Kaanch Network, the next-generation layer 1 Blockchain network, is driving Real World Asset Tokenization adoption worldwide. With presale crossed over 1.12 million, Kaanch is specifically designed for Real World Asset Tokenization to address regulatory uncertainty, technological hurdles, and market skepticism. This purpose-built blockchain is unlocking new opportunities for liquidity for platform builders and making investments in real-world assets as simple as trading.

This guide explores why the Kaanch network is the best to build a Real-World Asset Tokenization platform, and how its features align with the investor’s goals.

The Promise and Pain Points of Real-World Asset Tokenization

Financial investments are always considered stable, with wealth-building potential. However, market limitations like illiquidity, high entry barriers, complex global regulations, and slow settlements make it inefficient and outdated.

Kaanch network overcomes these hurdles through Real World Asset Tokenization with transparent, instant, and cross-border transactions. Its amalgamation with RWA makes it well-suited for creating frameworks that Fintech, Real Estate, Banks, and Businesses need to grow in regulated global environments.

Why Kaanch Network is Leading the Real-World Asset (RWA) Tokenization Revolution

The tokenization of real-world assets is one of the most transformative innovations in business. But despite the hype, only a few platforms have been able to deliver scalable, secure, and compliant infrastructure to support RWAs at a global level. But Kaanch network is changing it with:

Unmatched Speed and Scalability for Real-world Use

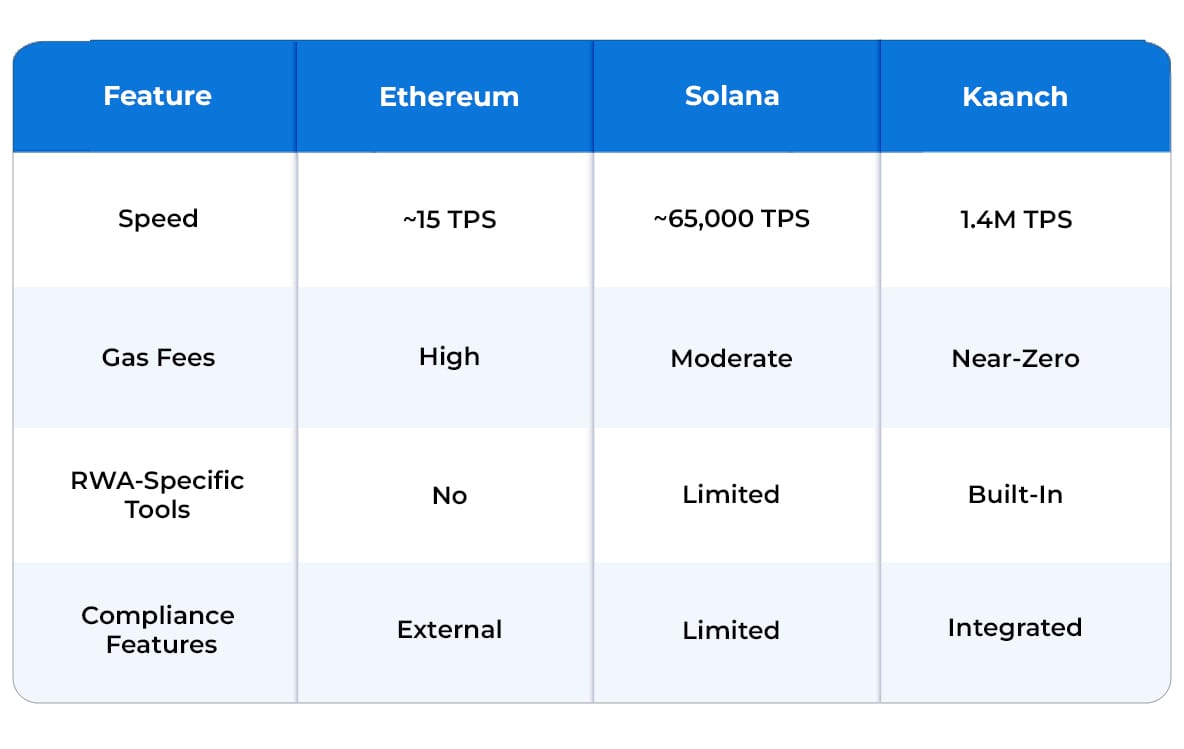

While Ethereum pioneered the RWA asset tokenization, its slow transaction speeds and high gas fees have limited its practicality. Solana offers faster transactions but lacks the tailored infrastructure needed for large-scale RWA deployment.

Ethereum vs. Solana vs. Kaanch

Kaanch Network delivers an industry-leading 1.4 million

Transactions per second (TPS) with sub-second finality and near-zero gas fees. This performance enables investors to do real-time trading, perform seamless ownership transfers, and make fractional investments—even during high-volume periods. For fintech companies looking to scale without sacrificing efficiency or cost, Kaanch is the only blockchain fast enough to handle RWAs at the enterprise and institutional levels.

Seamless Interoperability Across Blockchains

Cross-chain compatibility is a must in today’s decentralized world. Most blockchains operate in isolated ecosystems, limiting liquidity and accessibility. Kaanch Blockchain is built for full interoperability, allowing assets tokenized on Kaanch to be bridged across networks like Ethereum, Solana, and BNB Chain.

