The Indian banking sector has been under immense pressure from non-performing assets (NPAs), which are valued at more than ₹10 lakh crore, limiting the banks’ lending capacity and weighing on credit growth.

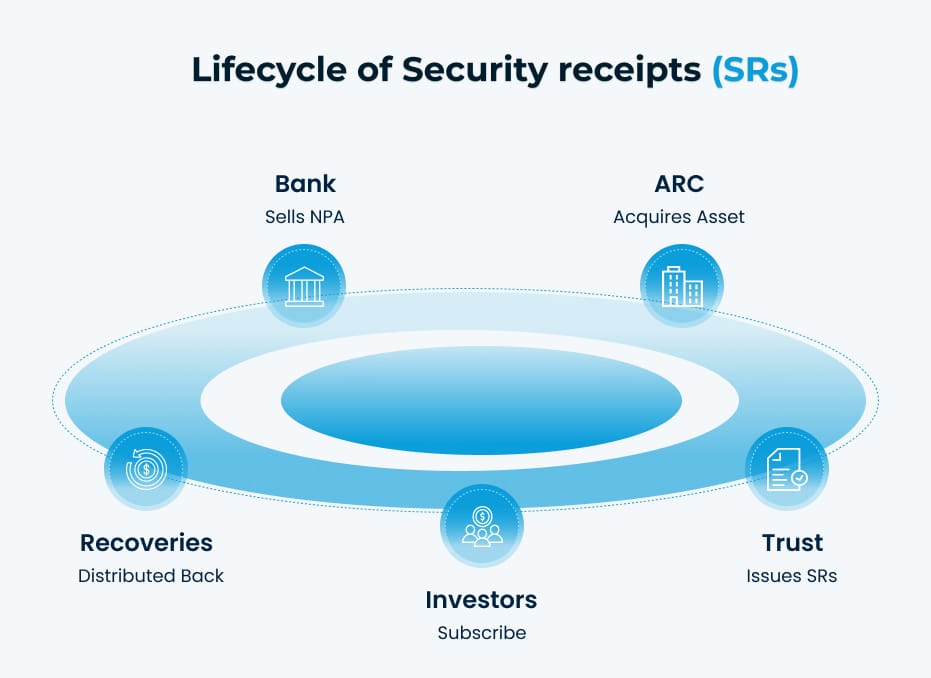

To resolve these stressed loans, the Securitisation and Reconstruction of Financial Assets and Enforcement of Security Interest Act, 2002 (SARFAESI Act) created Asset Reconstruction Companies. The companies acquire NPAs at discounts and issue Security Receipts (SRs) to investors as consideration.

While these instruments give investors rights over recoveries from the acquired assets, they remain largely illiquid, with limited secondary market options, limiting portfolio diversification and timely exits for participants.

Tokenization provides a possible shift. By converting SRs into digital tokens, they can be divided into smaller units, traded more efficiently, and monitored with greater transparency. The regulatory backdrop has improved, with SEBI’s February 2025 notification expanding the pool of qualified buyers to all RBI-regulated NBFCs and HFCs.

This document provides an insight about a detailed overview of SR tokenization once the regulatory bodies adopt this through enactment .

A Visual Journey Of NPAs To Tokenization

Understanding Security Receipts Issued by ARCs

Security Receipts (SRs) are financial instruments issued by ARCs to finance NPA acquisitions from banks. They represent an undivided interest in a pool of distressed assets, granting investors a share of recoveries from loan resolutions, asset sales, or legal actions.

The returns from this are variable, tied to recovery success, offering high-yield potential with inherent risks.

- Governance : Issued under Section 7 of the SARFAESI Act, 2002, SRs are managed through trusts by ARCs, ensuring investor protection.

- Market Scale : As per the CRISIL report, ARCs oversee approximately ₹1.5 lakh crore in assets under management (AUM) in 2025.

- Risk Profile : Backed by impaired assets, SRs carry uncertainty but offer attractive returns when recoveries succeed.

