The rise of DeFi has revolutionized the financial landscape. It fosters an open, accessible, and decentralized vision of finance, leveraging the disruptive blockchain technology to elude traditional intermediaries. At the heart of this transformative ecosystem lies a powerful tool: DeFi aggregators.

Understanding DeFi Aggregators

DeFi aggregator development is on the rise because of these platforms’ huge popularity and benefits.

Let’s first understand what DeFi aggregators are:

DeFi aggregators are platforms or protocols that streamline and optimize the trading, lending, and investing experience for users by finding the optimal rates and opportunities. Acting as the command centers, DEX aggregator platforms provide various decentralized financial services within a unified interface, simplifying the process for users.

Here’s how DeFi aggregator achieve this:

1. Single Interface

DeFi aggregators offer users a single point of access to multiple DeFi services. Rather than navigating a multitude of dApps and protocols, users can interact with various services through a unified interface and find the best rates and opportunities for trades, lending, investing, etc.

2. Optimization

DeFi aggregators use algorithms and smart contracts to analyze and optimize DeFi transactions on behalf of users. They seek out the best swap return, the lowest fees, and the most favorable terms, ensuring that users get the most value from their DeFi activities.

3. Efficiency

DeFi aggregator platforms automate complex operations associated with crypto swaps, yield farming, liquidity provision, lending, etc. This automation not only saves users’ time but also minimizes the risk of errors.

4. Cost Reduction

Gas fees on the Ethereum blockchain can be significant. Many DeFi aggregators aim to reduce these fees by batching transactions and executing them at optimal times, saving users money. These aggregator platforms do smart work with price impact. They work on the SOR (smart order route), which provides the multi-split and multi-hopping of routes based on price impact. It prevents the pools from imbalancing reserves by distributing the assets into multiple pools. It keeps pools safer from arbitrage and front-running attacks.

5. Security

DeFi aggregators typically integrate services and protocols that have undergone rigorous security audits, and they are also integrated with top-notch security protocols. This helps users make informed decisions and reduces the risk of falling victim to malicious smart contracts.

Creating a DeFi aggregator platform requires the expertise of an experienced DeFi aggregator development company. Check out this blog to understand the development process of DeFi aggregators.

