AI Summary

- In the blog post, the focus is on the rise of bonding curve technology in the digital asset market, particularly in the context of decentralized exchange software solutions.

- Bonding curve DEXs automate price determination and trading without the need for order books, providing continuous liquidity and automating market-making functions.

- The post outlines the step-by-step process of developing a bonding curve DEX, from clarifying the purpose and target audience to selecting the appropriate blockchain network, designing the bonding curve and tokenomics, smart contract development, UI/UX design, ensuring liquidity, security measures, regulatory compliance, testing, deployment, and marketing strategies.

- The post emphasizes the importance of choosing a reliable DeFi exchange development company for successful implementation.

- Bonding curve DEXs offer unique advantages for token launches, liquidity provision, and customized pricing models, making them an attractive option for entrepreneurs in the DeFi space.

Pump.fun dominated headlines, and bonding curve technology regained its shine. The mathematical concept became an excellent match for the digital asset market as it undergoes drastic price swings and leans on mechanisms to stabilize and rationalize market dynamics. Over time, bonding curve decentralized crypto exchange software solutions have emerged as a smarter, more efficient way to price assets and bootstrap liquidity.

If you’re an entrepreneur thinking of launching your bonding curve DEX, this guide has all you need to know before you kick off.

What’s a Bonding Curve DEX?

A bonding curve decentralized exchange software replaces the typical order book or AMM model with a mathematical pricing function. The mathematical model automatically determines asset prices and facilitates the execution of trades.

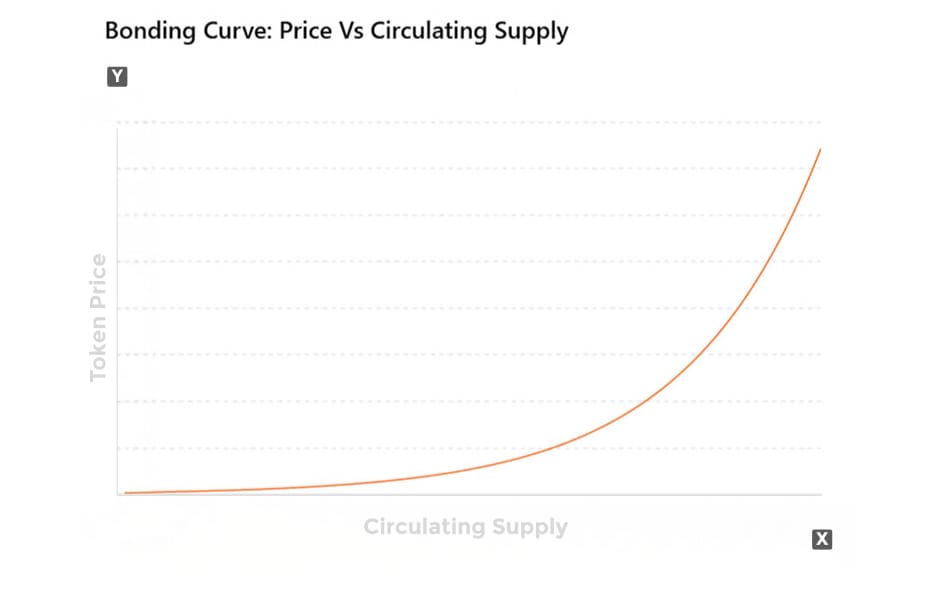

According to the predefined formula, the more people buy, the higher the token price increases. The more they sell, the lower it dips automatically. The algorithmically governed curve ensures that each purchase or sale alters the price.

How Does A Bonding Curve Decentralized Crypto Exchange Software Work?

- No order books are required to match buy and sell orders. Users buy tokens directly from the contract, not from other users.

