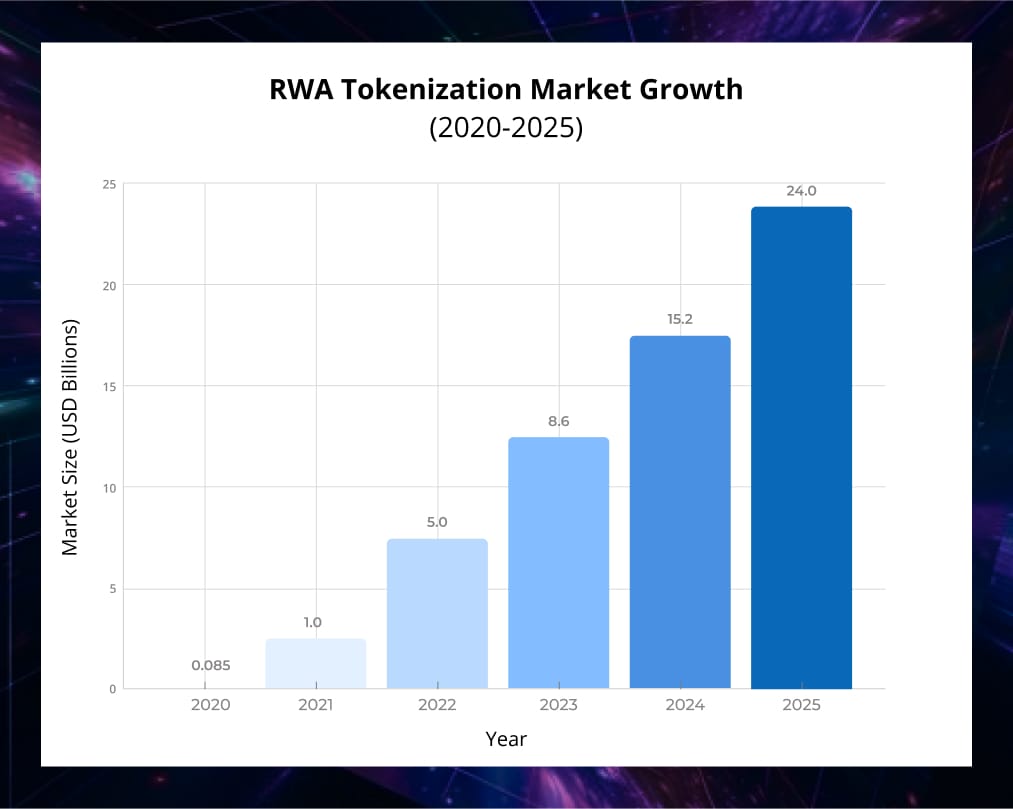

In finance, timing is everything. For years, RWA Tokenization, the idea of placing legal claims on physical or financial assets onto a blockchain, was discussed as a distant possibility. Yet, in 2024 and 2025, tokenization has transitioned from a whitepaper concept to an operational phase.

Institutional asset managers are tokenizing U.S. Treasuries, real estate developers are selling fractionalized properties in Dubai, and banks are piloting tokenized money market funds.

These initiatives clearly state that:

- Investor demand is real: Transactions are oversubscribed when structured properly.

- Jurisdictions are competing Jurisdictions are actively pursuing court tokenization projects.

- Platforms are being built Businesses are moving from minting stages to complete asset tokenization infrastructure development.

For enterprises and investors evaluating entry, must have clarity on where, how, and under what legal structures to participate is required. The following guide covers all aspects of Asset Tokenization and monetizing opportunities that come along with it.

