AI Summary

- Cryptocurrency exchange software solutions have evolved beyond just trading Bitcoin to encompass a wide array of assets like NFTs, stocks, and more.

- These platforms offer a range of functionalities such as staking, borrowing, yield farming, and social trading.

- Entrepreneurs looking to enter this booming market must consider factors like development costs and ideal features.

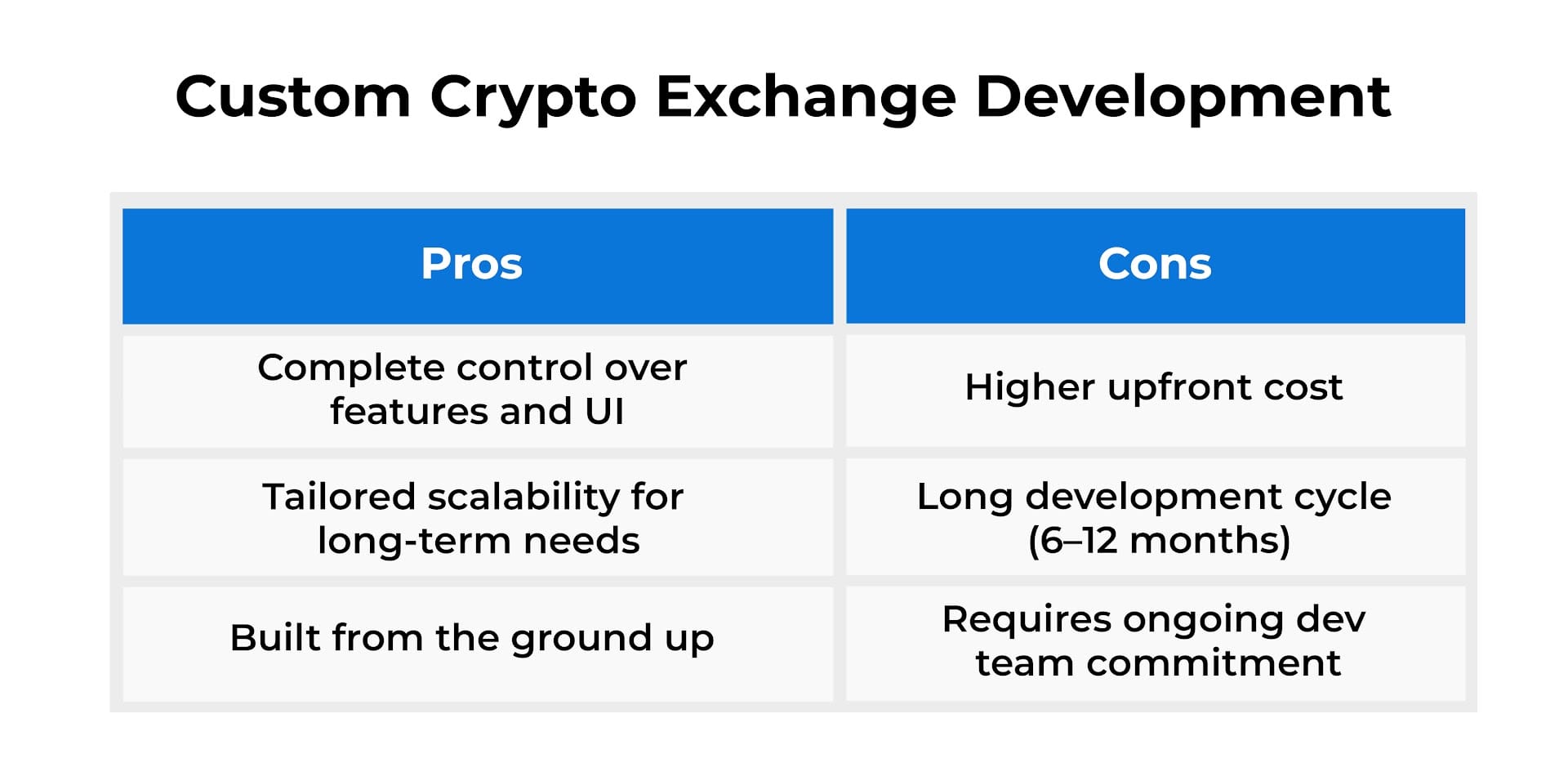

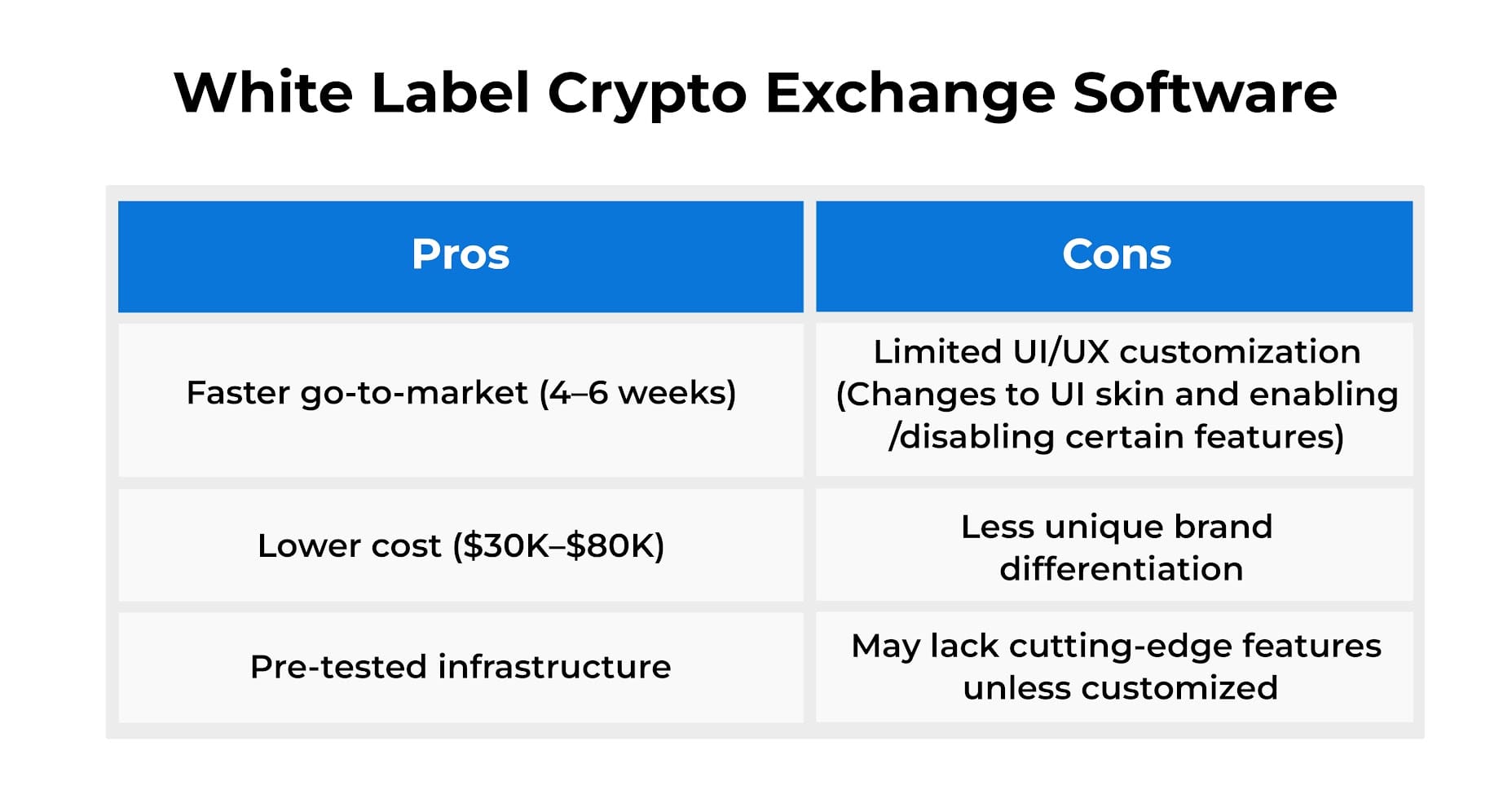

- Custom development allows for full control and unique offerings but requires a higher budget, while white label solutions offer faster launches and lower costs.

- The cost of building a cryptocurrency exchange software can range from $40k to $500k, influenced by factors like platform complexity, technology stack, and development team location.

Today’s cryptocurrency exchange software solutions are more than just applications for buying Bitcoin. These digital equivalents of stock exchanges, combined with a PayPal-level front-end, facilitate trades for cryptocurrencies, NFTs, stablecoins, tokenized RWAs, stocks, equities, etc. And like the cryptocurrency world has transcended beyond Bitcoin, the role of crypto exchange software solutions has also evolved from mere trading infrastructures to full-fledged ecosystems enabling traders to:

- Stake cryptocurrencies

- Lend or borrow assets

- Participate in launchpads (IEOs/IDOs)

- Earn through yield farming or liquidity mining

- Store assets in custodial or non-custodial wallets

- Buy crypto using fiat (on-ramp) or withdraw to bank accounts (off-ramp)

- Convert between stablecoins

- Claim airdrops or promotional rewards

- Copy other traders’ strategies (social/copy trading)

- Access real-time market analytics and tools

- Engage with gamification modules and community features

- Participate in governance

- Use prepaid crypto cards

- Play games while earning rewards in cryptocurrencies

- Run algorithmic or grid bots

No wonder mainstream cryptocurrency exchanges command billions in daily trading volumes. At the time of writing this blog, when the crypto market cap stood at $3.7 trillion, here’s how the top 8 trading platforms were performing.