Popular DeFi Aggregators

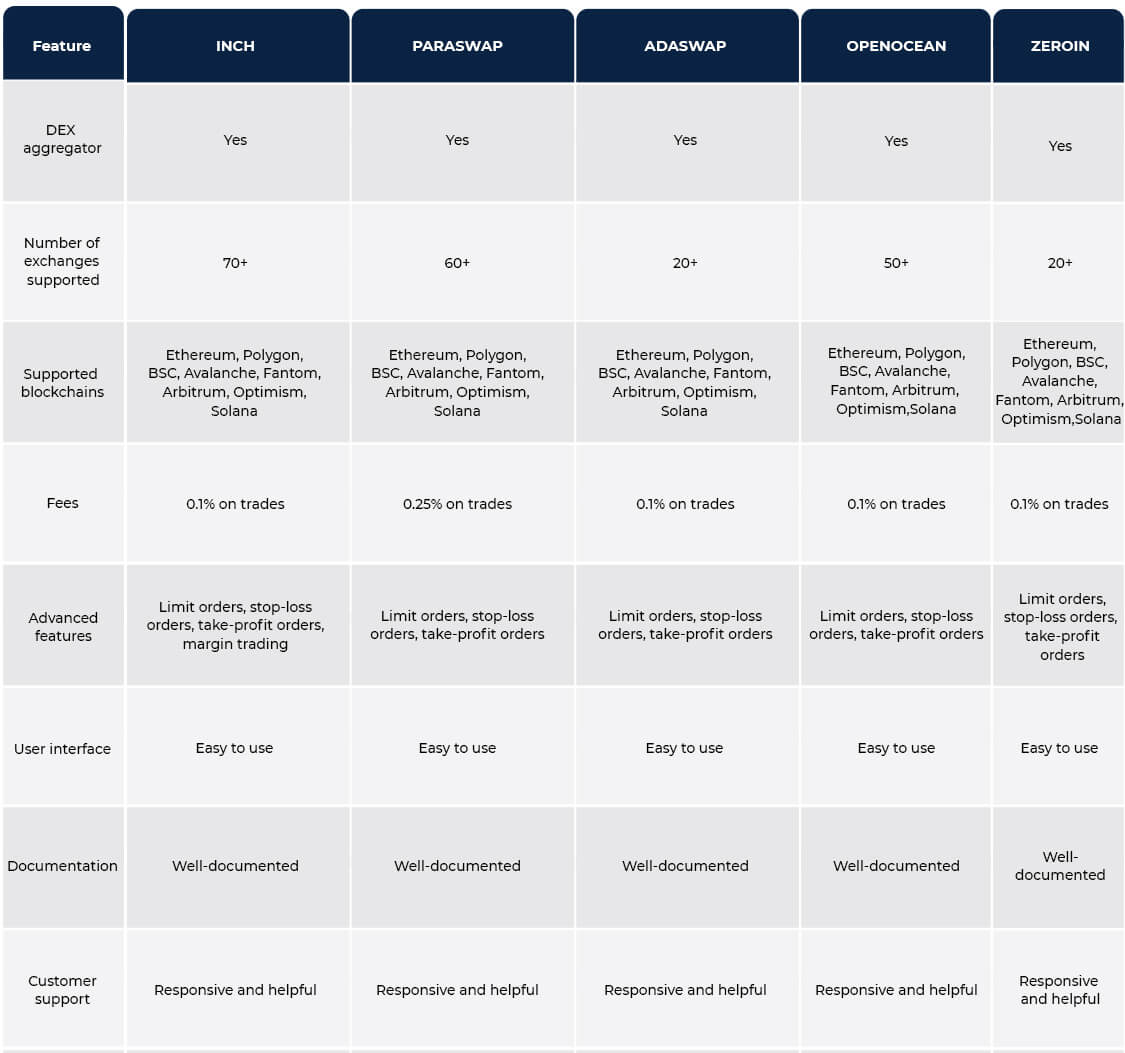

Several DeFi aggregators have gained popularity within the ecosystem. Here is a list of top DeFi aggregators:

1 inch Fusion Mode

Known for its efficient routing and aggregation of decentralized exchanges, 1inch offers users the best possible token swap rates. It offers several features that make it a popular choice for DEX traders, including

- Multi-DEX Integration: Now aggregates liquidity from 40+ DEXs, including Uniswap v4, Curve v2, PancakeSwap v4, and Maverick. Also added support for Request-for-Quote (RFQ) orders, allowing professional market makers to compete for trades.

- Expanded Network Support: Added support for Arbitrum, Optimism, Polygon zkEVM, Base, and Linea, in addition to Ethereum, BNB Chain, and Polygon.

- Optimal Trade Routing: The platform automatically routes users’ trades to DEXs offering the most competitive rates and minimal slippage, maximizing the value of their assets.

- Token Swap: Users can easily swap one cryptocurrency for another on 1inch, taking advantage of aggregated liquidity for a wide range of tokens.

- Limit Order Auctions: Liquidity providers (market makers) compete to fill limit orders, often offering better rates than static DEX pools.

- Gasless Swaps: Users can now execute swaps without paying upfront gas fees (gas costs are deducted from the swapped tokens).

- MEV Protection: Protects against “Maximal Extractable Value” bots that front-run trades, ensuring users get fairer pricing.

ParaSwap V4

- Multi-DEX Aggregation: ParaSwap aggregates liquidity from various DEXs like Uniswap, SushiSwap, Balancer, and others, ensuring users access the best prices and liquidity pools.

- Best Price Execution: The DeFi Aggregator platform automatically routes trades to DEXs with the most favorable rates and terms, helping users achieve optimal execution.

- Intent-Based Trading: Users set desired outcomes (e.g., “swap X for Y with max slippage 1%”), and solvers compete to fulfill orders.

- Cross-Chain Swaps: Supports swaps across Ethereum, Polygon, Arbitrum, Optimism, and Base in a single transaction.

- MEV Protection: Partnerships with Flashbots and Chainlink’s Fair Sequencing Service to prevent front-running.

- Gasless Swaps: Users pay fees in tokens (e.g., USDC) instead of native gas tokens (e.g., ETH).

Adaswap

- Cardano Hydra Integration: The DEX aggregator platform supports layer-2 scaling via Hydra heads for near-instant, low-cost swaps.

- Milkomeda EVM Compatibility: Enables cross-chain swaps between Cardano and EVM chains (Ethereum, Polygon).

- Limit Orders & TWAP: Added time-weighted average price (TWAP) orders for large trades.

- Adaswap DAO: Governance via ADAT token, voting on fee structures and new features.

OpenOcean

- AI-Powered Predictions: The “OceanGPT” tool forecasts optimal swap times based on historical gas and price data.

- Expanded Cross-Chain Support: The DeFi aggregator platform added Solana, Sui, and Cosmos to existing Ethereum/BNB/Polygon integrations.

- Fiat On-Ramp: Direct purchases via credit card (partnering with Banxa and Simplex).

- OOE Token Utility: Staking rewards, fee discounts, and governance voting.

ZeroIn

- Gas Fee AI Oracle: The DeFi aggregator platform predicts optimal transaction times using machine learning (supports Ethereum, Polygon, and Arbitrum).

