AI Summary

- Experience a revolutionary shift in the financial industry with Alchemy Pay's introduction of the ability to buy tokenized U.S.

- stocks directly with fiat currency.

- This game-changing development eliminates the need for a complex crypto intermediary, creating a direct path from local currency to tokenized ownership of real-world assets.

- The fiat-to-RWA tokenization model simplifies the investment process, making it more accessible to mainstream users and institutions alike.

- By leveraging familiar payment methods and ensuring legal compliance, this innovative approach opens up new possibilities for global financial participation.

Alchemy Pay’s announcement that users could buy tokenized U.S. stocks directly with fiat didn’t just mark a milestone for them; it was a proof point for the entire industry. For years, RWA Tokenization platform development services were limited in practice. They lived in a bubble where only crypto-savvy investors could participate.

Now, the fiat-to-RWA tokenization model changes the equation. It creates a direct bridge: local currency → tokenized ownership.

This creates a new architecture for financial access. One that has the power to transform how billions of people invest, how institutions distribute assets, and how businesses build financial ecosystems.

This guide will provide you with everything you need to know about fiat-to-RWA Tokenization platform development services, including how to build the necessary digital asset infrastructure and monetize it.

Understanding How Fiat-To-RWA Works

The Tokenization Infrastructure with Fiat-To-RWA enables investors to purchase tokenized versions of real-world assets (stocks, bonds, real estate, commodities, carbon credits, etc.) directly with fiat currency. Instead of requiring the user to take an indirect route through Bitcoin or Ether, they can:

- Deposit money via a credit card, bank transfer, or wallet.

- Instantly receive tokens representing the desired asset.

How does it differ from earlier models?

- Old flow: Fiat → buy crypto → transfer crypto → buy token. Multiple rails, multiple custody models, more counterparty risk, and UX friction.

- Fiat-first flow: Fiat → payment rails (card, bank transfer, local wallet, CBDC/stablecoin) → platform executes legal onboarding + custody pairing → tokens credited. Users never need to see or manage crypto.

Primary value proposition

- Removes onboarding friction for mainstream users.

- Preserves legal enforceability by pairing tokens with regulated custodial arrangements and legal trusts.

- Enables fractional exposure and programmable payouts while anchoring settlement in fiat or compliant digital fiat equivalents.

Here is an example:

Let’s say a user in Brazil wants to invest $10 in Tesla.

- With old models: He buys USDT → transfers to the exchange → converts to Tesla token → pays fees.

- With fiat-to-RWA: Pay BRL 50 with local wallet → instantly get Tesla tokens in app.

This simplicity is the reason that big global brokerages and payment giants are investing in the Real-World Asset Tokenization Platform Development, as once fiat ramps become common in tokenization, mass adoption becomes possible.

Build Fiat-to-RWA Tokenization Platform!

Strategic Value Drivers in Fiat-to-RWA Models

- Accessibility

Most markets are fragmented. Traditional brokerage infrastructure excludes millions due to geography, minimum ticket sizes, or regulatory hurdles. By integrating fiat rails, a fiat-to-RWA tokenization platform service removes these access barriers. The result is a larger, more diverse user base for the platform itself. Builders who design with local payment options (UPI, Pix, SEPA, etc.) will embed scalability into their own digital currency infrastructure.

- Fractional Ownership

Fractionalization turns high-value assets into micro-investments. A commercial property worth $300M or a sovereign bond issuance worth $200M can be divided into tokens that cost a few dollars each. For the builder, this is about creating the conditions for higher transaction frequency. Smaller entry points translate into more trades, recurring fees, and a user base.

- Liquidity

Liquidity has to be built into the system. Tokenization makes assets tradable, but fiat ramps bring the participant base that makes those trades meaningful. For investors, this means they can enter and exit positions more flexibly. For builders, it means a platform that sustains itself through continuous activity- market-maker agreements, redemption mechanisms, and anchor allocations all contribute to recurring transaction flows and long-term credibility.

- Trust and Familiarity

Mainstream investors are more comfortable with familiar rails like Visa, Mastercard, or local bank transfers than they are with digital wallets or crypto exchanges. By embedding those rails, real-world asset tokenization platforms inherit some of that trust. For builders, this is about accelerating adoption without incurring massive education and marketing costs. Trust becomes an operational shortcut to scale.