The cryptocurrency market is maturing rapidly, and with this surge comes a corresponding increase in entrepreneurs and enterprises seeking to launch their exchanges to capitalize on the opportunity. However, before any venture leaps into the trillion-dollar market, these are some questions that arise:

- How to build a cryptocurrency exchange software?

- How much does cryptocurrency exchange software development cost?

- Factors That Influence Cryptocurrency Exchange Development Costs

- Top 6 Crypto Exchange Development Companies and Their Pricing

- What are the ideal features for cryptocurrency exchange software development?

- Final Takeaway

Let’s answer these questions.

How to build a cryptocurrency exchange software?

Building your cryptocurrency exchange software requires a clear vision. Depending on your specific requirements, you can choose between custom and white label cryptocurrency exchange software development. This primary decision impacts everything from development cost, flexibility, time-to-market, to the positioning of your exchange.

1. Custom Cryptocurrency Exchange Software Development

Picking custom development means hiring developers to code your entire crypto exchange software from scratch. The ultimate benefit in this mode of development is full ownership, control, and customization. So, you can implement features, UI/UX, and workflows of your choice. There’s no standard template that you have to fit in.

Ideal for:

- High-budget cryptocurrency exchange software development projects. Businesses must be able to afford the high costs associated with a skilled and experienced team of backend developers, frontend developers, UI/UX designers, QA testers, DevOps for deployment, project managers, and blockchain specialists.

- Businesses that require high-level scalability.

- Those bringing a novel concept, leveraging a proprietary technology, or launching their cryptocurrency exchange software in a specific regulatory niche that off-the-shelf solutions can’t handle.

- Businesses that want to stand out with a unique offering or deploy some unique integrations that are not available in off-the-shelf solutions.

2. White Label Cryptocurrency Exchange Software Development

A white label cryptocurrency exchange is a premade software that can be licensed or purchased and rebranded to launch a fully functional cryptocurrency exchange. The cryptocurrency exchange software development company usually compiles a trading engine, other modules, wallets, and a user interface in a package, and businesses can customize and configure it according to their needs.

With custom cryptocurrency exchange software development comes a greater risk of how the product will align with the market. White label crypto exchanges reduce this risk since they come with a proven platform. Other benefits? Lower cost, faster launches. Businesses leveraging this can allocate these saved resources to focus on branding, acquiring users, and compliance.

Ideal for:

- Startups and established companies like banks that want to add digital asset capabilities without building cryptocurrency exchange software from scratch.

- Businesses that don’t want to alter fundamental aspects of the trade engine or database but want basic adjustments.

- Startups or first-time founders seeking a safer and faster entry into the crypto world.

Did you know?

Businesses may face hardships with scaling substandard white label cryptocurrency exchange software solutions when the user base explodes or the platform’s features or transaction speeds are to be enhanced.

- Hybrid Crypto Exchange Development Approach: Some businesses may also take this approach, where they start with a white label cryptocurrency exchange software development and gradually replace or heavily modify various parts of it. Or they may use a white label exchange for one aspect and custom build other components.

How much does cryptocurrency exchange software development cost?

Building a fully-functional cryptocurrency exchange software may cost anywhere from $40k to $500k, depending on your requirements (features, technologies, timelines) and who builds it. But what’s included in this cost estimate? Here’s a granular breakdown of major cryptocurrency exchange software development cost components:

- Frontend & Backend Development: Includes dashboard, trading engine, APIs, wallets, staking, lending, and other modules.

- UI/UX Design: Intuitive, responsive designs for web/mobile

- Smart Contract Audits: Security audits, especially for DEXs

- Hosting & Maintenance: Cloud infra, DevOps, server security

- Licensing & Compliance: Jurisdiction-specific KYC/AML, legal advisory

- Marketing & SEO: PR, influencer campaigns, SEO-driven content

- Ongoing Updates & Support: Technical support, new feature rollouts

Factors That Influence Cryptocurrency Exchange Development Costs

Here are the core variables that determine your total investment:

1. Platform Complexity

- A basic spot trading exchange is cheaper than a full-featured cryptocurrency exchange software development that has premium features such as margin trading, derivatives, NFT marketplaces, copy trading, and grid trading modules

- Features like staking, P2P trading, or on-chain vaults often require additional architecture and smart contract development.