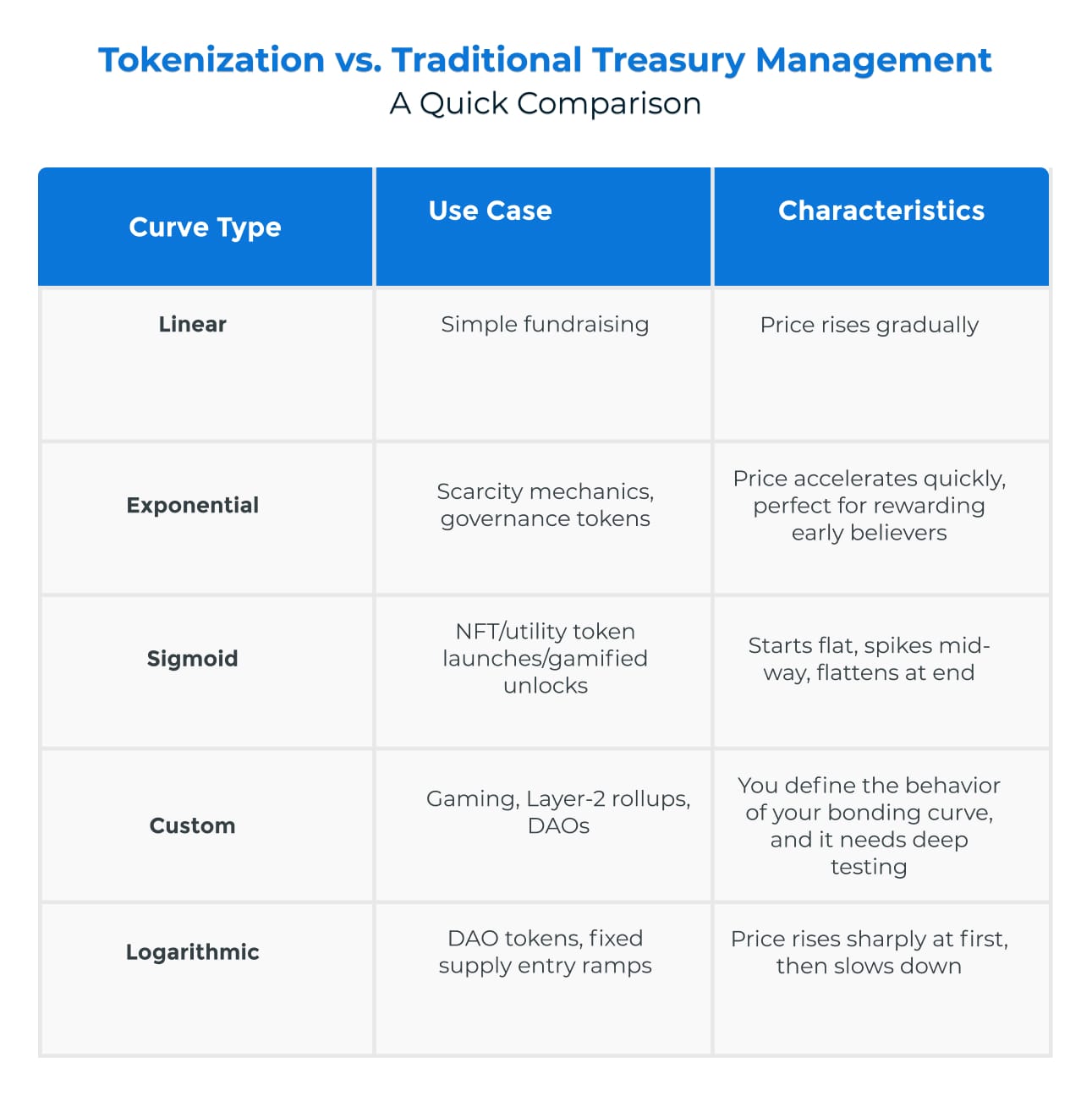

- Price is defined by a curve (usually exponential or sigmoid).

- Liquidity is baked into the curve, not pooled between multiple parties. So, traders can buy or sell tokens at any point in time without needing a direct counterparty. This ensures continuous liquidity.

- No need for market makers as Bonding curve DEX automates it. The smart contract adjusts the price in real-time, acting as a market maker.

