The global travel industry, valued at $1.63 trillion in 2025 and projected to reach $2.55 trillion by 2033, is entering a period of rapid transformation. Payments, once seen as a background function, are now becoming a strategic driver of growth and customer experience. Traditional payment systems hold travel businesses back with slow settlements, high fees, and limited global reach, falling short of what today’s travelers expect. Stablecoin remittance platforms revolutionize the industry by offering instant settlements, lower costs, and complete transparency across borders. Instead of fighting outdated systems, travel companies can finally focus on growth, tap into new markets, and deliver the seamless experiences customers expect.

Source: Finextra

In this blog, we’ll explore why building a custom payment platform is becoming a must for travel businesses. You’ll see how it improves both technical operations and financial performance, and why the companies that move first will be the ones shaping the future of the travel economy.

How Do Traditional Travel Payments Undermine Growth?

Legacy payment rails in the travel sector are weighed down by intermediaries, from card networks and correspondent banks to clearinghouses and FX providers. Each layer introduces friction in the form of settlement delays, high processing fees, and compliance overheads. For global airlines, OTAs, and hotel groups, these inefficiencies translate into constrained liquidity, delayed supplier payouts, and reduced capacity to reinvest in expansion. In a business where margins are already narrow and the speed of settlement is critical, slow-moving capital becomes a direct barrier to growth.

At the same time, travelers are demanding faster, simpler, and more transparent experiences, yet legacy systems deliver the opposite. High transaction costs, opaque FX spreads, and frequent chargebacks not only erode profitability but also diminish trust. In emerging markets where credit card penetration is low, reliance on outdated rails excludes large customer segments altogether. This is where modern alternatives like a stablecoin remittance platform present a compelling advantage, offering instant settlement, lower costs, and global accessibility that traditional systems cannot match.

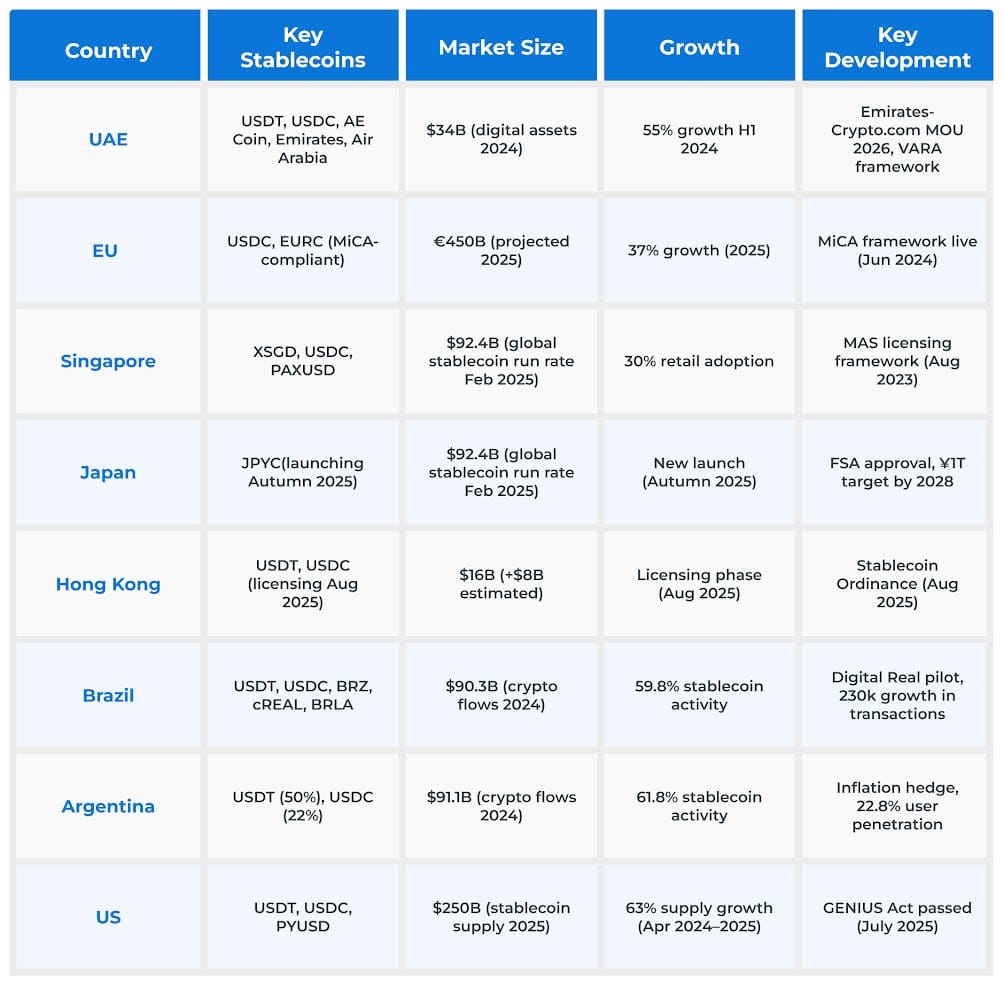

Top Countries Driving Stablecoin Adoption in Travel Payments

The findings reveal three emerging themes guiding the adoption of stablecoin remittance across travel.