RWA Tokenization Explained: Definition and Use-Cases

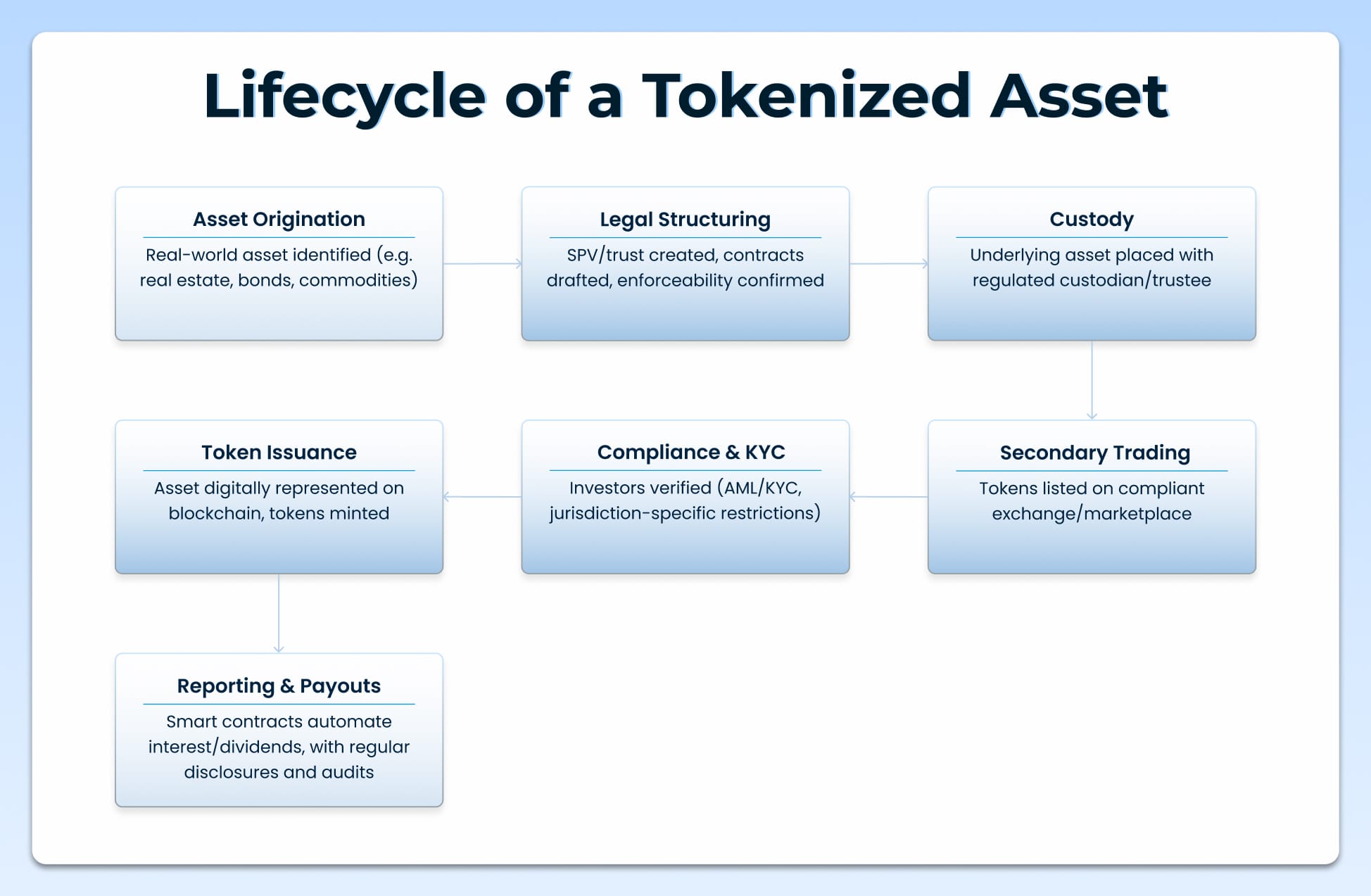

RWA Tokenization, in practical terms, is the process of converting enforceable rights to a real-world asset into one or more blockchain-based tokens that can be transferred, fractioned, and integrated into financial infrastructure.

