The KIMA token is now live, ushering in a new era of real-world asset tokenization infrastructure. To build a tokenization platform, whether for real estate, private credit, intellectual property, or tokenized funds, businesses need more than minting logic. They need institutional-grade compliance, finality, cross-chain settlement, and off-chain integration. This post explores everything: what Kima Network provides, how KIMA works, and how it is contributing to building a scalable RWA tokenization platform.

Why Do Most RWA Tokenization Platforms Fail?

There is a high demand among investors and enterprises for tokenized access to real-world assets. The technology bottleneck isn’t this high demand, but incompatible tokenization infrastructure.

Platforms that issue tokens without addressing settlement, compliance, and integration fail to scale. Most of them fall apart post-minting because they:

- Rely on insecure bridges.

- Lack of on-chain compliance

- Don’t enforce finality proofs.

- Fail to integrate end-to-end workflows.

While developers spend months on bridges, oracles, and APIs, none of it meets institutional standards.

How KIMA Network Fixes the Problem?

Kima Network offers a decentralized settlement layer built specifically for real-world asset tokenization services. Key components include:

1. Validator-Based Settlement Mesh

A network of decentralized nodes tracks asset custody verifies cross-chain swaps, and logs settlement proofs in an immutable ledger. Therefore, businesses can avoid relying on centralized oracles or bridges, reducing attack surface and increasing trust.

2. MPC & TSS Security

Assets are transmitted via Multi-Party Computation (MPC) and Threshold Signature Schemes (TSS). Keys are never wholly exposed, and bridging logic is executed securely across validators, no smart contract bridges needed.

3. Atomic Delivery-versus-Payment (DvP)

Kima ensures atomicity: assets and payment settle together, or not at all. This avoids escrow vulnerabilities and smart contract bugs common in DeFi bridges.

4. Compliance-Core Architecture

Compliance isn’t an afterthought. KYC/AML, jurisdiction filters, and programmable transaction rules are embedded at the protocol level. Transactions failing checks are automatically rejected; no separate compliance stack needed.

5. Cross-Chain + TradFi APIs

Kima supports asset transfers across Ethereum, Polygon, and Solana, and integrates with traditional financial systems via secure SDKs. This bridges tokenized assets to banking, legal, and CRM tools.

6. Developer SDKs

REST/gRPC libraries in JavaScript, Python, and Java allow:

- Mint tokens post-KYC

- Initiate atomic swaps

- Enforce legal and jurisdictional constraints.

- Fetch settlement proofs

KIMA Token Mechanics and Utility

The KIMA token is the engine powering Kima’s settlement and compliance infrastructure.

1. Settlement Payment

Every cross-chain transfer, compliance check, and settlement event incur a small KIMA fee. These fees flow to validator nodes or are burned, creating an aligned economic model.

2. Staking & Network Security

Validators stake KIMA to earn permission to validate swaps and compliance events. Staking secures the network and discourages malicious behavior, as stakes are slashed for misconduct.

3. Governance

KIMA holders vote on upgrades: new validator admission, fee models, compliance rule extensions, or integrations. Token-based governance ensures protocol ownership by builders and participants.

This token utility makes settlement secure, reliable, and community-led, removing the need to build proprietary staking systems or compliance controls from scratch.