- Implementation Leaders: The USA, UAE, and Singapore are already demonstrating how regulated deployment of a stablecoin remittance platform can deliver tangible growth.

- Regulatory Anchors: The European Union, Japan, and Hong Kong are shaping the frameworks that will provide long-term stability and compliance assurance.

- High-Growth Markets: The USA, Brazil, and Argentina reflect rapid consumer-driven adoption, while the United States combines regulatory advances with unmatched scale, making it the core hub for stablecoin payment platform development.

Source: FXCintel

For global travel businesses, the shift is not simply about modernizing payments. It is about adopting the infrastructure that will define the next generation of commerce. A forward-looking stablecoin development company can help airlines, retailers, and booking platforms capture efficiencies, unlock new markets, and strengthen their position in a Web3-driven economy.

Why Is a Stablecoin Remittance Platform a Natural Fit for Travel Businesses?

- Borderless Transactions: Stablecoins enable seamless cross-border transfers without relying on multiple intermediaries. Travelers can pay in one currency while businesses receive stable, fiat-pegged digital assets instantly.

- Lower Transaction Fees: By removing banks and third-party processors, stablecoin remittance platforms significantly reduce costs, allowing travel businesses to offer more competitive pricing and better margins.

- Price Stability: Unlike volatile cryptocurrencies, stablecoins maintain value by being pegged to fiat currencies. This protects both tourists and service providers from sudden exchange rate fluctuations.

- Always-On Availability: Payments are processed in real time, 24/7, accommodating global travelers booking flights, hotels, or tours across different time zones.

- Faster Settlements: Instead of waiting for days, stablecoin transactions settle within minutes, improving liquidity and operational efficiency for travel businesses.

- Enhanced Trust & Transparency: Blockchain-powered stablecoin payments are traceable and secure, giving customers confidence in their transactions while reducing fraud risks.

Through stablecoin development services, travel businesses achieve streamlined payments, reduced operational costs, and greater customer trust. The logical progression is to assess how these capabilities generate measurable technical and financial gains.

How Do Travel Businesses Benefit Technically and Financially?

Technical Advantages

- Instant Settlement: Stablecoins bypass correspondent banking networks and card processors, allowing bookings, cancellations, and refunds to clear in seconds rather than days.

- Programmable Payments: Through smart contracts, businesses can automate reward points, refunds, loyalty programs, and supplier payments, reducing manual errors and operational overhead.

- Seamless Interoperability: A purpose-built stablecoin remittance platform can integrate with existing booking engines, airline systems, and payment gateways via APIs.

- Fraud and Chargeback Reduction: Transactions recorded on an immutable blockchain significantly reduce disputes, fraudulent bookings, and chargeback-related losses.

- Scalability for Emerging Markets: Stablecoins enable direct participation in regions with limited card penetration but high smartphone adoption, broadening customer reach.

Financial Advantages

- Lower Transaction Costs: Stablecoin transactions eliminate layers of fees associated with card processors, correspondent banks, and foreign exchange conversions, often reducing costs by up to 70 percent.

- Liquidity Efficiency: Near-real-time settlements improve working capital cycles, giving travel businesses faster access to funds.

- Revenue Expansion: Accepting stablecoins opens access to a growing segment of crypto-native travelers, particularly in markets like Latin America, where stablecoins are widely used to hedge inflation.

- Cross-Border Optimization: Stablecoins remove the friction of currency conversion spreads and settlement risks, allowing businesses to maximize margins on international bookings.

- Regulatory-Ready Infrastructure: With frameworks like MiCA in Europe and stablecoin-specific rules in the United States and Asia, a compliance-friendly design ensures adoption is sustainable.

Strategic POV

The integration of stablecoin payments equips travel businesses with both operational resilience and market adaptability. A well-architected stablecoin remittance network allows companies to serve crypto-native customers, while stablecoin development frameworks ensure that integrations remain compliant and scalable.

Forward-looking enterprises exploring stablecoin payment platform development can unlock efficiency at scale, positioning themselves ahead of slower competitors. As the Web2-to-Web3 transition accelerates, travel businesses that embrace innovation early will capture efficiencies, expand market reach, and secure long-term profitability.

Conclusion

The travel industry is changing fast, and having the right payment systems is now crucial to staying ahead. Traditional payment methods are slow, expensive, and often confusing, leaving travelers frustrated. Stablecoin payment platform development offers a smarter solution by enabling instant, borderless transactions with lower fees and full transparency. Companies that adopt this technology can streamline their operations, enhance the customer experience, and gain a significant competitive edge in the rapidly growing Web3 travel economy. Take your travel business into the future with Antier and lead the industry with stablecoins.