The digital finance sector is set to transform with ISIN Backed Tokenized Assets. Backed by International Securities Identification Number, these Tokenized assets are globally recognized and bridge the gap in traditional finance to trade, track and verify securities. This guide explores how ISIN backed tokenization services are transforming digital asset management globally.

Understanding ISIN-Backed Tokenization

ISIN, also known as the International Securities Identification Number (ISIN), is a global standard for identifying financial securities.

When combined with blockchain tokenization, it creates a powerful mechanism for digitalizing and fractionalizing assets. The ISIN backed securities process transforms traditionally illiquid assets into tradeable digital tokens, offering unprecedented flexibility in asset ownership and investment.

The ISIN framework unlocks regulatory legitimacy in tokenization, making all transactions Auditable, Standardized and Transparent. It is an upgrade to securities credibility in the traditional finance and DeFi world. Integrating ISIN numbers ensures these digital tokens meet international financial standards, bridging the gap between innovative digital assets and established financial frameworks.

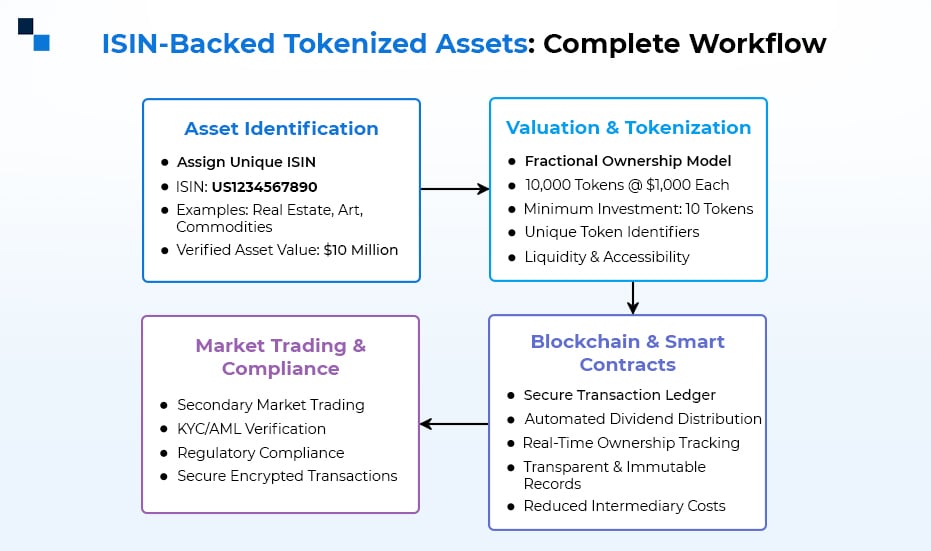

How Does the ISIN Backed Tokenized Assets Work?

Let’s understand it with an example: Take Token Number 0 representing a fraction of a commercial property in New York City. Here’s how the process works:

- Token Number 0 is created and assigned a unique ISIN (US1234567890).

- The property’s metadata (location, valuation, ownership details) is stored on the blockchain.

- A smart contract automates dividend distributions and ownership transfers.

- Investors purchase tokens on a secondary market, with each transaction recorded on the blockchain.

- Regulatory compliance is maintained through KYC/AML checks and real-time reporting.

- Token holders can track their investments via a user-friendly dashboard and trade tokens on a digital exchange.