Evolution of Investor Eligibility

- 2002–2008 : Eligible buyers for SRs include the banks, financial institutions, insurers, and Foreign Institutional Investors (FIIs).

- 2008 Notification : SEBI extended access to NBFCs meeting asset size thresholds (₹100 crore for systemically important NBFCs, ₹50 crore for others) and 10% Capital to Risk-Weighted Assets Ratio (CRAR).

- 2025 Notification (SEBI Gazette, February 28) : All RBI-regulated NBFCs and HFCs qualify, eliminating asset size restrictions to enhance market participation, with measures to prevent defaulting promoters from regaining control.

Core Problem: SRs are vital for cleaning bank balance sheets but lack the liquidity and accessibility needed to attract a broad investor base.

Tokenization of Real-World Assets and SRs: The Concept

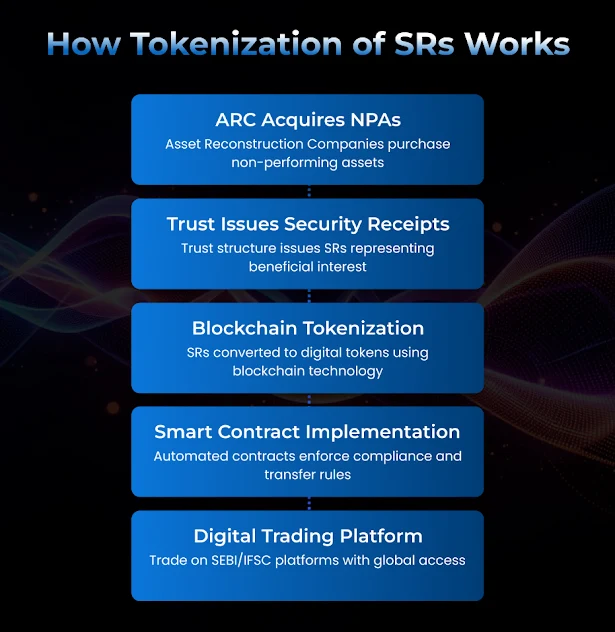

RWA tokenization allows financial institutions to convert assets like loans into digital tokens on a blockchain, which is a secure, decentralized ledger ensuring immutable records. For SRs, this process fractionalizes ownership into tradable units, improving liquidity and accessibility for investors.

Process?

1. Issuance : ARCs acquire NPAs and issue SRs through a trust under SARFAESI.

2. Token Creation : SRs are digitized into tokens on a permissioned blockchain, designed for regulatory compliance. Investors can purchase tokens.

3. Smart Contracts : Self-executing code is used to automate recovery distributions, enforce investor eligibility, and implement SEBI’s 2025 promoter restrictions.

4. Trading : Tokens are listed on regulated platforms for trading, including SEBI-approved Alternative Trading Facilities (ATFs) or GIFT City’s International Financial Services Centre (IFSC) exchanges.

This way, tokenization unlocks the fractional ownership rights for investors. Thus, instead of a minimum ticket size of several crores, they could participate with a minimal amount to broaden access.

In India, Edelweiss ARC is eyeing ₹6,000 crore in recoveries. If even a fraction of this were tokenized- ₹500 crore pool, liquidity could increase by around 30%. The RBI’s Central Bank Digital Currency (CBDC) trials are positioning the SR tokens as regulated securities, distinct from cryptocurrencies, aligning with GIFT City’s IFSCA guidelines.

Benefits Of Security Receipt Tokenization

For Investors

The Tokenization of Security Receipts can help to address the key pain points in the SR market, offering significant benefits, such as:

- Enhanced Liquidity

Traditional SRs rely on slow, costly OTC trading. Tokenized SRs enable 24/7 trading on digital exchanges, reducing transaction costs and enabling investors to enter or exit positions efficiently.

- Fractional Ownership

Tokenization lowers investment thresholds from crores to ₹10,000, enabling participation from NBFCs, HFCs, high-net-worth individuals (HNIs), and global investors via GIFT City. This broadens access and diversifies funding.

