2024 has witnessed a sharp growth in the global tokenization market, valued at $3.5 billion, and expected to cross $19.4 billion by 2033. With this growth, Real Estate has experienced the most valuable transition. Traditionally considered higher illiquid, the real estate market is now overcoming the longstanding limitation with the White-Label Tokenization Platform. This transformation is leading to enhanced capital access, liquidity, and investor participation.

Unlike the custom blockchain solutions, the White-Label Tokenization Services offer modular, compliance-ready systems that reduce the technical and financial barriers to launching asset-backed tokens. This guide explores how white-label solutions will empower real estate firms and investors in 2025.

Demystifying White-Label Tokenization Platform

A white-label tokenization platform is a ready-made software infrastructure designed to let enterprises issue, manage, and trade tokenized real-world assets (such as real estate) without building the tech stack from scratch. These platforms allow real estate enterprises to digitize residential, commercial, or industrial properties into blockchain-based tokens that can be traded, owned fractionally, and distributed globally.

The provider handles the technology. The real estate company controls the branding, compliance preferences, and token parameters.

A white-label tokenization platform provides real estate with blockchain infrastructure that serves specific business needs:

1. Tokenization Properties for Fractional Ownership

Real estate developers and asset managers can tokenize high-value properties and break them into digital shares with the White Label Tokenization Services. Investors can purchase fractions, starting at small amounts (e.g., $50–$500), depending on the platform design.

Business outcome: Wider investor base, fewer capital bottlenecks, faster deal closure.

2. Increased Asset Liquidity

Traditionally, selling a property share involves legal paperwork, escrow, and weeks of delay. With White-Label Tokenization Services, real estate firms can convert their properties into on-chain tokens that can be sold within minutes, either peer-to-peer or on licensed secondary marketplaces.

Business outcome: Simpler exits for investors, higher asset attractiveness, greater fundraising flexibility.

3. Capital Raising from International Investors

White-label platforms integrate global KYC/AML modules, which enable investors from multiple countries to onboard digitally and participate in tokenized offerings that comply with local rules.

Business outcome: Geographic capital restrictions are minimized. More capital sources become available.

4. Streamlining Ownership Transfers

The White Label tokenization platform works according to the terms and conditions mentioned in the smart contracts. These contracts manage investor wallets, ownership proof, and transaction history. No notary or paperwork is required.

Business outcome: Lower administrative cost, zero reconciliation errors, and fully auditable asset records.

