Executives today are asking a critical question: How can stablecoins transform enterprise payments in both B2C and B2B markets? The answer lies in their ability to combine speed, cost-efficiency, and compliance into a single, scalable framework. Stablecoin development is not just a technology play. It is a boardroom-level strategy that enables enterprises to modernize payment systems, unlock cross-border efficiency, and strengthen customer and partner trust. With stablecoin payment platforms gaining regulatory recognition across major markets, forward-thinking leaders are viewing stablecoins as an integral part of financial infrastructure, rather than an experimental add-on.

For decision-makers, the business case is clear: early adopters are already reporting significant reductions in transaction costs, improved liquidity management, and stronger market positioning. In this blog, we explore the strategic advantages of stablecoins across B2C & B2B operations, highlight market trends, and provide actionable insights to help executives evaluate the right stablecoin payment platform development solutions for their enterprise.

Market Momentum: Why Executives Are Betting on Stablecoin Development

The stablecoin market has experienced remarkable growth, driven by increasing adoption and growing interest from enterprises. These digital assets are increasingly supporting large-scale B2C and B2B transactions with speed, security, and reliability. Enterprises that leverage stablecoin payment platforms are already seeing improvements in efficiency, transparency, and cost reduction.

- Market size growth: From approximately $50 billion in circulation in 2020 to over $251.7 billion by mid-2025.

- Daily transaction volumes: USDT alone handles $20–25 billion daily, while total stablecoin transaction volume reached $5.7 trillion across 1.3 billion transactions in 2024, highlighting the scalability of stablecoin development.

- Investor confidence: Stablecoin companies raised $649 million in Q4 2024, including a $600 million investment in Tether from Cantor Fitzgerald, signaling strong belief in stablecoin development solutions.

- Cross-border remittance efficiency: Settlement times dropped from 43 hours to under 30 minutes (nearly 99% faster), with transaction costs reduced by 50–80% compared to traditional money transfer operators, showcasing the potential of stablecoin remittance solutions.

Regulatory clarity has improved globally, providing enterprises with a solid foundation to adopt stablecoin solutions:

- EU: MiCA framework fully operational as of December 2024.

- Singapore: Payment Services Act updated with explicit stablecoin licensing requirements.

- United States: GENIUS Act establishes federal stablecoin regulation.

- Other markets: The UAE and other progressive jurisdictions are developing supportive frameworks for stablecoin payment platform development.

The adoption of stablecoins is increasingly a strategic business imperative. Enterprises implementing these solutions report:

- Up to 40% reduction in transaction costs.

- 92% faster settlements, enhancing cash flow.

- Greater transparency across global supply chains using robust stablecoin payment platforms.

Major brands, including Ferrari, and traditional financial institutions now process billions in annual stablecoin volumes. Platforms such as BVNK handle over $15 billion annually in enterprise payments, underscoring the transformative potential of stablecoins for modern finance.

Your competitors are already saving millions with stablecoins. Why aren’t you?

The Business Case for Stablecoin Development Across B2C and B2B Payments

Consumer expectations and enterprise payment needs are evolving rapidly. Shoppers now demand instant transactions, low fees, and global accessibility. At the same time, enterprises handling high-value B2B transfers face delays, complex compliance requirements, and costly cross-border operations. Traditional payment systems often fail to meet these challenges, creating friction for both consumers and businesses. Modern payment demands are met through stablecoin payment platform development, enabling enterprises to enhance operational efficiency and deliver seamless experiences in both B2C and B2B payments..

For B2C payments, stablecoin payment rails offer tangible advantages:

- Instant settlement: Transactions are confirmed in near real-time, enhancing customer trust and satisfaction.

- Reduced costs: Removing intermediaries lowers fees and eliminates hidden charges that frustrate consumers.

- Global reach: Businesses can accept payments internationally without the complexity of currency conversion or delays.

Retailers and e-commerce companies are already leveraging these capabilities. Online marketplaces integrating stablecoin remittance solutions have reported faster refunds, fewer chargebacks, and stronger customer loyalty. By implementing such solutions, enterprises can transform payments into a strategic differentiator, improving conversion rates, repeat purchases, and overall brand perception.

Beyond consumer-facing benefits, stablecoins allow businesses to build enterprise-grade infrastructure that is secure, compliant, and scalable. These platforms enable companies to integrate blockchain-enabled payments into existing systems, providing a foundation for future expansion and digital innovation.

