Tokenization of real-world assets has progressed significantly, no longer at an early stage where there were just experiments or pilots taking place but rather, real-world asset tokenization is now a significant change in how we structure ownership, transferring value and managing assets in global financial markets by 2026. As institutional players, developers and infrastructure providers continue to mature their strategies surrounding tokenization of assets, the key question has changed from whether to tokenize to how to do it sustainably.

The maturing infrastructure surrounding Real World Asset (RWA) tokenization has required organizations that once explored building bespoke blockchains to re-evaluate their long-term viability. In the current environment, custom protocols are falling out of favors and viewed as having introduced complexity, operational challenges, regulatory uncertainty and increased maintenance costs whereas they were previously viewed as providing innovation and flexibility. This has led to a fundamental reassessment of why build on RWA tokenization platforms instead of creating isolated systems.

The success of tokenization in 2026 can be attributed to scalable blockchain infrastructure for RWA’s institutional trust, and the ability of developers to efficiently build applications. The only path for production-grade asset tokenization that aligns with real capital, real regulatory environment and actual market demand is to use purpose-built platforms.

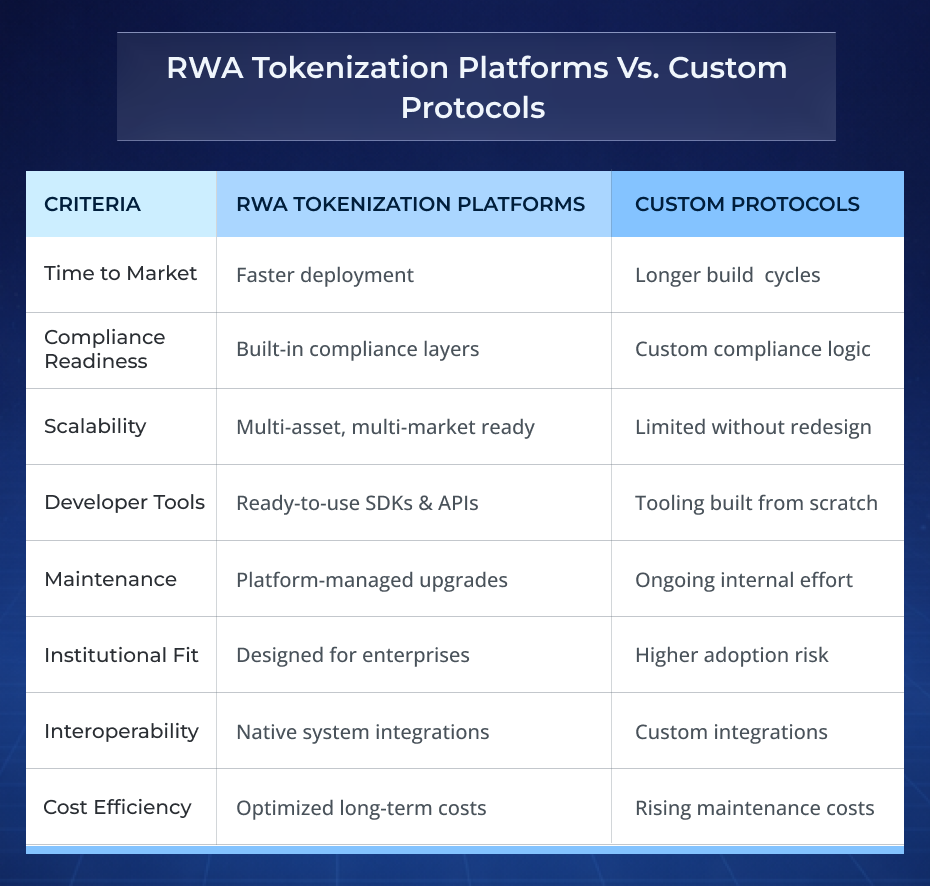

RWA Tokenization Platforms vs. Custom Protocols: What’s the Real Difference?

At a functional level, both approaches enable real-world asset tokenization, but their long-term implications differ significantly. The distinction lies not in token creation itself, but in how assets are governed, scaled, and maintained over time.

Why Build on RWA Tokenization Platforms for Institutional-Grade Asset Issuance?

Institutional adoption fundamentally reshapes infrastructure requirements. When assets move from pilot programs into live markets, institutions demand assurances that extend far beyond basic token issuance. Institutional use cases for RWA platforms reflects these elevated expectations.

Compliance-by-Design Architecture

Regulatory compliance for institutional issuers needs to be enforced in real-time, without any retrofitting after-the-fact. RWA Tokenization Platforms include KYC, AML, investor eligibility, and other regulatory compliance rules enforced through smart contracts, which reduces both risk and ensures that regulatory compliance is consistently executed throughout the entire lifecycle of an asset.

Governance and Permissioned Access

Unlike the public, open nature of DeFi (Decentralized Finance), institutional participants require highly restrictive role-based access controls on their platforms. Therefore, RWA Tokenization Platforms have built in administrative actions, controlled issuance, and approval workflows within their governance capabilities, which are difficult to replicate anywhere else without extensive development on custom protocols.