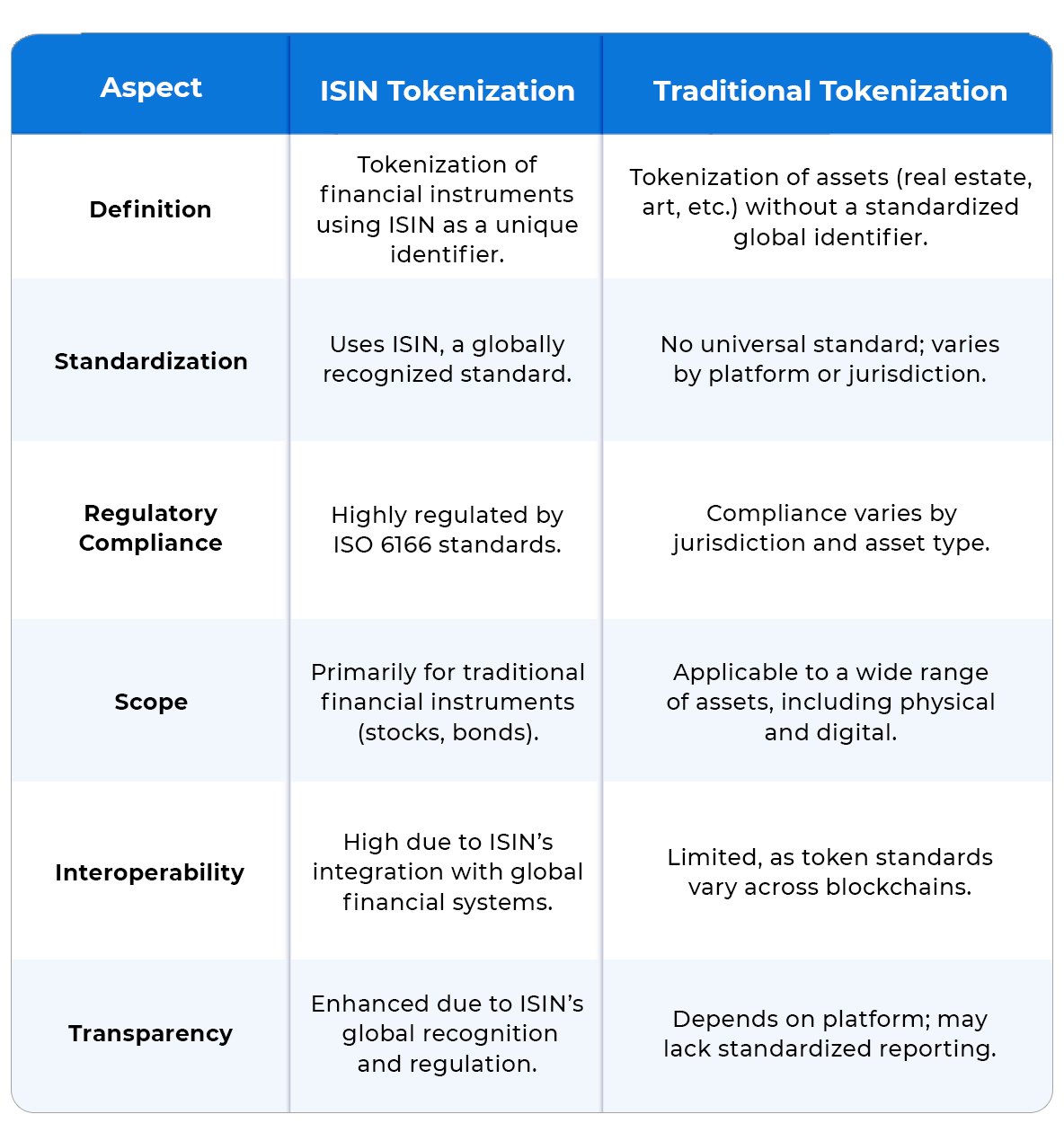

ISIN vs. Traditional Tokenization: A Comparative Overview

ISIN-Backed Tokenization: The Case of BlueGrace Energy Bolivia (BGEB)

BlueGrace Energy Bolivia (BGEB) is leading the way with ISIN-backed tokenized assets, introducing the world’s first ISIN-registered tokenized voluntary carbon credits, transforming the carbon offset industry.

- First ISIN-Registered Voluntary Carbon Credits – BGEB’s credits, registered under ISIN (UK.BG.MAX 785.985257), establish a new benchmark for credibility in carbon markets.

- Blockchain-Enabled Tokenization – Blockchain for ISIN-backed assets ensures secure and transparent transactions, reducing the risks of double counting and fraud.

- Exclusive Trading on NeXchange – The credits are traded on NeXchange, providing a secure and compliant platform for investors.

ISIN Backed Tokenization: Benefits To Investors and Platform Builder

Benefits to Investors

- Enhanced Transparency

ISINs provide a globally recognized identifier for financial instruments, ensuring that investors have clear and standardized information about the underlying asset. This transparency reduces ambiguity and builds trust in the tokenized asset.

- Regulatory Compliance

ISIN-backed tokens are tied to regulated financial instruments, which are already compliant with global financial regulations. This reduces legal and compliance risks for investors, making it safer to participate in tokenized markets.

- Global Accessibility

ISINs are universally recognized across international markets. This allows investors to access tokenized assets from different jurisdictions without facing barriers related to asset identification or verification.