Essential Architecture Details

1. Validator Mesh

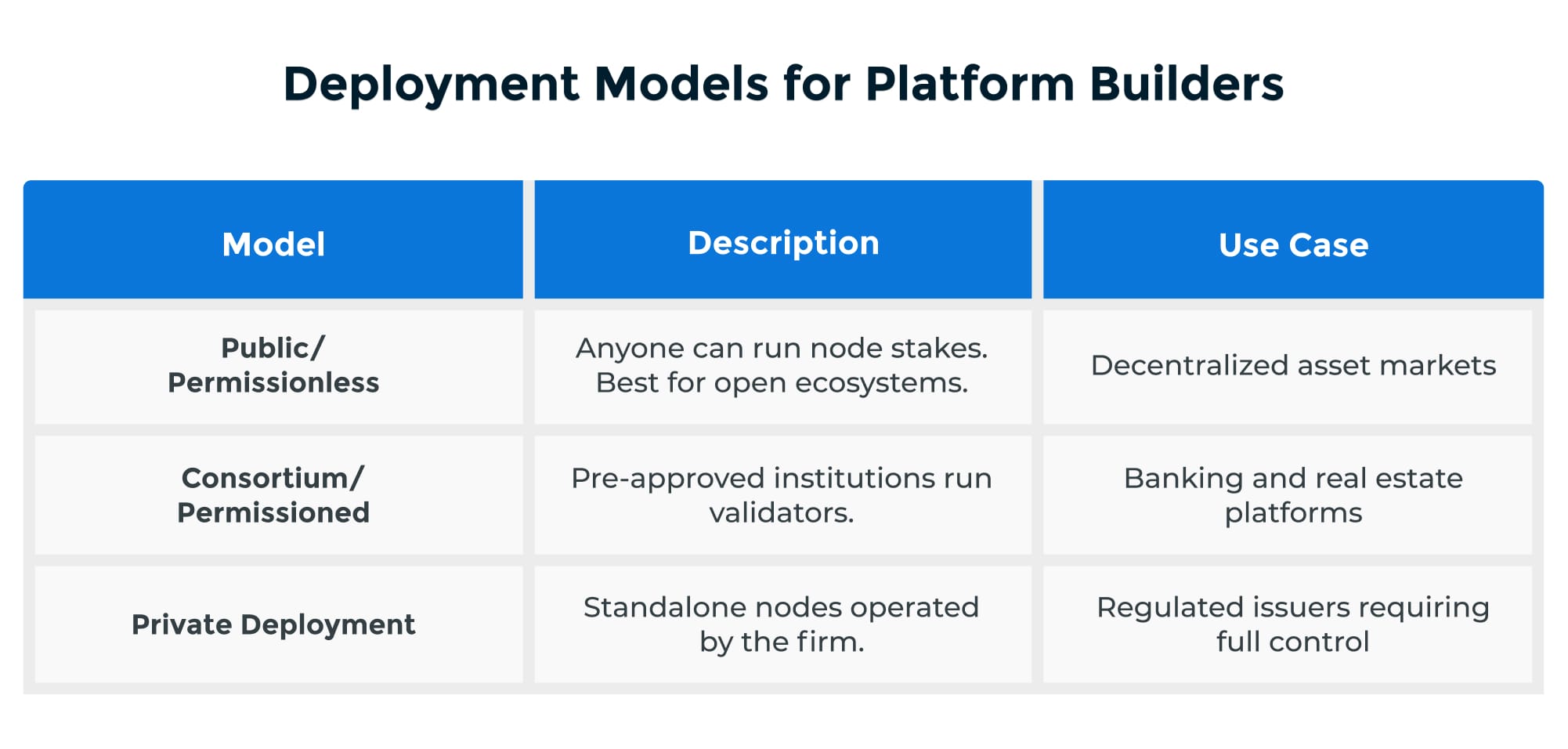

Nodes are set up in either permissioned or permissionless configurations. The platform owner can define size via a consensus policy. They coordinate via Byzantine Fault Tolerance (BFT) to:

- Monitor tokenized asset pools.

- Process compliance checks

- Approve DvP swaps

- Record settlement proofs in a synchronized ledger

2. MPC-Based Key Management

Each chain uses MPC/TSS among multiple nodes to authorize asset transfers. Keys remain distributed, and no single node has full control. This enforced distribution ensures robust security for high-value asset flows.

3. Atomic Swap Flow

Let’s say an investor wants to transfer a tokenized asset from Ethereum to Solana:

- Frontend initiates a transfer via Kima SDK.

- Validator nodes collaborate to generate a TSS signature approving asset lock on Ethereum and mint on Solana.

- If any node fails or disconnects, the transfer aborts

- Upon success, a settlement receipt is logged, processed, and cross-posted to off-chain systems.

All execution is atomic, guaranteeing that any transfer fully completes or rolls back.

4. Programmable Compliance

Smart compliance modules can:

- Verify KYC/AML status

- Restrict transfers based on user jurisdictions.

