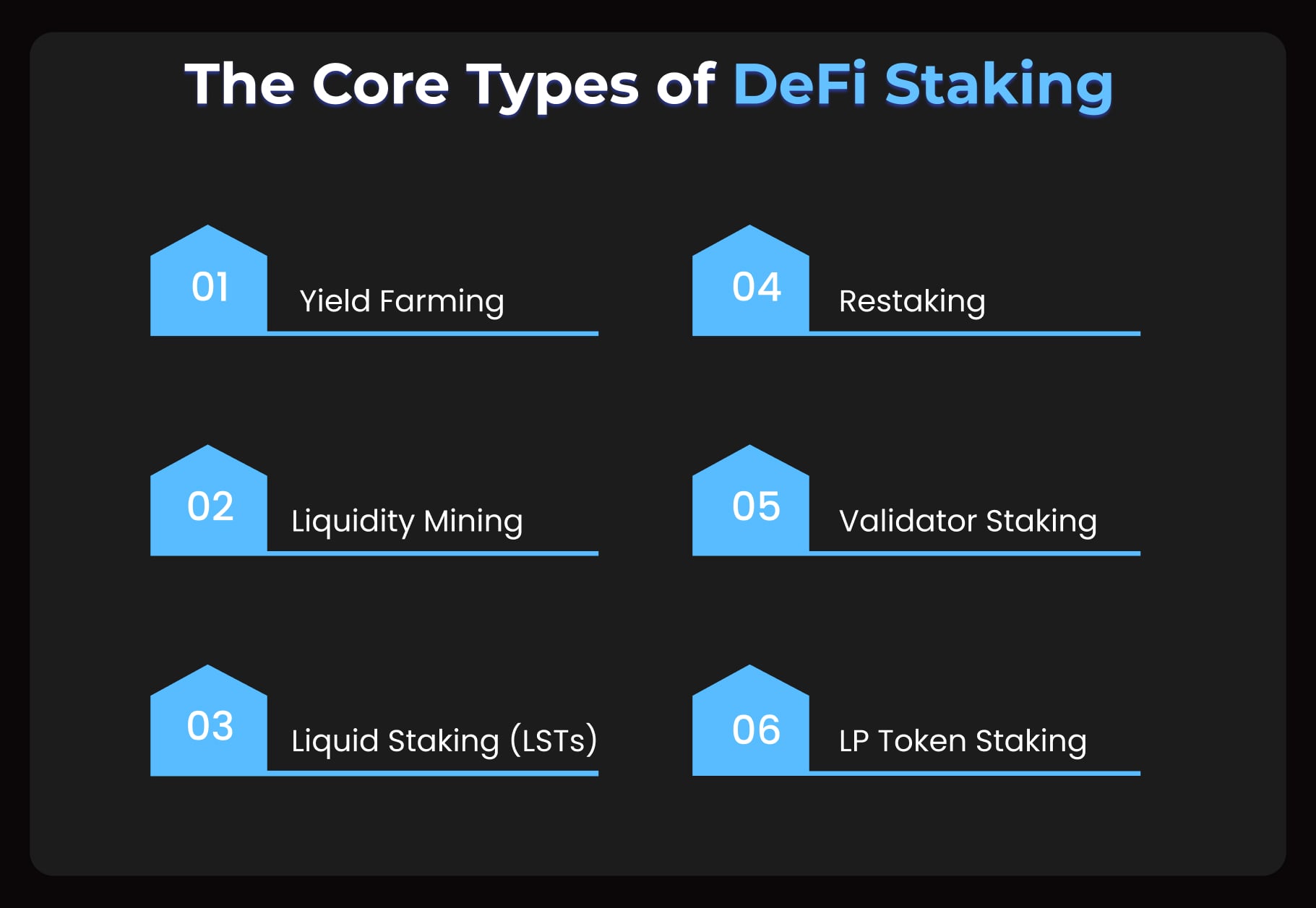

Types of DeFi Staking You Should Know

The new and volatile crypto assets accompany numerous risks that every DeFi investor must be aware of. There are numerous types of DeFi staking available in the market that every DeFi enthusiast needs to know. Let’s explore them in detail.

- Yield Farming

Yield farming stands as one of the most established and high-reward strategies in DeFi. It allows users to move assets across multiple protocols to chase better APYs and maximize DeFi passive income.

Why it matters:

- Supply assets to lending/borrowing markets and earn interest

- Shift liquidity between pools to capture higher yields.

- Benefit from automated, 24/7 smart contract operations

- No custodians or intermediaries involved

- Liquidity Mining

Modern DeFi Staking Development incorporates liquidity mining mechanisms, where users contribute token pairs (such as ETH/USDC) to decentralized liquidity pools, ensuring smoother trading flows and unlocking additional rewards through fees and incentive tokens.

Key advantages:

- Earn rewards from AMM trading fees.

- Deepens DEX liquidity

- Easy entry and exit for traders

- A highly searched segment in the DeFi staking ecosystem

- Liquid Staking (LSTs)

Liquid staking is one of the fastest-growing categories in 2024–2025. Users stake assets and receive a liquid token (such as stETH, mSOL, or jitoSOL) that can be used across DeFi platforms for additional yield.

Why it’s trending:

- Zero lock-in periods; users stay fully liquid

- Earn staking rewards while using LSTs for other activities.

