LATAM’s population has exceeded 650 million and this region has the world’s highest income inequality, fueling social unrest and economic instability. High inflation, currency volatility, limited banking access, and costly cross-border transactions are common pain points, particularly in countries like Argentina, Venezuela, Brazil, and Mexico. These issues have created fertile ground for cryptocurrency adoption, especially through crypto wallets, which offer decentralized, mobile-first solutions. LATAM’s crypto market has grown exponentially, with transaction volumes reaching billions in the first half of the year alone, driven largely by stablecoins that account for over 90% of exchange activity. This adoption isn’t speculative; it’s practical, addressing real-world financial gaps where traditional systems fall short.

Latin America Crypto Wallet Market Highlights

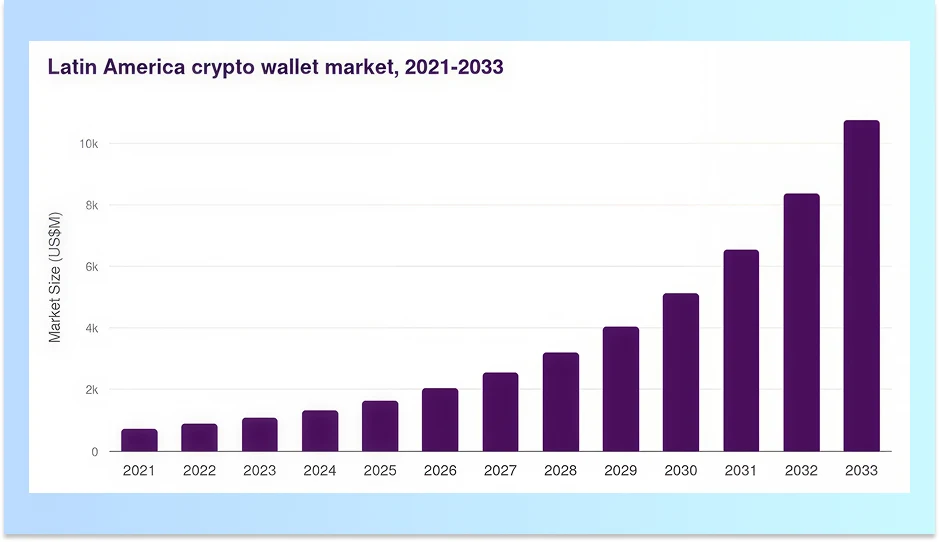

- The Latin America crypto wallet market recorded revenues of USD 1,326.8 million in 2024.

- The market is projected to expand at a robust CAGR of 26.5% between 2025 and 2033.

- Among wallet types, hot wallets emerged as the top revenue-generating segment in 2024.

- Hot wallets are also anticipated to be the fastest-growing segment throughout the forecast period.

- On a country level, Brazil is set to register the highest CAGR from 2025 to 2033.

Source links: https://www.grandviewresearch.com/horizon/outlook/crypto-wallet-market/latin-america

Top 2025 Trends in Crypto Adoption in LATAM

LATAM’s crypto ecosystem is maturing rapidly, with a global ownership rate of 12.4% but higher regional averages. The more the cryptocurrency adoption rate the more the crypto wallet development and demand increases as it is the only tool that helps one store, manage and trade assets. Key trends include:

- Stablecoin Dominance : Over 90% of 2025 exchange volumes are USDT/USDC, up from prior years, as they serve as “digital dollars” for stability. Local pegs (BRL, MXN) are surging, reflecting hybrid fiat-crypto models.

- Market Growth Projections : The crypto market hit $162B in 2024, projected to reach $442B by 2033 at a 10.5% CAGR. Brazil drives 77% of activity (up from 17% in 2020), followed by Argentina/Colombia.

- Regulatory Evolution : Countries like Brazil and Argentina are advancing frameworks, balancing innovation with protection. El Salvador’s Chivo wallet (commission-free, interoperable) set a precedent.