The token is not the asset itself, but the representation of rights. Unless the tokens are tied to a legal structure, they are just metadata floating on a blockchain.

Asset Types Commonly Used in Tokenization Projects

Real-world assets that have already been tokenized or are under active consideration include:

- Financial instruments: U.S. Treasuries, corporate bonds, commercial paper.

- Real estate: Villas, office towers, logistics parks.

- Private credit: SME loans, invoice factoring, microfinance bonds.

- Commodities: Gold, oil, diamonds, agricultural stock.

- Alternative assets: Art, luxury cars, carbon credits, intellectual property rights.

Most of the current market activity is concentrated in short-duration fixed income (treasuries, money market instruments) and real estate, as these categories deliver measurable yields and have strong investor demand.

RWA Distinction from Traditional Securitization

While traditional securitization and tokenization work on common principles, they fractionalize and distribute claims on assets; the difference lies in infrastructure and accessibility:

- Settlement speed: Securities still settle through legacy clearing systems. Tokens can settle near instantly.

- Ownership granularity: Securities usually demand high minimums. Tokenization lowers entry barriers.

- Programmability: Smart contracts embed compliance, payouts, and restrictions natively.

- Global reach: Tokens can be accessed cross-border (where regulation permits).

Market, Regulatory, and Technical Conditions Accelerating the Growth of RWA Tokenization

For a long time, the narrative of “democratizing access” or “transforming finance” has often overshadowed the absence of legal, institutional, and technical readiness. But now, several concrete drivers have converged to make the Real-World Asset Tokenization Platform feasible and operational across major markets.

Institutional Capitals Are Deploying Asset Tokenization Infrastructure

- Leading asset managers such as BlackRock, Franklin Templeton, and JPMorgan have launched tokenization pilots.

- Tokenized U.S. Treasuries now represent one of the fastest-growing segments of blockchain-based financial instruments, increasingly used as collateral within regulated and semi-regulated markets.

- The critical change is that institutional participants no longer frame tokenization as a proof-of-concept exercise; they evaluate it as a portfolio integration strategy.

Strategic implication: Institutional participation validates tokenization as a credible market infrastructure component. This reduces reputational risk for issuers and accelerates regulatory engagement.

Jurisdictions Across the Globe Are Upgrading Rules for RWA Implementation

- The United Arab Emirates and Singapore are positioning themselves as global hubs by issuing explicit frameworks that accommodate tokenized securities.

- Switzerland continues to refine its digital asset regime, with enforceability of tokenized securities codified in the DLT Act.

- China’s CSRC, in contrast, directed brokers in September 2025 to pause RWA initiatives in Hong Kong, underlining the fragility of regulatory momentum.

Strategic implication: Jurisdictional choice is now a competitive determinant. Issuers selecting domiciles in supportive regions gain access to legal certainty and investor confidence, while projects in ambiguous or restrictive jurisdictions face structural limitations.

Technology Infrastructure Has Reached Operational Maturity

- Oracle providers such as Chainlink have released solutions tailored for RWA proof-of-reserve attestations and event verification.

- Developer platforms, including QuickNode and Fireblocks, now provide modular integration for custody, compliance workflows, and reporting.

- The transition from bespoke engineering to standardized modules enables an RWA Tokenization platform development company to deliver audited, production-ready platforms within months rather than years.

Strategic implication: The bottleneck is no longer technology itself, but disciplined alignment between technical modules, custody frameworks, and legal enforceability.

Investor Requirements for Yield and Diversification

- In a high-interest environment, investors seek short-duration, yield-bearing instruments. Tokenized treasuries provide both predictable returns and operational efficiency.

- At the same time, investors outside institutional channels demand access to assets traditionally restricted by high entry thresholds, including real estate, private credit, and commodities.

- By combining fractional ownership models with compliance-oriented distribution, tokenization expands investor bases without undermining regulatory safeguards.