- Exploding popularity in searches for “liquid staking” and “LST token.”

- Dominant TVL growth in 2025

This category is crucial for any modern DeFi staking platform development strategy.

- Restaking

Restaking enables users to reuse staked assets to secure additional protocols. This creates layered yield opportunities without unstaking original deposits. Benefits:

- Multiple reward streams from the same assets

- Strengthens shared security layers

- High search interest in “EigenLayer restaking” and “restaking rewards.”

- Validator Staking

Validator staking involves locking tokens directly within a blockchain’s consensus system (such as Ethereum, Solana, or Avalanche). It offers predictable rewards and long-term network contribution.

Highlights:

- Strengthens blockchain security

- Ideal for long-term holders

- Growing search interest in “ETH staking,” “validator rewards,” and “proof-of-stake staking.”

- LP Token Staking

After providing liquidity to a DEX, users receive LP tokens. These LP tokens can then be staked in additional pools to earn extra rewards. Why users prefer it:

- Double earnings (liquidity rewards + staking rewards)

- Supports long-term liquidity for protocols

- Rising searches for “LP token staking” and “double yield DeFi.”

LP staking is widely adopted across yield aggregators and AMM platforms.

- Governance Staking

Governance staking allows users to stake tokens to participate in voting and decision-making processes while earning rewards. Key attributes:

- Supports decentralized governance

- Encourages long-term token holding

- Essential for DAO-driven ecosystems

Although not yield-maximizing, governance staking is vital for communities in decentralized networks. Comprehensive DeFi staking platform development services help projects implement flexible reward distribution models designed to attract long-term token holders.

Find Out Which Staking Model Fits Your Strategy

Benefits of DeFi Staking Platform Development

The incentives to invest in DeFi staking platform development are stronger than ever. Here are the key drivers.

- Earn Steady Passive Income: Through platforms built using advanced DeFi staking platform development, users can earn continuous returns simply by locking their digital assets into secure smart contracts. This creates a dependable, hands-off income stream without the need for active trading or market monitoring.

- Access Higher Annual Yields: DeFi staking typically offers better APYs than traditional finance due to decentralized incentives, protocol-driven rewards, and liquidity-based yield structures. This allows investors to maximize returns on their crypto holdings.

- Increase Token Utility Value: Staking enhances token utility and reduces circulating supply, leading to improved demand and long-term value stability. This reinforces healthier tokenomics and strengthens the overall ecosystem.

- Maintain Complete Asset Control: Smart contract–powered staking ensures users retain full ownership of their funds at all times. This non-custodial model provides greater security, transparency, and autonomy compared to centralized platforms.

- Explore Multiple Earning Models: Modern DeFi Staking Development supports diverse earning opportunities, such as yield farming, liquidity mining, liquid staking, and restaking, allowing users to choose strategies that align with their risk appetite and reward expectations.

- Strengthen Network Security Layers: By staking assets, users help secure the blockchain’s consensus mechanism, reinforce network resilience, and contribute to long-term protocol stability, while earning rewards for their participation.

How Does DeFi Staking Work?

Here’s a detailed visual breakdown that simplifies the DeFi staking process, making it easier to see how assets move through each stage to generate passive income.

Once assets are locked, the smart contract manages the entire reward lifecycle, handling yield calculations, distributing incentives, and ensuring complete transparency. A reliable DeFi staking platform development company enhances this experience, enabling users to simply track their returns, claim or compound rewards, and grow passive income seamlessly.

Request a Proposal for DeFi Staking Development Services

Why Partner With Experts for DeFi Staking Platform Development?

Building a secure, high-performing DeFi staking platform requires deep expertise in blockchain architecture, smart contract engineering, token economics, and security audits. Partnering with an experienced development team ensures your platform is reliable, scalable, and compliant with best practices. Experts help you integrate multiple staking models, automate reward mechanisms, optimize APYs, and deliver a seamless user experience. With the right partner, you reduce risk, accelerate launch timelines, and unlock greater value for your users and token ecosystem.

Key Advantages of Expert Support

- Faster development with proven frameworks

- Secure and audited smart contracts.

- Support for multiple staking models

- Optimized user experience and returns

- Scalable architecture for future growth

The Takeaway

Investing in DeFi staking development services is simply a win-win idea for modern businesses and customers, where they can reap its countless benefits in the long run. Opening a wide range of income streams to being an environment-friendly alternative, DeFi staking is here to feature numerous other benefits in the times ahead.

Planning to invest in DeFi staking services for your modern business? Antier is a globally recognized DeFi staking platform development company that deals with the diverse DeFi staking needs of global clients while assuring flawless yet robust solutions. Book a session with industry experts now to discuss your needs and develop a DeFi staking platform successfully!

Frequently Asked Questions

01. What is DeFi staking?

DeFi staking involves locking crypto assets in a smart contract to earn rewards and passive income, while also enhancing blockchain security and network resilience.

02. How does DeFi staking benefit investors?

DeFi staking incentivizes investors by providing competitive passive income, such as Ethereum’s 3–5% APY, while promoting liquidity and stability within the DeFi ecosystem.

03. What are the different types of DeFi staking?

The main types of DeFi staking include yield farming, which allows users to maximize returns by moving assets across protocols, and liquidity mining, which incentivizes users to provide liquidity to DeFi platforms.