In 2025, the real-world asset tokenization market will have hit $15.2 billion, with forecasts pointing toward $16 trillion by 2030. Banks, fintech’s, and institutional investors are accelerating platform development to capitalize on fractional ownership, 24/7 liquidity, and programmable compliance.

This guide outlines the top 10 real-world assets driving tokenization growth. It is designed for institutions seeking RWA Tokenization Platform Development Services to enter this expanding sector.

What are the top Real-World Asset categories to Tokenize?

1. Real Estate

Real estate tokenization turns property into tradable digital shares. Instead of buying an entire building, investors can own fractions. These tokens represent legal ownership and entitle holders to rental income or profits. It opens the doors to global investors, reduces paperwork, and boosts liquidity in a traditionally slow-moving market. For platforms, it’s the high-value gateway to institutional and retail investors onboarding.

- Market Size: $2.8 billion

- Leading Platforms: Propy, RealT

- Key Features: Fractional ownership, automated rent distribution, smart contract-enabled title transfers

- Development Insight: Integrate KYC/AML, real-world oracles, and real estate compliance layers. Prioritize liquidity through secondary markets and smart contract-based governance.

2. U.S. Treasury Bonds

U.S. Treasury bonds are low-risk government debt instruments- IOUs backed by the U.S. government. Treasury bond tokenization gives investors around-the-clock access to stable, yield-generating assets without traditional settlement delays. For fintech’s, it’s a compliance-friendly asset class to onboard institutions looking for digital versions of their most trusted investments.

- Market Size: $500 million

- Key Players: Ondo Finance, Franklin Templeton (BUIDL)

- Use Case: Tokenized access to low-risk, yield-bearing government debt

- Development Insight: Build on Ethereum or Polygon with support for ERC-3643 and programmable compliance for regulated exposure.

3. Gold and Precious Metals

Gold has always been the go-to hedge against inflation and economic turmoil. Tokenized gold lets people buy and trade fractional pieces of real, vault-stored metal without handling the physical bars. It combines gold’s age-old value with blockchain’s speed and transparency. For platforms, gold tokenization attracts both crypto-skeptics and investors wanting tangible, inflation-resistant assets.

- Market Size: $1+ billion

- Notable Tokens: Tether Gold (XAUT), Paxos Gold (PAXG)

- Key Benefits: Divisibility, global access, on-chain proof-of-reserves

- Development Insight: Use audited vaults and real-time price feeds via oracles. Platforms must support compliance, reserve validation, and multi-jurisdictional access.

4. Private Credit

Private credit is funding that goes straight to businesses, no banks, no red tape. It’s often used by small and mid-sized companies that need capital quickly but don’t want to jump through traditional hoops. Private credit tokenization turns these loans into digital assets, making it easier for investors to participate and track returns. For platforms, it’s a real opportunity to modernize a market that’s long overdue for an upgrade.

- Market Size: $3.5 billion

- Leading Platforms: Centrifuge, Maple Finance

- Application: SME lending via tokenized debt instruments

- Development Insight: Support loan origination, repayment automation, and MiCA-compliant workflows. Embed institutional-grade security and real-time risk analytics.

5. Corporate Bonds

Corporate bonds are debt issued by companies to raise money. Tokenizing them simplifies issuance, automates interest payments, and enables instant trading. It cuts settlement from days to minutes and lowers costs across the board. Real-World Asset Tokenization Platform for corporate bonds can attract enterprises seeking efficient financing and investors looking for reliable, income-generating assets with fewer gatekeepers.

- Growth Rate (2024): 60% YoY

- Key Example: Bitbond

- Core Functionality: Streamlined debt issuance with smart contracts for programmable interest

- Development Insight: Compliant ERC-3643 tokens, instant settlement, and treasury integration are non-negotiables for institutional-grade bond tokenization.

