Market entry for crypto products now demands more than core custody. Businesses expect systems that manage liquidity, enforce compliance, mitigate fraud, and enable monetization, all with enterprise SLAs. Antier’s AI white label cryptocurrency wallets were engineered for these demands. They combine production-grade custody options, cryptographic key management, and explainable AI to detect anomalous intent, optimize on-chain execution, and automate compliance hooks. The platform is delivered as modular, API-first components that integrate with payment rails, KYC providers, and custodians. For enterprise teams and investors, Antier’s value is measurable: shorter time to pilot, auditable automation that reduces operational cost, and productized features that turn wallets into revenue engines. This article explains market signals, Antier’s technical differentiators, a rigorous feature comparison, typical cost profiles, and a practical deployment roadmap.

Market Dynamics: Why Is AI Mandatory Now?

- Fraud and automated attack tooling are increasing; enterprises must adopt machine learning for detection and response.

- Regulatory regimes such as the EU’s MiCA and tightened AML rules require audit-ready telemetry, provenance, and controls in wallet stacks. Enterprise wallets must expose compliance hooks and immutable audit trails.

- Institutional demand favors composable, white-label blockchain wallet platforms that ship with SDKs, REST/gRPC APIs, observability, and configurable policy engines rather than consumer-first standalone apps.

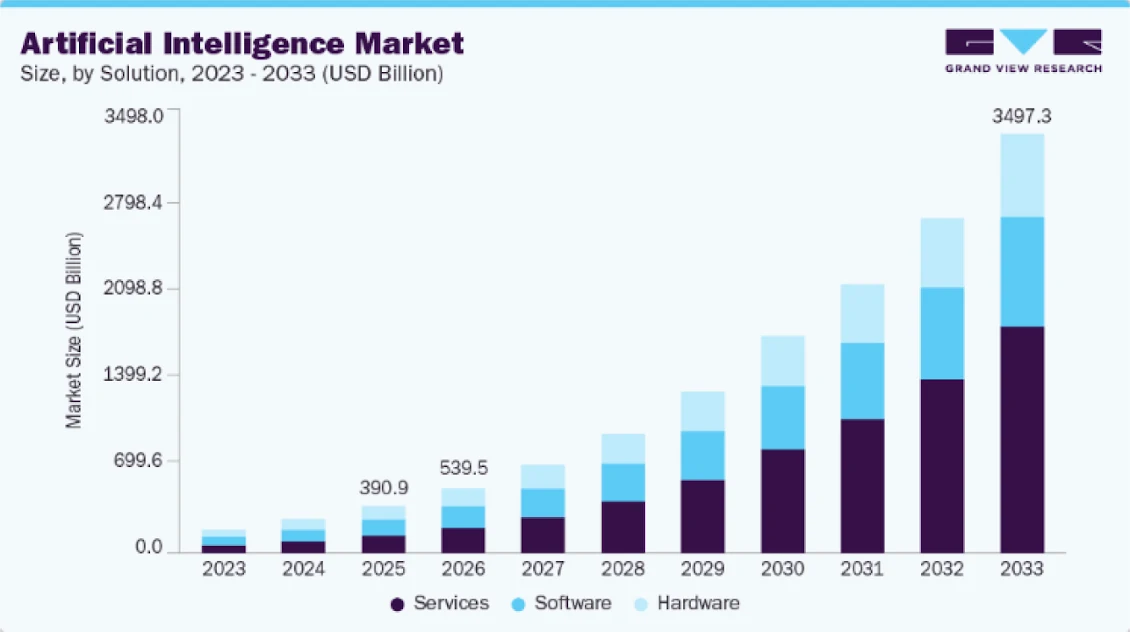

- The global artificial intelligence market size was valued at USD 390.91 billion in 2025 and is projected to reach USD 3,497.26 billion by 2033, expanding at a CAGR of 30.6% from 2026 to 2033. The continuous research and innovation directed by tech giants are driving the adoption of advanced technologies in industry verticals, such as automotive, healthcare, retail, finance, and manufacturing.

Insight: prioritize vendors that publish integration adapters for custody, PSPs, exchanges, and KYC providers. This reduces engineering risk and shortens procurement cycles.

Launch The Most Secure AI-Smart Crypto Wallet With Antier’s Team

Antier’s Technical Differentiators

Antier’s customized crypto wallet development solutions are architected for enterprise-grade deployments and operational observability. Key components and capabilities:

- Key management : choices for MPC (threshold signatures) and HSM-backed custody, pluggable per-client policy. MPC reduces single-point-of-failure risk while supporting high availability and transaction throughput.

- Explainable AI layer : model outputs are logged and surfaced with feature-level explanations for compliance reviews and SLA reports. This supports auditability and regulator engagement.

- Transaction simulation engine : pre-execution analysis that checks contract risk, abnormal parameter patterns, and known exploit signatures. Users and compliance teams receive deterministic risk scores.

