Intermediaries, paperwork, and inefficiency have long defined the mortgage industry. But that landscape is changing fast. Imagine a world where mortgage approvals take just minutes, where borrowers and lenders connect directly through transparent, smart contracts, and where liquidity flows effortlessly without friction. This is the new reality driven by DeFi development.

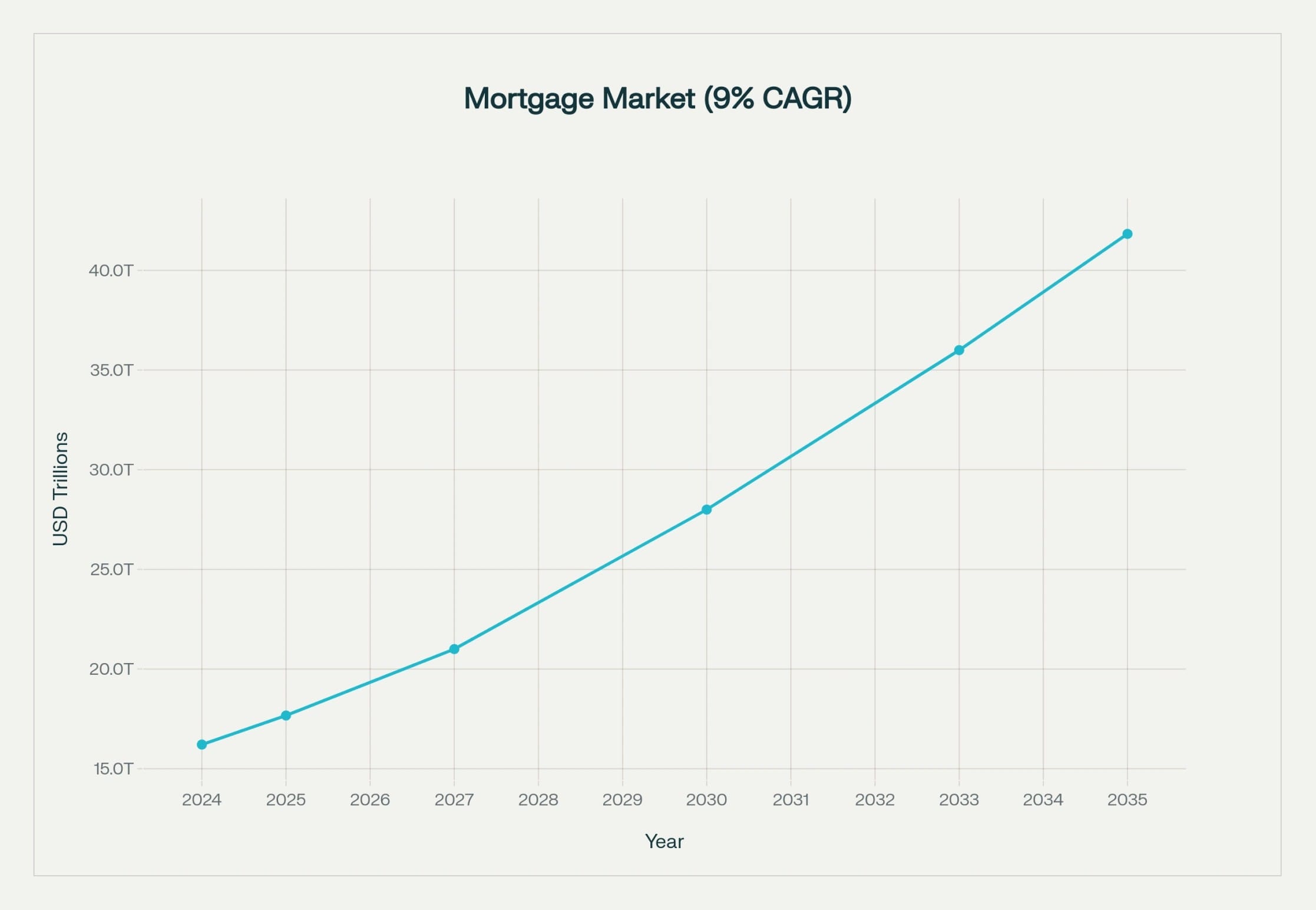

The global mortgage market, projected to grow from $16 trillion in 2024 to over $40 trillion by 2035 at a 9% CAGR, is ripe for disruption. Traditional systems are too slow and costly to sustain this growth. DeFi bridges that gap with automation, transparency, and borderless accessibility, redefining how mortgages are originated, financed, and traded.

