Real-world asset tokenization is moving from concept to capital deployment, but most infrastructure projects never make it past pilot. The reason isn’t a lack of interest; it’s failure to build for compliance, custody, and integration. A scalable Real-World Asset Tokenization Development requires architecting systems that align with institutional workflows, regulatory mandates, and multi-jurisdictional asset handling.

This guide lays out the technical infrastructure requirements for the Real-World Asset Tokenization Platform based on leading solutions that work beyond the proof-of-concept phase.

Why Most Tokenization Infrastructure Projects Fail?

Despite growing interest, over 95% of tokenization initiatives stall at the pilot phase as infrastructure assumptions are misaligned with operational realities.

Many teams underestimate what it takes to operationalize tokenization beyond a proof of concept. They focus on blockchain compatibility or token design but overlook the foundational elements: data verification, cross-border custody workflows, jurisdictional compliance logic, and enterprise-grade system integration.

The result is a platform that may work in isolation but cannot scale across asset classes, geographies, or regulatory regimes.

How to Build Infrastructure That Powers Onchain Finance at Scale?

1. Oracle Infrastructure

Most oracle systems in the market today were designed for decentralized finance, delivering token prices every few seconds. However, real-world assets require multi-layered data validation that goes far beyond price feeds.

An institutional-grade tokenization platform must support oracles capable of verifying:

- Asset ownership and transfer restrictions.

- Regulatory eligibility and accreditation.

- Underlying asset performance metrics.

- Cross-jurisdictional regulatory status.

For example, if a real estate-backed token is invalidated by a regulatory change in the asset’s jurisdiction, it must be embedded in the Oracle logic, not managed through manual review.

2. Custody Integration

The Real-World Asset Tokenization Development infrastructure must support secure custody, compliant transfer, and reconciliation of digital assets across traditional and blockchain-based systems.

In many implementations, custody integration is limited to basic API calls with digital asset custodians. While functional in limited pilots, these connections quickly become operational bottlenecks when scaled.

Enterprise-grade custody integration in Tokenization Platform requires:

- Support for both on-chain and off-chain settlement.

- Compatibility with regulated custodians (e.g., Fidelity, BitGo, Coinbase Custody).

- Real-time reconciliation with core banking and asset servicing systems.

- Multi-signature wallet frameworks and HSMs for institutional key management.

- Emergency halt procedures to ensure compliance under regulatory scrutiny.

These custody workflows differ by jurisdiction and asset type. Without designing for this complexity from the outset, tokenization platforms can fail during the first institutional onboarding process.

3. Compliance Architecture

Many tokenization initiatives treat compliance as a post-MVP add-on. The Real-world asset tokenization requires asset-specific compliance logic, including:

- Jurisdiction-specific investor accreditation checks.

- Lock-up periods and transfer restrictions based on securities regulations.

- Automated reporting triggers for beneficial ownership concentration.

- Loan covenant enforcement in tokenized private credit.

Embedding compliance directly into the token logic, at the smart contract layer, ensures that transfers, redemptions, and reporting are enforced automatically. Attempting to retrofit compliance into a middleware layer creates significant technical debt, elevates regulatory risk, and increases audit complexity.

4. Transaction Settlement

Traditional Blockchain financial infrastructure operates on T+2 settlement cycles, while blockchain supports instantaneous (T+0) settlement. This creates a fundamental mismatch that impacts everything from reconciliation to compliance reporting.

A real-world asset tokenization development infrastructure must handle scenarios where:

- Blockchain settlement finalizes immediately, but traditional custodians require multi-day asset transfer processing.

- Regulators expect batch reporting, but transactions occur in real-time.

- Cross-border asset flows trigger jurisdiction-specific compliance reviews mid-settlement.

Platforms must include logic to harmonize settlement workflows, providing a consistent experience for institutional users without violating regulatory expectations.

5. Enterprise-Grade Performance

Most tokenization platforms are tested at low volumes and collapse under real-world institutional activity. Database design, indexing, monitoring, and observability become mission critical. Without these capabilities, platforms fail at the exact moment they begin onboarding real institutional flows.

Production-grade tokenization infrastructure must support:

- Thousands of concurrent transactions with sub-second latency.

- Cross-chain transaction execution and reconciliation.

- Caching strategies optimized for metadata-heavy token formats (e.g., ERC-1400).

- Load balancing that accounts for gas volatility and network congestion.

Proof-of-Work: Why Private Credit Leads RWA Tokenization?

As of mid-2025, private credit represents over 60% of the $24 billion RWA tokenization market. Unlike theoretical use cases, private credit addresses specific operational inefficiencies in traditional lending and asset servicing.

Successful platforms in this space have been built to:

- Automate compliance with loan covenants and investor restrictions.

- Provide real-time performance monitoring and alerting.