- Portfolio Rebalancing: Auto-adjusts token allocations based on user-defined risk profiles.

- Security Upgrades: Integrated with Forta Network for real-time threat detection.

- Multi-Chain Tracking: Monitors assets across 15+ chains, including Aptos and zkSync Era.

Zapper 2.0

- Cross-Chain Management: The DEX aggregator platform tracks and swaps assets across Ethereum, Solana, and Cosmos.

- NFT Dashboard: View and value NFT collections alongside DeFi positions.

- Automated Strategies: “Set-and-forget” yield farming (e.g., auto-compound Curve LP rewards).

- Institutional Tools: Tax reporting integrations (CoinTracker, TokenTax) and multi-sig support.

Matcha

- Matcha Pro: Advanced charting, limit orders, and API access for high-frequency traders.

- zkSync Era & StarkNet Support: The DeFi aggregator platform expanded Layer 2 trading with near-zero gas fees.

- MEV-Free Trades: Uses CoW Protocol (batch auctions) to prevent front-running.

- KYC/AML Options: Compliant trading for institutional users (partnered with Fireblocks).

Essential Features of DeFi Aggregators

DeFi aggregators, also known as decentralized finance aggregators, are designed to streamline DeFi interactions and provide users with the best possible outcomes.

Top DeFi aggregators have the following features:

1. Multi-Platform Access

One of the primary functions of DeFi aggregators is to provide users with access to multiple DeFi platforms and services from a single interface. This multi-platform access eliminates the need for users to navigate multiple dApps and protocols separately.

2. Token Swap Optimization

DeFi aggregators optimize token swaps. These features ensure that users get the best possible exchange rates and lowest fees by routing their transactions through various DEXs.

3. Single Wallet Connection

Users typically connect a single cryptocurrency wallet (e.g., MetaMask) to the aggregator, which streamlines the process of interacting with multiple DeFi protocols and eliminates the need for multiple wallet connections.

4. Liquidity Provision Assistance

DeFi aggregators may assist users in providing liquidity to decentralized liquidity pools. They can help users find the most profitable pools and provide the necessary guidance for participation.

5. Gas Fee Reduction

Gas fees on the Ethereum network can be prohibitively high, especially during periods of network congestion. DeFi aggregators aim to reduce these fees by optimizing transaction batching and timing.

6. Security and Risk Management

Aggregators often integrate services and protocols that have undergone security audits and have a strong track record. This helps users make informed decisions and minimize the risk of interacting with vulnerable or malicious smart contracts.

7. User-Friendly Interfaces

DeFi aggregators prioritize user-friendliness by providing intuitive and easy-to-navigate interfaces. They aim to make complex DeFi operations accessible to users with varying levels of technical expertise.

8. Portfolio Management

Some aggregators offer comprehensive portfolio management tools. Users can track and manage their DeFi assets, investments, and liabilities across various protocols from a single dashboard.

9. Privacy Considerations

Certain DeFi aggregators prioritize user privacy by minimizing the collection of personal information. This approach aligns with the principles of financial privacy that are core to DeFi.

10. Education and Information

DeFi aggregators may implement gamified education modules to help users stay informed and make well-informed decisions.

11. Cross-Chain Compatibility

While many DeFi protocols operate on Ethereum, cross-chain compatibility is becoming increasingly important. Some aggregators extend their services to other blockchains, allowing users to access DeFi opportunities on multiple networks.

12. Integration with Hardware Wallets

Security-conscious users often prefer hardware wallets for storing their assets. Some DeFi aggregators integrate with hardware wallets to provide a secure and seamless user experience.

13. Community and Support

Aggregators often have active communities and support channels to assist users with their questions, concerns, and technical issues.

14. Real-Time Data

Aggregators provide real-time data on token prices, interest rates, and other relevant information, helping users make timely decisions.

15. Token Support

Aggregators typically support a wide range of tokens and assets, ensuring that users can access the DeFi services they need.

The Future of DeFi Aggregators

As DeFi continues to tread towards mainstream adoption, aggregators will evolve to meet the needs of a broader user base. We can expect more innovation and improved security measures from DeFi aggregator platform development service providers. AI-powered DeFi aggregators are the next generation of these centralized trading hubs, aggregating the information, activity, and liquidity of various DeFi protocols. With more technological innovations, these platforms will continue to simplify access, enhance transactional efficiency, and reduce costs for users.

Are you looking for the best DeFi aggregator platform development company? Antier has extensive experience and expertise in building DEX aggregator platforms. We can build DEX aggregators with advanced SOR algorithms integrated with 3rd-party APIs (1inch, Open Ocean, etc.). Get in touch for a free consultation!