In this blog, we will explore how to build a blockchain-powered mortgage platform through DeFi, uncovering the technology, architecture, and strategy behind the next major shift in global lending.

Why the Mortgage Industry Needs DeFi

The mortgage industry is one of the largest yet most inefficient sectors in finance. Traditional mortgage approvals can take up to six weeks, requiring extensive manual verification, multiple intermediaries, and redundant documentation. The result? High costs, slow processes, and limited access to credit. According to industry data, the average mortgage origination cost in 2023 reached $11,600 per loan, rising 35% in three years. Even top-performing lenders still spend nearly $6,900 per loan, a 2.4x gap between top and bottom performers.

DeFi technology offers a faster, leaner, and more transparent alternative. With DeFi development, mortgage approvals can be automated via smart contracts, cutting processing time from weeks to minutes. Blockchain-based platforms can also reduce closing time by up to 80%, while enabling full auditability and fraud prevention through immutable on-chain records.

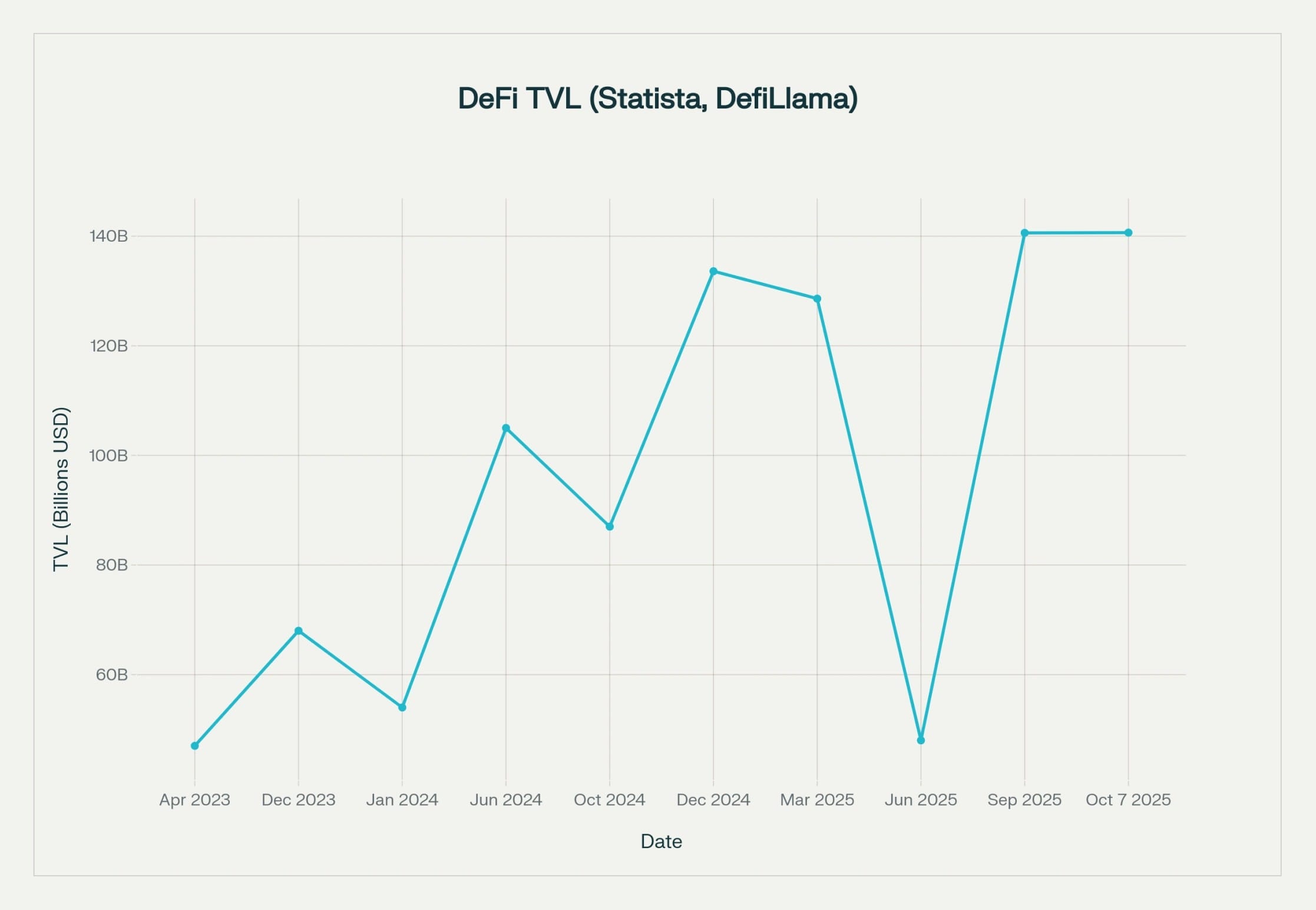

Between 2023 and 2025, global DeFi TVL has surged to around $140 billion, weathering volatility to achieve strong recovery and adoption momentum. This chart underscores a critical fact: trust in decentralized financial infrastructure is growing, signaling readiness for large-scale applications like mortgage lending.

This growth is not theoretical; it’s already reshaping real-world lending. The Bank of China, for instance, reduced property valuation time from days to seconds using blockchain automation. These results highlight how decentralized systems outperform legacy models on speed, cost, and data transparency.

How DeFi Development Powers a Mortgage Platform

At its core, a blockchain-powered mortgage platform runs on smart contracts. From KYC verification to loan disbursement and repayment, each event is recorded on-chain, reducing errors and removing the need for manual reconciliation.

Through DeFi development, these smart contracts are programmed with lending logic that ensures transparency, compliance, and automation, giving both borrowers and lenders full visibility into how funds move, collateral is managed, and interest is calculated.

Here’s a look under the hood of a DeFi-driven mortgage platform:

Smart Contracts → Tokenized Collateral → Stablecoin Payments → Oracles → Identity & Compliance Layer