- Integrate directly with loan servicing and credit scoring systems.

- Deliver lower operational costs and increased transparency.

Private credit in on-chain finance is proof that tokenization works when infrastructure is designed around the asset class, not just the blockchain.

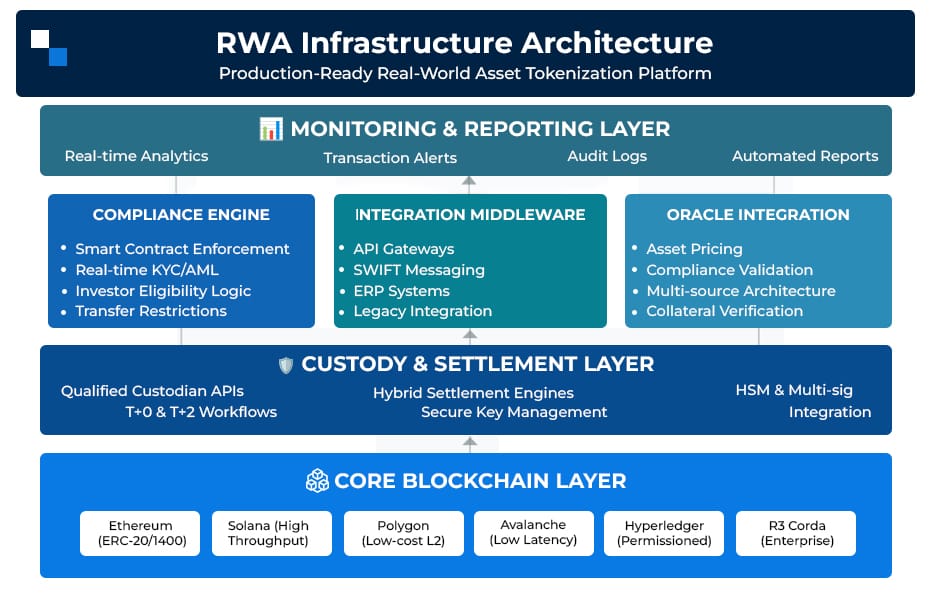

A production-ready, real-world asset tokenization development platform should include the following components:

1. Core Blockchain Layer

- Ethereum: For standards (ERC-20, ERC-1400) and ecosystem access.

- Solana: For throughput-heavy use cases.

- Polygon: For low-cost Ethereum compatibility.

- Avalanche: For low-latency finality.

2. Oracle Integration

- RWA-specific oracles for asset pricing, compliance validation, and collateral verification.

- Multi-source architecture for redundancy and data integrity.

3. Custody & Settlement Layer

- Qualified custodian APIs.

- Hybrid settlement engines supporting both T+0 and T+2 workflows.

- HSM and multi-sig integration for secure key management.

4. Compliance Engine

- Smart contract enforcement of transfer restrictions.

- Real-time KYC/AML verification.

- Rule-based accreditation and investor eligibility logic.

5. Integration Middleware

- API gateways and data transformation tools to integrate with legacy systems.

- Support for SWIFT messaging, core banking infrastructure, and ERP systems.

6. Monitoring and Reporting Layer

- Real-time analytics and transaction alerts.

- Audit logs for on-chain and off-chain actions.

- Automated regulatory report generation.

Design Principles for Institutional-Ready Tokenization

To meet institutional expectations, tokenization infrastructure must be designed with the following in mind:

- Compliance-First Architecture: Compliance logic must be embedded at every layer, from token design to transaction processing.

- Operational Integration: RWA Tokenization platform must interface cleanly with existing institutional systems, not require clients to abandon their workflows.

- Scalability by Design: Anticipate growth from day one. Architect for horizontal scaling, distributed caching, and multi-chain expansion.

- Auditability and Transparency: Regulatory-grade audit trails are non-negotiable. Infrastructure must provide both blockchain-native and traditional audit support.

Build Infrastructure That Solves for Real-World Complexity

Platforms that succeed are not those that showcase impressive technical demos, but those that solve deeply entrenched operational problems for institutions. Whether you’re building for private credit, real estate, or securitized instruments, success depends on infrastructure that can support compliance, performance, security, and interoperability. For that, it is non-negotiable to understand the full spectrum of technical, operational, and regulatory demands required to build at scale.

Looking to Build an Institutional-Grade Tokenization Platform?

Global institutions trust Antier to design and deliver mission-critical real-world asset tokenization infrastructure. Our Real-World Asset Tokenization Development Company combines regulatory compliance, institutional custody, and scalable architecture into platforms built for real deployment.

Whether you’re tokenizing credit, real estate, or funds, our on-chain finance infrastructure supports full lifecycle asset management. Partner with Antier to build tokenization infrastructure that stands up to enterprise demands.