- This makes it perfect for:

- Illiquid or long-tail assets

- New Tokens

- DAO token sales

- NFT fractionalization

- Protocol-specific utility tokens

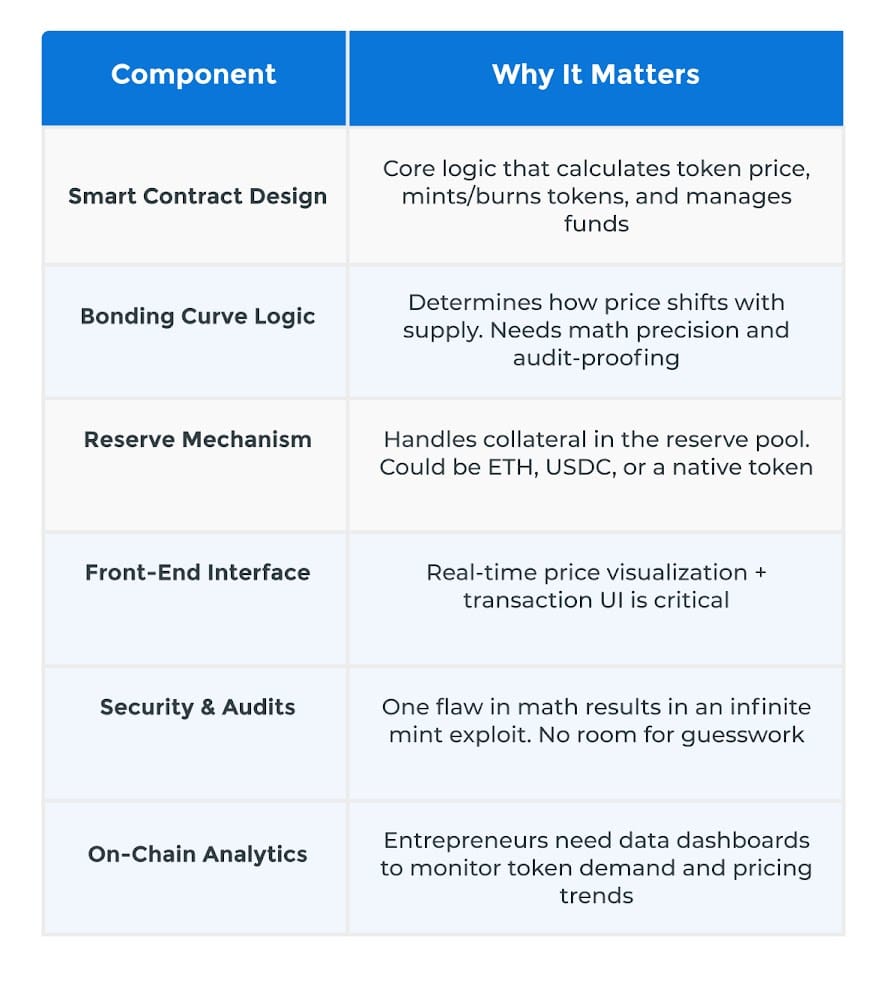

Key Components of Bonding Curve Decentralized Exchange Software Development

Bonding Curve Decentralized Exchange Software Development Benefits

Bonding curve decentralized exchange software development is attractive for entrepreneurs and simultaneously beneficial for traders. Here’s how:

- Automated Price Discovery: The prices are purely determined by the real-time market demand and supply, and the smart contract automatically updates the price each time there is a change in market dynamics due to crypto purchases or sales. An equilibrium is maintained without any manual intervention, facilitating fairer, transparent pricing.

- Continuous Liquidity: As mentioned earlier, bonding curve AMM decentralized exchange software solutions don’t need counterparties for trades. Users can trade with smart contracts at any time, and they will always give a price that corresponds to the real-time supply of that crypto/token. Platforms like UniSwap and Bancor have already demonstrated how efficiently they facilitate trades in low trading volume markets where thin order books could be a roadblock.

- Great for Token Launches: A bonding curve-based decentralized launchpad and exchange makes an excellent entry for new token launches, where they can initialize their token pools, attracting early buyers. As buyers get in, the price of cryptocurrency swells while token projects simply rely on bonding curves that automate sales and continuous price adjustments.

- Lower Slippages For Various Assets: The bonding curve decentralized crypto exchange software can customize the curve formula to suit their asset type. They can implement a flatter curve for less volatile markets (like Curve Finance does for stablecoin markets) and a steeper curve for highly scarce or volatile assets. This way, they can enable lower slippages (leveraging flatter curves) for certain assets.

Bonding curves bring together the sovereignty of DeFi and automated market maker logic, ensuring traders don’t feel controlled and always have a fair price for assets.

