The fintech world is entering an era where speed, security, and trust are no longer optional but essential for survival. Cross-border remittance, once slowed by intermediaries, delays, and complex compliance processes, is now being reshaped by two breakthrough innovations: “Stablecoin Remittance and Decentralized Digital Identity (DID).”

Together, these technologies are redefining how value and identity move across borders, making transactions faster, cheaper, and far more trustworthy. Forward-thinking FinTech’s are already combining remittance with DID to lower operational costs, eliminate fraud, and simplify customer onboarding. The next generation of market leaders will be those who act early, partnering with a stablecoin development company that can merge digital identity and blockchain payments into a secure, compliant, and scalable ecosystem.

Let’s explore:

Why DID-Powered Stablecoin Remittance Is Fintech’s Next Big Edge

The remittance industry is undergoing a silent revolution, one driven by the convergence of DID and stablecoin payment systems. What used to take days and involve multiple intermediaries can now happen in seconds, with identity and compliance baked directly into the transaction layer.

Now imagine this:

A user completes a one-time verification using a DID credential securely stored on-chain. That credential, cryptographically verified and privacy-preserving, becomes their passport for every future transaction. When they send money abroad, the platform instantly authenticates their DID, and the transfer settles via a stablecoin pegged to a fiat currency like USD or EUR.

- No repeated KYC checks.

- No manual compliance approvals.

- No third-party intermediaries.

- No multi-day settlement windows.

This model defines the future of stablecoin remittance platform development, where the identity assurance of DID meets the transaction efficiency of stablecoins to deliver the first truly trust-driven remittance ecosystem. In this new architecture, identity and value move together, verified, compliant, and instant. Every participant in the network, user, sender, receiver, and regulator, can verify transactions without exposing sensitive data. For fintechs, this fusion opens new dimensions of scalability and trust. It allows them to:

- Slash onboarding times by up to 80%, thanks to reusable DID credentials that eliminate repetitive KYC submissions.

- Reduce compliance costs with automated verification and on-chain identity proofs instead of manual audits.

- Build trust with regulators, leveraging transparent, auditable DID trails that meet KYC/AML mandates across jurisdictions.

- Expand globally with programmable, fiat-pegged stablecoins that enable 24/7 cross-border payments with instant settlement.

- Enhance security by removing centralized databases vulnerable to breaches or misuse.

- Deliver a frictionless user experience, where verification, transfer, and settlement feel like a single seamless process.

Leading innovators are already partnering with specialized teams offering stablecoin development services to implement DID frameworks that make remittance faster, safer, and universally compliant. Together, these systems create the backbone for next-generation financial ecosystems, transparent, borderless, and built for global scale.

Let Identity and Stablecoins Power Your Global Payment Growth

The Stack Behind the Future of Payments

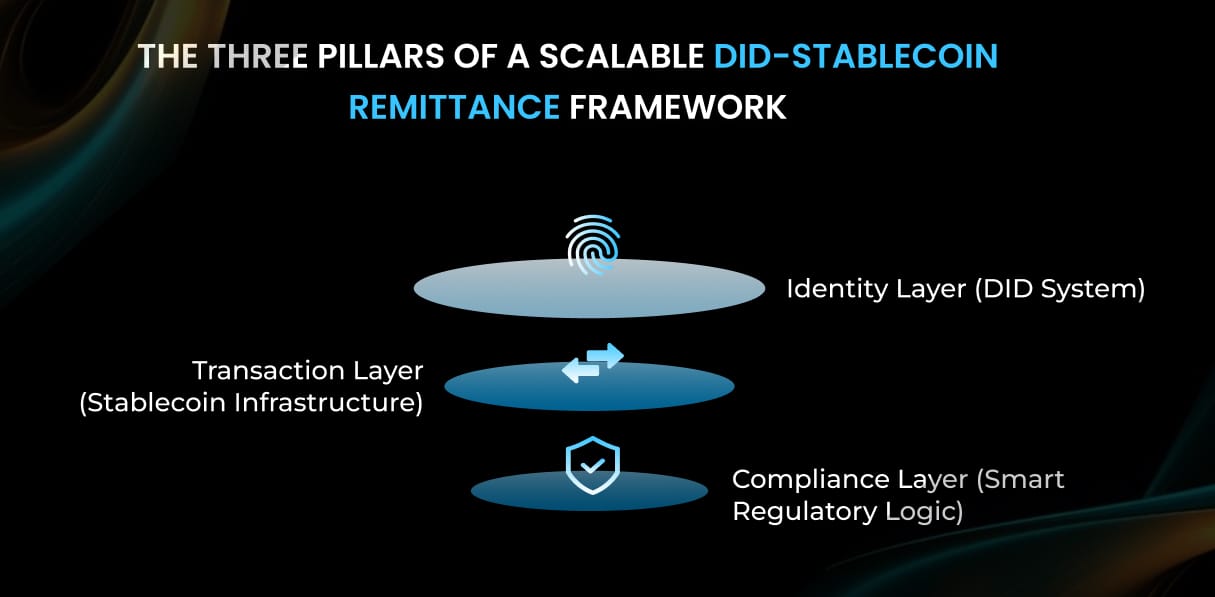

Most successful fintechs build on a three-layer model that keeps every process secure, compliant, and transparent.