This means a tokenized real estate asset on Kaanch can be traded or held on other blockchains without friction, maximizing exposure and liquidity. Investors benefit from more flexible entry and exit points, while platforms can expand market reach effortlessly.

Secure and Decentralized Ownership via Smart Contracts

Kaanch Blockchain leverages smart contracts to automate ownership rights, dividend distributions, and transfer processes, eliminating reliance on costly intermediaries. These tamper-proof contracts ensure:

- Ownership cannot be forged or contested

- No unnecessary third-party fees

- Instant, transparent transfers without bureaucratic delays

With blockchain acting as legal proof of ownership, investing in real-world assets becomes significantly more secure and efficient. Whether it’s commercial property or tokenized commodities, Kaanch’s architecture ensures integrity and trust at every layer.

How Kaanch Network Is Addressing the Real-World Challenges of RWA Tokenization

Tokenizing real-world assets can also have certain limitations. Many platforms have stumbled when confronted with legal complexity, market skepticism, and technical limitations. Kaanch Blockchain for RWA Tokenization is designed to overcome these exact challenges.

1. Built-In Legal Compliance and Regulatory Readiness

Legal uncertainty remains a major bottleneck in RWA adoption. From SEC securities classifications in the U.S. to AML laws globally, the regulations keep changing with time.

Kaanch embeds compliance directly into its infrastructure, offering:

- Automated KYC/AML with native identity verification (.knch domains).

- Immutable audit trails for transparent reporting.

- Permissioned smart contracts to control asset access by jurisdiction or investor type.

For businesses that would otherwise spend months and significant capital building compliance tools, Kaanch delivers these features out of the box.

2. Real Liquidity Through Global Market Access

Liquidity is the lifeblood of any financial market. Without active buyers and sellers, tokenized assets lose appeal. Kaanch’s high throughput and sub-second finality enable real-time, low-fee trading, even for micro-investments.

It’s cross-chain bridges allow tokenized assets to tap into multiple liquidity pools, expanding market potential. Migrating from Ethereum to Kaanch could increase user growth and create a boom secondary market within six months.

3. Enterprise-Grade Security, Scalability, and Resilience

Security concerns around smart contracts and network congestion are valid, especially in high-value asset classes like real estate or infrastructure. Kaanch addresses these risks with:

- A robust network of over 3,600 validators ensures deep decentralization.

- Purpose-built RWA token standards minimize contract bugs.

- A resilient architecture that prevents congestion even under load.

This provides institutions with the confidence they need to onboard real-world assets onto the blockchain securely and reliably.

4. Transparent Governance and On-Chain Reporting

Trust is crucial, particularly for institutional investors and high-net-worth individuals. Kaanch uses a Decentralized Autonomous Organization model that gives stakeholders voting rights over protocol upgrades, treasury management, and platform rules.

Every vote, decision, and transaction are recorded on-chain for full auditability. This transparency fosters a level of trust and accountability that traditional real estate or financial systems often lack.

5. Cost-Efficient Operations and Easy Integration

Deploying a compliant, scalable Real World Asset solution from scratch is costly. Kaanch significantly reduces development time and costs with:

- Ultra-low transaction fees.

- Developer-friendly APIs and SDKs.

- Easy integration with current solutions.

Whether a startup launching its first property token or a legacy institution modernizing its infrastructure, Kaanch offers rapid time-to-market with a lower total cost of ownership.

What Can Be Tokenized on the Kaanch Network?

Almost anything of value. The Kaanch Network is transforming how we invest in the real world by bringing high-value assets on-chain and making them accessible to everyone.

1. Real Estate

No need for millions upfront. On Kaanch, you can invest in residential and commercial properties or even raw land by owning fractional shares. Earn rental income through smart contracts while building your real estate portfolio one token at a time.

2. Fine Art & Collectibles

Art is no longer just for galleries or the ultra-wealthy. Tokenized masterpieces—from paintings to sculptures—let you own a piece of cultural history without needing to buy the whole work. You can even trade these digital shares, just like stocks.

3. Commodities & Precious Metals

Trade tokenized gold, silver, oil, and rare minerals—without the hassle of physical storage or shipping. Kaanch turns traditional commodities into digital assets you can invest in anytime, from anywhere.

4. Stocks & Bonds

Kaanch unlocks global access to traditional financial instruments. Tokenized stocks and bonds are available 24/7, with no market hours and no borders. It’s investing made simple and seamless.

Intellectual Property & Royalties

Artists, musicians, and creators can now tokenize their work. Fans and investors can buy a share of future royalties, supporting talent while earning passive income. It’s ownership with purpose.

These aren’t just niche use cases—they’re trillion-dollar markets. And they’re all being brought onto the blockchain, powered by Kaanch.

What Does the Future Hold for Kaanch Network?

The Kaanch Network will make the Real-World Asset Tokenization development more practical and share a better user experience with investors by offering the following:

- 1.4 million transactions per second for true financial scalability.

- Near-zero fees for affordable investments.,

- Smart contract automation for secure, trustless ownership.

- Multi-chain interoperability for global, borderless trading.

Kaanch Network is not just another blockchain that is fast and secure, it’s a foundation for the next generation of investing. One where access is open, ownership is transparent, and opportunity is limitless.

The future is decentralized. The future is tokenized. The future is Kaanch.

Are you ready to take your stake in it? Partner with Antier and build your scalable tokenization platform that reshapes the user experience and makes tokenization investments borderless.