- Institutional Alignment

Major institutions are already experimenting with tokenized funds, debt, and settlement layers. What they lack is a direct retail distribution channel. Fiat-to-RWA platforms quietly solve that gap. This unlocks monetization opportunities across custody, issuance, trading, and ongoing liquidity services.

The Technical Architecture of Fiat-to-RWA Platforms

A fiat-to-RWA tokenization platform is a multi-layered ecosystem. Each component must be secure, compliant, and scalable. Let’s break it down.

Asset Tokenization

This is where everything begins. Tokenization converts real-world assets- equities, bonds, real estate, commodities into blockchain tokens.

- Smart Contracts: These define ownership, handle fractionalization, and automate dividend or coupon payments. A $1M building can be split into 1M tokens, each with rules baked into the code.

- 1:1 Backing: Every token must represent an actual share, deed, or unit of the underlying asset. Builders can’t afford “synthetic” claims -proof of backing is non-negotiable.

- Automated Actions: Smart contracts can push interest payouts or rental yields without human intervention, reducing operational overhead and errors.

For Real-World Asset Tokenization Platform Development, the strength of this layer defines investor trust. A weak tokenization model risks legal disputes and reputational damage.

Fiat Payment Integration

Fiat Payment Integration enables investors to invest with Visa, Mastercard, PayPal, UPI, SEPA, Pix, or local wallets.

- Multi-currency Support: Investors from different regions can pay in local currency, while the backend handles instant FX conversion.

- Fraud Prevention: AI-driven checks reduce chargeback fraud, while APIs manage instant settlement.

- User Familiarity: When users see “Pay with card” instead of “Buy crypto first,” adoption skyrockets.

Custody and Asset Management

Behind every tokenized unit must sit a real asset, held securely. This acts as a credibility layer. Without strong custody partnerships, even the best tech stack will fail to attract serious investors.

- Custodians: Licensed banks, brokers, or trust companies safeguard assets.

- Proof of Reserves: On-chain attestations confirm assets exist, building transparency.

- Audit Trails: Custodians generate regulatory reports that back investor claims in court.

Compliance Infrastructure

A fiat-to-RWA platform that ignores compliance won’t last. This includes:

- KYC/AML: ID verification, biometrics, and continuous transaction monitoring are table stakes.

- Licensing: Depending on the jurisdiction, builders may need exchange, broker-dealer, or ATS licenses.

- Jurisdiction Filters: Block or adapt services in regions were certain assets face restrictions.

Trading & Liquidity Infrastructure

Liquidity plays a crucial role in tokenized assets. Without it, tokens remain just records on a chain.

- Order Matching Engine: Executes buy/sell orders efficiently.

- Secondary Market Support: Enables tokens to be resold, improving exit options.

- Institutional APIs: Allow market makers to plug in and keep order books deep.

User Experience Layer

Even the best backend fails without a clean front-end. The UI/UX must have:

- Multi-Asset Wallets: One interface for fiat, tokenized assets, and stablecoins.

- Dashboards: Real-time performance analytics, history, and portfolio breakdowns.

- Cross-Platform Access: Mobile apps, web platforms, and APIs ensure investors stay engaged.

