If you’re managing cross-border payments today, you know how complex and costly they can be. Traditional rails mean long settlement times, high FX spreads, and fragmented systems across regions. The cross-border payments market already represents a $194 trillion opportunity in 2024, projected to reach $320 trillion by 2032, making efficiency more critical than ever. Now imagine a single app where your business treasury team can send, receive, convert, and reconcile international payments in real time, with built-in compliance, risk controls, and liquidity.

That’s the promise of the Stablecoin SuperApp. In 2025, such platforms could be as common for corporates as mobile banking is for consumers today. Powered by regulated digital assets, a stablecoin superapp development integrates stablecoin remittance, foreign exchange, wallets, and compliance into a seamless stablecoin payment system. For banks, fintechs, and global enterprises, it’s more than a new tool; it’s a new strategy.

What Is a Stablecoin SuperApp?

A Stablecoin SuperApp is an all-in-one digital platform that combines the services of a stablecoin wallet, exchange, payment gateway, and remittance channel in a single interface. Instead of using multiple providers for cross-border transfers, currency conversion, compliance, and reporting, businesses can manage everything efficiently from one system. It can be thought of as a combination of popular messaging and payment platforms for enterprise payments, but powered by regulated stablecoins and on-chain settlement. Users can hold, send, receive, convert, and even automate stablecoin transactions globally while benefiting from built-in KYC, AML, and treasury management tools.

Source: TheBlock

Enterprise demand is clear: 90% of global institutions are either using or piloting stablecoins, and 88% of North American firms see recent regulations such as the GENIUS Act as enablers rather than obstacles. This growing institutional confidence is driving adoption, stablecoin remittances now make up 26% of US remittance transactions, with the average transfer value nearly doubling to $3,800 as trust in real-world use cases strengthens.

Behind the scenes, this seamless user experience is supported by advanced stablecoin development solutions. These include secure smart contracts, APIs, and compliance modules that handle complexity so that end-users experience a fast, compliant, and user-friendly platform. In this post, we’ll unpack what a Stablecoin SuperApp could mean (benefits, challenges, risks), how stablecoin development solutions and stablecoin payment systems play into your roadmap, and how to evaluate or build one.

