The Real Estate Tokenization Platform Development comes with plenty of promises. However, the first question businesses need to address before simplifying the tokenization journey is the cost. As more property owners, real estate firms, brokers, and private companies invest in Real Estate Tokenization Platform Development, the demand for digitizing property ownership is growing. This guide will help figure out how much investment is needed to build a Real Estate Tokenization Platform.

Why Real Estate Tokenization Platform Development?

Tokenization is reshaping the entire landscape of property management and ownership. Property owners can convert their real estate properties into digital tokens using the Real Estate Tokenization Platform. By removing middlemen, the tokenization platform unlocks fractional ownership, transparency, and higher liquidity in property trading and enables global investors to invest, trade, and manage real estate without legal, financial, operational, or technical hassles.

Factors That Impact the Real Estate Tokenization Platform Development Cost

The Real Estate Tokenization Platform development cost can vary, depending on what the platform needs to do, where it will operate, and who will use it. Someone creating a minimal platform to tokenize a single property for a closed group of accredited investors in one country has a much lighter lift than someone launching a multi-jurisdictional platform with automated dividends, multi-chain support, and real-time investor dashboards. While features and functionality drive price, there are certain factors that impact the Real estate tokenization platform cost.

1. Blockchain Infrastructure

The tech stack plays the most important role, and the cost varies with every blockchain network. While the Ethereum blockchain for development is battle-tested and secure, the gas fees are quite high, especially if it supports high-frequency activity.

Polygon, Polygon, BSC, or Tezos can be more suitable options to build mid-tier platforms. Solana could be the best choice for lightning-fast transactions; however, it may not be ideal for high-value assets. And, for flexible, energy-efficient, interoperable platforms, Polkadot could be an ideal choice.

2. Smart Contract Development

Smart contracts are the legal infrastructure automated on-chain. The terms and conditions mentioned in the smart contracts determine KYC logic, Revenue distribution, dispute resolution, and other important functions. The real estate tokenization platform requires a smart contract for:

- Token issuance (with or without lockups)

- Ownership transfers (with restrictions)

- Revenue/profit sharing

- Cap table logic (especially for equity-based models)