Strategic implication: Investor demand is observable, not speculative. The rapid sale of tokenized properties in Dubai and the increasing role of tokenized treasuries in institutional DeFi strategies reflect tangible, bid-side pressure.

Build a Tokenization Platform that Delivers Measurable Advantages to both Issuers and Investors!

Benefits of RWA Tokenization for Market Participants

The adoption of RWA Tokenization delivers distinct advantages for both investors and issuers. Together, these benefits establish tokenization as a credible framework for modern financial markets.

Investor Advantages: Liquidity, Access, and Transparency

- Broader Market Access through Fractionalization: RWA Tokenization lowers entry thresholds by fractionalizing high-value assets. Real estate portfolios, corporate bonds, and commodities can be converted into tokenized assets, enabling participation from investors previously excluded by high minimum ticket sizes. This expands the investor base while maintaining enforceable ownership rights.

- Improved Liquidity in Traditionally Locked Markets: Tokenization introduces secondary trading mechanisms for assets historically considered illiquid. Investors in real estate or private credit gain optionality to exit or rebalance positions, reducing the illiquidity discounts that have long burdened these markets.

- Transparency through On-Chain Records: Immutable audit trails provide investors with real-time visibility into token supply, distributions, and compliance status. This reduces reliance on opaque reporting and strengthens confidence in asset integrity.

- Programmability and Yield Enhancement: Tokenized treasuries or debt instruments can be programmed to function as collateral within regulated lending systems, enabling layered yield strategies. For investors, tokenization becomes not simply a tool for access but a mechanism for portfolio diversification and liquidity optimization.