Lifecycle Management and Corporate Actions.

Institutional assets require dividend distribution, interest payments, redemptions, and corporate actions. Tokenization platform development integrates these processes into automated workflows, ensuring accuracy and auditability at scale.

Reporting and Transparency

Regulators and investors expect clear reporting. Platforms generate immutable audit trails, real-time dashboards, and compliance-ready reports—critical components of blockchain infrastructure for RWA in regulated environments.

Together, these capabilities explain why build on RWA tokenization platforms has become the preferred approach for banks, funds, and asset managers seeking institutional-grade issuance.

Launch Scalable RWA Tokenization Platforms

How Developer Tools for Asset Tokenization Enable Faster Innovation

While institutions focus on governance and risk, developers prioritize efficiency and adaptability. In 2026, developer experience has become a decisive adoption factor, making developer tools for asset tokenization a central value proposition.

1. Standardized Smart Contract Modules

Platforms provide pre-audited templates for asset issuance, transfers, and settlements. Developers avoid repetitive coding while maintaining flexibility for customization—accelerating real-world asset tokenization initiatives.

2. APIs and SDKs for Seamless Integration

Modern RWA tokenization platforms expose APIs that connect blockchain layers with traditional systems such as CRMs, ERPs, custody providers, and payment rails. This interoperability is essential for enterprise adoption.

3. Upgradeability and Modular Design

Unlike rigid custom protocols, platforms support upgradeable components. Developers can introduce new compliance rules, asset types, or features without disrupting existing assets—an essential requirement for tokenization platform development in dynamic regulatory environments.

4. Testing, Monitoring, and Analytics

Sandbox environments and monitoring tools reduce deployment risk. These developer tools for asset tokenization allow teams to iterate faster while maintaining production-grade reliability.

By reducing infrastructure overhead, platforms allow developers to focus on product innovation rather than maintenance—reinforcing why build on RWA tokenization platforms in 2026.

How Blockchain Infrastructure for RWA Supports Scalable Tokenization

Scalability in asset tokenization extends beyond transaction throughput. True scalability encompasses compliance, interoperability, governance, and operational resilience. Blockchain infrastructure for RWA must support growth across markets and asset classes without repeated redesign.

1. End-to-End Support Through the Asset Lifecycle

The platforms support issuance, compliance review, secondary transfer (where applicable) and redemption through an integrated lifecycle automation framework. It is critical for the success of scaling initiatives for real-world asset tokenization.

2. Interoperability with Financial Ecosystems

Custodians, settlement systems and identity providers are fundamental institutions within the financial ecosystem, and WA tokenization platforms can integrate seamlessly with these ecosystems, enabling continuity between the traditional financial market and the on-chain market.

3. Jurisdictional Flexibility

As regulations vary across regions, platforms enable jurisdiction-specific compliance modules. This adaptability is a defining advantage of platform-based tokenization platform development.

4. Security & Operational Resilience

Centralized updates, repeated audits and ongoing monitoring reduce systemic risk; on the contrary, custom protocols generally expose issuers to disjointed security practices.

These capabilities enable Blockchain-based infrastructure for RWA to be adequately robust enough to scale as adoption grows, thereby enhancing long term viability of platforms.

These infrastructure capabilities ensure blockchain infrastructure for RWA remains robust as adoption scales, reinforcing platforms as long-term solutions.

Why Real-World Asset Tokenization Is Moving Toward Platform Models

As we have seen with cloud computing and enterprise software, there is a clear trend toward using platform-based approaches for real-world asset tokenization (RWA). Financial institutions have historically built their core systems independently of each other; however, this will not be the case moving forward because of the availability of standardized security and redundant systems.

Platforms consolidate compliance, governance, and developer enablement into a single operational layer. This convergence reduces friction, accelerates adoption, and lowers risk for institutional use cases for RWA platforms.

As the market for RWAs continues to mature and evolve, platform-based approaches for transferring value will become the dominant method for moving value on-chain. Although there are still some areas where custom protocols could provide useful solutions, production-ready RWA tokenization will be founded on scalable, compliant RWA tokenization platforms.

Develop RWA Tokenization Solutions Faster

Antier as a Strategic Partner for Institutional RWA Tokenization

With a strong foundation in blockchain infrastructure for RWA, Antier enables asset issuers, financial institutions, and enterprises to tokenize real-world assets across real estate, funds, commodities, private equity, and structured financial products. Its approach to tokenization platform development emphasizes compliance-by-design, modular architecture, and robust developer tools for asset tokenization, ensuring faster time-to-market without compromising governance or regulatory alignment.

By combining institutional-grade security, lifecycle automation, and interoperability with existing financial systems, Antier empowers organizations to move beyond custom protocols and build sustainable, production-ready real-world asset tokenization ecosystems. For institutions seeking to operationalize tokenization with confidence in 2026 and beyond, Antier stands as a strategic partner delivering the infrastructure, expertise, and execution required to scale RWA initiatives globally.