- Enforce holding periods

- Automate tax or AML reporting

Developers can deploy or integrate plug-and-play compliance modules into on-chain transaction pipelines.

5. Off-Chain Oracles & Data Feeds

While Kima focuses on settlement, it supports seamless integration with price oracles (e.g., Chainlink) for assets requiring valuation, triggers, or collateral checks.

Data feeds are optional, but chainable into workflows by code via SDKs.

Developer Process and Example Flow

Here’s a core flow showing how to build a real-world asset tokenization platform using Kima:

Step 1: Platform Onboarding & KYC

Use the front-end to collect identity info and verify via an external provider. Store KYC passes in the database. Call Kima SDK to register the user and asset with the settlement network.

Step 2: Asset Token Minting

Once vetted, mint a tokenized asset (e.g., property, debt note) to the user’s wallet. Metadata includes jurisdiction, compliance rules, and legal references.

Step 3: Cross-Chain or Settlement Transfer

User initiates transfer, either across chains or on the same chain. Kima SDK packages the request, flags required compliance modules and sends it to the validator network.

Step 4: Atomic Swap Execution

Validators run checks, execute MPC/TSS signatures to lock/mint assets, and generate settlement receipts.

Step 5: Off-Chain Integration

Settlement receipts are routed via an integration layer to legal, accounting, or CRM systems. Automated notifications, contracts, or tax filings can be triggered through the existing stack.

Step 6: Governance & Monitoring

The Real-world asset tokenization services become a node operator (optional), staking KIMA to receive part of the settlement fees. Firms can monitor network health, manage upgrades, and participate in governance.

Security, Performance, Finality

1. Security Layers

- MPC/TSS secures asset keys

- BFT consensus defends against up to ~1/3 malicious nodes

- No smart-contract bridge code = minimal attack vectors

- Compliance rules enforce identity and jurisdiction at the protocol layer.

2. Performance

- Throughput: 100–1,000 TPS depending on the validator count

- Latency: Sub-second confirmation per chain—compliant with institutional needs

- Native batching: allows for bundling transfers and cutting costs

3. Finality

Every settlement event creates:

- Inclusion proof on-chain

- Cryptographic receipt

- Optionally notarized off-chain (e.g., IPFS, AWS, or corporate legal systems)

These proofs support audit, legal, and regulatory review.

KIMA Infrastructure for Real World Asset Tokenization: Possible Use-Cases

1. Real Estate Fractionalization

Real Estate firms can break physical property into tokenized shares, enforce KYC rules, automate rent flow distribution, and enable cross-chain trading, all while ensuring compliance and finality.

2. Private Credit Instruments

Financial Institutions can issue tokenized debt notes with on-chain enforcement of maturity, interest payments, and legal jurisdiction restrictions.

3. Equity & Fund Tokens

Banks and Fintech companies can enable compliant share transfers with settlement proof, multi-chain liquidity, and regulator-friendly audit tools

4. Intellectual Property & Royalties

Fractionalize IP, enforce license logic, and automate royalty remission via proof-of-settlement events. Each scenario leverages Kima’s infrastructure to deliver enterprise-ready tokenization services.

Why Build with Kima Now?

- Institutional-Grade Tech right now. No need to assemble and maintain heavy plumbing.

- Compliance Built-In: programmable, auditable, and legally defensible.

- Scalable Settlement: high throughput, atomicity, finality, and cross-chain reach.

- Deep Integration: work with existing systems, finance, legal tech, and CRM.

- Ecosystem Bootstrap: KIMA gives infrastructure, incentives, and community.

To build a RWA platform that can stand up to legal scrutiny and perform at scale, KIMA is the launchpad.

Takeaway

The KIMA token is more than a utility token; it’s the infrastructural keystone for real-world asset tokenization platforms. From MPC security and atomic cross-chain settlement to embedded compliance and developer SDKs, it offers a full-stack solution for builders who want production-grade, legally sound platforms.

If you’re building in the real-world asset space, real estate, credit, equity, IP, Kima eliminates months of infrastructure work. It gives the foundation to focus on the product. Want to integrate the KIMA infrastructure into your tokenization solution?