Why Stablecoin SuperApps Matter for Cross-Border Payment Strategies

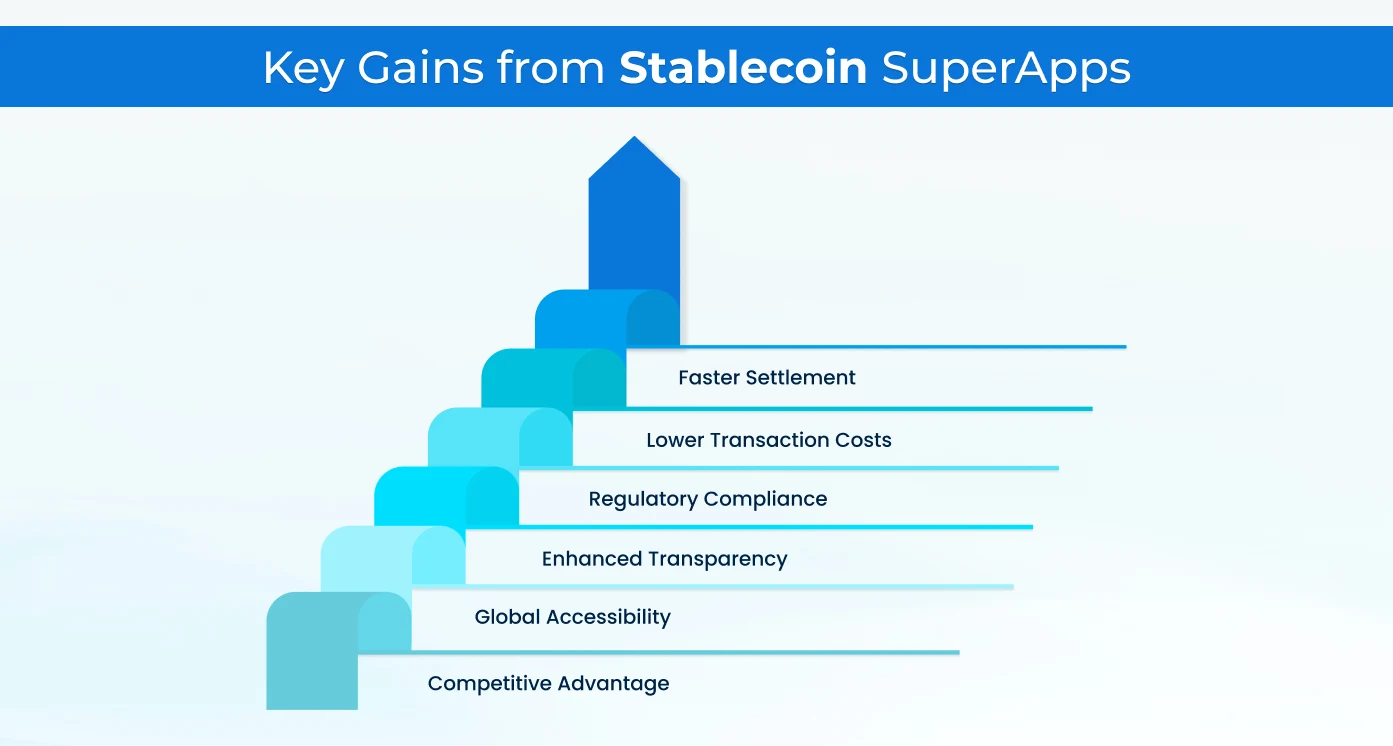

Here are the key reasons why stablecoin superapps are becoming critical for enterprises

- Faster Settlement: Traditional international transfers typically take 2–5 business days to complete. Stablecoin superapps deliver near-instant settlement in minutes, operating 24/7/365, improving cash flow, reducing operational delays, and enabling businesses to respond quickly to supplier or client needs.

- Lower Transaction Costs: Businesses can significantly reduce payment fees by removing intermediaries and minimizing reliance on correspondent banks. Stablecoin remittance provides an affordable alternative to SWIFT or wire transfers while maintaining transparency and reliability.

Example: Traditional SWIFT transfers can run $20–$50 per transaction plus 2–5% hidden FX markups, while stablecoin payments often cost under $1 with transparent fees. On a $100,000 international payment, enterprises can save $3,500–$4,500 per transfer.

- Regulatory Compliance: Built-in KYC and AML modules ensure compliance across multiple jurisdictions. Enterprises using a stablecoin superApp can manage legal and regulatory obligations efficiently, mitigating risk and building trust with regulators and partners.

- Enhanced Transparency: On-chain transactions offer full visibility and auditability. Every payment is recorded in a transparent ledger, simplifying reconciliation, reducing disputes, and giving finance teams confidence in the accuracy and integrity of their cross-border operations.

- Global Accessibility: Multi-currency support and access to regions with limited banking infrastructure make stablecoin superapps highly scalable. Businesses can expand globally, send and receive funds in multiple currencies, and improve their reach to new markets efficiently.

- Competitive Advantage: Early adoption of stablecoin superapps allows companies to offer faster, cheaper, and more reliable payments. Leveraging stablecoin development solutions positions enterprises as innovative, client-focused, and ready to lead in the evolving global payments landscape.

Request a Customized ROI Analysis for Your Cross-Border Payments

For CFOs, treasury managers, and fintech leaders, understanding and integrating stablecoin development solutions into cross-border payment strategies is no longer optional. It is a key lever for efficiency, cost optimization, and market expansion in 2025.

Core Features of a Stablecoin SuperApp for Enterprises

Here are the core functionalities every business should consider:

- Multi-Currency Stablecoin Wallet Development: Supports multiple stablecoins, allowing businesses to hold, send, and receive funds in different currencies. This feature simplifies cross-border transactions, reduces dependency on traditional banking, and improves liquidity management using robust stablecoin development solutions.

- Instant Stablecoin Remittance: Enables near real-time transfers to global partners, suppliers, and subsidiaries. By eliminating intermediaries, this module accelerates payment cycles, reduces fees, and ensures predictable settlement times through an advanced stablecoin payment system.

