What is Hyperliquid and Why Does It Matter in 2025?

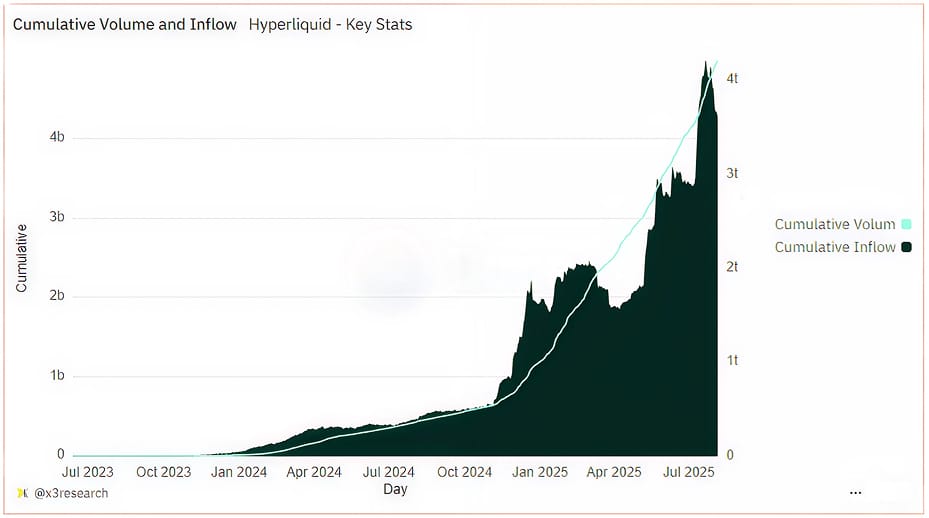

Hyperliquid is a leading decentralized perpetual futures exchange that offers on-chain, non-custodial trading with near-instant, CEX-like transaction execution. It supports USDT perpetual futures contracts and operates on a custom-built Layer 1 chain purposefully designed for high-frequency derivatives trading. In July 2025, the perpetual DEX (dominating the market with over 75% market share) closed its best month ever with $320M cumulative trading volumes and a whopping 47% month-on-month growth.

Source: https://dune.com/x3research/hyperliquid

Hyperliquid also drove 35% of blockchain revenue in July, capturing a major share of high-net-worth users from Solana.

“Hyperliquid was able to capture much of Solana’s momentum, and likely Solana’s market capitalization, because it offers a simple, highly functional product.”

– VanEck’s head of digital assets research

But behind the rapid growth and headline numbers lies a more important question: what exactly makes Hyperliquid work? This blog breaks down the core mechanics, architecture, and trading model powering Hyperliquid’s rise.