Step-by-Step Bonding Curve DEX Development Process

Launching a bonding curve DEX is a smart move, especially for those targeting niche tokens, community-led assets, or anything tough to list on a traditional AMM.

Here’s what you need to do:

1. Get Clear on Why You’re Building This

Before a single line of code is written, or DeFi Exchange Development Company is hired, answer this:

- Who is this DEX for?

- Why would someone choose your bonding curve over Uniswap, Curve, or Balancer?

- What makes your pricing model or asset pool interesting?

You might want to focus on a specific asset class, such as real-world asset tokens, tokenized stocks, or niche community tokens. A unique selling point or niche segment guides all other decisions. So, do your market research and find what users like or dislike about the popular bonding curve decentralized crypto exchange software solutions on the market. Here’s the list:

- Uniswap – Constant product AMM (bonding curve = x * y = k)

- Balancer – Generalized AMMs with customizable bonding curve logic

- Curve Finance – Specialized bonding curve for stable assets

- Bancor – Introduced continuous token models with bonding curves

- Ubeswap (Celo) – Mobile-friendly AMM with bonding curve mechanics

- Catalyst AMM – More advanced AMM with curve governance (in development)

Just after you decode things, you can aim for real pain points or serve some underserved market segments.

2. Choose a Chain That Fits Your Audience

Your chain choice for bonding curve decentralized exchange software development will have an impact on cost, speed, and user base. Not every DEX needs to launch on Ethereum.

- Ethereum: the largest DeFi ecosystem with lots of users and assets, and tons of liquidity, but gas fees are brutal during peak hours.

- Polygon, Arbitrum, BSC: Faster, cheaper, and EVM-compatible, making them a good middle ground.

- Solana or Cosmos: If you’re building for speed freaks or custom chains, go here. However, development tooling and programming languages are different. Moreover, you’re targeting the non-EVM crowd.

Make this choice based on where your potential user areas are, your bonding curve DEX development budget, and composability requirements.

Also:

- Carefully navigate the trade-offs in decentralization and security, and choose what aligns with your goals.

- Decide on the consensus mechanism and scalability solution if relevant.

3. Design the Bonding Curve and Tokenomics

As mentioned earlier, you can choose different bonding curves (steeper or flatter), but you can also choose your bonding curve formula that aligns with your tokenomics.

Also, figure out:

- What’s the starting price?

- Will your decentralized crypto exchange software be backed by a reserve pool?

- How does supply expansion impact the price?

- Are you charging fees on trades? (If yes, how will that be distributed?)

- Is there a governance token involved?

- Will there be any liquidity mining rewards/incentives?

If this part is fuzzy, let a seasoned strategist from your DeFi exchange development company help. It’ll save you a ton of pain later.

4. Smart Contract Development

Your bonding curve lives on-chain, governed solely by smart contracts.

- Ensure that you hire the best decentralized crypto exchange software developers to write and implement the bonding curve logic behind swaps, liquidity management, governance, staking, and everything else.

- Those DEX developers must be well-versed in your specific programming languages (Solidity, Rust, Move), and they must use battle-tested libraries (like OpenZeppelin) for common components.

- Simulate trades before deploying anything to the mainnet, and always get your contracts audited. Bugs on-chain mean millions gone overnight.

Rule of thumb: If your DeFi exchange development company can’t explain how slippage works on your curve, fire them.

5. UI/UX Design

Decentralization is something on the backend. All users care about is how your UI/UX is. Is it worth their trust, is it attractive, and at the same time making things simple and fast for them, or is it mobile-friendly?

Here are some must-haves:

- Clean interface for swapping tokens, staking, viewing pool stats, etc.

- Enable your users to connect wallets (MetaMask, WalletConnect)

- Show real-time pricing and slippage, clear confirmations for transactions.

- Let users preview how much they’ll get before they hit “Swap”

Keep it light, user-friendly, mobile-friendly, and responsive. If it feels like a 2009 banking app, users will bounce. So, prioritize UI/UX during your Bonding DEX development.

6. Solve the Liquidity Problem Before It Solves You

Bonding curves can bootstrap with little liquidity, but you’ll still need your pools deep to reduce slippage. Ensure

- Seed initial reserves (ETH, USDC, whatever)

- Offer early LP incentives with yield farming initiatives (token rewards, whitelists, etc.)

