Real estate tokenization Platform Development is actively reshaping how property is owned, financed, and distributed in Dubai. In July 2025, Prypco Mint, an approved infrastructure, sold a Dh1.75 million villa in Dubai land’s Rukan Community in under five minutes. The sale onboarded 169 investors from 40 nationalities, each receiving blockchain-verified ownership for an average investment of Dh10,355. Backed by the Dubai Land Department and executed through smart contracts, the solution was a fully compliant operational model of asset fractionalization.

This guide outlines how firms can build a legally sound, technically scalable, and regulatory-aligned Real Estate Tokenization Platform in Dubai.

Real-Estate Tokenization in Dubai: The Smart Choice for Entrepreneurs in 2025

The Dubai government is integrating Real Estate Tokenization into the country’s economic strategy. The 2033 vision targets over $16 billion in tokenized real estate assets, combining public oversight with institutional-grade infrastructure. Ripple’s integration with Dubai title deed systems through the XRP Ledger is the first such initiative globally. VARA and DLD are the backbones behind these initiatives.

For real estate firms, this represents a rare confluence:

- Policy alignment: VARA, DLD, and Central Bank cooperation have never been tighter.

- Technology maturity: Smart contracts, custody, and token standards are proven and deployable.

- Investor demand: Global and local investors are actively seeking fractional real estate exposure.

For property developers, Real Estate tokenization platform development offers an alternative to debt financing and project delays. For asset managers, it expands investor access beyond high-net-worth segments. For brokers, it opens doors to recurring, platform-based income models. For fintechs, it’s an entirely new product class, licensed, tradable, and globally investable.

Real Estate Tokenization in Dubai: Recent Breakthroughs Defining the Next 12–18 Months

1. Prypco Mint Launch (25 May 2025)

A government-backed pilot with UAE residents investing in Real Estate Tokenization Dubai, starting from AED 2,000 (~US$540), with cryptos temporarily off-limits.

- The first tokenized villa (Business Bay) sold out in under 24 hours to 224 investors.

- Kensington Waters apartment went fully subscribed in under two minutes.

- A third property sold in 5 minutes, a tokenized villa.

2. Ripple + Ctrl Alt + XRP Ledger

On 16 July 2025, Ripple’s custody system went live with Ctrl Alt to store Dubai Land Deeds on XRPL.

- Ctrl Alt became the first VARA‑licensed VASP for real estate issuance.

- Ripple now has custody clients globally and is the first DFSA‑licensed payments firm in Dubai. Its RLUSD stablecoin is DFSA‑approved.

3. Bergen County, New Jersey Pilot

370,000 deeds, totaling ~$240B in property value, are being digitized on Avalanche in a five‑year program.

- Improves processing times, revenue collection, and fraud prevention.

- Included in a global wave of land-record pilots, from Teton County (2019) to Baltimore (2023).

What Real Estate Tokenization in Dubai Enables for Each Stakeholder?

Tokenization is not one-size-fits-all. Here’s how different market players can leverage a Real Estate Tokenization Platform in Dubai:

1. Property Builders

Property builders can launch a white-label tokenization platform to tokenize high-value properties. This will unlock fractional ownership to global investors while retaining control over sales, capital inflows, and rental income streams. With smart contracts, automate distributions and reporting.

2. Fintech Startups

Real Estate Tokenization Platform Development is a gateway for Fintech Startups to enter the property investment space without holding physical assets. They can launch platforms that enable token trading, automate KYC/AML, and offer programmable yields, without direct real estate exposure.

3. Real Estate Brokers

Brokers can move from commission-based deals to platform-driven transactions. They can host tokenized listings, offer investment analytics, and build a recurring income model via transaction fees or asset management services.

4. Asset Managers & Funds

Asset managers can use tokenization platforms to fractionalize fund holdings and increase investor participation. Launch tokenized REIT-like models, automate yield payouts, and provide on-chain reporting to regulators and stakeholders.

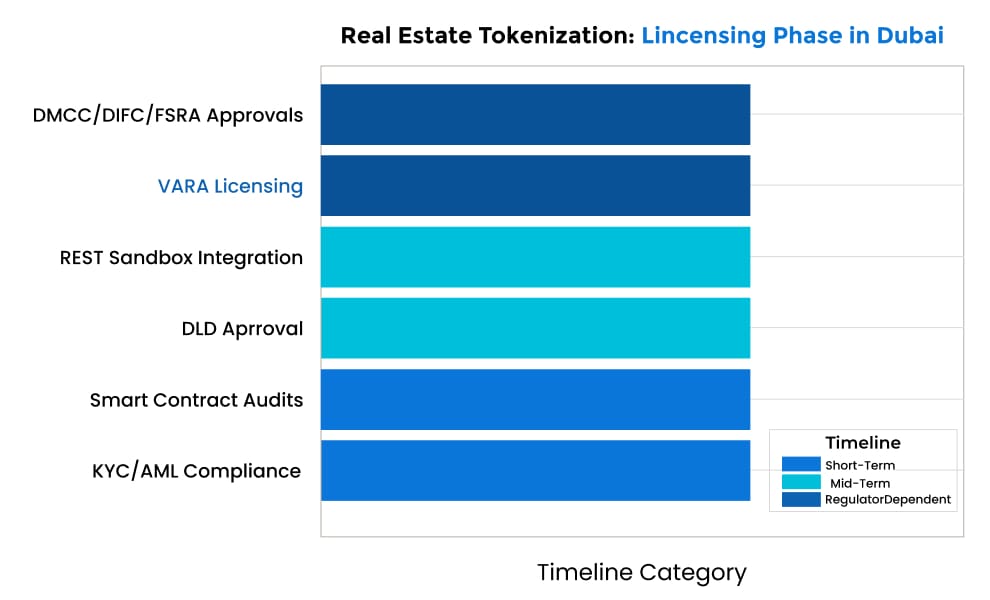

Licensing Requirements in Dubai to Launch Real-Estate Tokenization Platform

Building a Real Estate Tokenization Platform in Dubai involves navigating a multi-agency regulatory process:

VARA (Virtual Assets Regulatory Authority)

- Issue VASP licenses for platform operations.

