Australia Just Made Bitcoin Home Loans Legal – Here’s How They Work

Australia’s financial regulators have probably given the green light for BTC-backed home loans as Block Earner blazes the trail. Homebuyers do not need to sell their crypto holdings to secure a house, as they can keep them as collateral for their deposit. These once-speculative, digital assets are being used as a form of payment, collateral, and whatnot. Now they’re a tangible path to homeownership in Australia.

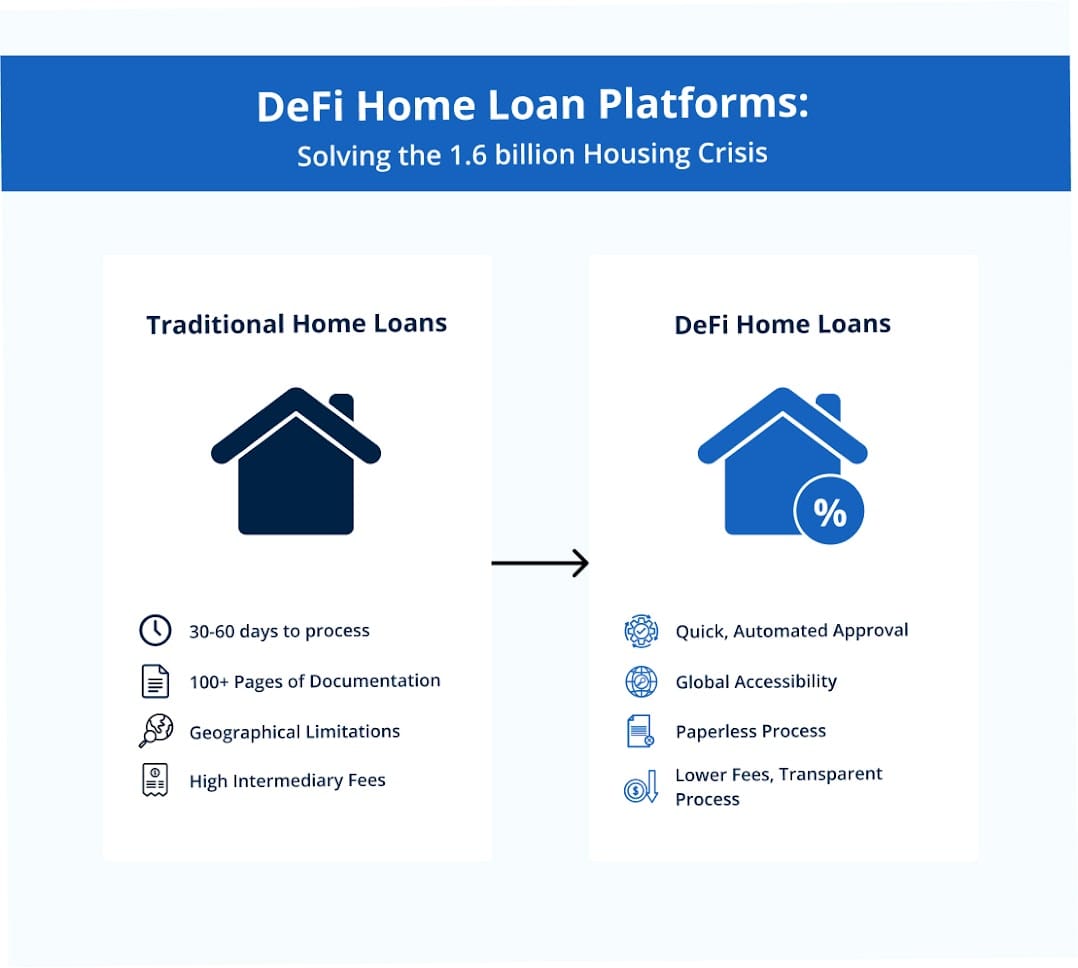

Here’s how DeFi home loans will work:

- Collateral Mechanism:

Bitcoin becomes your security deposit. Now, any aspiring home buyer may lock up a set amount of BTC in a protected smart-contract-based “escrow” account (on a Home Loan DeFi Lending Platform).

If BTC’s market value drops too much, the system will alert the buyers (a “margin call”) and ask them to add more BTC or cash to keep the loan safe. If they don’t, it can also sell some of their BTC to cover the shortfall.

- Loan-to-Value:

LTV is just the percentage of the home’s value that the lender will cover. With crypto’s wild price swings, DeFi home loan apps might only offer 50–60% LTV.

For example, on a $500,000 home, at 60% LTV, home buyers get a $300,000 loan, and their BTC collateral would be sized to cover that amount plus a buffer.

- Repayment Structure:

Homebuyers repay DeFi loans just like a traditional mortgage loan. Regular monthly payments are calculated in a similar way to pay off principal and interest over time.

The twist? They pay in Aussie dollars. Their BTC stays locked until they finish all their repayments, then it’s released back to them. The result? No BTC lost, its value appreciated (most probably), and they ultimately own a house without losing anything.

- Regulatory Guardrails:

Even though these home loan DeFi lending platforms are collateralizing and accepting repayments in cryptocurrency, they must follow Australia’s financial safety rules for lenders as well as crypto platforms.

That means verifying who borrowers are (with KYC) and monitoring transactions (with AML) to prevent money laundering. These compliance modules within crypto home loan platforms ensure the system stays legal and secure.

Last time we wrote about the benefits and challenges of DeFi home loan platform development, it was merely a niche trial, but now the narrative has graduated from whitepapers and landed in the real-world economies.

Why DeFi Development Is No Longer Optional After BTC Home Loan Approval in Australia?

