$143+ billion. That is the current combined market cap of tokenized RWAs and DeFi assets. But today’s investors are no longer betting on just big ideas. They are putting capital behind real-time execution that is transparent, verifiable, and built onchain. If you are building a tokenized real-world asset platform or a DeFi protocol, investor readiness requires more than a polished whitepaper. It demands proof that your token works under real conditions and lives onchain from day one.

So how do top founders gain that level of trust?

How do they go from tokenomics to mainnet in just days?

This blog unpacks how onchain crypto token development services are reshaping the roadmap for RWA and DeFi projects. Learn how you can launch smarter, scale faster, and deliver investor confidence from the start.

What Is Onchain Token Development?

Onchain token development refers to the process of creating a token whose full logic is governed by smart contracts deployed directly on a public blockchain. Unlike offchain or semi-centralized tokens, these tokens are completely transparent, tamper-proof, and auditable in real time.

This approach ensures that all token-related activities are verifiable by investors, communities, and regulators without relying on manual inputs or third-party databases. Onchain tokens can support advanced functionality like automated vesting schedules, dynamic bonding curves, staking logic, governance voting, and cross-chain operability, all coded immutably into the blockchain layer. For projects launching tokenized RWAs or building DeFi ecosystems, on-chain crypto token development is now seen as a credibility standard, not just a technical option. It conveys trust, maturity, and preparedness to investors seeking transparency and automation.

How Onchain Token Development Builds Trust for Both RWA & DeFi Models?

Trust is the currency of growth, and onchain token development is the most direct way for RWA and DeFi projects to earn it. Whether you are tokenizing a real estate portfolio or building a decentralized lending platform, investors expect more than just a whitepaper. They want verifiable proof. Onchain logic delivers that proof.

When a token’s core functions, such as minting, burning, yield distribution, and governance, are programmed into smart contracts, the system becomes immutable, transparent, and publicly auditable. This kind of visibility minimizes friction with regulators, increases investor confidence, and builds long-term credibility.

For RWAs:

- Token holders can verify asset backing through oracles and smart contract records.

- Revenue flows and yield distributions are automated with no manual intervention.

- Compliance measures from the real world can be encoded into the logic for seamless oversight.

For DeFi:

- Treasury management, staking, and reward systems are fully visible and locked after deployment.

- Governance structures become community-driven, fostering stronger alignment with stakeholders.

- Liquidity locks, vesting periods, and security features can all be verified on-chain

By using trusted token development services, your project avoids the uncertainty of custom-built code and gains access to a pre-tested, audit-ready foundation. This allows you to focus on building investor relationships rather than debugging logic or patching vulnerabilities. This is exactly what today’s RWA and DeFi investors are looking for.

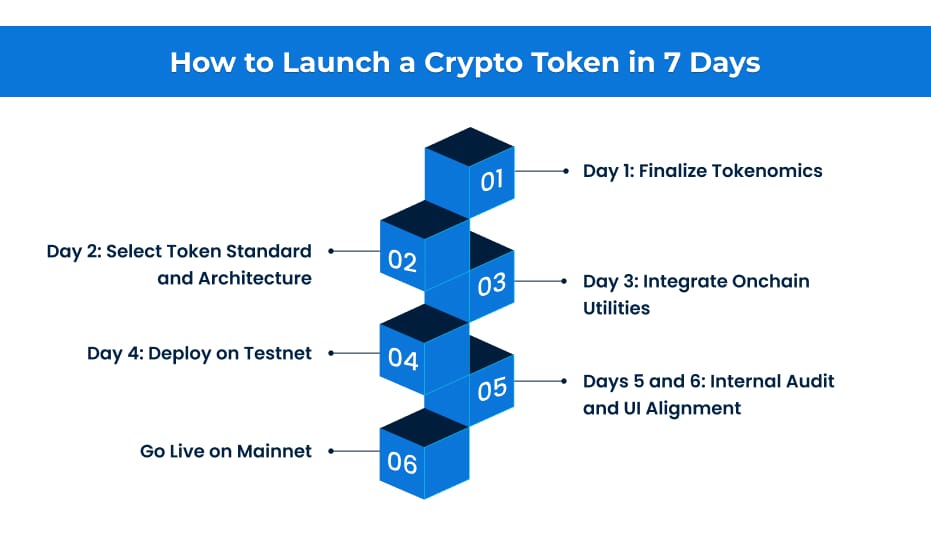

How to Launch a Crypto Token in 7 Days

Day 1: Finalize Tokenomics

Establish total supply, distribution logic, lock-in periods, vesting schedules, and token utility. Every number must support both user growth and investor confidence.

Day 2: Select Token Standard and Architecture

Choose the right chain and format. ERC-20, BEP-20, or a custom multi-chain architecture based on your audience and scaling needs. This stage also involves customizing smart contract modules to suit your project’s exact purpose.

Day 3: Integrate Onchain Utilities

Add staking logic, yield mechanisms, DAO support, and real-time compliance tools like whitelisting and transfer restrictions. These on-chain features signal project maturity and increase investor trust.

Day 4: Deploy on Testnet

Simulate smart contract performance in real-world conditions. Test every function, including minting, burning, transfer logic, vesting flows, and governance hooks.

Days 5 and 6: Internal Audit and UI Alignment

We run audit-ready checks and sync all smart contract logic with any frontend interfaces like token dashboards or vesting portals. This stage ensures everything is launch-ready.

Day 7: Go Live on Mainnet

Once tested and verified, your token is deployed publicly. We provide post-launch support, technical documentation, and optional investor pitch materials.

The shortcut? White-label token development. It eliminates the need to code from scratch, reducing risk while maintaining flexibility. You save time, minimize risk, and still retain full control over features like tokenomics, vesting, and compliance. It’s the fastest way to launch a secure, investor-ready token without sacrificing flexibility or quality.

Explore the full breakdown How to Launch Your Crypto Token and take the next step with clarity.

Ready to Build an Investor-Grade Token Onchain?

Onchain token development builds investor confidence through transparency, automation, and real-time traceability. Whether you’re launching an RWA-backed asset or a DeFi protocol, smart contracts offer the trust layer investors demand. With professional token development services, you can launch faster, cut costs, and reduce risk.

Want to move from whitepaper to mainnet in just seven days? Antier’s token development services make it possible. As a trusted token development company, we offer a proven framework that covers everything: tokenomics, smart contract deployment, onchain integrations, and regulatory readiness. Get your project investor-ready with speed and confidence.

Frequently Asked Questions

01. What is onchain token development?

Onchain token development is the process of creating a token governed by smart contracts on a public blockchain, ensuring transparency, tamper-proofing, and real-time auditability without relying on manual inputs or third-party databases.

02. How does onchain token development build trust for RWA and DeFi projects?

Onchain token development builds trust by providing verifiable proof of a token's core functions, such as minting and governance, which are programmed into immutable smart contracts, enhancing transparency and investor confidence.

03. Why is investor readiness important for tokenized RWA and DeFi platforms?

Investor readiness is crucial because it requires more than just a polished whitepaper; it demands proof of a token's functionality under real conditions, which onchain development provides, thereby conveying trust and preparedness to investors.