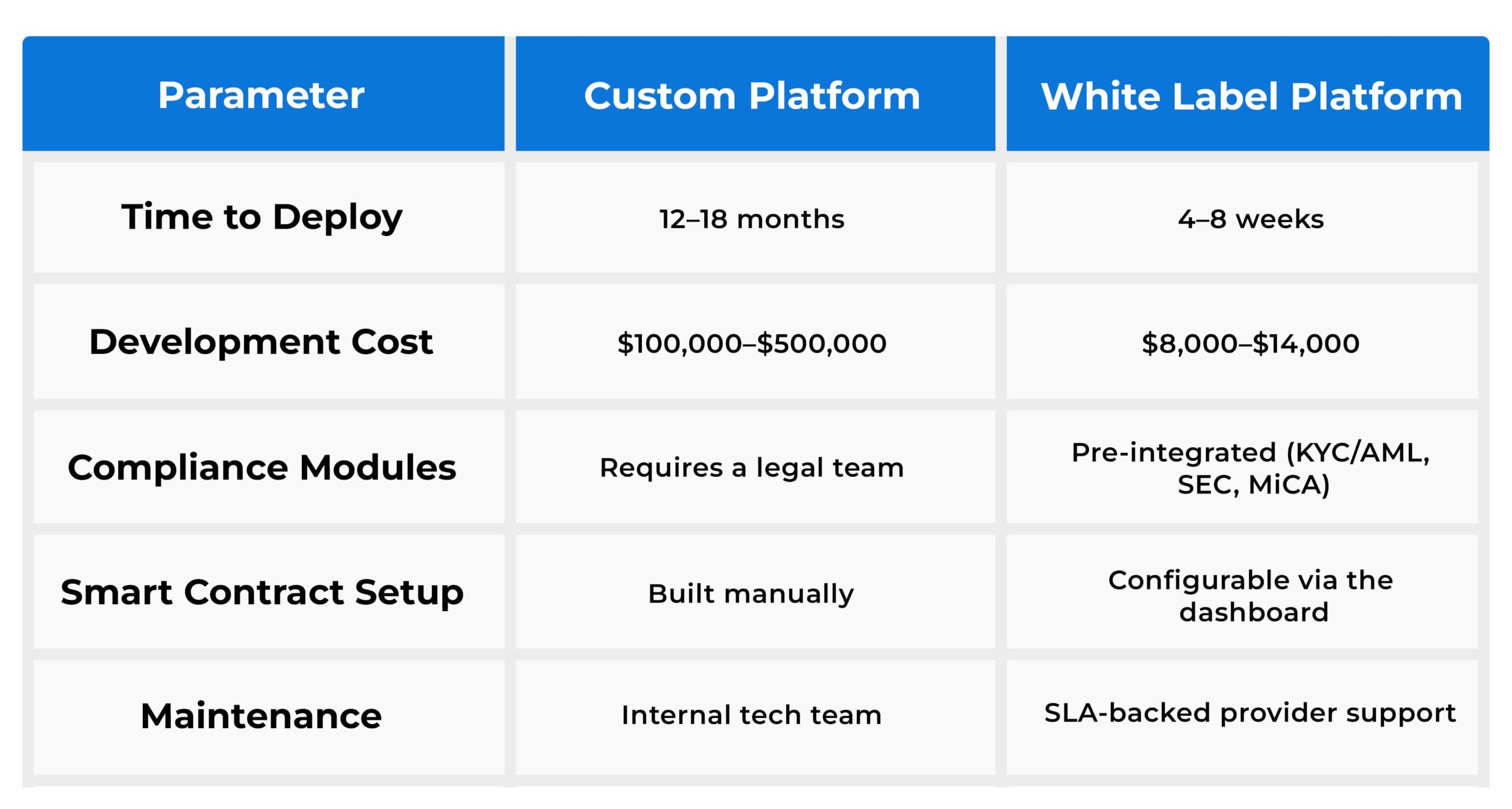

Real Cost & Time Benefits for Real Estate Firms

It is expensive and time-intensive to build an in-house tokenization solution. White-label alternatives deliver the same functionality with fewer risks and clearer ROI. This results in reduced capital spend, faster go-to-market, and lower tech dependency. Here is how a white-label tokenization solution can help real estate firms save big:

Security & Compliance Structure

Real estate tokens are financial instruments. Any enterprise issuing them needs built-in risk controls, legal alignment, and investor protection. White-label tokenization platforms address this through:

- Jurisdictional Compliance Frameworks: The White-Label Platforms include customizable compliance logic for U.S. SEC regulations, EU MiCA, and country-specific investor limits.

- Automated KYC/AML: Investor onboarding is digitized with identity verification, AML checks, and accreditation workflows.

- Smart Contract Audit & Security: Contracts are externally audited and deployed using version-controlled, tested libraries. Assets are held via multi-signature or institutional-grade custody.

- Transaction Reporting & Logs: Every ownership transfer, payout, and wallet action are recorded immutably and available for reporting or regulatory requests.

Core Capabilities Built for Real Estate Enterprises

A White-label tokenization platform typically includes the following modules:

- Real Estate Token Issuance Module: Set up token structure: total supply, valuation, yield distribution logic.

- Investor Dashboard: Users can view holdings, receive payouts, access documents, and trade tokens.

- Admin Dashboard: Enterprises can manage listings, monitor compliance alerts, and perform audits.

- Smart Contract Configuration: Real estate firms can set dividend terms, lock-up periods, and whitelisting rules, all through a GUI.

- Custody & Wallet Integration: Wallet systems include multi-sig cold storage or links to custodians like Fireblocks or BitGo.

White Label Tokenization Platform Development: Architecture Overview

- Blockchain Infrastructure: It supports Ethereum, Polygon, BNB Chain, or permissioned blockchains like Hyperledger. Enterprises can choose any blockchain for White-Label Platform Development based on gas costs and network liquidity.

- Tokenization Logic: Tokenization logic is a term in smart contracts that converts property into tokens with automated ownership and income distribution.

- Custody & Access Control: The Wallet management enforces KYC-only access. Custodians hold tokenized shares according to the investor class.

- Secondary Trading Module: This is an optional module for peer-to-peer trading or integration with regulated security token exchanges.

What Business Value Does the Tokenization Platform Generate?

Real estate enterprises using white-label tokenization services are seeing tangible impact:

- Faster Capital Access: Funds raised within days or weeks, compared to months through institutional channels.

- Lower Legal and Admin Costs: Automation of share issuance, investor onboarding, and compliance tracking reduces payroll dependency.

- Enhanced Transparency: Blockchain-based asset tracking helps in audits, investor updates, and real-time dashboards.

- Global Expansion Without Branches: International capital can be raised without a physical office setup, reducing entry costs to new markets.

How To Choose a White Label Tokenization Platform Development Company?

It is crucial to understand that not all providers offer the same level of reliability, support, or technical clarity. When choosing a technology partner, enterprises should verify:

- Real estate-specific case studies

- Jurisdictional compliance readiness

- Smart contract flexibility

- Custody integrations with licensed providers

- Security certifications (SOC 2, ISO 27001)

- Active support for upgrades and maintenance

A qualified White label Tokenization Platform Development Company must demonstrate operational experience, not just a brochure.

Takeaway

Real estate tokenization is no longer an experiment. It is an operational, regulated, and scalable model adopted by funds, asset managers, and developers globally. White-label platforms remove the tech overhead, lower capital requirements, and reduce time to execution. For enterprises seeking direct investor access, improved liquidity, and lower cost of capital, white-label tokenization platform services can unlock operational advantage.

Want to launch a White-Label Tokenization Platform for your real estate firm? Partner with Antier to deploy a customized solution.