Issuer and Platform Advantages: Efficiency and Capital Expansion

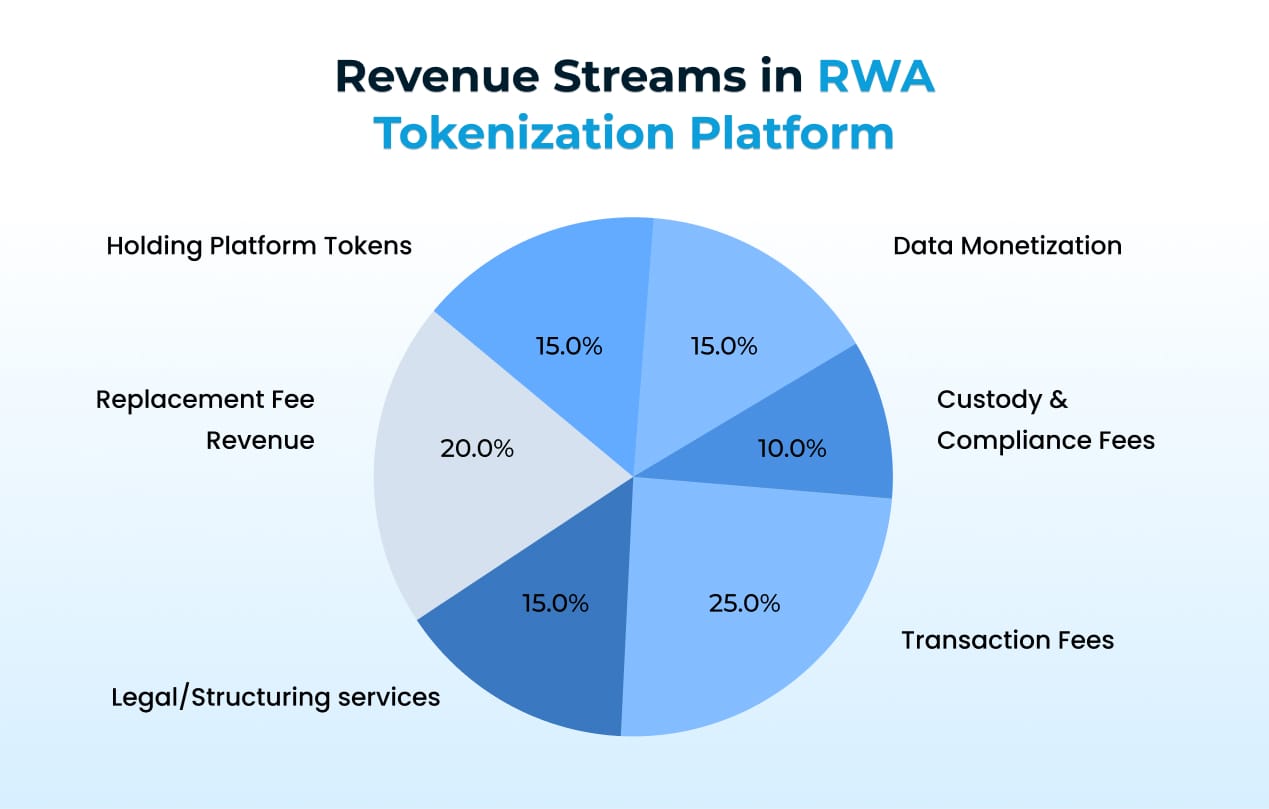

- Operational Efficiency through Automation: With RWA tokenization platform development, issuance, settlement, and compliance are automated via smart contracts. This minimizes intermediary costs and accelerates transaction cycles, improving the overall economics of asset servicing.

- Access to Global Investor Pools: Tokenization platforms can serve institutional, accredited, and retail investors depending on regulatory permissions. Broader distribution reduces liquidity risks, improves price discovery, and allows issuers to capture fairer valuations.

- Product Innovation and Structural Flexibility: Unlike traditional markets, tokenized platforms support hybrid instruments that combine equity and debt features. Issuers can design securities tailored to investor demand, expanding product scope beyond conventional frameworks.

- Data and Secondary Revenue Streams: Platforms generate additional value through compliance dashboards, investor analytics, and reporting services. For issuers, secondary markets also enable faster capital recycling, turning illiquid assets into instruments that can be sold and redeployed efficiently.

Regulatory Landscape: Where Tokenization Can and Cannot Thrive

Regulation determines market access, product design, and unit economics for any RWA tokenization platform. Below are jurisdiction-by-jurisdiction assessments framed for platform builders: why to build there, what must be solved, first-mover advantages, and immediate next steps.

1. USA

In the United States, tokenization is treated through the lens of securities law. The SEC has made it clear: if an instrument looks like a security, it is one. This hasn’t stopped institutions. Tokenized treasuries and money market funds are being piloted, but only for accredited investors.

For a platform builder, the U.S. offers depth of capital and institutional appetite, but retail remains blocked, and compliance costs are significant. Platforms here must be engineered for institutional distribution, not mass retail.

2. Europe

Europe is fragmented. Switzerland leads with its DLT Act, which recognizes tokenized securities outright, making it attractive for issuers who want certainty. The wider EU is still bound by MiFID II; MiCA helps, but national frameworks complicate cross-border issuance.

Builders here can succeed if they target institutional flows and align with local legal wrappers, but friction remains.

3. Singapore

Singapore offers perhaps the cleanest balance in Asia: clear MAS guidance, sandbox regimes, and active institutional adoption.

Platforms like InvestaX are already live. For builders, this is fertile ground- regulatory clarity combined with global financial credibility.

4. UAE (Abu Dhabi/ Dubai)

The UAE is moving the fastest. Dubai’s VARA and Abu Dhabi’s FSRA provide explicit rules, and adoption spans both billion-dollar institutional deals and retail pilots.

A builder here benefits from regulatory support, investor enthusiasm, and first-mover visibility.

5. China

By contrast, Hong Kong and mainland China highlight political fragility. Hong Kong’s positioning as a digital asset hub was undercut when China’s CSRC instructed brokers to pause RWA projects in late 2025.

