In September 2025, Alchemy Pay just launched a game-changer that will change how crypto platforms, especially cryptocurrency exchanges, serve their customers. Now that the web3 payment giant allows direct purchase of tokenized US equities (fractional shares, backed 1:1) with Visa, Mastercard, and local fiat rails, it is certain that fiat-to-RWA rails are no longer optional. With the benchmark set, they have become table stakes for cryptocurrency exchange software development.

Why is integrating a Fiat-to-RWA platform essential for crypto exchanges?

- Exchanges without fiat RWA ramps will appear stale or limited, as more crypto players will likely follow Alchemy’s lead.

- Once buying tokenized RWA via cash becomes a practice for users, they’ll expect it from the exchange of their choice. Not having that feature may result in losing customers post this expectations reset.

- A crypto exchange software could take fees or huge spreads on fiat↔tokenized RWA transactions, just as they do on crypto trades. Not integrating a fiat-to-tokenized asset gateway would mean leaving money on the table.

- Exchanges without a fiat real-world asset ramp won’t be able to capture the new wave of users who want exposure not just to crypto but also to stocks, ETFs, and other financial instruments.

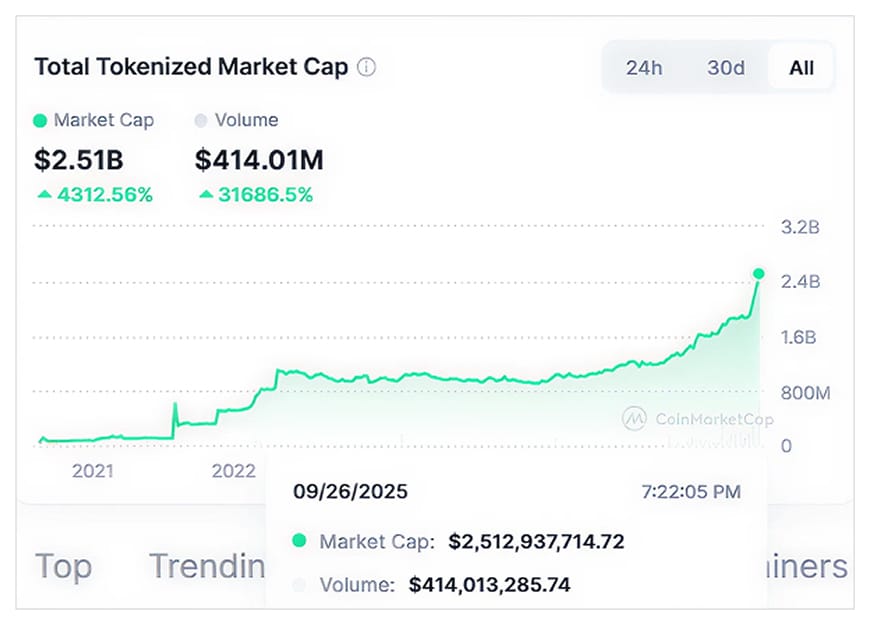

- RWA tokenization is officially a $2.5B market, and is projected to hit $16 trillion by 2030. Not facilitating effortless RWA access means missing out on one of the biggest growth stories of the decade.

- Beyond user demand and revenue, fiat-to-tokenized asset rails integration into a crypto exchange software also creates stickier ecosystems. Once users manage tokenized RWAs and crypto on the same platform, they’re less likely to switch to another platform.

- This integration is also essential for B2B positioning, as issuers of tokenized assets will prefer the exchanges with a fiat-to-real-world asset ramp.

- Any cryptocurrency exchange software development that includes a fiat-to-blockchain asset bridge will benefit from being early in the race and could become a category leader before the feature becomes common.

What Are Fiat-to-RWA Rails?

As the name justifies, Fiat-to-RWA rails are infrastructure that support conversions between the two distinct assets- RWA and Fiat. A fiat-to-RWA platform integrated into a cryptocurrency exchange software is, therefore, something that facilitates:

- Fiat Entry & Exit: Supporting deposits, withdrawals via card, bank, or local pay methods.

- Tokenization/Issuance Linkage: The mechanism that mints tokenized versions of real assets (stocks, real estate, bonds) and links them 1:1 with real underlying holdings.

- Custody & Reconciliation: Managing the off-chain infrastructure holding the asset (e.g., real stocks) and reconciling with token balances on chain.

- Redemption/Exit Path: Allowing users to move between assets, which may include cashing out in fiat or redeeming a token for the real asset.

- Trading/Liquidity Support: Market makers, order books, or hybrid crypto exchange software with backstop liquidity, cross-chain/cross-market support technology.

The abovementioned can also be stated as essential components of a fiat-to-tokenized RWA exchanges.

Also Read>>> The Missing Piece in RWA Tokenization: Why Every Project Needs a Compliant ATS Strategy

Why Alchemy Pay’s Move Isn’t the Noise?

- No Crypto Detour: Users can go straight from fiat to tokenized stocks, cutting any middle conversion steps.

- Global Scale: The leading Web3 giant offers support for Visa, Mastercard, and local payment methods in more than 170 countries.

- Trust Factor: Each token is 1:1 backed by real shares held with regulated custodians.

- Market Signal: Cryptocurrency exchange software will be judged on which rails they support. Fiat on/off ramps for crypto won’t suffice.

How to build Fiat-to-RWA Rails Into Crypto Exchange Software?

1. Pick Your Target Assets and Geographies

- Decide on what assets you’d want to tokenize and list – US securities, carbon credits, real estate tokens, tokenized gold, or commodities.

- After you do that, it’s time to finalize the countries and fiat methods your cryptocurrency exchange software platform will support.

