Mobile wallet app development solution remains a central gateway between users and Web3/DeFi services. The global mobile wallet market continues rapid expansion driven by contactless payments, fiat ↔ crypto rails, and enterprise demand for programmable wallets and tokenization. The market estimate shows high growth through 2030, reflecting enterprise interest in secure, multi-rail wallet systems.

This guide is written from an enterprise, Web3-product perspective: selection criteria below, followed by seven vendor profiles.

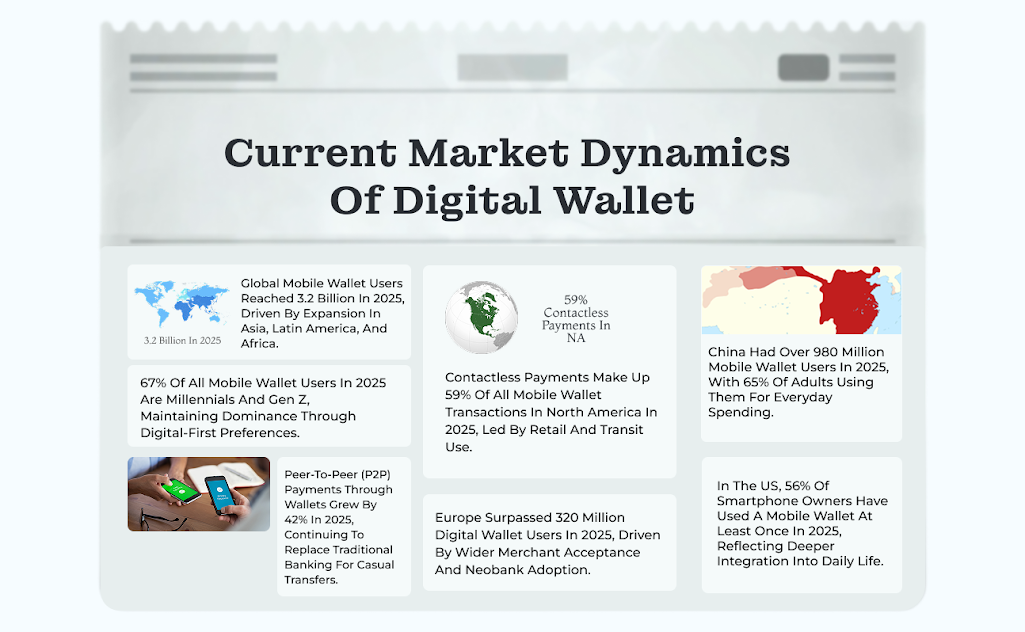

Stay Updated With The Present Digital Wallet Market!

What Enterprises Should Evaluate While Crypto Mobile Wallet App Investment?

- Security & key management : HSM / MPC / hardware wallet compatibility\

- Custody model : custodial, non-custodial, hybrid & institutional hot/cold separation

- Multi-chain & DeFi readiness : cross-chain bridging, smart-contract tools, DeFi integrations

- Compliance & fiat rails : KYC/AML integrations, on/off-ramp partners, settlement support

- Operational readiness : SLAs, monitoring, audits, post-launch support

- Time-to-market & cost transparency : white-label vs custom, modular pricing

- UX & growth features : easy onboarding, SDKs, merchant integrations, loyalty, analytics

Now let us start navigating the top most crypto wallet app development companies who have managed to stay popular in this high competitive web3 market.

Explore The Best Mobile Wallet App Development Companies

1. Antier

Antier stands out as a crypto defi wallet development company and full-spectrum partner, delivering enterprise-grade wallet systems with modular architecture, DeFi integrations, and multi-chain custody. Antier builds mobile crypto wallets that combine self-custody, institutional hot/cold key management, and on/off-ramp rails for fiat and crypto. Their engineering focus includes high-throughput transaction processing, smart-contract DeFi wallets, and layered security (HSM and MPC-ready designs) so enterprises can scale safely. Choosing Antier means prioritizing a partner that handles architecture, audits, and white-label crypto wallet deployment while offering post-launch support and custom integrations for liquidity, staking, and AML workflows. This company exemplifies a practical, future-aware approach to wallet delivery for large businesses.

2. Debut

Debut focuses on rapid, compliance-minded digital wallet app development for mid-market firms, blending clean UX with secure key management and token support. Their product-led process prioritizes frictionless onboarding, programmable wallets with card tokenization and fiat on-ramps, and KYC-enabled reconciliation. This company and its team reduces time-to-market through reusable components, provides partner SDKs and analytics dashboards, and offers SLA-backed support and clear costing models that simplify procurement for enterprise buyers. They commonly work with fintechs, neobanks, and retailers to implement loyalty, micropayments, and dispute management tailored to local regulations. Debut also performs security audits and periodic compliance reviews to meet enterprise audit cycles.