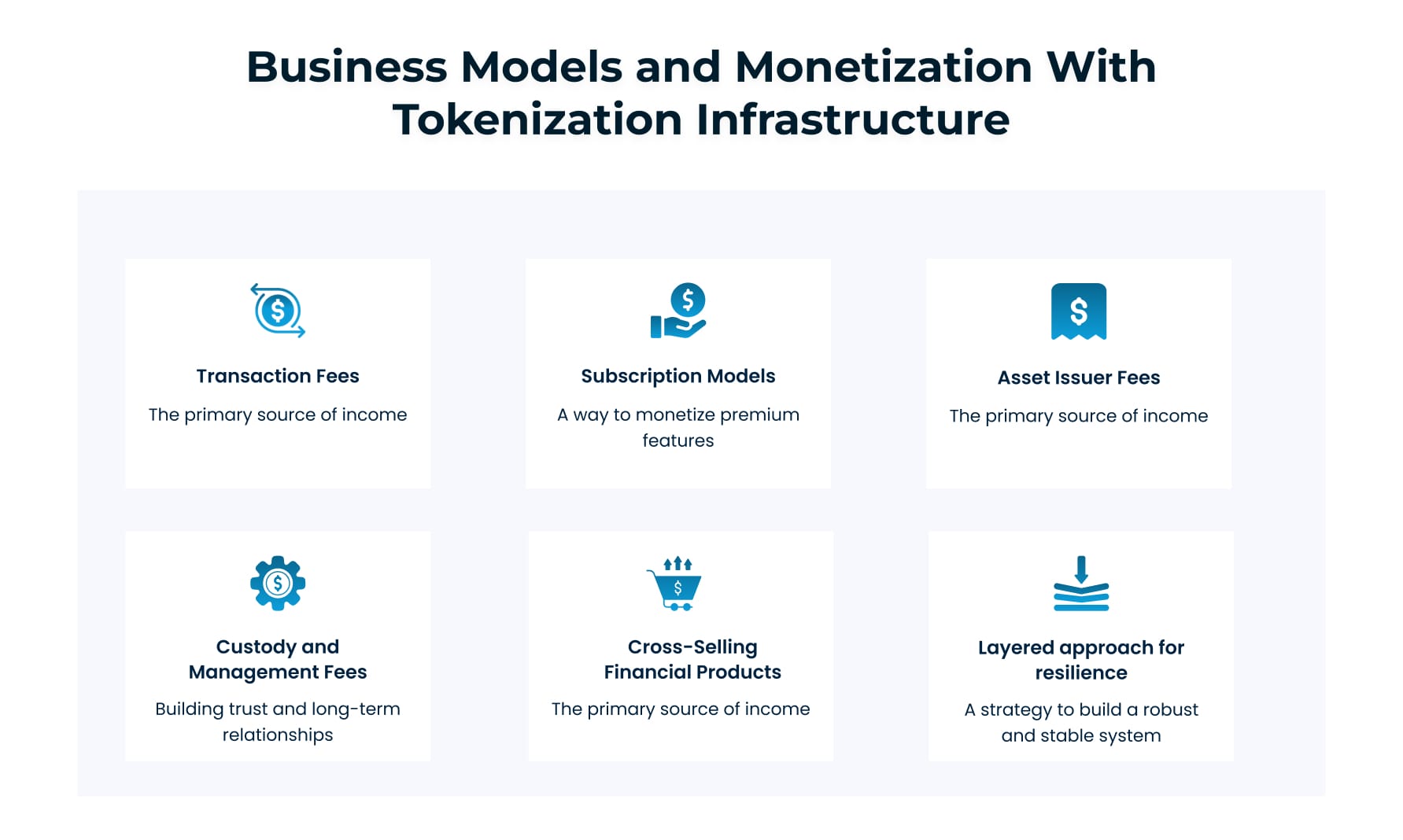

Fiat-to-RWA platforms are commercial ecosystems designed to generate sustainable revenue. The architecture itself creates multiple monetization pathways that can be layered together for resilience.

- Transaction Fees- The Core Revenue Stream

Every purchase, sale, or redemption of tokenized assets can be charged a small fee. Much like stock exchanges, this ensures that platform activity translates directly into revenue. Even micro-fees compound significantly as transaction volumes grow with fractional ownership.

- Subscription Models – Monetizing Premium Features

Advanced dashboards, AI-powered robo-advisors, portfolio automation, and tax optimization tools can be packaged into subscription tiers. This creates predictable recurring revenue while serving more sophisticated investors without alienating retail entrants.

- Asset Issuer Fees – Charging for Access to Infrastructure

Developers, fund managers, or commodity custodians who tokenize their assets on the platform can be charged issuance and listing fees. For enterprises, this model positions the platform as a gateway to new capital markets.

- Custody and Management Fees – Building Long-Term Credibility

Platforms holding tokenized assets on behalf of users can levy custody fees, similar to AUM-based charges in traditional finance. This ensures ongoing income tied to the value of assets under custody, incentivizing platforms to attract large-scale issuers and institutional clients.

- Cross-Selling Financial Products- Expanding Beyond Trading

Once tokenized assets are onboarded, platforms can offer collateralized lending, insurance, or structured products. For example, tokenized real estate shares can serve as collateral for instant loans, creating new profit centers.

Case Example:

A platform targeting Middle Eastern diaspora investors could tokenize Indian real estate. Investors pay in AED and own fractional tokens. The platform earns:

- Entry fees from property developers.