Entrepreneurs planning any home loan DeFi lending platform need to pivot fast. Even if you’re an emerging lending startup, you must rethink your stack post the BTC Mortgage News. Here’s why:

1. First‑Mover Advantage

Though the first mover in crypto loans is already here, you can still deploy the whole home loan logic on-chain or develop an efficient hybrid model. Traditional lending apps won’t adapt overnight. With strategic DeFi Development, you can launch compliant, scalable home/car or MSME lending protocols that will own the market’s edge.

2. Transparent & Programmable

Smart contracts automate collateral management, margin calls, and liquidations. Decentralization eliminates any black‑box decisions, and borrowers see every step on-chain. The only challenge with DeFi home loan platform development is user education. If you get it right with your DeFi development company, you can launch a crypto home loan platform that’s simpler, fairer, and more trustworthy than traditional lending systems.

3. Cost Efficiency

We all know that removing centralized middlemen slashes operational costs, and in the case of home loans, this cost is substantial. DeFi development eliminates those hundreds of intermediary costs, translating to less overhead costs, better interest rates (maybe because the platform’s operational costs are reduced), and faster approvals.

4. Regulatory Alignment

With the first Bitcoin home loans in the market, the concept becomes legal. DeFi home loans platforms that bake in AML/KYC from day one will avoid costly shutdowns and penalties. For more clarity, they can connect with legal DeFi experts at their DeFi development company.

5. Investor & Media Spotlight

Everyone’s eyes are on this very recent story. A well‑executed DeFi home loan product will attract media buzz and institutional partnerships. You can also get your MVP in a few weeks from a reliable DeFi development company and launch in phases, tapping into the current hype while building a mature crypto loan product.

How To Legally Launch A DeFi Home Loans Platform in Australia?

Launching a DeFi Home Loans platform involves these core steps:

1. Regulatory Blueprint

- Register as an AUSTRAC‑compliant entity

- Implement rigorous KYC/AML workflows

- Consult with legal experts at your DeFi development company regarding lending licenses.

2. Smart Contract Architecture

- Collateral Vaults: Collaborate with your DeFi development company to secure on-chain escrow for BTC collateral.

- Each borrower gets a unique vault contract that holds their BTC collateral.

- Vault logic enforces: no withdrawals until full repayment, and only the authorized borrower and platform controller can interact.

- Admin functions (e.g., emergency pause, parameter updates) require 2-of-3 signatures, mitigating single‑point failures with multi-sig security.

- Recommend your DeFi development company to use an upgradeable proxy pattern so they can patch bugs or add features (e.g., support for ETH or USDC as collateral) without redeploying all vaults.

- Margin Management Module: Real‑time oracles fetch prices, trigger top‑ups, and liquidations.

- Integrate with multiple on‑chain oracles (Chainlink, Band) to get median BTC/AUD rates.

- Implement fallback logic with your DeFi development company that says if one oracle stalls, switch to the next. This avoids blind spots.

- When collateral ratio dips below your “maintenance threshold” (e.g., 130%), the contract auto‑flags the vault.

- The borrower receives an on‑chain notification and a grace period (e.g., 24 hrs) to top up.

- If the borrower misses the top‑up window, the contract sells only enough BTC to restore the minimum collateral ratio.

- Surplus proceeds (if any) return to the borrower; deficits become bad‑debt provisions covered by your risk fund.

- Loan Engine: This DeFi home loan platform development module tracks interest accrual, repayment schedules, and event triggers.

- Per‑block interest calculations are stored on‑chain. Borrowers get no rounding surprises.

- Collaborate with your DeFi development company to implement flexible interest models. You may pick fixed-rate, variable-rate (algorithmic based on utilization), or a hybrid, depending on your requirements.

- Borrowers can repay principal + interest on any schedule, whether it be monthly, biweekly, or custom.

- Also, don’t miss coding the early‑payoff bonuses: e.g., 0.1% interest rebate for paying off 6 months early.

- Set standardized events for front‑end UI, such as collateral insufficiency, top-up required, and loan repaid.

- Also, tell your DeFi development partner to integrate a backend “watcher” service (off‑chain) to fire email/SMS alerts.

- Governance and Admin Controls:

- Adjustable settings stored in a central “Config” contract: LTV caps, interest rates, liquidation penalties.

- Ensure that only governance token holders (or a multisig party) can update these logics, ensuring decentralization of risk rules.

- Install a circuit-breaker function with the help of a DeFi development company to pause new borrowing or liquidations in case of extreme volatility or exploits. Also, a graceful resume path should be implemented when the issue is resolved.

- Security and Auditability:

- Use tools like Certora or Scribble to mathematically prove core invariants (e.g., collateral never lost).

- All vault interactions must be on‑chain. Anyone (or any auditor) can verify total outstanding debt vs. collateral.

- Schedule regular red‑team exercises and bug bounties to catch edge‑cases before they cost you money.

- User Experience & Integration

- Join forces with your DeFi development company to integrate APIs to support MetaMask, Ledger, and common custodial wallets.

- Partner with licensed exchanges or payment gateways for fiat on/off ramps.

- Set up a dashboard & notifications module that notifies users of real-time collateral status, margin alerts, and repayment reminders via email/SMS.

Ready to Take Action?

Your competition is already eyeing this. Don’t let them outbuild you. Rewrite the rules of the traditional home loans with a DeFi-native home loan platform development that embraces crypto, or tokenized RWA collaterals.

Why Choose Antier’s End-to-End DeFi Development Services?

- Launch Your MVP Home Loan DeFi Lending Platform in 8 Weeks

- Implement AUSTRAC‑Compliant KYC/AML Workflows and Get Legal Advisory From Certified Experts

- Deploy Audited, Upgradeable Smart Contracts

- Integrate Multi-Oracles Price Feeds & Wallet Connectors

- Scale with 24/7 Maintenance & Support Services