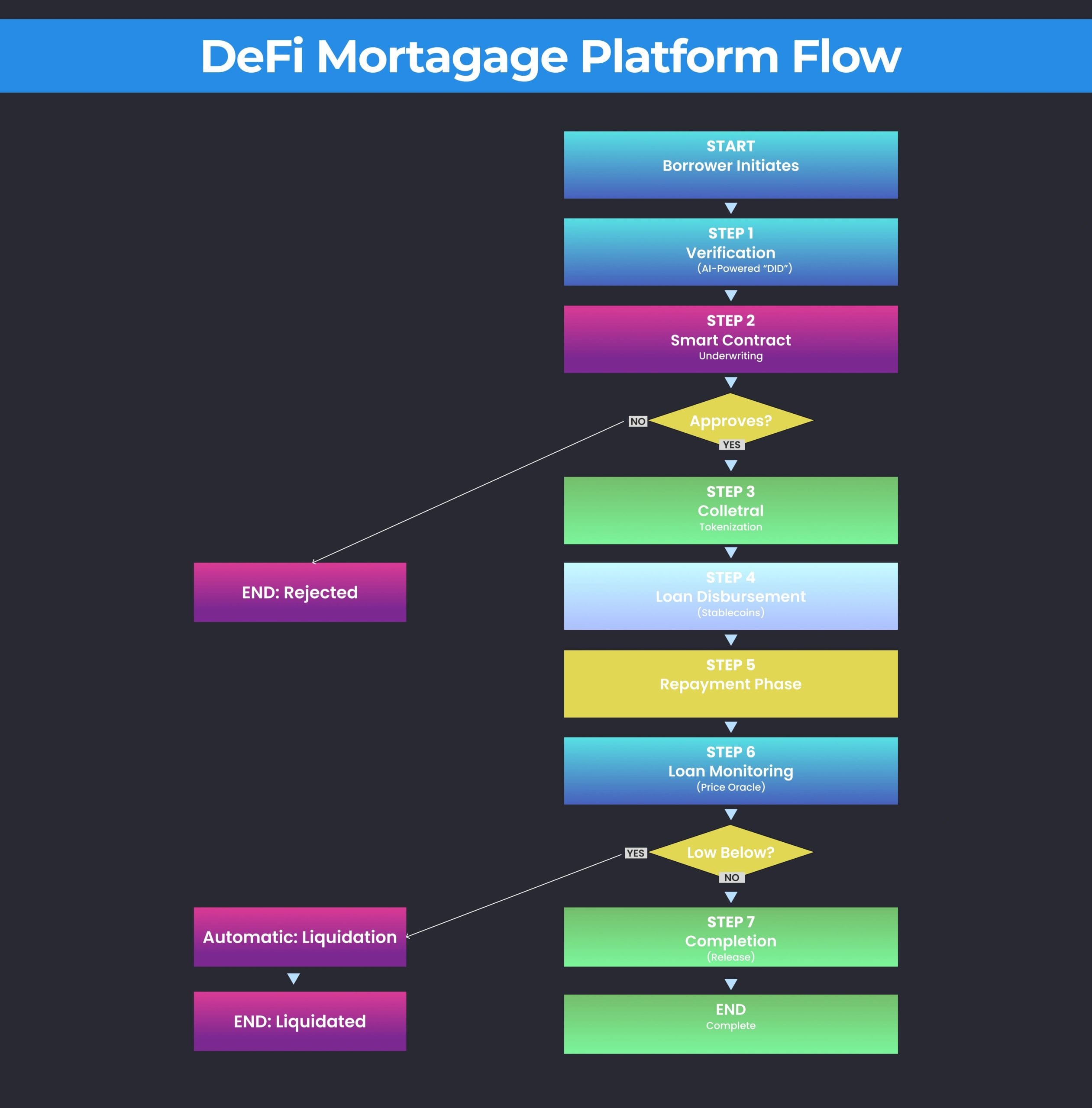

This architecture ensures security, auditability, and scalability, all while giving users control over their financial data. To understand how these components interact, here’s a high-level process flow that demonstrates how decentralized mortgages function, from borrower initiation to loan completion. This flow illustrates a fully automated DeFi mortgage cycle:

Borrower onboarding → Identity verification → Smart contract underwriting → Collateral tokenization → Loan disbursement in stablecoins → Repayment tracking via oracles → Compliance monitoring → Loan completion or liquidation.

Every interaction within this cycle is governed by blockchain logic, ensuring security, auditability, and scalability while giving users full control over their financial data. It’s not just a digital mortgage system; it’s a self-sustaining DeFi ecosystem built for transparency and institutional trust. When developed by an enterprise-grade DeFi development services provider, such platforms bridge traditional finance and decentralized technology with precision and scalability.

Want to build a mortgage platform that runs itself through smart contracts? Let’s design it.

Real-World Benefits of DeFi in Mortgage Lending

Here are five real-world benefits that make DeFi mortgage platforms the future of home financing.

- Faster Loan Approvals and Settlements