- Transparency and Efficiency

Blockchain’s immutable ledger provides real-time visibility into NPA performance. Smart contracts automate payouts, reducing disputes and administrative costs. This minimizes fraud risks inherent in manual processes.

- Regulatory Compliance

Tokens embed SEBI’s eligibility criteria and promoter restrictions, ensuring automated compliance. Blockchain data supports real-time monitoring by RBI and SEBI, addressing oversight challenges.

- Global Capital Access

IFSC platforms enable foreign investment, aligning India with the global RWA tokenization market, projected at $5 trillion by 2030 by McKinsey.

- Operational Efficiency

ARCs benefit from reduced administrative costs and accelerated resolution cycles, enhancing recovery rates. Digital processes align with Environmental, Social, and Governance (ESG) principles by minimizing paper usage.

For Platform Builders

Businesses building tokenization platforms for SRs in India can capitalize on a transformative opportunity, addressing market inefficiencies and establishing leadership.

- Market Leadership and Revenue Potential

Launching compliant tokenization platforms for Security Receipts (SRs) positions firms as early movers in India’s ₹1.5 lakh crore ARC market. Solving the liquidity gap makes such platforms commercially viable, generating income through transaction charges, subscription services, and data offerings. With SEBI reforms broadening investor access, an additional ₹2–3 lakh crore is expected to enter the segment by 2027, creating significant revenue opportunities.

- Strategic Partnerships

Progress will rely on strong partnerships. Collaborating with ARCs secures asset pools, while working with fintech firms ensures regulatory alignment and technical execution. Engagement with GIFT City’s IFSC exchanges provides international visibility, reinforcing credibility and attracting overseas investors.

- Technological Differentiation

Adopting blockchain architecture allows platforms to stand apart from conventional systems. Integration with banking infrastructure and depository networks, combined with real-time compliance reporting, transforms technology into both a differentiator and a trust-building mechanism.

- Scalability and Innovation

Sandbox pilots, similar to the RBI’s ongoing CBDC experiments, offer proof of concept and a pathway to scaling. Incorporating advanced cybersecurity and digital KYC reduces risks tied to fraud and compliance, instilling confidence among investors and regulators.

- ESG Alignment

Digitization of SR issuance and trading also advances environmental and governance goals. By reducing paper use and manual processes, tokenization platforms align with ESG priorities and strengthen their appeal to global funds increasingly committed to sustainable finance.

Develop blockchain-powered SR Tokenization platforms that attract global investors

SRs Tokenization: Understanding The Regulatory Landscape and Challenges in India

India’s regulatory framework balances innovation with oversight, addressing complexities in digital asset adoption.

Key Regulatory Bodies Monitoring SR Tokenization

- SEBI: Regulates SRs as securities under SARFAESI and the Securities Contracts (Regulation) Act, 1956 (SCRA), overseeing issuance and trading.

- RBI: Supervises ARCs and NBFCs, maintaining caution on digital assets to ensure systemic stability.

- IFSCA: Enables RWA tokenization pilots in GIFT City, facilitating global access.

- Digital India Act (Expected Late 2025): Anticipated to clarify tokenized asset classifications.

Compliance Obligations For SR Tokenization

- KYC/AML: Platforms must integrate Aadhaar and PAN-based verification per the Prevention of Money Laundering Act (PMLA).

- Taxation: Tokens classified as Virtual Digital Assets (VDAs) incur a 30% tax under the 2022 Finance Act, while securities attract a 12.5% capital gains tax, requiring clear delineation.

- Depository Oversight: NSDL and CDSL may manage token settlement and ownership records.

- RBI Norms: 2025 guidelines differentiate government-guaranteed SRs (lower capital provisioning) from standard SRs (NAV-based valuation).

Regulatory Challenges To Overcome

- Legal Clarity: Uncertainty over token classification persists until the Digital India Act is enacted.

- Interoperability: Blockchain integration with legacy banking systems requires hybrid solutions, addressing technological misalignment.

- Cybersecurity: Digital assets face hacking risks, necessitating advanced encryption and monitoring.

- Judicial Enforceability: The legal standing of smart contracts under the Indian Contract Act, 1872, remains untested.