6. Japan

Japan has amended its securities law to accommodate security tokens. Conservative, yes, but credible -disclosure standards are strict, yet enforceability is clear.

7. India

India is experimenting cautiously through sandboxes, but broader adoption is still some distance away.

Maximize and Expand Investor Reach with Enterprise-ready Tokenization Platforms!

How to Decide (practical rule set for founders)

- Map investor target to domicile: retail + cross-border demand → UAE; APAC institutional → Singapore; legal enforceability priority → Switzerland/ Japan; deep institutional pools → US.

- Adopt a modular architecture: enforceability, custody, and compliance modules must be pluggable per jurisdiction.

- Treat regulation as product design: transfer logic, gating, and reporting should be code-backed by legal opinion.

- Pilot small scale by repeatability: run 1–2 issuances per asset class, validate market-making, then automate issuance templates.

How Real-World Asset Tokenization Translates into ROI

The value of RWA Tokenization is realized through efficiency gains. What it truly offers are structural levers- ways to reduce costs, widen investor reach, and improve liquidity. When engineered properly, these levers translate into measurable ROI gains for both investors and issuers.

How Investors Capture More Value?

- From Six-Figure Minimums to Fractional Access: Tokenization lowers entry thresholds. Real estate and bond deals that once required large commitments can now be accessed with far smaller tickets. A broader investor base narrows liquidity premiums and improves market efficiency.

- Turning Illiquid Assets into Tradable Positions: Historically, selling partial interests in real estate or private credit was near impossible. Tokenization enables secondary trading, and even limited liquidity reduces forced-sale discounts. Dubai’s property tokens demonstrate this shift in practice.

- Replacing Opaque Reports with On-Chain Proof: Smart contracts and immutable records provide real-time visibility on token supply and cash flows. Automated coupon payments and revenue shares reduce discretion, creating transparency and predictability.

- Building Yield on Top of Yield: Where regulation permits, tokenized treasuries can be used as collateral in DeFi markets, generating additional yield layers. While systemic risks exist, investors are already deploying this strategy, showcasing tokenization’s composability.

Why Issuers and Platforms Gain a Competitive Edge

- Cutting Out Intermediary Costs: Issuance and settlement run through smart contracts, reducing the role of clearing systems and placement agents. Lower friction means higher net proceeds per transaction.

- Recycling Capital at Market Speed: Liquidity shortens capital cycles. Tokenized receivables or SME loans can be sold and redeployed within weeks, not quarters, accelerating issuer returns.

- Accessing Capital Pools That Legacy Markets Miss: A tokenization platform can serve institutions in regulated jurisdictions while reaching retail where permitted. Modular compliance expands the investor base and reduces concentration risks.

- Designing Products: Legacy Systems Can’t Support: Tokenization allows hybrid instruments, equity-debt bundles, revenue-share structures, tailored to investor appetite. Platforms offering this flexibility differentiate themselves from traditional vehicles.

Navigating the Risks of RWA Tokenization

Every efficiency that improves ROI introduces a corresponding risk. For platform builders, recognizing these vulnerabilities early and engineering mitigations into the design is what separates a sustainable tokenization business from a failed pilot.

Popular Real-World Case Studies (2024–2025)

The credibility of RWA Tokenization rests on execution, not theory. Several projects launched in 2024–2025 provide instructive insights — demonstrating where tokenization delivers genuine market value, and where limitations remain.

1. DAMAC and MANTRA: Institutional-Scale Tokenization in the UAE

In January 2025, DAMAC Properties announced a $1 billion partnership with MANTRA to tokenize real estate and data centers.

Strategic relevance:

- This was not a single asset but a portfolio-level initiative, signaling institutional-scale adoption.

- It reflects the UAE’s regulatory positioning — frameworks from VARA and FSRA are deliberately designed to attract tokenization capital.

- The project highlights the complexity of execution: beyond token issuance, this required full RWA tokenization platform development with compliance, custody, and investor interfaces.