- Improved Liquidity

Tokenization of ISIN-backed assets enables fractional ownership, making it easier for investors to buy, sell, and trade smaller portions of traditionally illiquid assets like bonds or equities. This enhances market liquidity.

- Reduced Counterparty Risk

ISINs are issued by National Numbering Agencies (NNAs), which are authoritative bodies. This ensures the authenticity and legitimacy of the underlying asset, reducing the risk of fraud or misrepresentation.

- Easier Due Diligence

Investors can quickly verify the details of an asset using its ISIN, streamlining the investment decision-making process. This is particularly useful for institutional investors who require thorough due diligence.

- Interoperability

ISIN-backed tokens can seamlessly integrate with existing financial systems, enabling efficient trading, settlement, and reporting. This interoperability makes it easier for investors to manage their portfolios across different platforms.

- Portfolio Diversification

ISIN-backed tokenization allows investors to access a wider range of traditional assets (e.g., bonds, equities, ETFs) in a tokenized format. This enables better portfolio diversification and risk management.

Benefits to Platform Builders

- Regulatory Alignment

Using ISINs ensures that the tokenization platform complies with global financial regulations. This reduces the risk of legal challenges and makes it easier to operate in multiple jurisdictions.

- Market Credibility

Platforms that use ISIN-backed tokenization gain trust from institutional investors, regulators, and other stakeholders. The use of a globally recognized standard like ISIN enhances the platform’s credibility and reputation.

- Easier Integration

ISINs are already integrated into global financial systems, making it easier for platform builders to connect with exchanges, custodians, clearinghouses, and other financial infrastructure providers.

- Scalability

ISIN-backed tokenization can scale across multiple asset classes and jurisdictions because ISINs are universally recognized. This allows platform builders to expand their offerings without facing significant technical or regulatory hurdles.

- Reduced Onboarding Friction

Investors and institutions are already familiar with ISINs, which simplifies the onboarding process. This reduces the time and effort required to attract and retain users on the platform.

- Enhanced Interoperability

Platforms using ISINs can interact more easily with other financial systems and blockchains. ISINs provide a common reference point, enabling seamless data exchange and collaboration across ecosystems.

- Access to Institutional Capital

Institutional investors are more likely to participate in ISIN-backed tokenization due to its regulatory and standardized nature. This opens up access to a significant pool of capital for platform builders.

- Streamlined Reporting

ISINs simplify reporting and auditing processes because they are already part of global financial reporting standards. This reduces the administrative burden on platform builders and ensures compliance with regulatory requirements.

ISIN-Backed Securities Platform Development: Key Components Not to Ignore

For Enterprises looking to develop an ISIN-Backed Securities Platform, several critical considerations come into play:

Advanced Blockchain Architecture

The process involves building a blockchain system that can:

- Process multiple types of assets simultaneously

- Maintain data integrity across thousands of transactions

- Provide real-time transaction verification

- Support complex smart contract interactions

- Scale to accommodate growing numbers of users and assets

Secure Authentication Mechanisms

For ISIN token development solutions, implement:

- Multi-factor authentication protocols

- Biometric verification options

- Hardware security key integration

- Advanced encryption for user credentials

- Continuous monitoring of access attempts

- Risk-based authentication that adapts to user behavior

Scalable Transaction Processing

Scalability ensures the Blockchain for ISIN-backed assets, Tokenized securities can handle increasing transaction volumes without compromising performance. It must have:

- Ability to process hundreds of transactions per second

- Efficient load balancing across multiple servers

- Dynamic resource allocation

- Minimal latency during peak transaction periods

- Seamless integration of new blockchain nodes

Comprehensive Compliance Tools

Compliance tools are sophisticated software systems that:

- Automatically check transactions against regulatory requirements

- Generate detailed compliance reports

- Flag suspicious activities

- Ensure KYC (Know Your Customer) and AML (Anti-Money Laundering) standards

- Maintain audit trails for every transaction

- Update compliance protocols based on changing regulations

This is similar to having an always-alert compliance officer monitoring every financial transaction in real-time.

Set New Standard with ISIN Backed Tokenization Platform

ISIN will promote the mainstream adoption of tokenization. Fintech companies, Real Estate, Enterprises will leverage it to set a benchmark for secure and compliant asset-backed digital investments.

Companies like BlueGrace Energy Bolivia are leading the financial sector with such initiatives, and it’s time for others to get into the race and unlock the perks.

Empower your business to modernize the operations, attract global investors, and maximize the value of their assets securely and efficiently.