- FX Management and On-Chain Settlement: Provides integrated foreign exchange conversion with transparent rates. On-chain settlement ensures immutability, reduces errors, and allows enterprises to manage currency exposure efficiently while leveraging blockchain-powered stablecoin development.

- Compliance Dashboards (KYC/AML): Offers built-in modules to meet regulatory requirements across multiple jurisdictions. Enterprises can monitor transactions, generate audit-ready reports, and maintain compliance using a secure, stablecoin payment platform.

- ERP and Treasury Integration: Connects the superapp to enterprise resource planning and treasury systems. This integration streamlines accounting, reconciliation, and reporting, reducing operational overhead while leveraging stablecoin development services.

- Audit and Reporting Tools: Provides detailed transaction logs, proof of reserves, and performance reports. These tools give finance and compliance teams transparency, traceability, and confidence in the reliability of the stablecoin remittance system.

How to Build a Stablecoin SuperApp (In-House vs. Partner)

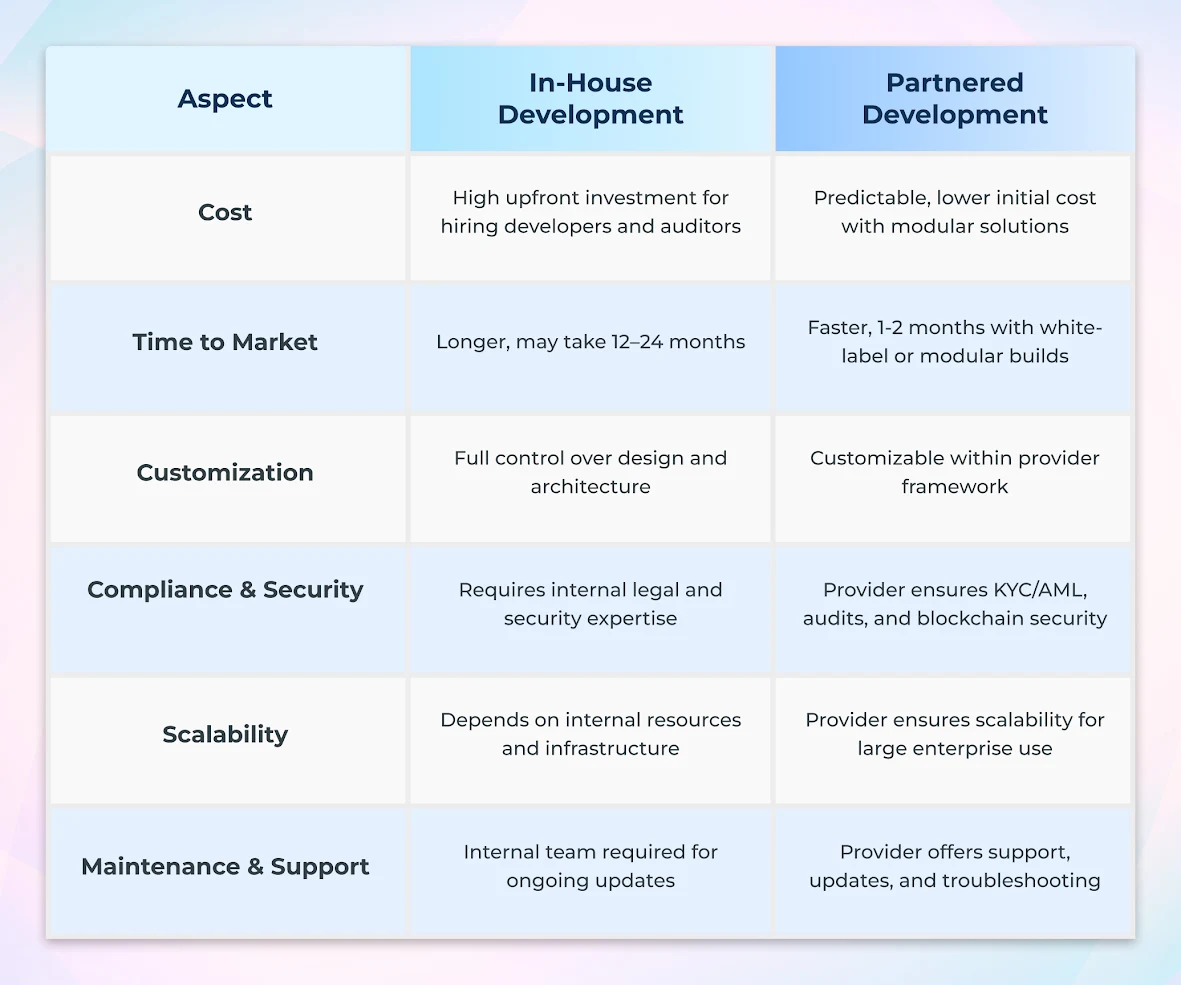

Building a stablecoin superapp requires careful planning, expertise in blockchain technology, and compliance knowledge. Enterprises can either develop the platform in-house or collaborate with a stablecoin development services provider. Each approach has advantages and trade-offs:

In-House Development: This involves using internal resources to design, build, and maintain the superapp. It provides full control over architecture, customization, and security protocols. However, it requires significant investment in blockchain developers, auditors, and regulatory compliance teams.

Partnering with a Company: Leveraging expert stablecoin development solutions accelerates time-to-market and reduces operational risk. Providers offer pre-built modules like wallets, compliance dashboards, and remittance engines. This approach ensures the superapp is secure, scalable, and compliant without the need for heavy internal resources.

Comparison Table: In-House vs. Partnered Development

Choosing the right approach depends on business priorities. High-value enterprises focused on speed, compliance, and reliable stablecoin payment system operations often prefer partnering with experienced stablecoin development services providers. This strategy ensures the superapp is robust, fully compliant, and ready to handle global cross-border payments efficiently.