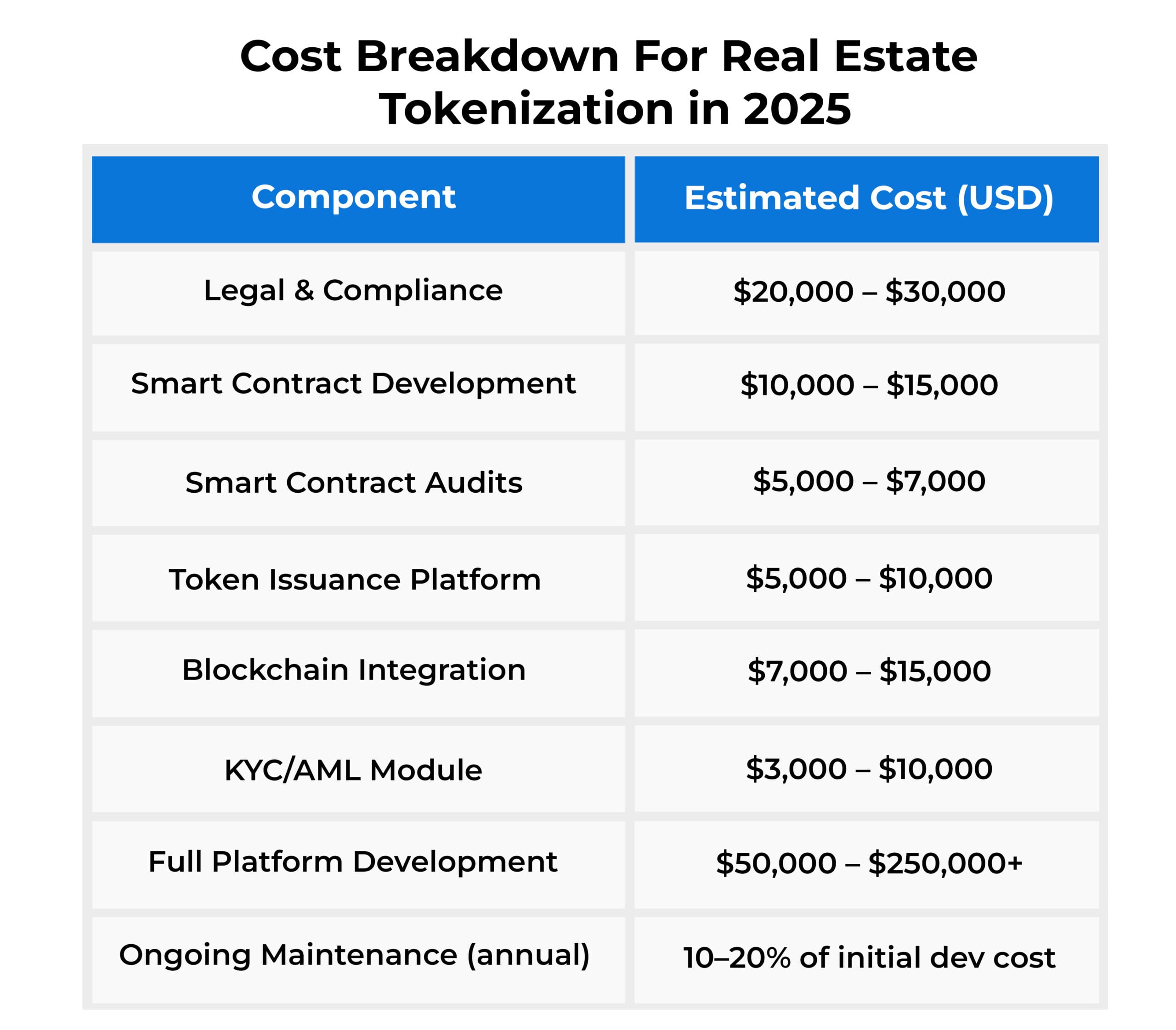

While open-source templates exist, most platforms require at least some customization. That means development time, testing, and security audits. Expect to spend $10,000–$15,000 on smart contract engineering, with an additional $5,000–$7,000 for third-party audits.

Skipping the smart contract is like gambling with both compliance and investor confidence.

3. Compliance and Legal Architecture

The regulations to operate a tokenization platform vary from country to country. Most real estate tokens qualify as securities, which means full legal vetting and compliance infrastructure are required.

In the US, the tokenization platform must be compliant with the SEC and the Howey Test. In the EU, it must be MiCA-compliant and other country-specific regulations. Asia has a mixed landscape; Singapore and Hong Kong are relatively clear, while India is still evolving. Download our detailed ebook on Regulatory requirements across countries for Real Estate Tokenization Platform Development.

Each jurisdiction brings added costs:

- Legal consultation: $15,000–$30,000 depending on asset type and structure

- KYC/AML modules: $3,000–$10,000 depending on provider and depth

- Ongoing reporting: May require integrations or manual legal reviews

Please note: Skipping legal compliance across countries can make a platform eligible for lawsuits.

Core Features of Tokenization Platform That Impact Cost

A minimal Real Estate Tokenization Platform typically includes:

- Token creation (ERC-20 or similar standard): Tokens are used to digitally represent property shares. ERC-20 is the most common format and keeps things compatible across wallets and exchanges.

- Wallet integration: Wallet enables users to store, send, or receive tokens. Custodial wallets are simpler for non-crypto users and easier to manage for regulated assets.

- Simple compliance layer: This is for the basic identity verification to meet AML laws without building complex compliance systems.

- Basic admin panel for issuers: It enables asset issuers to upload documents, manage token supply, and manually track investor participation or distributions.