2. Technology Stack

- Centralized exchanges may use Node.js, React, PostgreSQL, Redis, etc.

- DEXs use Solidity, Rust, Substrate, Cosmos SDK, etc.

- The more niche or high-performance the stack, the costlier the crypto exchange development services.

3. Customization vs. White Label Crypto Exchange Development

- Fully custom-built platforms usually cost more and take longer as compared to white label cryptocurrency exchange software development.

- White label exchanges can slash cost and development time by up to 70%.

4. Geographic Location of Exchange Software Development Team

- The cryptocurrency exchange development cost highly depends on where your cryptocurrency exchange software development team is located.

- Rates tend to be lower in developing countries and higher in developed ones, reflecting differences in the cost of living and market expectations.

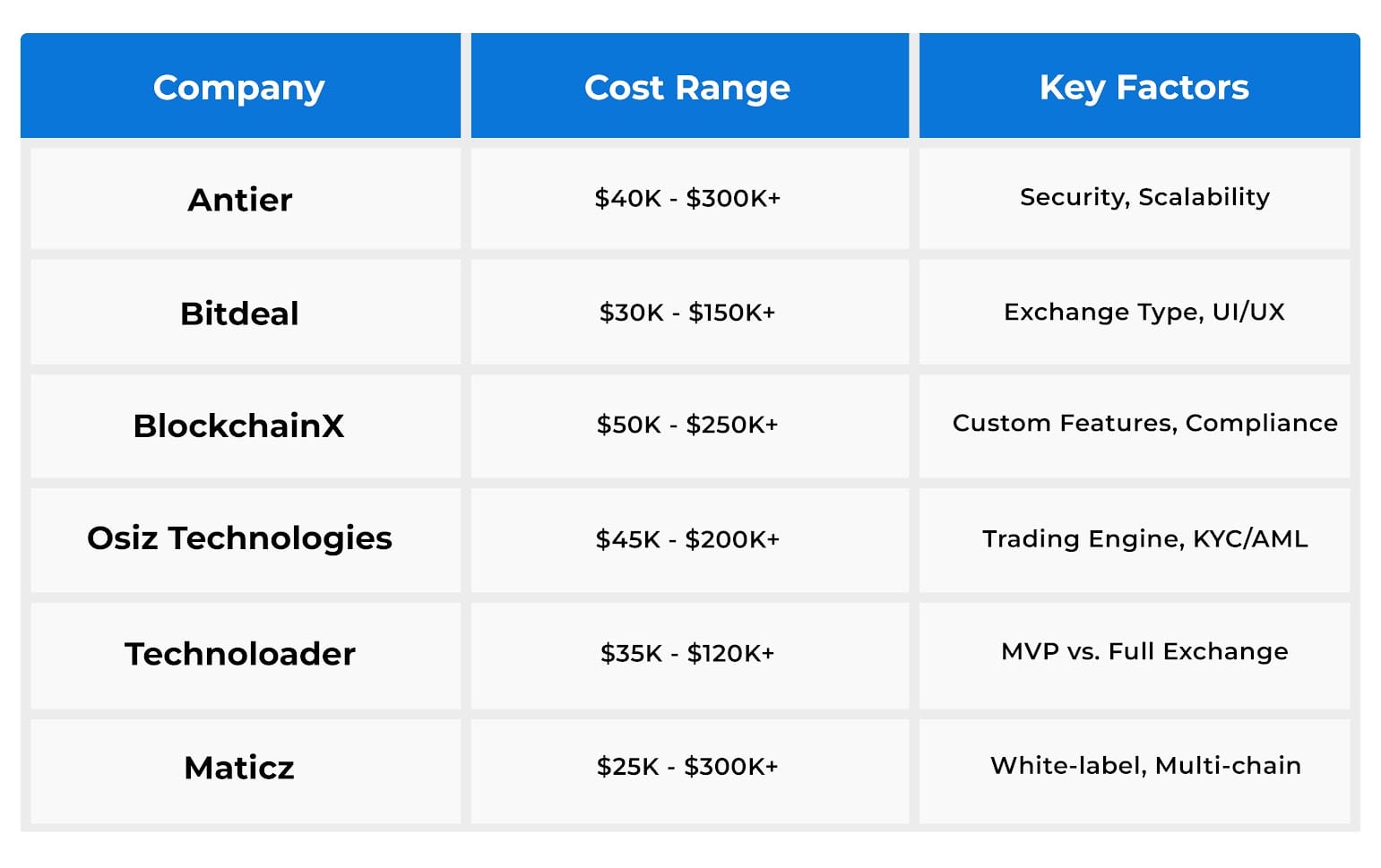

Top 6 Crypto Exchange Development Companies and Their Pricing

Here’s a cost estimate for cryptocurrency exchange development from the top 6 crypto exchange development services providers.