Explore Why 95% Choose Partnership Over In-House

What You Should Be Aware Of: Risks & Challenges

Using a Stablecoin SuperApp offers efficiency, but enterprises must address several risks:

- Regulatory Compliance: Meeting KYC and AML requirements across jurisdictions is critical.

- Security Threats: Cyberattacks require robust encryption, multi-signature wallets, and secure key management within a stablecoin payment system.

- Operational Complexity: Integrating wallets, remittance engines, and ERP systems can create challenges.

- Liquidity Management: Ensuring adequate stablecoin reserves and managing FX exposure is essential.

- Scalability & Volatility: The platform must handle growing transaction volumes, and stablecoins can face temporary volatility.

Partnering with an experienced stablecoin development company mitigates these risks, ensuring a secure, compliant, and efficient cross-border payment solution.

Conclusion

A Stablecoin SuperApp could redefine what “cross-border payments” mean for you in 2025: near-instant transfers, far lower hidden costs, greater transparency, and the ability to flex into new geographies with fewer constraints. But it is not plug-and-play; success demands careful strategy, including regulatory readiness, liquidity, trust, and infrastructure.

For decision-makers in finance, operations, or strategy, now is the time to explore, pilot, assess, partner, and plan. Antier, a renowned stablecoin payment platform development company, provides expert services to help enterprises navigate this evolving payments landscape and secure a real competitive edge. Get started with Antier and make cross-border payments seamless, fast, and strategic.

Frequently Asked Questions

01. How does a stablecoin superapp reduce cross-border remittance costs?

A Stablecoin SuperApp eliminates intermediaries and reduces reliance on correspondent banks, enabling near-instant transactions with lower fees. It leverages blockchain efficiency and stablecoin payment systems to optimize liquidity and reduce operational costs.

02. How long does it take to build a stablecoin superapp?

Development timelines range from 3 to 12 months, depending on customization, module complexity, and compliance integration. Using pre-built solutions accelerates time-to-market.

03. How secure and compliant is a stablecoin superapp for global payments?

Advanced security protocols, multi-signature wallets, encryption, and built-in KYC/AML modules ensure that transactions remain secure and fully compliant with cross-border regulations.