Despite these hurdles, SEBI’s 2025 reforms and RBI’s regulatory sandbox, which have supported fintech pilots, provide a foundation for compliant tokenization.

Steps To Take into Consideration To Build a Compliance-First Structure for SR Tokenization

A structured approach ensures alignment with India’s regulatory framework.

Step 1 : ARC and SPV Establishment

ARCs acquire NPAs and establish an SPV trust under SARFAESI to issue SRs. These are digitized into tokens on a permissioned blockchain.

Step 2 : Token Design and Smart Contracts

Tokens represent fractional SR ownership. Smart contracts are programmed to:

- Distribute recoveries automatically.

- Restrict access to SEBI-defined qualified buyers.

- Enforce promoter exclusion per the 2025 notification.

Contracts are audited to comply with SEBI’s Issue of Capital and Disclosure Requirements (ICDR) standards.

Step 3 : Investor Onboarding

Platforms integrate RBI-approved digital KYC, linking Aadhaar and PAN for verification. Only qualified buyers are whitelisted, ensuring compliance with PMLA and SEBI regulations.

Step 4 : Listing and Trading

Tokens are listed on SEBI-approved ATFs or IFSC exchanges in GIFT City, facilitating domestic and global trading. Depositories (NSDL/CDSL) oversee settlement and ownership tracking.

Step 5 : Regulatory Reporting

Blockchain platforms provide real-time data feeds to RBI and SEBI for monitoring. Automated reporting ensures compliance with tax obligations, including capital gains.

Step 6 : Pilot and Scalability

Initial deployment occurs within RBI’s regulatory sandbox to validate compliance and functionality. Platforms scale post-validation, leveraging clarity from the Digital India Act.

Cost Considerations

Initial infrastructure costs, estimated at ₹50–100 crore, cover blockchain development, and compliance systems. Increased liquidity and foreign capital inflows, as seen in Edelweiss ARC’s 2025 pilot, offset these expenses.

Strategic Considerations for Stakeholders

ARCs, NBFCs, and platform developers should:

- Collaborate with fintech providers specializing in blockchain and regulatory compliance to navigate India’s legal landscape.

- Monitor RBI’s 2025 digital asset guidelines and SEBI’s implementation updates for strategic opportunities.

- Leverage GIFT City’s IFSC for global market access, aligning with international tokenization standards.

Lessons from International Markets for India’s SR Tokenization

1. Switzerland’s Success : Switzerland thrives with tokenized bonds with legal support and collaboration-India could boost this with RBI-SEBI teamwork.

2. U.K.’s Sandbox Approach : The U.K.’s digital securities sandbox builds trust. India’s regulatory sandbox could follow suit to attract investors.

3. UAE’s Global Reach : Dubai’s financial hub leverages global capital. GIFT City could mirror this, but India must tackle interoperability issues.

Begin with pilots, learn from cybersecurity lapses abroad, and educate investors. India’s NBFC network is a strength to build on.

Applying Global Insights to India’s Context

- Standardized Protocols : Europe’s blockchain standards can ease India’s banking integration challenges—a smart move for efficiency.

- Fintech Partnerships : Singapore’s incentives for fintechs suggest India should encourage ARCs like Edelweiss to innovate further.

- Investor Protection : The U.S. prioritizes transparency—India can enhance SEBI’s 2025 rules to build trust with better tools.

Businesses should build scalable, global-ready platforms, while investors diversify with tokenized SRs. With GIFT City’s reach, India can draw foreign capital now.

TakeAway

Tokenization of Security Receipts offers a transformative solution to the illiquidity challenges in India’s ₹10 lakh crore distressed asset market. Supported by SEBI’s 2025 regulatory expansion and RBI’s sandbox initiatives, it enhances liquidity, transparency, and access. Businesses developing tokenization platforms can lead this innovation, addressing investor and ARC pain points while unlocking significant market potential. Stakeholders acting promptly to build compliant, scalable solutions will shape India’s distressed debt market, driving financial innovation and economic value.