- Covers token issuance, exchange, custody, and advisory functions.

- Requires KYC/AML systems, cyber risk management, and audit trails.

Dubai Land Department (DLD)

- Approval is needed to record ownership changes.

- Participation in the REST Sandbox program for blockchain-based platforms.

- Alignment with freehold ownership rules is mandatory.

DMCC, DIFC, FSRA (if applicable)

Depending on the jurisdiction of setup, approvals may also be required from:

- DMCC for commodity-backed or mixed-use developments.

- DIFC for financial structuring.

- FSRA (Abu Dhabi) if cross-emirate licensing is involved.

Tech Stack for Real Estate Tokenization Platform Development in Dubai

To Tokenize Real Estate in Dubai, a full-fledged platform must integrate several core technologies:

Customizations can be built around any specific business model or asset class.

Real Estate Tokenization Platform: Key Features for Investors

1. Fractional Ownership

Real Estate Tokenization Platform enables the division of high-value properties into tradable token units. Investors can purchase a fraction of a property without full ownership, thereby increasing accessibility while reducing entry barriers. Ideal for luxury developments and diversified portfolios.

2. Smart Contract Automation

The smart contract automation can handle issuance, dividends, buybacks, and compliance checks automatically. It reduces operational overhead, eliminates intermediaries, and ensures investor trust through transparency. Each contract is auditable and compliant with the UAE’s digital asset frameworks.

3. Secondary Market Integration

This allows investors to buy, sell, or trade real estate tokens in real-time. Built-in order book, price history, and liquidity modules ensure market fluidity, which is essential for high adoption and better investor exit options.

4. Cross-Border Investor Onboarding

The Real Estate Tokenization Platform Dubai facilitates international participation with multilingual KYC/AML modules and multi-currency support. It converts global interest in Dubai real estate into actual participation through frictionless compliance pathways.

Operational & Administrative Capabilities

1. Regulatory Compliance Suite

Integrates with VARA, DLD, and other Dubai-based regulators for AML, transaction reporting, and audit logs. Keeps the platform aligned with local laws, reducing the risk of shutdown or fines.

2. Income Distribution Module

Automates rent, profit-sharing, or dividend payouts through wallet-linked contracts. Investors receive timely payments based on their token holdings, boosting trust and platform retention.

3. Property Management Dashboard

Real-time reporting of maintenance, occupancy, and ROI metrics. Property owners can upload documents, view investor breakdowns, and manage listings, all from a single admin panel.

4. White-Label Licensing Option

Enables brokers, developers, and real estate brands to operate the platform under their own identity. Pre-built, customizable templates reduce go-to-market time.

1. Transaction Fees

Most common model: charge a percentage on every buy, sell, or lease transaction completed on the platform. Suitable for active platforms with a large investor pool.

2. SaaS for Developers & Brokers

Offer the platform as a monthly subscription with white-label branding. Ideal for brokers and developers seeking recurring income from tokenized listings.

3. Revenue Sharing

Share profits or rental income directly with token holders and platform stakeholders. Adds incentive alignment and makes tokenized income feel real.

4. Tokenized Fund Model

Ideal for asset managers. Launch tokenized REIT-like products and provide investors with a share of a real estate portfolio.

Launch a Real Estate Tokenization Platform in Dubai: Implementation Checklist

Check out the core must-have platform functionalities to Tokenize Real Estate in Dubai:

1. Secure VARA VASP license

Obtain authorization from the Virtual Assets Regulatory Authority to legally operate issuance, custody, and advisory services on your platform.

2. Connect to the DLD REST sandbox

Integrate with Dubai Land Department’s blockchain-based sandbox to test ownership recording and property registry synchronization in a compliant environment.

- Integrate CMA and Zand-like banking rails: Establish Client Money Account protocols and link fiat payment rails through regulated banks like Zand for investor fund management.

- Choose blockchain layer (XRPL recommended): Select a blockchain protocol, such as XRPL, for performance, compliance, and integration with government-backed title deed tokenization standards.

- Develop modular smart contracts with audit-ready logic: Code automated token issuance, distribution, and compliance rules using smart contracts that meet regulatory audit requirements.

- Launch MVP with investor UI + yield distribution flow: Deploy a functional minimum viable platform enabling investors’ onboarding, token access, and automated income distribution.

- Build secondary market and custody integration: Enable token liquidity through a compliant trading module and institutional-grade custody for secure asset holding.

- Complete VARA & Central Bank compliance audit: Ensure all platform components pass regulatory scrutiny from both VARA and the Central Bank for operational clearance.

- Deploy a public launch with investor education and PR: Go live with full market visibility, supported by user training, FAQs, and strategic communication to build trust and adoption.

Takeaway

Dubai is ready, investors are interested, and the only thing missing is the infrastructure to make it scale. Whether you’re a property developer, a real estate broker, or a fintech startup, building your own Real Estate Tokenization Platform Development in Dubai gives you a first-mover edge in a multi-billion-dollar transformation.

Schedule your free consultation with Antier today and take the first step toward launching your own Dubai-compliant, investor-ready infrastructure. Our Real Estate Tokenization Platform Development Company will guide you through every stage, from architecture to launch.