Pro Tip:

India falls for: UPI/NEFT/IMPS

Europe chooses: SEPA

LATAM prefers: PIX

2. Payment/Fiat Infrastructure

- Integrate card processors, local bank APIs, and payment aggregators that facilitate interaction of your crypto exchange software with local fiat rails.

- Build FX/currency conversion layers for seamless conversions between fiat currencies as and when required.

- Don’t miss to implement risk and fraud check mechanisms (including chargeback protection, KYC checks, AML filters, and much more)

- Build a robust, fast settlement and clearance layer to optimize how and when fiat actually lands in users’ accounts.

3. Tokenization and Issuance Layer

- Decipher the token model, fractionalization, and backing mechanisms, etc.

- Collaborate with your cryptocurrency exchange development company to build smart contract logic for minting, burning, dividends, or coupon distributions.

- At this step, you also finalize if you’re tokenizing assets in-house (for that, you’ll need a separate tech integration) or just partnering with issuers.

- You’ll also need legal wrappers for treasury management, SPV, custodian agreements, etc.

4. Custody and Reconciliation Mechanisms

- Partner with regulated custodians/brokers/trust companies for facilitating seamless custody and management of tokenized RWAs.

- Maintain an off-chain ledger to tie real shares to on-chain tokens.

- Set your procedures for periodic audit, attestation, and proof-of-reserves.

- Build a robust reconciliation engine with your cryptocurrency exchange development company that detects mismatches, handles corporate actions (splits and dividends), etc.

5. Trading and Liquidity

- Your exchange platform development company also helps build an order-matching engine for tokenized assets that may be based on an on-chain or centralized order book, or a hybrid approach.

- For setting up a fiat-to-RWA gateway, there’s a need for plenty of liquidity. You may need to partner with market makers and liquidity providers to meet those needs.

- Cross-chain fiat-to-blockchain asset bridges may be required for cross-chain RWA interactions.

- At this stage of cryptocurrency exchange software development, your tech provider will also integrate price oracles to make real-time pricing from equity markets available on your exchange platform.

Launch Your Fiat RWA Ramp-Enabled Crypto Exchange Software With Antier

6. Redemption, Exit, or Settlement Path Development

- As mentioned above, users must be able to redeem tokens for the real asset or fiat. For building those settlement windows, there is a need for smart contract development that handles token burns, underlying asset release, fiat-to-RWA conversion, and funds/asset delivery.

- You may also join forces with your exchange platform development company to set up slippage buffers and initial fees.

7. Compliance and Risk Operations

- Building a comprehensive compliance and risk management module involves technical as well as legal interventions for:

- KYC/KYT (transaction monitoring)

- Jurisdiction controls (which assets are allowed where)

- Securities law compliance associated with the prospectus, limitations, and reporting

- Corporate action management for dividends and splits management, and reflection on balances

- Integration of mechanisms to protect both platforms and users from excessive risk. This includes setting maximum leverage or position sizes, monitoring overall exposure to certain assets, or using advanced AI-based automation systems to flag fraudulent or suspicious trading behavior.

8. Frontend and Investor UI/UX Development

- Collaborate with your cryptocurrency exchange software development company to build clean dashboards showing token and underlying asset metrics and crypto, fiat, and token wallets, all in the same interface.

- Also, ensure that your crypto exchange software shows comprehensive notifications for corporate actions, redemptions, etc, along with the dashboards in the local language and localized payment options.

9. Infrastructure, Scaling, and Security

- Ensure to build with modular microservices so you can enable or disable fiat-to-RWA ramps at any time.

- Also, build a scalable architecture with APIs, message queues, and event sourcing.

- Scalable architecture built through APIs for modular integrations, message queues for load distribution, and event sourcing for consistent state recovery.

- Reliability during your Fiat-to-RWA rails-ready cryptocurrency exchange software development is ensured through backups, disaster recovery plans, and SLAs.

10. Monitor, Iterate, and Grow

- For the last time, monitor liquidity, trade depths, abandonment mechanisms, and all other seamless workflows and launch.

- You can also expand to new geographies gradually, even if you launch in a single country/region at first.

- Similarly, you can add more asset classes later and partner with brokers, token issuers, and big-money players as and when needed.

Also Read>>> Building Digital Asset Exchange for Tokenized RWA: Essential Components

Final Word

Alchemy Pay dropped the biggest feature of the decade. It’s no more about “if cryptocurrency exchange software solutions should support fiat-to-RWA ramps. The question is: Who can afford not to integrate this game-changer feature?

But building such a crucial feature into your crypto exchange also comes with a fair share of risks. Cryptocurrency exchange software development company like Antier can help architect fiat-to-RWA rails-enabled digital asset exchanges with intention, security, and resolved and abundant liquidity.

Share your requirements today.

Frequently Asked Questions

01. What is the significance of integrating Fiat-to-RWA platforms for cryptocurrency exchanges?

Integrating Fiat-to-RWA platforms is essential for cryptocurrency exchanges as it meets user expectations, enhances revenue opportunities, and captures a growing market for tokenized real-world assets, ensuring competitiveness in the evolving crypto landscape.

02. How does the lack of Fiat-to-RWA integration affect cryptocurrency exchanges?

Exchanges without Fiat-to-RWA integration risk appearing outdated, losing customers who expect seamless access to tokenized assets, and missing out on potential revenue from transaction fees on fiat-to-tokenized RWA trades.

03. What are Fiat-to-RWA rails?

Fiat-to-RWA rails are infrastructures that facilitate the conversion between fiat currency and tokenized real-world assets, enabling users to deposit and withdraw funds through various payment methods within a cryptocurrency exchange.