- Demographic Shifts : Adoption grew 18.3% in 2025, skewed toward younger users (e.g., 25-34 age group leading). Women and low-income groups are increasingly involved via mobile wallets.

- Integration with Traditional Finance : Cards (e.g., Visa/Bridge stablecoin cards in 6 countries) and apps blend crypto with daily use. Remittances and e-commerce are key drivers, with million dollars projected in Mexico’s adoption by year-end.

Stablecoins power parallel economies, with customzied crypto wallets enabling peer-to-peer cash on popular blockchain networks.

Enterprise Pain Points In LATAM Region

Let’s from the problems enterprises and end-users face every day, so that you get a clear picture of what is actually happening and how this can be solved. A clear understanding of the pain points help one make decisions wisely:

1. Costly cross-border transactions and remittances : Traditional remittance corridors are expensive: layered fees, poor FX rates, intermediary charges, and slow settlement times add up for senders and receivers. Enterprises also face expensive cross-border supplier payments and payroll disbursements.

2. High remittance costs & slow settlement (retail) : Smaller transfers are disproportionately costly and often take days to settle, hurting low-income recipients.

3. Currency volatility and inflation : Several LATAM economies face recurring inflation and currency depreciation; businesses and consumers seek ways to protect value.

4. Underbanked and mobile-first populations : Many users have limited access to traditional banking but widespread mobile access — they need low-friction, trusted digital financial services.

5. Fragmented local payment rails and liquidity friction. : Each country has different instant-payment rails, banks, and PSPs; lack of unified rails drives friction and costs.

6. Regulatory uncertainty and AML/KYC complexity : Divergent regulatory frameworks across countries create compliance overhead and operational risk for cross-border fintech operations.

7. Trust & user experience gaps : Low-trust environments require transparent fees, clear dispute processes, and localized support to drive adoption.

How White-Label Crypto Wallets Solve These Challenges?

A white-label cryptocurrency wallet is not just a quick deployment tool — it’s a powerful, pre-built framework tailored to address LATAM’s most pressing financial challenges with speed, compliance, and scalability:

- Slash costly cross-border transactions with stablecoin rails. White-label wallets come with ready-to-integrate stablecoin support and local fiat gateways, cutting out expensive intermediaries and enabling near-instant, low-fee settlements for both remittances and enterprise payouts.

- Provide dollarization & inflation protection. With built-in stablecoin functionality, these wallets let users store USD-equivalent balances and enterprises manage predictable supplier payments, reducing exposure to volatile local currencies.

- Enable faster payroll & merchant settlements. Pre-configured settlement modules allow real-time disbursements that boost liquidity for SMEs and workers, a major upgrade from traditional banking delays.

- Deliver financial inclusion with mobile-first design. White-label wallets are optimized with tiered KYC, local languages, and lightweight UX, ensuring accessibility even for underbanked, mobile-first users.

- Integrate seamlessly with local rails. Ready APIs connect to systems like PIX in Brazil and regional PSPs, ensuring smooth fiat to crypto conversions and market liquidity.

- Ensure compliance out of the box. Automated KYC/AML, customizable jurisdictional rules, and audit-grade logging are built in, transforming compliance into a managed feature rather than a hurdle.

- Build trust with enterprise-grade security. Embedded features like MPC/HSM custody, transparent fees, clear dispute workflows, and optional institutional custody reinforce confidence for enterprises and conservative users.

Fast-Track LATAM Growth With 100% Regulated Crypto Wallets

What Enterprises & Investors Should Prioritize in a LATAM Customized Crypto Wallet?

When it comes to entering the LATAM crypto market, building just any wallet isn’t enough — enterprises and investors need to think smarter. A white-label digital wallet gives the advantage of speed, compliance, and adaptability, but success in this region depends on knowing what to prioritize. From regulatory readiness to seamless local integrations, the right choices such as choosing the right white label crypto wallet service provider can determine whether your wallet scales across LATAM or struggles to gain trust.

1. Regulatory-first architecture– Build compliance into product design: automated KYC/AML, reporting-ready ledgers, adaptable risk rules per jurisdiction. Regulatory landscapes change rapidly across LATAM; compliance is a feature, not an afterthought.