6. Commodities

Commodities like oil, wheat, and metals are vital to the global economy but tough to trade in fractional amounts. RWA Tokenization Platform makes that possible; investors can buy small shares of barrels of oil or sacks of grain. It creates new liquidity and allows traders worldwide to invest in real-world goods without dealing with logistics. For platforms, it’s a chance to tap into global trade with digital efficiency.

- Market Size (2024): $1.2 billion

- Tokenized Assets: Oil, agricultural products, industrial metals

- Key Technology: Algorand ASA, Chainlink oracles

- Development Insight: Real-time pricing, fractional trading, and support for cross-border transactions are critical. Build with modular smart contracts for commodity-specific rules.

7. Art and Collectibles

Fine art and rare collectibles are high-value, low-liquidity assets. With RWA Tokenization Platform Development Services, investors can sell a fraction of a Picasso or a rare watch, no billion-dollar portfolio required. It also enables fast trading and transparent provenance tracking. For platforms, this niche is a magnet for HNWIs and family offices seeking alternative investments with cultural or emotional value alongside financial upside.

- Market Size: $800 million

- Key Platforms: Vottun, Tokenize.it

- Token Standards: ERC-721 for NFTs

- Development Insight: Build platforms with custody solutions, IP verification, and investor onboarding modules. Ensure provenance and title authentication to support HNWI participation.

8. Private Equity

Private equity involves investing in private companies before they go public. Traditionally reserved for insiders and institutions, tokenization opens access to a broader investor base. Investors can buy in with smaller amounts and trade ownership more easily. For platforms, it means digitizing a multi-trillion-dollar market that’s been walled off for decades, bringing liquidity and transparency to one of the most profitable corners of finance.

- Market Size: $1.5 billion

- Notable Platforms: Securitize, Antier Solutions

- Use Case: Digitization of private equity funds for improved liquidity and access.

- Development Insight: Ensure cross-chain operability, full regulatory compliance, and investor onboarding. Offer programmable lock-in periods and performance-based distribution logic.

9. Carbon Credits

Carbon credit tokenization are permits that allow companies to release a set amount of carbon dioxide into the atmosphere. When tokenized, these credits become digital assets that can be tracked, verified, and traded more easily. This gives the carbon market more transparency and trust. Carbon credit tokenization opens smart entry for businesses into the growing world of green finance, where profit and sustainability go hand in hand.

- Market Size (2024): $400 million

- Leading Platforms: Carbcoin, 4IRE

- Core Focus: ESG-compliant carbon offset tracking

- Development Insight: Use scalable blockchains like Polygon and automated verification protocols. Compliance with global ESG standards is critical for investor adoption.

10. Intellectual Property (IP)

IP assets, like music royalties, patents, or licensing rights, are valuable but often underutilized. IP Tokenization allows creators and rights holders to fractionalize ownership and raise capital by selling shares in future earnings. Fans or investors can own a piece of a song, invention, or script. For platforms, IP tokenization unlocks a creative economy of recurring revenue, legal innovation, and fan-driven monetization models.

- Market Size: $600 million

- Applications: Tokenized patents, royalties, copyrights

- Key Technologies: Concordium, ZKPs

- Development Insight: Build customizable smart contracts for revenue-sharing models. Integrate the licensing frameworks and audit logs to ensure legal enforceability.

Why These Assets Matter in 2025

- Regulatory Progress: Clarity from the U.S. GENIUS Act and EU MiCA accelerates institutional onboarding.

- Technological Advancements: Layer-2 chains (e.g., Polygon) and cross-chain messaging (Chainlink CCIP) increase platform scalability.

- Institutional Endorsements: BlackRock, JPMorgan, and Citibank have initiated RWA strategies. Over 119 issuers tokenized assets in 2024.

- Cost Efficiency: Bank of America estimates $20B annual savings in clearing/settlement costs through RWA adoption by 2030.