Traditional mortgage approvals can take weeks due to manual verification and documentation. DeFi eliminates these bottlenecks through automated smart contracts that validate borrower credentials, assess collateral, and execute disbursements instantly. This reduces loan processing time from weeks to minutes, giving borrowers faster access to liquidity while lenders operate with greater efficiency.

- Transparent and Tamper-Proof Lending Process

Every transaction on a DeFi-based mortgage platform is recorded on a public ledger through advanced DeFi development practices. This ensures that all loan terms, payments, and ownership details remain fully auditable and immune to tampering. Such blockchain-backed transparency builds trust between borrowers, lenders, and regulators, something traditional banking systems continue to struggle to offer consistently.

- Lower Costs Through Disintermediation

By replacing middlemen with smart contracts, DeFi lending dramatically reduces operational and administrative costs. There are no underwriting fees, broker commissions, or third-party verification charges. The result is a leaner, more affordable mortgage process where both borrowers and lenders benefit from lower fees and improved capital efficiency.

- Borderless Access and Financial Inclusion

DeFi mortgage platforms open lending opportunities to global participants without the constraints of location, credit score biases, or centralized control. Anyone with an internet connection and a digital identity can participate, providing unprecedented access to credit markets. This global accessibility makes DeFi a strong tool for inclusive and equitable housing finance.