- Manual dividend tracking: Manage distributions (like rental income) are tracked outside the system and disbursed manually, with no automated profit-sharing logic.

- Smart contract logic for ownership records: This keeps track of who owns what using immutable blockchain records, replacing traditional paper-based property ledgers.

The average cost of a real estate tokenization platform in 2025 can be $40,000 to $60,000 if you are working with an experienced Real estate tokenization platform Development Company and using a public blockchain like Polygon or BSC to keep fees manageable, with minimum features.

Functional and Regulatory Triggers for Advanced Cost Tiers

The cost of building Real Estate Tokenization Platform 2025 for scale, compliance, and automation, costs escalate fast. Here’s what drives the budget above $100,000:

- Serve users in multiple jurisdictions: This requires region-specific compliance logic and data handling practices to meet different regulatory mandates.

- Automate compliance workflows (AML, investor classification, limits): It reduces manual compliance tasks by embedding rule-based workflows for investor screening and investment restrictions.

- Offer secondary trading or connect with regulated exchanges: This enables token resale and liquidity but brings exchange licensing, custodial integration, and legal oversight into the picture.

- Handle real-time rental income distribution: Automatically distributes income based on token holdings, requiring high-accuracy smart contracts and time-based calculations.

- Display portfolio performance to investors: This adds interactive dashboards that track token value, income returns, and ownership history, a frontend-heavy feature.

- Payment gateways: They facilitate secure custody and fiat conversion but increase API complexity and compliance dependencies.

Long-Term Security Requirements and Maintenance Costs

Security is non-negotiable, and it continues well after launch. Choose a white-label tokenization development company that meets security and maintenance requirements even after the platform launch. Here is what a platform needs:

- Encrypted wallets to secure token access with advanced encryption protocols to prevent unauthorized control.

- MFA and secure login flow to ensure only authorized users access the platform through multi-factor authentication and session management.

- Transaction monitoring to track transactions in real time to flag fraudulent behavior, manipulation, or regulatory violations.

- MPC for key management for multi-party computation to distribute control of private keys across servers, removing single points of failure.

And once it’s live, it’s never done. Budget 10–20% of your initial build cost annually for maintenance, regulatory updates, and adapting to tech shifts like blockchain forks or API changes.

Optional Modules for Better Functionality

As platforms mature, additional functionality becomes necessary. These features push development and compliance needs further:

- Secondary trading for liquidity: It requires regulatory clearance and exchange-level matching logic to allow token resale among approved investors.

- NFTs for luxury or unique property types: Tokenizes distinctive assets.

- AI modules to auto-verify investor profiles or assess property value: This speeds up compliance and investment analysis.

- Real-time dashboards for investor performance tracking: This helps to present live investment data accurately.

- DeFi integrations for stablecoin-based rental yields: It offers passive income options via stablecoin protocols.

Real Estate Tokenization Platform Development Cost: Where It Starts, Where It Ends

In 2025, the starting cost for a basic real estate tokenization platform, something that handles token creation, basic compliance, and asset representation, generally begins around $40,000 to $60,000. That figure includes core development, initial legal consultations, and foundational smart contract work.

However, the cost to launch a real estate tokenization platform climbs significantly as more advanced features are added. For platforms supporting multiple asset types, automated revenue distribution, investor onboarding, jurisdiction-specific compliance modules, secondary trading, and data integrations, the investment can reach $100,000 to $300,000 or more. And that doesn’t include the ongoing maintenance or legal fees tied to evolving regulations.

Be Cautious About Your Investments

For Real Estate Tokenization Platform Development, Real Estate firms must understand that tokenization is a regulatory product, and implementing smart contracts, legal compliance, and security is non-negotiable. The process should be strategic with clearly defined must-haves. Map out jurisdictions and investor profiles. Choose your blockchain based on real trade-offs, not trendiness. And above all, pick a development team that understands the legal, financial, and technical stakes of what you’re building.