- Identity Layer (DID System)

Users control their verified digital credentials and can share them instantly across platforms. Each identity is authenticated through cryptographic proofs, removing repetitive KYC checks and ensuring privacy-preserving verification.

- Transaction Layer (Stablecoin Infrastructure)

This layer manages instant, low-cost cross-border transfers using stablecoins pegged to fiat currencies. It supports automated settlements and continuous liquidity, forming the operational core of a stablecoin payment platform.

- Compliance Layer (Smart Regulatory Logic)

Compliance is built into the system through programmable smart contracts. Real-time KYC and AML validation using DID data ensures that every transaction remains transparent and regulator-friendly.

Together, these layers create a strong foundation for fintechs to launch global, auditable, and scalable remittance platforms. Collaborating with experts in stablecoin development solutions helps align identity, payments, and compliance under one trusted ecosystem, ready for the demands of modern finance.

Who’s Leading the Way?

Global fintech leaders are proving how stablecoins are transforming cross-border payments.

- Circle’s USDC processed over $1 trillion in monthly transactions in November 2024, surpassing $18 trillion in total volume. Between June 2024 and June 2025, on-chain USDC payments reached $6 trillion, with circulation up 78% year-over-year. Overall, stablecoins powered $27.6 trillion in transactions in 2024, exceeding Visa and Mastercard combined, proving that stablecoin payment rails are now mainstream.

- PayPal integrated its PYUSD stablecoin into Xoom, allowing U.S. users to fund remittances with zero transaction fees. Partnerships with Cebuana Lhuillier (Philippines) and Yellow Card (Africa) now deliver 24/7 settlements beyond banking hours.

- Visa extended stablecoin settlement to PYUSD, USDG, and EURC across Ethereum, Solana, Stellar, and Avalanche, creating a multi-chain, low-friction network for global transfers.

The impact is undeniable:

- Settlement speed: Near-instant vs. 2–5 days traditionally.

- Cost: Pennies per transaction vs. $25–$50 for wire transfers.

In emerging markets, stablecoins now deliver stability without bank accounts, while smart contracts automate escrow, revenue sharing, and micropayments. Businesses adopting custom stablecoin development solutions can replicate these gains, achieving faster onboarding, lower fraud, improved liquidity, and up to 90% cost savings compared to legacy systems.

Be the Fintech That Redefines Global Remittance in 2026

Why Partnering with a Stablecoin Development Company Is Non-Negotiable?

Integrating DID with stablecoins is far more than a technical implementation. It is a strategic business transformation that reshapes how organizations manage compliance, trust, and liquidity on a global scale. To execute it successfully, fintechs need partners who combine deep blockchain fluency, regulatory intelligence, and precision-led architecture capable of handling real-world volume and compliance standards.

This is where Antier becomes your competitive advantage.

We specialize in designing stablecoin remittance ecosystems powered by scalable, compliance-grade blockchain frameworks. Our solutions are engineered to meet the needs of modern financial institutions, fast, transparent, and regulator-ready. Our stablecoin development services include:

- Seamless DID integration for instant and verifiable KYC onboarding.

- Token and smart contract development customized for programmable, compliant payments.

- Cross-border liquidity management to support global settlements and minimize volatility.

- End-to-end platform design and deployment with built-in interoperability and security.

If you’re ready to future-proof your fintech business, partner with Antier, the world’s leading stablecoin development company trusted by banks, payment innovators, and blockchain pioneers across the globe. Let’s build your DID-powered stablecoin remittance platform today!

Frequently Asked Questions

01. What are the key innovations reshaping cross-border remittance in fintech?

The key innovations are Stablecoin Remittance and Decentralized Digital Identity (DID), which together enhance transaction speed, security, and trust.

02. How does DID improve the remittance process?

DID allows for one-time verification of user identity, enabling instant authentication for future transactions and eliminating the need for repeated KYC checks and manual compliance approvals.

03. What benefits do fintech companies gain by integrating DID with stablecoin remittance?

Fintech companies can significantly reduce onboarding times and compliance costs, streamline operations, and create a more trustworthy remittance ecosystem.