- Tokenized Collateral and Liquidity Opportunities

Through asset tokenization, property titles and mortgage assets can be represented as digital tokens. These tokens can be traded or fractionalized, unlocking liquidity that traditional mortgage systems cannot offer. This innovation gives lenders new ways to manage risk and investors new opportunities to participate in mortgage-backed DeFi pools, making real estate finance more dynamic and liquid than ever before.

By merging automation, transparency, and global accessibility, it redefines how homes are financed, owned, and traded. With expert DeFi development, these benefits become tangible realities for institutions and innovators alike.

Step-by-Step: Building a Blockchain-Powered Mortgage Platform

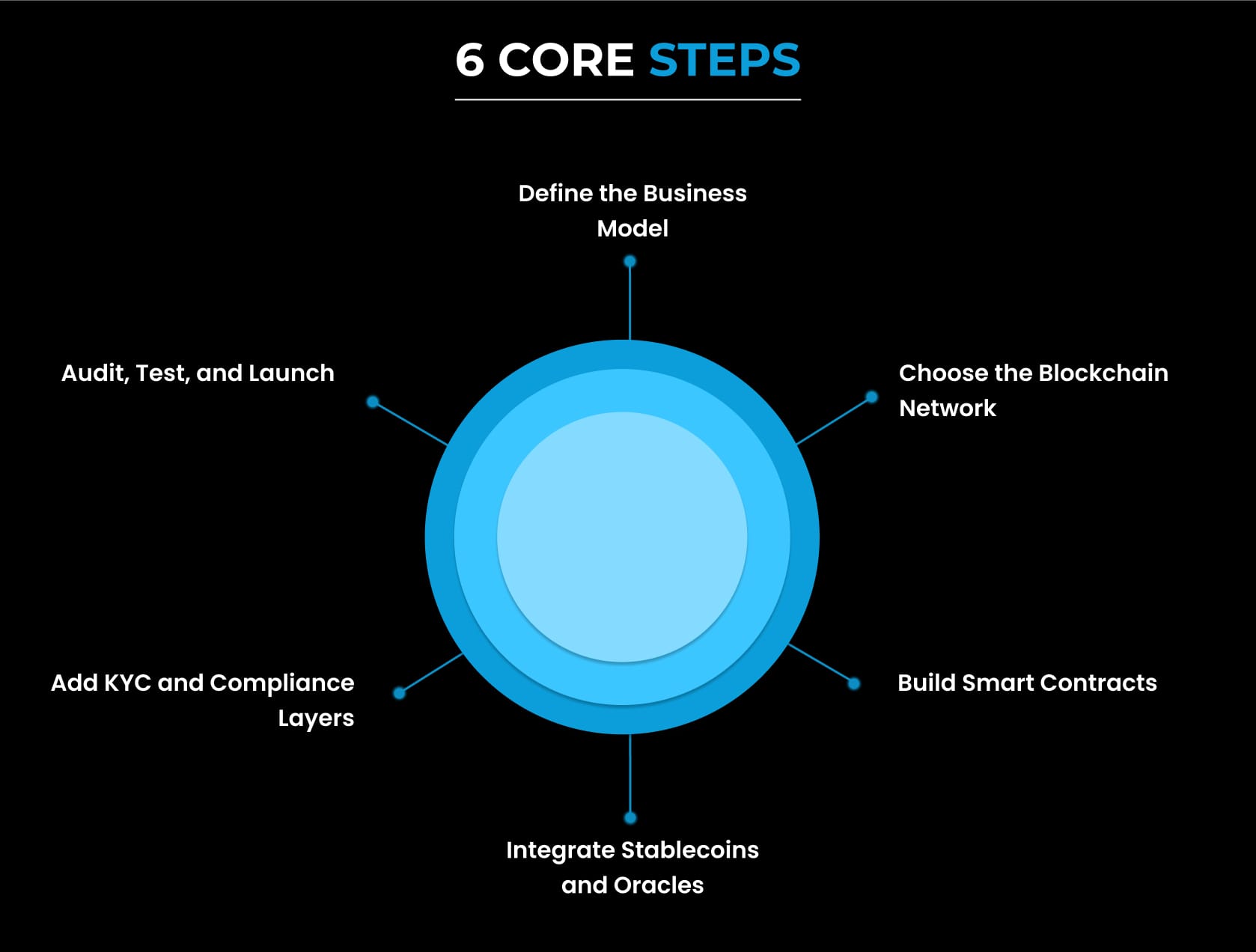

Building a blockchain mortgage platform is about smart design, not just smart contracts. It requires balancing finance, compliance, and technology within a transparent, trustless ecosystem powered by DeFi Development.