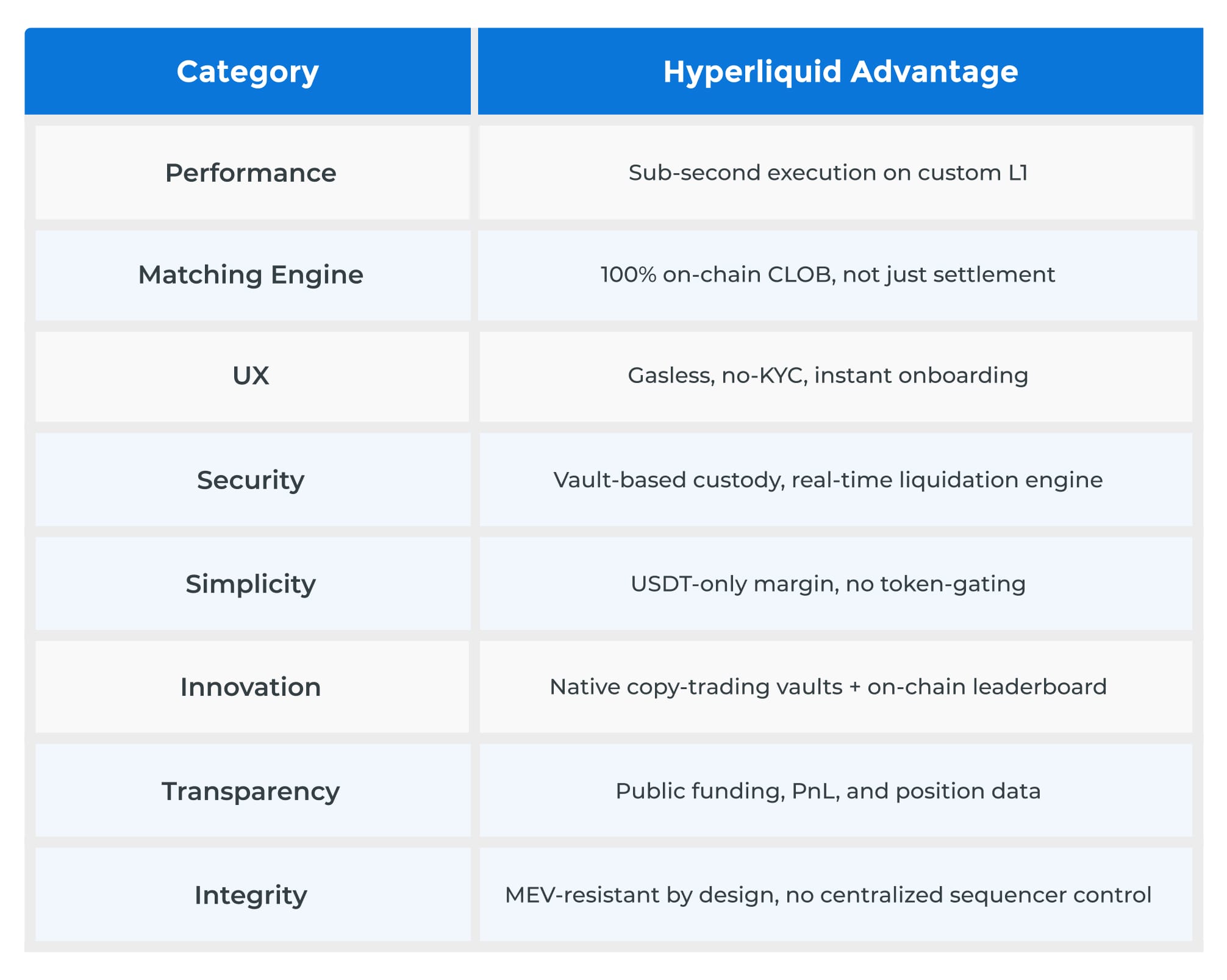

Core Features of Hyperliquid Perpetual Exchange

- Custom Layer 1 Blockchain

What does Hyperliquid’s Custom L1 mean?

The USDT perpetual futures DEX is not dependent on Ethereum, Cosmos, or a rollup. It runs on its custom blockchain, designed specifically for high-speed, high-frequency trading.

Why that matters:

- It doesn’t share space with NFTs, memecoins, or spammy DeFi apps.

- It doesn’t slow down when Ethereum is congested.

- All the resources focus on one thing: processing trades instantly and reliably.