2. Multi-rail fiat on/off ramps– Local PSPs, bank partners, and instant-pay integrations (PIX, local EFT networks). Redundancy prevents liquidity bottlenecks.

3. Stablecoin & multi-asset support– USD-pegged stablecoins (USDT/USDC and regionally accepted tokens), plus major chains for settlement choice.

4. Security & custody model– Choose the right custody for use-case: institutional-grade custodial services for enterprise clients; non-custodial options for retail users who demand control. Implement MPC, HSM, and audited smart contracts.

5. Local UX, language, and trust signals– Spanish/Portuguese language support, local customer care, and transparent FiT/Cs for enterprises and end users. Design for low-trust environments: clear transaction explanations, visible fees, and dispute pathways.

6. Scalable APIs & B2B capabilities– The white label cryptocurrency wallets you design should expose APIs for payroll, merchant checkout, compliance checks, and wallet-as-a-service (WaaS) for banks and large corporates.

7. CBDC & future-proofing– Architect so the wallet can connect to central bank digital currencies (CBDCs) and new regulated rails as they appear.

Prioritizing the right features in a LATAM-focused, white-label crypto wallet ensures enterprises and investors gain both user trust and market longevity. And yet, even the smartest wallet strategy cannot succeed without a rigorous compliance framework. Thus, let us move to the next section that helps businesses explore the compliance and regulatory checklist.

Regulatory & Compliance Checklist For LATAM White Label Wallet App

Every smart investor makes a decision that never calls for regret. Regulatory and compliance is one of the aspect of decision making towards your white label cryptocurrency wallet development goals. It is important that you navigate through all the regulatory and compliance related considerations.

- VASP licensing/registration per country : obtain required crypto/payment authorizations locally.

- AML/CFT program : documented policies, periodic risk assessments, automated monitoring, SAR/STR workflows.

- KYC & CDD : tiered onboarding, ID verification, UBO checks, and enhanced due diligence for high-risk users.

- Sanctions & PEP screening : real-time checks against global (OFAC/EU/UN) and local lists.

- Travel Rule compliance : propagate originator/beneficiary data for transfers above regulatory thresholds.

- Data protection & privacy : GDPR-style compliance, data residency, consent handling and breach notification rules.

- Local payments/remittance licensing : secure PSP, money-transmitter, or remittance authorizations where required.

- Tax reporting & transparency : automate regulatory reporting and provide customer tax documents.

- Custody & security : MPC/HSM key management, cold storage, audited custodians, and custody insurance.

- Audit & assurance: SOC2/ISO27001, smart-contract audits, and annual penetration tests.

- Capital, client funds & segregation : meet local capital requirements and segregate client assets.

- Record retention & audit trails : immutable ledgers, tamper-evident logs, 5–10 year retention policies.

- Vendor & third-party controls : contractual security SLAs, due diligence, and continuous monitoring.

- Incident response & regulator notice : defined IR playbook and jurisdictional timelines for breach reporting.

Hire Antier For A Fully-Reulated LATAM White Label Crytpo Wallet

LATAM presents a rare, time-bound opportunity for enterprise-grade crypto wallets. Costly cross-border transactions , long a burden for users and businesses, can be materially reduced using on-chain settlement, stablecoins, and strong local partnerships. When wallets are built with compliance-first design, multi-rail liquidity, and mobile-first UX, they deliver both social impact (financial inclusion and cheaper remittances) and a defensible enterprise business model. For investors and enterprises, the path to product-market fit is clear: prioritize compliance, stablecoin liquidity, local partnerships, and a secure, scalable architecture.

Are you planning to hire an reliable white label crypto wallet development company? Connect with Antier! Partnering with our certified team means collaborating with industry experts who bring years of proven experience in building compliant, regulation-ready white-label crypto wallets. With deep market credibility, a track record of successful global deployments, and business-driven strategies, we empower enterprises to launch wallets that are not only secure but also positioned for long-term success.