- Adaptive authentication : behavioral biometrics and contextual risk scoring to reduce false positives and support secure account recovery.

- Integration fabric : REST/gRPC APIs, webhooks, SDKs for mobile/web, and prebuilt connectors for custodians, payment rails, and exchanges.

- Observability and SRE tooling : distributed tracing, model performance dashboards, and retraining pipelines with human-in-the-loop controls.

Decision point : demand the ability to toggle AI policies and to capture raw telemetry for independent audits.

Feature Comparison: AI White-Label Web3 Wallets Vs. Other Providers

| Capability | Antier AI White-Label Wallet | Hardware-First Wallets | Consumer DeFi Wallets | SDK-Only Providers |

|---|---|---|---|---|

| Key Management | MPC / HSM, policy-driven custody | Air-gapped hardware keys | Single-device seed keys | Cloud KMS or custom MPC |

| AI Risk Intelligence | Pre-execution simulation, explainable ML | None | Basic heuristics | Limited or external |

| Compliance Readiness | Audit logs, MiCA / AML hooks | Partial, infra-level only | Minimal | Custom |

| Enterprise Integration | REST / gRPC APIs, PSP & custody adapters | Restricted, vendor-locked | DeFi-native only | API-rich, unopinionated |

| Time to Deploy | White-label rollout in weeks | Long hardware cycles | Fast retail launch | Fast MVP, slow compliance |

| Best Suited For | Regulated banks, fintechs, exchanges | Vault custody use cases | Retail DeFi users | Dev-led startups |

Core Security Features of Antier’s AI White-Label Crypto Wallet

- End-to-end encryption for data in transit and at rest

- Policy-driven key lifecycle management

- Role-based access control with least-privilege enforcement

- Multi-factor authentication for users and administrators

- Secure API gateway with tokenization and rate limiting

- Immutable audit logs with compliance-ready exports

- Network isolation and infrastructure segmentation

- Secure CI/CD pipelines with automated security checks

- Continuous vulnerability scanning and patch management

- Data privacy controls with configurable residency and consent

These core security controls form the foundation of Antier’s wallet architecture. Being the leading cryptocurrency wallet development company, our certified teams ensure that every deployment meets enterprise expectations for confidentiality, integrity, and availability without introducing operational friction. Built as defaults rather than add-ons, these features allow businesses to launch and scale with confidence while remaining audit-ready across jurisdictions.

Cost profiles: What Enterprises Should Budget For An AI-Smart Crypto Wallet?

Benchmarks vary by scope, integration, and assurance requirements. Recent vendor analyses and market surveys show wide ranges, which reflect different assumptions. Typical phases and indicative ranges:

- Phase 1 : White-label core (custody, basic UX, API): from low five figures to mid five figures.

- Phase 2 : Multi-chain, MPC/HSM, compliance automation, basic AI modules (transaction scoring, recovery): mid-five figures to low-six figures.

- Phase 3 : Enterprise SLA, custom integrations (bank rails, custodians, fiat on/off ramps), advanced AI, audits and certification: mid- to high-six figures and above.

Recommendation : use a staged procurement model; start with a white-label core to validate product-market fit, then license advanced AI modules and custody adapters.

Checklist for AI Smart Crypto Wallet Service Provider Evaluation

Before investing in any product or hiring a partner, you must ask the crypto wallet development companies for the following deliverables prior to procurement:

- Architecture diagrams showing custody, AI decisioning, and telemetry flows.

- Sample policy configurations and how to change them.

- Model explanations and test reports for the risk-scoring models.

- SLA statements for uptime, latency, and incident response.

- Third-party security audit and a recent penetration test report.

Conclusion: Why Hiring An Experienced Partner is Important?

Antier’s AI white-label crypto wallets are engineered with security as a design principle, not a retrofit. Our teams bring together deep expertise across blockchain engineering, applied cryptography, AI systems, crypto payments, stablecoins, and regulatory compliance to deliver wallets that are resilient, scalable, and production-ready. From secure development practices to layered defense architectures, every component is built to withstand real-world threats while supporting business growth. We outperform other providers by delivering applications that implement best-in-class security practices alongside advanced security features at the same time, ensuring enterprises never have to choose between innovation, compliance, and protection.

Connect with our 24/7 available experts to discuss your vision.

Frequently Asked Questions

01. What are the key features of Antier's AI white label cryptocurrency wallets?

Antier's AI white label cryptocurrency wallets include production-grade custody options, cryptographic key management, explainable AI for detecting anomalous intent, optimized on-chain execution, and automated compliance hooks.

02. Why is AI considered mandatory for crypto market entry now?

AI is essential due to increasing fraud and automated attacks, as well as the need for compliance with regulatory regimes that require audit-ready telemetry and controls in wallet stacks.

03. How does Antier's platform benefit enterprise teams and investors?

Antier's platform offers measurable value through shorter time to pilot, auditable automation that reduces operational costs, and productized features that transform wallets into revenue engines.