- Custody fees for holding investor assets.

- Trading fees on secondary transactions.

- Loan fees if those tokens are used as collateral.

This layered approach ensures RWA Tokenization Platform Services are not reliant on a single revenue stream, making them resilient to market cycles.

Ensure Every Layer of Your RWA Platform Meets Institutional Standards

The Future of Fiat-to-RWA

The trajectory of fiat-to-RWA platforms in 2025 shows that tokenization has left the experimental stage and is moving into digital asset infrastructure. Verified data highlights just how fast this sector is scaling, and why builders must act decisively.

Tokenized Government Bonds – Sovereigns Leading the Shift

Governments and central banks are accelerating tokenized debt pilots. Municipal and sovereign issuers have already issued tokenized bonds, and more are expected to follow as legal recognition of digital securities improves. These projects are not symbolic; they are the blueprint for regulated RWA adoption at scale. Builders who prepare their platforms for sovereign instruments will be first in line for institutional partnerships.

Market Growth: From Millions to Billions

The global tokenized RWA market has grown from just $85 million in 2020 to over $21 billion by April 2025. By Q2 2025, estimates put the market at over $25 billion. This proves that the model is not speculative; it is commercially validated. For builders, this is the strongest signal that scaling digital currency infrastructure now can capture exponential demand.

Settlement Rails: CBDCs and Regulated Stablecoins

Payment infrastructure is catching up. In India, the e-rupee pilot reached INR 10.16 billion (≈ USD $122 million) in circulation by March 2025. Over 130 jurisdictions are exploring CBDCs, while stablecoin regulations in the U.S., EU, and Asia are formalizing compliant digital settlement. For builders, integrating CBDCs and regulated stablecoins into fiat-to-RWA platforms will soon be non-optional.

Cross-Chain Interoperability – The New Liquidity Requirement

In 2024, interoperability protocols already held over $8 billion in total value locked (TVL), and usage is accelerating in 2025 as more asset classes move on-chain. Builders who ignore cross-chain rails risk fragmenting liquidity. Supporting multiple ledgers and building with modular APIs ensures platforms remain relevant as token flows spread across ecosystems.

AI in Investing – Intelligent Market Operations

AI-driven robo-advisors and predictive analytics are increasingly integrated into tokenized investment platforms. As the AI market itself grows into the hundreds of billions, builders should expect AI-powered KYC, fraud detection, and portfolio optimization to become standard. Platforms that combine tokenization with AI-driven services will deliver not only access but also intelligence.

Institutional–Retail Convergence

BlackRock, JPMorgan, and sovereign wealth funds are actively experimenting with tokenized products. The missing link remains retail distribution. Fiat-to-RWA platforms sit at that bridge, and by 2025, it is clear that the winners will be the operators who can channel institutional supply into compliant, liquid, and user-friendly retail ecosystems.

Takeaway

Fiat-to-RWA is becoming a fast-scaling financial architecture. The data proves demand: from $85M in 2020 to $25B+ in 2025. Regulatory rails are aligning, sovereigns are adopting, interoperability is maturing, and AI is reshaping operations.

For enterprises building in this space, the path is clear:

- Build compliance-first.

- Integrate fiat rails with CBDCs and stablecoins.

- Design for interoperability.

- Engineer liquidity from day one.

Antier, a global RWA Tokenization Platform Development company, builds scalable fiat-to-RWA systems with compliance, security, and modular growth at the core. Our experience spans tokenized real estate in the Middle East to equity apps in Asia. Partner with our experts to build your next-generation platform today.

Launch Your Fiat-to-RWA Platform!

FAQs

Q1: Is fiat-to-RWA legal?

Yes, but regulated. Tokenized equities are securities; platforms must comply with local securities laws.

Q2: What assets can be tokenized with fiat ramps?

Stocks, bonds, real estate, commodities, carbon credits, private equity, and even art.

Q3: How is fiat-to-RWA different from DeFi?

DeFi operates in crypto-native environments. Fiat-to-RWA integrates traditional finance (fiat money) with tokenized assets.

Q4: Can small businesses build fiat-to-RWA platforms?

Yes. White-label solutions from providers like Antier reduce costs and accelerate launch.

Q5: What’s the main risk?

Regulation and custody reliability. Platforms must work with licensed custodians and ensure compliance.