3. Synodus

Synodus builds developer-friendly mobile wallet app development solutions aimed at startups and enterprises wanting extensible, audit-ready wallets. They emphasize modular SDKs, multi-chain bridging, and secure key abstractions that allow businesses to plug quickly into DeFi rails and NFT flows. Synodus’s engineering practice centers on testable CI/CD, smart-contract verification, and privacy-preserving telemetry to balance product insights with user confidentiality. For enterprises, Synodus offers custom integrations for custodial/non-custodial models, centralized liquidity, and hardware wallet compatibility, plus ongoing maintenance and feature roadmaps. Their practical, developer-first approach accelerates secure wallet launches while also supporting enterprise training and incident response, a good fit for regulated fintechs and gaming platforms.

4. Aalpha

Aalpha positions itself as a value-conscious engineering partner for mobile wallet application development, focusing on cost-effective MVPs and incremental feature builds. They provide end-to-end services: architecture, hot/cold wallet separation, token standards, and merchant integrations for payment acceptance. Aalpha’s advantage is a compact, experienced team that delivers faster sprints, realistic cost estimates, and localized compliance plugins for varied markets. Built-in analytics, white-label UI themes, and optional managed hosting help enterprises accelerate deployment while retaining customization. Their services include security audits, compliance checklists, and support for enterprise SLAs. Aalpha offers fixed-price and T&M models and has experience across remittances, marketplaces, and fintechs.

Talk to Our Experts To Start Your Crypto Mobile Wallet Journey!

5. Mobiollete

Mobiollete appears to be a niche or emerging crypto wallet service provider; during public research we could not locate a broadly verifiable public profile, so the description below synthesizes typical capabilities for teams operating under similar brand profiles. As an experienced mobile wallet development company, such firms usually provide lightweight, customizable wallets with secure key storage, payment-rail connectors, and partner SDKs for merchants and banks. They focus on fast prototypes, local payment integration, and B2B white-labeling to help retail and regional banking partners onboard digital payments quickly. Mobiollete follows this model, enterprises can expect agile delivery, basic AML/KYC integrations, and options for custodial or non-custodial deployments optimized for local payments.

6. Maticz (Maticz)

Maticz specializes in white-label crypto e-wallet platforms and is known for configurable stacks that reduce build time while offering enterprise features. They provide multi-currency support, token management, NFT compatibility, and optional custodial services. Maticz’s engagement model helps clients estimate e-wallet app development cost early through modular pricing: base white-label, add-on modules (staking, swaps, KYC), and managed services. This allows enterprises to forecast budgets and choose incremental rollout strategies tied to product-market fit. Maticz also emphasizes security reviews, automated DevOps, and post-launch monitoring so businesses can keep uptime and compliance predictable while scaling.

7. SCAND

SCAND is a European development firm delivering end-to-end crypto wallet app development services with a strong emphasis on security and multi-platform delivery. They build mobile and web wallets that support multi-currency balances, hardware wallet integrations, and enterprise key-management options. SCAND combines UX-first interfaces with backend scalability, offering API-first architectures and merchant payment integrations. Their teams support security audits, regulatory compliance, merchant settlement logic, and loyalty program integration. Enterprises often select SCAND for its engineering depth and ability to integrate with banking rails. SCAND provides SLA options and ongoing DevOps for mission-critical services, making them suitable for regulated projects across multiple jurisdictions.

Wrapping It Up!

Building a secure, scalable mobile crypto wallet is a strategic imperative for enterprises. This guide outlines selection criteria, market trends, and strengths of seven vendors so procurement teams can decide confidently. Prioritize security, multi-chain support, compliance, and clear post-launch SLAs when shortlisting partners. For organizations seeking an experienced, enterprise-ready team that delivers end-to-end wallet systems, Antier combines technical depth, DeFi integrations, and deployment support to accelerate time-to-market. Choosing Antier will help you succeed faster and launch your customized crypto wallet solutions in the market.

Why We Become the Priority Shortlist?

- Enterprise readiness : modular architecture + HSM / MPC design for institutional clients.

- DeFi + fiat rails : integrated on/off-ramp and staking/liquidity integrations that reduce vendor sprawl.

- Delivery & support : end-to-end audits, white-label deployment, and ongoing SLA support, critical for large buyers.

Contact us today!

Frequently Asked Questions

01. What is driving the growth of the global mobile wallet market?

The growth is driven by contactless payments, fiat ↔ crypto rails, and enterprise demand for programmable wallets and tokenization, with an estimated increase through 2030.

02. Who are the primary users of mobile wallets in 2025?

In 2025, 67% of mobile wallet users are Millennials and Gen Z, reflecting their digital-first preferences.

03. What should enterprises consider when investing in crypto mobile wallet apps?

Enterprises should evaluate security and key management, custody models, multi-chain readiness, compliance, operational readiness, time-to-market, cost transparency, and user experience features.