- Define the Business Model

Decide your focus: direct lending, mortgage pools, or fractional ownership. Define lending terms, collateral types, and user roles. A reliable DeFi development company helps align your model with real-world mortgage workflows and regulatory goals.

- Choose the Blockchain Network

Select the right chain based on speed, cost, and compliance needs. Ethereum, Polygon, or private networks all serve different use cases. With expert services, you can ensure scalability and interoperability from day one.

- Build Smart Contracts

Smart contracts automate lending, repayments, and collateral management. Partnering with a seasoned DeFi development solution provider ensures your contracts are secure, audited, and ready for real transactions.

- Integrate Stablecoins and Oracles

Stablecoins ensure price stability while oracles deliver real-time data like property values and rates. Together, they maintain transparency and accuracy across lending operations.

- Add KYC and Compliance Layers

Integrate KYC, AML, and identity verification tools to meet global regulations. Digital identity management systems help balance compliance with user privacy and institutional trust.

- Audit, Test, and Launch

Audit all smart contracts, test performance, and deploy in a secure environment. Post-launch monitoring ensures the platform remains reliable, compliant, and scalable.

These steps turn your concept into a powerful, compliant, decentralized DeFi mortgage ecosystem, built to scale through expert DeFi development services.

Talk to a DeFi strategist and begin building your blockchain-powered lending solution.

Monetization Models for DeFi Mortgage Platforms

Beyond lending, these platforms open new avenues for revenue and growth. By leveraging DeFi development, enterprises can transform traditional mortgage operations into automated ecosystems that generate consistent returns and scale effortlessly. Here are several monetization models to consider:

- Transaction Fees: Small percentages earned from every completed mortgage transaction create a continuous revenue stream while maintaining transparency for users.

- Liquidity Provision: Yield can be generated through staking or participation in lending pools, enabling platforms to strengthen liquidity and attract institutional participants.

- White Label Licensing: Offering your DeFi platform infrastructure as a white-label product to smaller mortgage fintechs helps expand market reach and establish new revenue channels.

- Cross-Collateralization: Allowing borrowers to use tokenized on-chain assets across multiple DeFi protocols increases engagement and creates flexibility within lending networks.

By implementing dynamic smart contracts and programmable fee structures, platform owners can maintain sustainable yields while keeping operations efficient and user-centric. When paired with a well-planned ecosystem, the result is a balanced financial network where lenders, borrowers, and the platform itself grow together seamlessly.

The long-term differentiator lies in partnering with an experienced DeFi development company that can align monetization models with protocol-level logic. Such collaboration ensures that each component of the ecosystem functions efficiently and compliantly, paving the way for enduring scalability and investor confidence.

Wrapping Up

DeFi is transforming mortgage lending into a transparent, efficient, and globally accessible ecosystem. By integrating DeFi development, businesses can automate processes, enhance compliance, and unlock new liquidity opportunities for both borrowers and lenders.

The future of mortgage platforms lies in decentralization, where smart contracts and tokenized assets replace intermediaries with programmable trust. To stay ahead in this shift, partnering with an experienced blockchain expert is essential. Design, develop, and scale your blockchain mortgage ecosystem with Antier, the global benchmark in DeFi development services.

Frequently Asked Questions

01. How is DeFi changing the mortgage industry?

DeFi is transforming the mortgage industry by automating approvals through smart contracts, significantly reducing processing times from weeks to minutes, and enhancing transparency and efficiency while lowering costs.

02. What are the benefits of using blockchain technology in mortgage lending?

Blockchain technology in mortgage lending offers benefits such as reduced closing times by up to 80%, full auditability, fraud prevention through immutable records, and direct connections between borrowers and lenders.

03. What is the projected growth of the global mortgage market?

The global mortgage market is projected to grow from $16 trillion in 2024 to over $40 trillion by 2035, at a compound annual growth rate (CAGR) of 9%, highlighting the need for more efficient systems like DeFi.