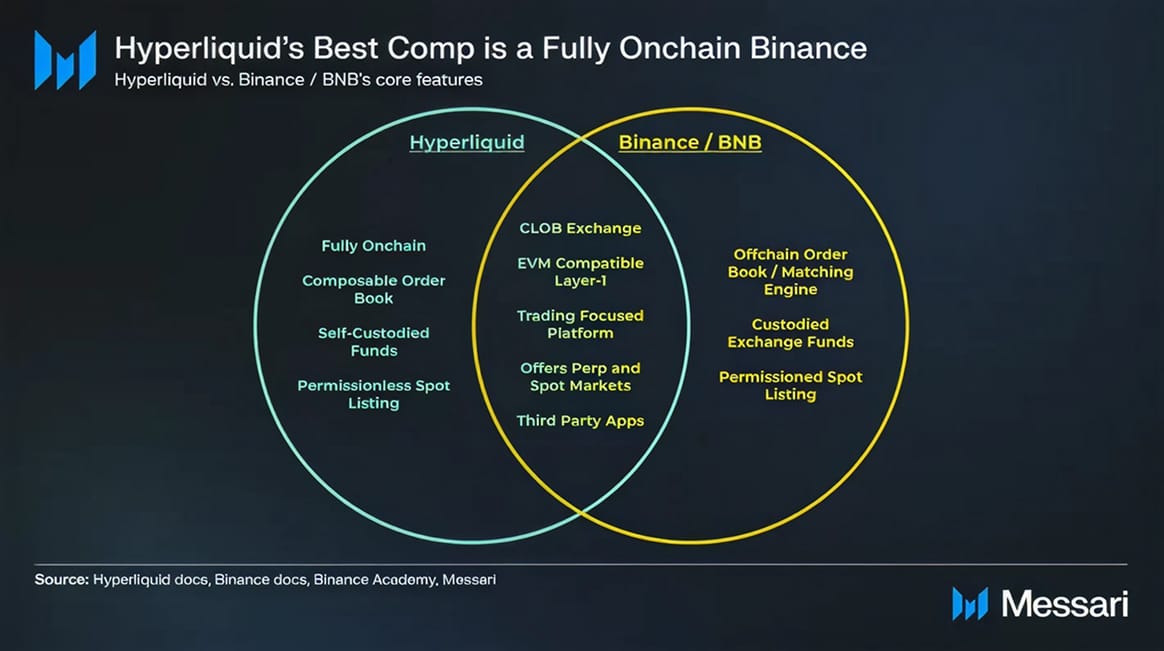

- On-Chain Orderbook (CLOB)

What it means:

Hyperliquid perpetual exchange utilizes a traditional order book model, similar to Binance or Coinbase, where buyers and sellers place limit or market orders.

Why that matters:

Most DEXs utilize AMMs, which are pools of funds that automatically match trades using predefined formulas, while others simulate decentralization by employing off-chain matching. That leads to:

- Compromised decentralization

- Slippage (traders get a worse price than expected)

- Front-running (bots jump ahead of legit users’ trades)

- Price inefficiency

With Hyperliquid’s CLOB maintained and updated on-chain:

- Traders see every bid and ask in real-time.

- Traders can place exact orders at exact prices.

- Traders know where your trade stands in the queue.

This makes the decentralized perpetual exchange ideal for pro traders or even retail ones.

- USDT-Only Collateral Model

What it means:

On Hyperliquid, all perpetual futures trades use USDT as the only collateral. You can’t deposit or trade using ETH, BTC, or other tokens. All trades are margined and settled in USDT.

Why USDT perpetual futures trading matters:

Most other perps DEXs support multi-collateral, meaning you can use ETH, ARB, OP, or other tokens as margin. That might sound flexible, but it creates major problems, such as:

- Price volatility: If traders’ margin is in ETH and the ETH price tanks, their position might get liquidated, even if the trade is in BTC.

- Harder Risk management: Traders need to track not just their trades, but also the price of their collateral, exposing them to greater risks.

- Complex margin calculations: Perpetual futures trading platforms must track multiple price feeds, which increases the likelihood of bugs or manipulation.

- More room for user error: Traders might accidentally overleverage without realizing that their collateral is dropping in value.

By using only USDT-only collateral design, Hyperliquid perpetual exchange offers:

- Stability: Traders’ margin doesn’t fluctuate. What they see is what they get, as USDT is quite stable.

- Simplicity: Traders need not manage multiple assets or convert tokens.

- Cleaner liquidations: Liquidation logic is straightforward and transparent, making the processes on USDT perpetual futures DEX simple and foolproof.

- Accurate PnL calculations: Since all PnL is settled in USDT, there’s no confusion about unrealized gains or losses across assets.

- No token risk: Traders are not exposed to the volatility of random altcoins just because they were used as collateral.

- No Gas Fees

What it means:

Users don’t pay blockchain transaction fees when they place, cancel, or fill orders. Hyperliquid perpetual futures, therefore, solves the biggest problem for traders.

Why that matters:

On most DEXs (like GMX or dYdX), every action costs a bit of ETH or another token, whether it be:

- Placing an order

- Cancelling an order

- The order fails due to slippage or delay

Every time traders need to pay for gas.

With Hyperliquid perpetual exchange, traders trade without worrying about topping up ETH or hidden fees. With USDT in their wallets, they’re good to go. Also, costs are abstracted at the protocol level via network optimizations. This also makes Hyperliquid compete directly with the CEXs, eating major market share, as no wallet pop-ups, failed transactions, or surprise fees disrupt the user experience.

Inspired enough? Here’s your Hyperliquid-inspired perpetual futures DEX development guide

- Non-Custodial Smart Vaults

What it means:

Assets stay in their owners’ full control. Hyperliquid perpetual exchange doesn’t hold traders’ funds like a centralized exchange.

Why that matters:

- No risk of a FTX-style blowup.

