The token economy is scaling faster than anyone predicted. Industry reports suggest trillions of dollars in tokenized assets by the end of the decade. In 2026, token development sits at the intersection of innovation and regulation, blending technology, compliance, and financial design into one strategic discipline.

New technologies, such as Layer-2 scaling, AI-assisted audits, and modular blockchains, are lowering barriers but increasing strategic complexity. This guide explores how founders can navigate these changes effectively and build tokens that stand the test of market maturity, regulation, and innovation.

What’s Changing the Token Development Landscape?

A few years ago, building a token involved writing a smart contract and deploying it on the Ethereum blockchain. Today, Token development has evolved into a complete business architecture. With frameworks like MiCA in Europe and policy updates from the U.S. SEC, the global landscape demands that every token development company aligns its process with higher standards of security, compliance, and governance.

Founders are no longer just asking how to launch; they’re asking how to sustain. From utility tokens to RWA-backed assets, every project now undergoes careful assessment of its tokenomics, liquidity, and audit protocols. That’s why professional development has become central to helping projects build sustainable, compliant ecosystems rather than speculative ones. As Web3 merges with traditional finance, crypto token development isn’t just about writing code; it’s about creating trust, transparency, and accountability.

In this environment, understanding the mechanics behind token creation ensures your project is not only efficient but also credible in a regulated, institutional-ready market.

The Key Drivers Behind Crypto Token Development Costs in 2026

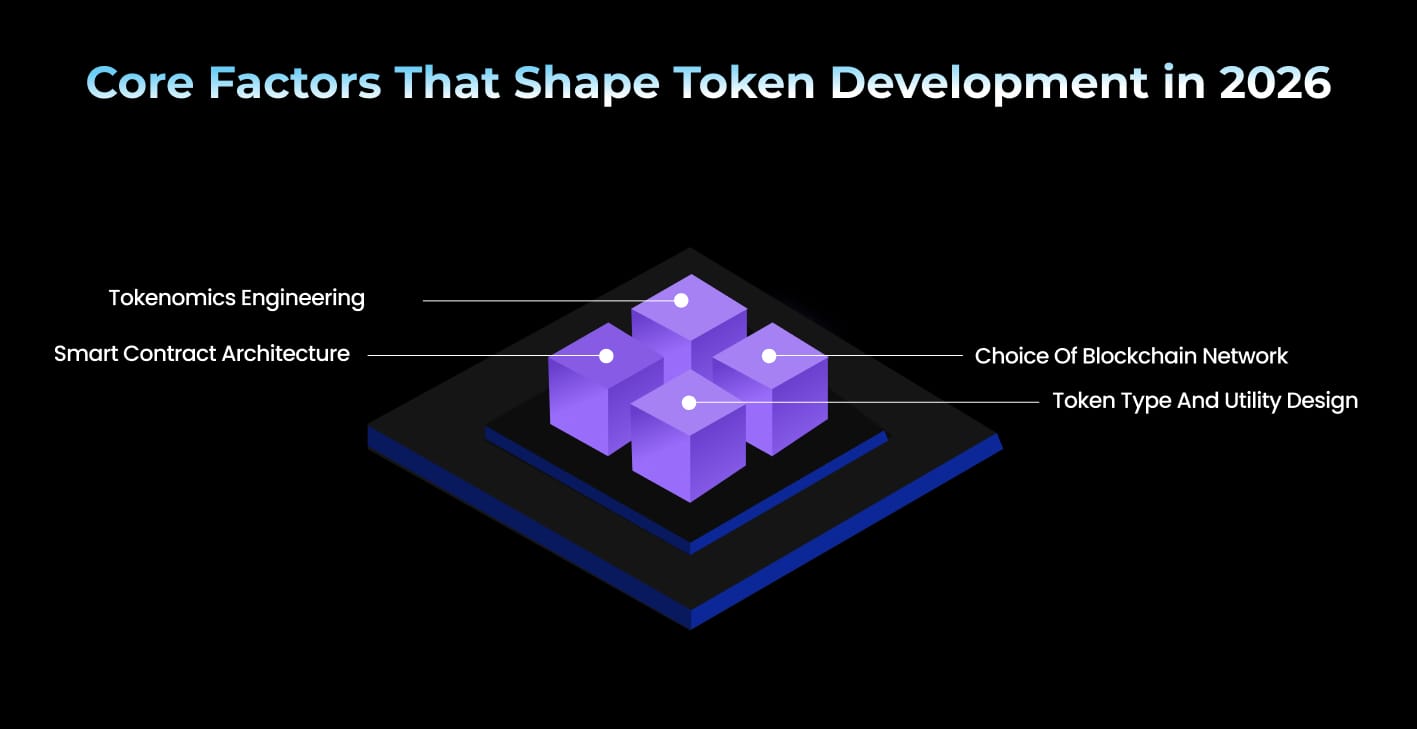

Token creation is no longer a one-dimensional process; it’s an ecosystem of technical and strategic layers that define your project’s scalability. Here’s what truly drives token development expenditure in 2026:

1. Choice of Blockchain Network

Ethereum remains dominant, but high-throughput networks like Solana, Avalanche, Polygon, and Base are becoming preferred choices for projects seeking speed and lower gas overheads. Each network comes with unique SDKs, consensus models, and integration paths, influencing time, skill requirements, and overall development approach.

- Evaluate interoperability and cross-chain bridge support for multi-network deployment.

- Consider community adoption and liquidity pool availability for faster market entry.

- Review regulatory acceptance of the blockchain in your target jurisdiction.

- Estimate long-term scalability and upgrade pathways to prevent future migration costs.