- Partner with DAOs, NFT communities, or projects looking to self-list

Your traders should be able to trade with reasonable slippage and low fees from day 1.

7. Implement Impenetrable Security

If you mess up on-chain security, it’s not just your money; it’s everyone’s. So be careful and go for:

- Thorough third-party audits by a reputable DeFi exchange development company or specialists.

- Use a multi-sig for treasury/admin controls

- Lock dangerous functions (like pausing trading or adjusting curve parameters)

For the user end, you’ll need to implement:

- HTTPS protection

- Backend rate-limiting

- DDos protection

- Regular bug bounty drives

- Oracle security

- MEV-protection

8. Don’t Pretend Regulations Don’t Exist

DeFi might be decentralized, but regulators aren’t blind.

If you’re dealing with tokens that could be securities or touching fiat, at least know the rules. Whether you target crypto-positive nations or others, you’ll still need to be up-to-date with the laws and regulations. Your DeFi exchange development company with legal expertise can assist you in launching legally and staying compliant.

In some regulations, you may require KYC/AML. There, you can implement optional KYC. Accordingly, your legal partners can help you target your specified jurisdictions.

9. Testing and Deployment

Don’t go from “ bonding curve decentralized exchange software development done” to “mainnet live” in one leap. Go for unit tests for contracts, watch how your system holds up under load, integration tests with the front-end, and beta testing to spot any UX bugs or issues before your customers get disappointed.

- Simulate price movement, curve behavior, and front-end weirdness if you’re using a custom bonding curve formula.

- You can go for phased rollouts, so you expand efficiently, eradicating any issues that arise.

Only after this do you even think about launching public pools.

10. Marketing and Community

No one will come for your bonding curve decentralized exchange software until you shout out loud. Consider a robust pre-launch and post-launch community and marketing plan.

- Consider incentives like airdrops or referral programs to onboard initial users.

- Post-launch, maintain an active community on Telegram/Discord or similar. This not only helps user retention but also gives you feedback and word-of-mouth promotion.

- Listing your DEX’s token (if you have one) on tracking websites (CoinGecko, DeFi Pulse, etc.) will improve visibility.

- Don’t miss out on cross-project partnerships. Perhaps your DEX can be an exchange module in a larger DeFi ecosystem or integrate with wallets and aggregators. This only gives you more traffic.

Now that you know all. It’s time to start your search…

Picking the Right DeFi Exchange Development Company

Your project will only be as strong as the DeFi exchange development company backing it. Pick one with

- Experience in Decentralized Exchange Software Development

- Solid portfolio in bonding curve or custom AMM logic

- In-house expertise on tokenomics modeling

- End-to-end services: Frontend, Smart Contract, Audits, DevOps

- Strong post-launch support (upgrades, analytics, liquidity strategies)

- Web3 marketing expertise

Build With Confidence, Launch With Purpose

Bonding Curve DEXs are still in the early stages. But they’re incredibly powerful for controlled token distribution, automated pricing, and liquidity bootstrapping without relying on whales or VC bags. Whether you’re planning your bonding curve DEX development for a DAO, a niche token, or a community-led economy, you will have to ace the architecture, curve math, and user experience.

Choose Antier

With years of experience building fool-proof decentralized crypto exchange software solutions and custom AMM logic, Antier helps you move from whiteboard to mainnet with confidence.

Share your project requirements right away!

Frequently Asked Questions

01. What is a Bonding Curve DEX?

A Bonding Curve DEX is a decentralized exchange that uses a mathematical pricing function to automatically determine asset prices, replacing traditional order book or automated market maker (AMM) models.

02. How does a Bonding Curve DEX ensure liquidity?

A Bonding Curve DEX ensures continuous liquidity by allowing users to buy or sell tokens directly from the smart contract, with prices adjusted in real-time based on a predefined curve, eliminating the need for market makers.

03. What are the benefits of Bonding Curve decentralized exchange software development?

The benefits include automated price discovery based on real-time market demand, fairer and transparent pricing, and the ability to facilitate trading for illiquid assets, new tokens, and DAO token sales without manual intervention.