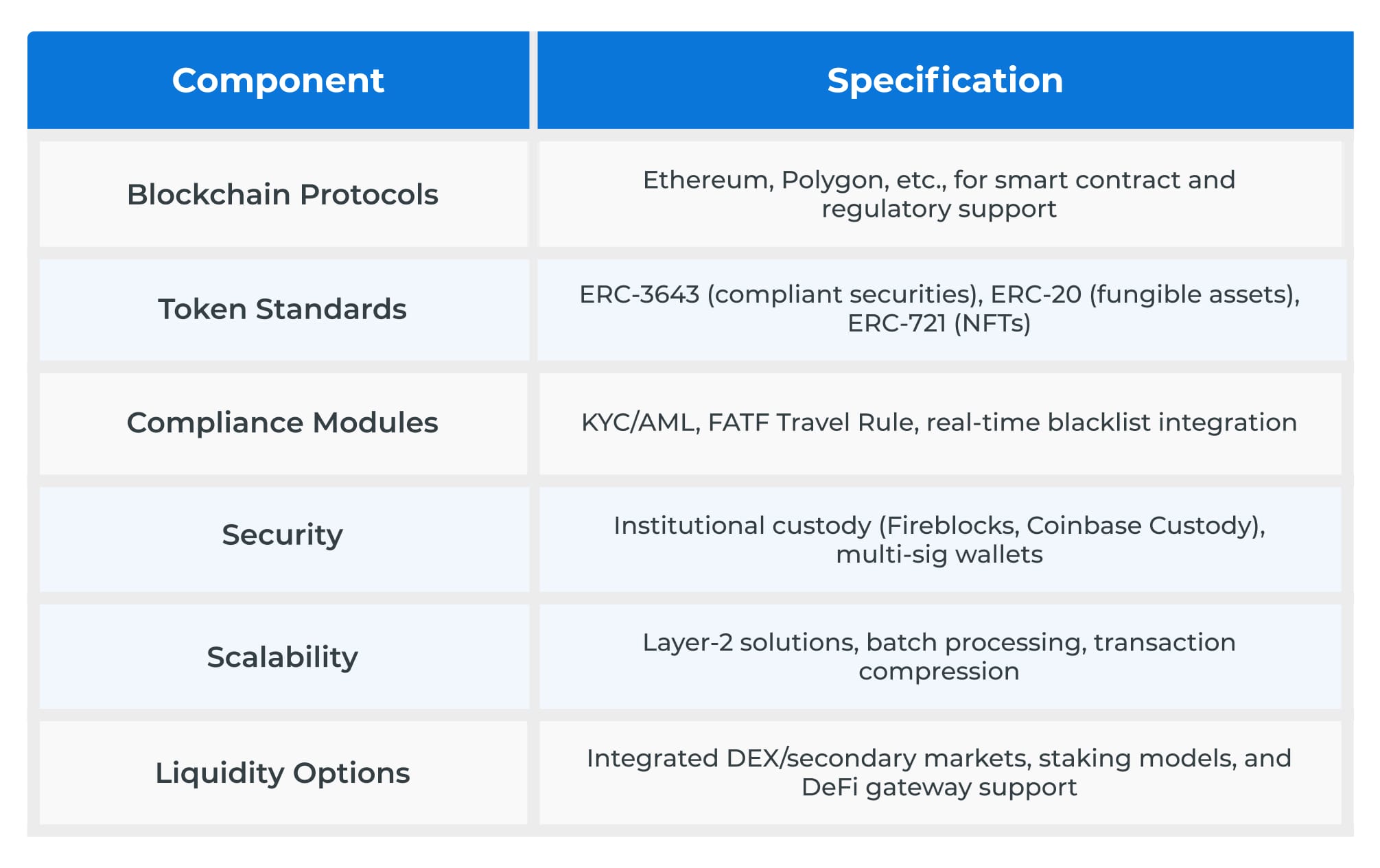

Building an RWA Tokenization Platform: Key Requirements

Takeaway

The above-mentioned are the top 10 real-world assets tokenization categories in 2025. These assets are reshaping how industries raise capital, share profits, and interact with global markets.

If you’re building a platform, partner with an experienced RWA Tokenization Platform Development Company to build a scalable and compliant platform architecture for your industry.