2. Prypco Villa Sale: Proof of Retail Demand

In late 2024, Prypco tokenized and sold a Dh1.75 million villa in Dubai in under five minutes.

Strategic relevance:

- Demonstrated real retail appetite for fractionalized real estate.

- Proved that tokenized property transactions can be executed faster than traditional sales.

Raised critical questions about secondary liquidity — once sold, how do tokens trade, and who provides exit options?

3. Goldman Sachs & BNY Mellon: Conservative Adoption in the U.S.

Both Goldman Sachs and BNY Mellon piloted tokenized money market funds in 2025 using a “mirror token” approach- tokens representing assets still custodied through traditional rails.

Strategic relevance:

- Confirms institutional appetite on Wall Street, but also illustrates caution.

- Positions tokenization as an efficiency upgrade rather than a wholesale market replacement.

- Demonstrates how RWA tokenization platform development services can be tailored to highly regulated frameworks.

4. Galaxy Digital: Extending Tokenization to Equity

Galaxy Digital partnered with Superstate to tokenize its own common stock on Solana in 2025.

Strategic relevance:

- Proves that equity, not only debt or real estate, can be tokenized when structured correctly.

- Tests the limits of corporate law and blockchain issuance.

- Shows issuers’ willingness to apply tokenization internally, not just to external assets.

5. Diamond Standard Fund: Commodities and Complex Valuation

In 2024, the Diamond Standard Fund launched a tokenized diamond product on InvestaX.

Strategic relevance:

- Moves tokenization beyond conventional asset classes into commodities with opaque valuation models.

- Validates the role of an asset tokenization development company in designing products where no retail market previously existed.

- Surfaces the challenge of price discovery: ensuring tokens reliably reflect underlying diamond values.

Ensure Every Layer of Your RWA Platform Meets Institutional Standards!

Where RWA Tokenization Is Heading Now? (2025 Insights)

1. Cross-chain frameworks becoming essential

New research is focusing on making Real-World Assets work seamlessly across multiple blockchains, reducing repeated verification, enabling more efficient settlement, and giving platforms flexibility.

2. Seazen Group in China exploring RWA tokenization

Seazen is setting up a Digital Assets Institute in Hong Kong to experiment with tokenizing its property income and IP, signalling major developers are considering RWAs as a liquidity tool in markets facing real-estate stresses.

3. New Liquidity Models

Hybrid market structures, collateral-based liquidity models, and better compliance/gating mechanisms for enhanced ROI.

4. Forecasts pushing toward trillions by 2030

Industry analysts see the total value of tokenized real-world assets rising from current tens of billions into $4-10+ trillion by 2030, assuming continued adoption in private credit, real estate, and regulatory clarity.

5. Institutional and regulatory readiness are rising

Platforms are being judged on compliance, proof-of-reserve, custody integrity, multi-chain deployments, and performance under stress

Takeaway

These developments in RWA Tokenization indicate it is reaching new levels of maturity. Businesses want to build an Asset Tokenization platform now; their competitive edge will be in combining legal robustness with technical innovation.

Partner with Antier to transform real-world assets into blockchain-powered financial instruments. Build secure, compliant, and future-ready platforms today.

Frequently Asked Questions

01. What is RWA Tokenization?

RWA Tokenization is the process of converting enforceable rights to a real-world asset into blockchain-based tokens that can be transferred, fractioned, and integrated into financial infrastructure.

02. What types of assets are commonly tokenized?

Commonly tokenized assets include financial instruments like U.S. Treasuries, real estate properties, private credit such as SME loans, commodities like gold and oil, and alternative assets like art and luxury cars.

03. How does RWA Tokenization differ from traditional securitization?

While both RWA Tokenization and traditional securitization fractionalize and distribute claims on assets, they differ in infrastructure and accessibility, particularly in terms of settlement speed and the legal structures involved.