2. Token Type and Utility Design

Utility tokens, governance tokens, RWA tokens, and NFT hybrids all demand different frameworks. The more complex your utility logic, staking, yield distribution, or governance voting, the more intricate your smart contract structure becomes.

- Define a clear value proposition to avoid overlapping utilities.

- Incorporate real-world use cases to strengthen investor trust and token relevance.

- Plan for token lifecycle events like minting, burning, and vesting logic.

- Evaluate regulatory implications for each token type to ensure compliance readiness.

- Design for interoperability across wallets and dApps to boost accessibility.

3. Smart Contract Architecture

At the heart of every token lies a contract that defines value logic, ownership, and transfer protocols. In modern crypto token development, this foundation ensures security, compliance, and long-term reliability.

- Implement multi-signature or time-lock mechanisms for enhanced governance security.

- Prioritize gas optimization to ensure cost-effective transactions.

- Utilize upgradeable contract patterns for future scalability and flexibility.

- Conduct multiple testnet iterations before mainnet deployment.

- Integrate automated monitoring tools for real-time anomaly detection.

4. Tokenomics Engineering

Tokenomics is where financial science meets behavioral design. Every token model, vesting schedules, burn mechanics, or reward loops must be simulated under multiple market conditions. Effective token development today requires this strategic financial modeling before a single line of code is written.

- Model supply and demand dynamics to ensure long-term liquidity stability.

- Design community-driven incentive systems to encourage participation.

- Build transparent governance and treasury management mechanisms.

- Simulate stress-test scenarios to evaluate sustainability under volatility.

- Ensure audit-ready documentation to attract institutional partners.

A reliable token development services provider integrates advanced modeling tools, community analytics, and predictive simulations to validate token sustainability. This holistic approach prevents inflationary risks, encourages retention, and supports steady growth across both retail and institutional ecosystems.

Request your personalized Token Development strategy today.

Token Creation Stages — A Strategic Breakdown

Stage 1: Ideation and Discovery

Define the token’s purpose—governance, DeFi utility, or asset representation. Clear goals shape the architecture, compliance, and long-term scalability.

Stage 2: Tokenomics and Modeling

Design the financial logic, including supply, distribution, and reward mechanics. Data-driven token development services use simulation tools to test sustainability under different market conditions.

Stage 3: Smart Contract Development

Develop, test, and deploy secure contracts using Solidity, Rust, or Move. Professional crypto token development ensures cross-chain compatibility and audit-readiness.

Stage 4: Security Audits

Third-party audits validate reliability and compliance. A trusted development company uses vulnerability scanning and real-time monitoring for maximum security.

Stage 5: Post-Launch Support

Manage liquidity, exchange listings, and community governance. Consistent updates keep tokens stable, compliant, and valuable.

Common Pitfalls Founders Should Avoid

Even visionary projects fail when they cut corners in early stages. Common mistakes include:

- Skipping tokenomics validation — resulting in unstable supply mechanics.

- Overlooking security audits — opening exploitable vulnerabilities.

- Choosing the wrong blockchain — leading to limited liquidity or scalability issues.

- Neglecting post-launch strategy — leaving tokens without community traction or exchange visibility.

Founders who prioritize structure, audits, and clarity early save months of rework later.

Get a Custom Token Development Estimate for 2026

What Questions Should You Ask Before Starting Token Development?

Q1. What real problem does the token solve, and what utility will it deliver in the ecosystem?

Q2. Which blockchain platform are we going to deploy on, and why is it the most appropriate network for our goals?

Q3. What type of token will it be (utility, governance, RWA, hybrid), and how will that affect token mechanics and user behaviour?

Q4. How is the smart contract architecture designed, what standards are being followed, and how will upgrades or changes be managed?

Q5. What are the tokenomics, supply model, distribution, vesting, inflation/deflation, reward mechanics, and have we stress-tested it under various market scenarios?

Q6. What security and audit processes are in place, including third-party review, bug-bounty programmes, and ongoing monitoring?

Q7. What regulatory and compliance considerations apply (jurisdictions, licensing, securities tests, AML/KYC) for our target markets?

Q8. What is the post-launch plan for liquidity, exchange listing, community governance, token burns or staking, and how will we maintain momentum?

Q9. Which metrics or KPIs will we track to measure token adoption, utility, engagement, and ecosystem health, and how will we pivot if targets aren’t met?

Asking these questions early gives you a much stronger foundation and signals to investors, partners, and users that you’re not just launching a token, you’re building a sustainable ecosystem through professional token development services.

Conclusion

The true cost of token development in 2026 is not defined by numbers but by precision, credibility, and scalability. Every choice, from selecting the right blockchain to designing effective governance, shapes the long-term success of your token. In a market where investors value transparency and regulators demand accountability, your token must reflect both innovation and trust. Whether you are tokenizing assets, building DeFi ecosystems, or creating AI-powered economies, progress begins with a partner who understands your vision and technology in equal measure.

Your project’s potential is not determined by how fast you launch but by how well you build. Choose expertise, choose structure, and choose sustainability with Antier, a trusted global leader in blockchain and crypto token development excellence.

Frequently Asked Questions

01. What is the current state of the token economy?

The token economy is rapidly scaling, with industry reports predicting trillions of dollars in tokenized assets by the end of the decade, driven by innovations in technology and regulatory compliance.

02. How has token development evolved in recent years?

Token development has transformed from simply writing smart contracts to a comprehensive business architecture that requires alignment with security, compliance, and governance standards due to evolving regulations.

03. What factors influence the costs of crypto token development in 2026?

The costs of crypto token development are influenced by the choice of blockchain network, the complexity of technical and strategic layers, and the need for interoperability and cross-chain support.