- User funds are stored in isolated, non-custodial vaults, not pooled contracts.

- Traders don’t need to “trust” the platform with their deposits.

- Real-time margin enforcement and PnL tracking, everything happens on-chain.

- Traders can withdraw at any time, with no third party blocking them.

Even though the Hyperliquid perpetual futures trading platform feels like a CEX in terms of speed and user experience, everything else remains in traders’ control, like in a true DEX.

- Sub-Second Execution Speed

What it means:

Trades are processed and finalized in under one second, not 10 or 30 seconds like other USDT perpetual futures DEXs.

Why that matters:

On Ethereum or Arbitrum:

- Traders might place a trade and wait and wait for a long time.

- Prices may also fluctuate while an order is stuck in “pending” status.

- Sometimes the trade fails, and traders still pay gas.

On Hyperliquid Perpetual Futures DEX, once traders click “buy” or “sell,” their order is matched and executed immediately without any

- Confirmation delay

- Mempool limbo

Optimized mempool design avoids Ethereum-style congestion. Traders get the price they clicked, just like on a centralized exchange. No frontrunning, MEV, or failed orders occur, making the USDT perpetual futures trading platform suitable for high-frequency traders.

Also Read>>> Essential Components of a Perpetual Futures DEX

- Isolated and Cross Margining and Transparent Funding Rates

What it means:

Traders have the freedom to choose between:

- Isolated margin: Risk is limited to just that one position.

- Cross margin: All the traders’ funds act as shared collateral across positions.

Also, funding rates are public, predictable, and enforced at fixed intervals through smart contracts. They are calculated based on the mark price, not the last traded price.

Why that matters:

- Pro traders get flexibility in managing risk.

- Beginners can avoid blowing up their entire account due to one bad trade.

- Most DEXs don’t give you this choice but Hyperliquid perpetual exchange does.

- Funding rates transparency prevents manipulation and keeps long-short balance healthy.

- Automated On-Chain Liquidations

What it means:

Along with the CEX-grade risk controls, Hyperliquid perpetual futures trading platform brings automated on-chain liquidations. This means when a position becomes undercollateralized (i.e., the trader can’t cover their losses), Hyperliquid automatically closes that position, and this process happens entirely on-chain, transparently, without any centralized intervention.

Why On-Chain Liquidations Matter:

Most decentralized perpetual exchange platforms still do one of the following:

- Rely on off-chain liquidation bots (often run by the team or insiders)

- Depend on a centralized sequencer to approve the liquidation

- Use opaque liquidation logic you can’t independently verify

That means:

- There can be delays in liquidation, leading to bigger losses or bad debt

- There’s room for front-running or insider liquidations

- Traders don’t always know how or when they were liquidated

Hyperliquid perpetual exchange runs liquidations entirely through on-chain logic, baked into its consensus layer.

That gives you:

- Deterministic liquidations: Everyone can verify exactly when and why a liquidation happened.

- Auditable history: Every liquidation is on-chain, so traders can trace it anytime.

- No middlemen or bots needed: The system handles it without needing third-party actors.

- Faster and fairer: Positions are liquidated as soon as they hit the threshold, reducing risk to the USDT perpetual futures DEX protocol and other traders.

- Fast Withdrawals Without Bridges

What it means:

Traders don’t need to move funds from Ethereum or any other chain to start trading on Hyperliquid. That means no use of third-party “bridges” that usually transfer tokens between blockchains.

Why does Hyperliquid Perpetual Exchange’s Bridgeless Model Matter?

- Bridging can take hours.

- It’s risky, as bridges have been hacked for billions.

- If the bridge fails, traders’ funds can get stuck or lost.

- Traders also have to sign multiple transactions, switch networks, and sometimes even manually claim tokens.

Hyperliquid perpetual futures exchange avoids all that mess by:

- Letting traders deposit USDT directly into its chain using their official gateway.

- No cross-chain steps, no switching RPCs, no need to use MetaMask in advanced mode.

Traders just:

- Connect their wallet

- Deposit USDT from Ethereum (or other supported networks)

- Start trading instantly

All the heavy lifting happens in the background. Traders don’t have to touch a bridge or worry about smart contract risk.

- Built-In Analytics and Trading Tools

What it means:

Hyperliquid perpetual exchange offers built-in and on-chain:

- Portfolio tracking

- Leaderboards that allow users to view the best-performing traders and vaults.