What are the Ideal Features for Cryptocurrency Exchange Software Development?

Ideal features for cryptocurrency exchange software development depend on what kind of trading platform you’re building: basic, advanced, or premium.

1. Basic Cryptocurrency Exchange Development

For a fundamental cryptocurrency exchange development, these features may suffice.

- Spot Trading Module

- Automated Third-Party KYC

- Market, Limit, and Stop Limit Orders

- Multichain USDT

- Crypto Swapping

- Fiat On/Off ramp

- External Liquidity Module

- News and Announcements

- Referral and Reward Programs

- Mobile Applications

- Admin Panel

Core or fundamental cryptocurrency exchange software development is usually very cost-effective and well-suited for those who are planning to deploy their exchange arm immediately and expand later on or gradually.

2. Advanced Cryptocurrency Exchange Development

For intermediate-level cryptocurrency exchange software development, businesses may need to add these features to their core trading platform template.

- Peer-to-Peer Trading

- Grid Trading

- Social/Copy Trading

- Multi-Access Role

- Fiat Payment Gateway

- Fiat Trading Pairs

- Airdrop

- Multi Lingual

- Admin chat support

- Automated Market Making Bot

- Native/Utility Token

- VIP Accounts

- Customer Support Chat

- NFT Collectables

There are additional exchange development costs and time associated with these features. Even if you’re picking a basic white label exchange for a core trading engine, you’ll need a specialized and reliable Cryptocurrency Exchange Development Company for integrating these.

3. Premium Cryptocurrency Exchange Software Development

For those who want to stand out from the crowd, these are some of the key features they can focus on apart from robust security:

- Advance

- Staking Module

- Prepaid Cards

- Merchant Payment Gateway

- NFT Marketplace

- Launchpad

- Crypto Loans

- Crypto Betting

- User chat

- Gamification Modules

- Price Alerts

- Lending & Borrowing

- Margin Spot Trading

- Crypto Arbitrage Modules

- Derivatives/ Perpetual Futures Trading

- AI-Powered Fraud Detection

- Smart Order Routing Engine

- AI-Powered Portfolio Management

- Adaptive Risk Management System

- AI-Agent Chatbot For Trader Support

- Personalized Trading Dashboards

- AI-Based Predictive Analysis

- NLP-Powered Sentiment Scanner

- AI-Driven Token Scoring System

- Dynamic Fee Optimization Engine

AI cryptocurrency exchange software development is not the future of exchanges, as many top-notch exchanges are already bringing AI integrations.

Final Takeaway

Launching your cryptocurrency exchange software is feasible and financially viable, given how you plan it. Your cryptocurrency exchange development company plays an essential role in providing you a clarity around your scope and aligning your needs with your budget. Whether you’re building a DeFi exchange or a compliance-first centralized exchange, the cost is driven by the depth of features, customization, and technology choices.

Startups Waste Months Guessing. Enterprises Burn Millions. Antier Fixes That For You

Whether you’re an emerging startup or an established financial institution or Web2 brand entering the Web3 space, a consultation from a leading crypto exchange development services provider like Antier can save you months of trial and error.

At Antier, we’ve successfully delivered 1,200+ Web3 implementations, which include more than 100 cryptocurrency exchange software solutions. Apart from our top-notch custom cryptocurrency exchange software development solutions that provide you with 100% flexibility, giving exactly what you want to build, our white label exchanges come packed with top-notch features.

Get in touch today for a no-obligation discovery call, a tailored quote, and a technical roadmap customized to your business goals.

Frequently Asked Questions

01. What are the main functions of modern cryptocurrency exchange software?

Modern cryptocurrency exchange software facilitates a variety of functions including trading cryptocurrencies, NFTs, stablecoins, staking, lending or borrowing assets, yield farming, and more, creating a comprehensive ecosystem for traders.

02. How can someone build a cryptocurrency exchange software?

To build cryptocurrency exchange software, one must have a clear vision and decide between custom or white label development, which affects cost, flexibility, time-to-market, and the exchange's positioning.

03. What factors influence the cost of cryptocurrency exchange software development?

Factors influencing the cost of cryptocurrency exchange software development include the choice between custom and white label solutions, desired features, development complexity, and the expertise of the development team.