- Copy trading through smart contract vaults that allow traders to mirror top performers.

- Historical PnL charts, volume, win rate, and everything else is recorded and queryable.

Why that matters:

Traders don’t need third-party tools or spreadsheets to track trades or PnL. Everything is integrated into the USDT perpetual futures DEX like a pro trading terminal.

- Built-In Matching Engine (No Sequencer Extraction or MEV Risk)

What it means:

Orders are matched directly by the blockchain itself. There’s no outside service that decides in what order the trade gets processed.

Why that matters:

Many rollup-based perpetual futures trading platforms (like dYdX v4 or ZK-based DEXs) rely on something called a sequencer, which is a central service that bundles transactions.

That introduces problems:

- The sequencer can reorder transactions to favor itself or others.

- It becomes a point of failure, as if it goes offline, the exchange stops working.

- Traders’ transactions might get front-run or delayed unfairly.

Hyperliquid perpetual exchange doesn’t use any third-party sequencer. The blockchain itself handles order flow, and its matching engine is designed to be MEV-resistant by default. This means every trader gets a fair, MEV-free, transparent experience. This feature makes it highly recommended for institutional and algorithmic traders.

Also Read>>> MEV-Protection & Gasless Swaps: DEX development Essentials For 2025

- No KYC or Signup Required

Hyperliquid perpetual futures exchange doesn’t ask for KYC. No ID uploads, no selfies, no email verification is required, as traders’ wallet is their identity in all web3 interactions on the perpetual futures trading protocol. Traders just connect and trade.

Why it matters:

Most perpetual futures DEXs, even some claiming to be decentralized, still require KYC or restrict users based on location. This leads to:

- Delays in onboarding

- Privacy risks from storing personal data

- Barriers for users in restricted jurisdictions

- Possibility of frozen or blocked accounts

Hyperliquid perpetual exchange skips all of that as it offers:

- Instant access: no approval process

- Global availability: anyone with a wallet can use it

- No stored personal data: nothing to leak or censor

Last but not least, there’s no V1 Stagnation

Many perp DEXs stall after launch. Hyperliquid perpetual futures trading protocol continues to evolve. UI, vaults, API, and contract upgrades are frequent and well-documented. This represents strong responsiveness to community and trader needs.

FAQs For Entrepreneurs Planning A Hyperliquid-Inspired USDT Perpetual Futures DEX Development

1. Do I need a custom L1 for Hyperliquid-like Perpetual Futures DEX Development?

Only if you want low-latency, on-chain order matching and liquidations. Otherwise, a fast L2 or appchain might work.

2. What’s Better For Decentralized Perpetual Exchange Development: Orderbook or AMM model?

Orderbooks = better UX, harder to build.

AMMs = easier to launch, worse for pro traders.

3. How do I handle price oracles like Pyth?

You can use a hybrid model: off-chain feeds + on-chain anchoring.

4. Should my decentralized perpetual exchange support multiple collateral types?

Learn from Hyperliquid. And if not, you can start with one (e.g., USDT). It simplifies risk and liquidation logic.

5. What’s the hardest part of building a perp DEX?

Achieving speed, security, and decentralization simultaneously. But you can count on a reliable decentralized perpetual exchange development company for that.

Want to Build a USDT Perpetual Futures DEX Like Hyperliquid?

Antier helps Web3 businesses launch high-performance, custom perpetual futures trading platforms with scalable architecture and centralized exchange-grade UI. We’ve built more than 150 exchanges for our clients. Count on us for:

- White-label solutions

- Custom perpetual logic

- Audited smart contracts

- Trading engine integration

And everything else..

Share your requirements today!

Frequently Asked Questions

01. What is Hyperliquid?

Hyperliquid is a decentralized perpetual futures exchange that offers on-chain, non-custodial trading with fast transaction execution, specifically designed for high-frequency derivatives trading.

02. How does Hyperliquid's custom Layer 1 blockchain benefit traders?

Hyperliquid's custom Layer 1 blockchain allows for high-speed trading without interference from NFTs or congested networks, ensuring reliable and instant trade processing.

03. What is the significance of Hyperliquid's on-chain order book?

Hyperliquid's on-chain order book provides real-time visibility of bids and asks, allowing traders to place precise orders and reducing issues like slippage and front-running commonly found in other decentralized exchanges.