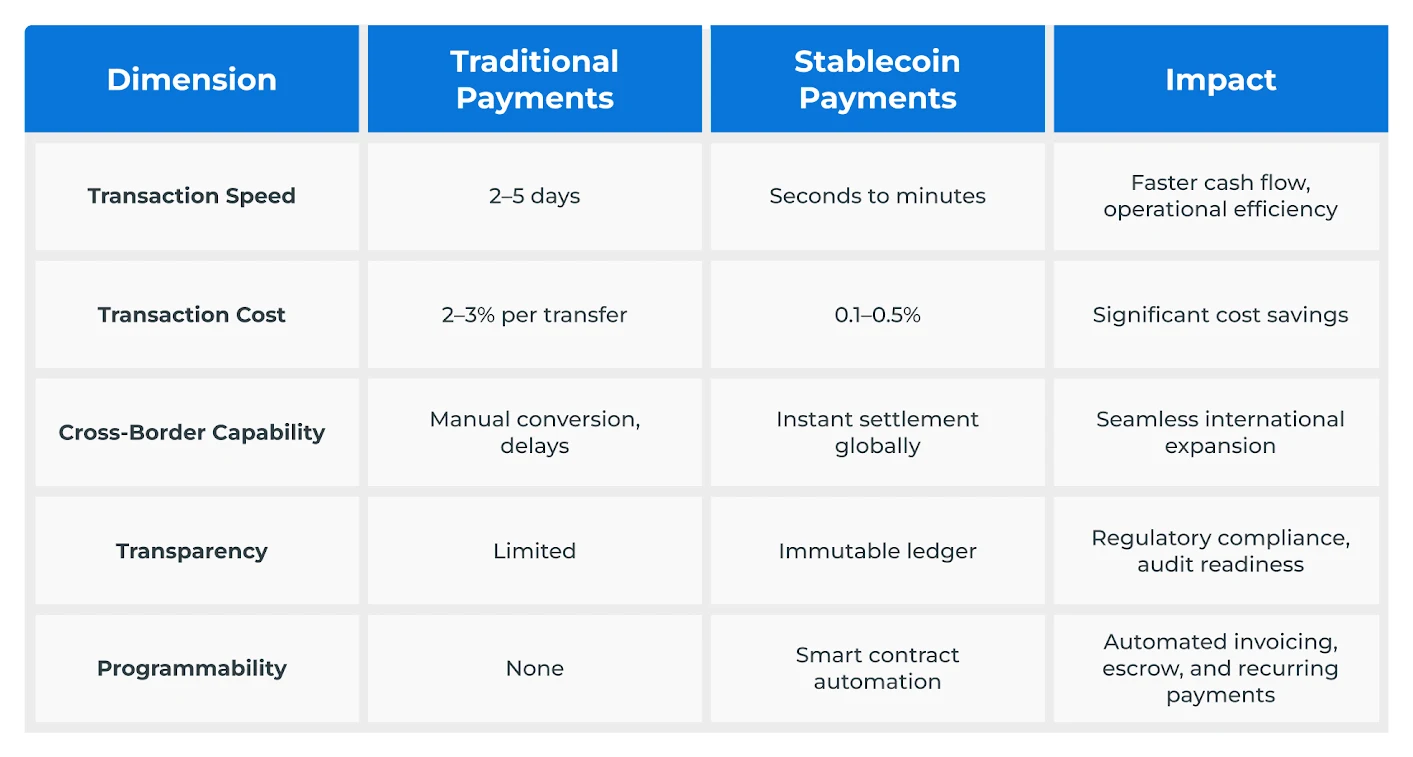

For B2B payments, stablecoins provide strategic and operational advantages:

- 24/7 transaction capability: Unlike traditional banking networks, Stablecoin Payment Rails support round-the-clock settlements, freeing up working capital and improving liquidity management.

- Programmable payments via smart contracts: Businesses can automate invoicing, recurring payments, and escrow functionality using enterprise-grade Stablecoin Payment Platforms.

- Transparency and auditability: Blockchain-based stablecoins provide immutable records for every transaction, helping organizations maintain regulatory compliance and financial integrity while leveraging Stablecoin Remittance for cross-border payments.

Logistics companies adopting stablecoin settlements are seeing significant cost savings. In one case study, an enterprise achieved a 40% reduction in expenses by eliminating intermediary fees and avoiding repeated foreign exchange conversions, streamlining cross-border transactions while improving overall operational efficiency.

Executives recognize stablecoins as more than just a payment mechanism. They function as a strategic lever to enhance resilience, enable international scalability, and uphold compliance standards. Implementing stablecoin remittance solutions empowers enterprises to respond dynamically to market disruptions, maintain strong financial controls, and achieve sustainable growth.

92% faster. 40% cheaper. 100% ready. Build your stablecoin rails today!

The Strategic Payoff of Optimized Stablecoin Payment Rails

The shift to stablecoin payment platforms represents more than backend innovation. It is a strategic investment that provides measurable business outcomes for both B2C and B2B operations.

Investing in stablecoin development solutions allows enterprises to reduce operational costs, accelerate settlement, and strengthen compliance, all while creating a superior customer and partner experience. For executives, the ROI is not only financial. It is strategic, reinforcing competitive positioning and signaling innovation to stakeholders.

Selecting the Right Stablecoin Payment Platform Development Company

The choice of a partner for stablecoin initiatives is a strategic decision at the boardroom level. Selecting the right stablecoin development company can be the difference between a smooth rollout and costly delays. Executives should evaluate providers on the following criteria:

- Regulatory alignment: Can the company ensure solutions comply with global financial and regulatory frameworks?

- Multi-chain expertise: Does the provider support multiple blockchain networks for scalability and resilience?

- Enterprise-grade security: Are the systems designed to withstand cyber threats and operational risks?

- Integration capabilities: Can stablecoin solutions be seamlessly integrated with existing ERP, treasury, and CRM systems?

- Long-term support: Does the partner offer ongoing compliance monitoring, upgrades, and support?

This structured evaluation ensures that stablecoin adoption delivers tangible business value while reducing risk. For both B2B and B2C operations, having a trusted and stablecoin payment platform development partner translates into faster deployment, higher reliability, and strategic confidence.

An Executive Takeaway

Stablecoins are no longer just a payment innovation. They are a strategic lever for modernizing enterprise finance, shaping the future of both B2C and B2B transactions. In consumer-facing operations, they elevate customer experience, reduce friction, and enable global reach. In enterprise ecosystems, they strengthen liquidity management, accelerate cross-border settlements, and deliver unmatched compliance transparency.

Forward-thinking enterprises that adopt a stablecoin payment platform development today secure first-mover advantages, operational efficiency, and market credibility. Waiting means not only higher costs but also losing ground to competitors already leveraging blockchain-powered payment rails. For executives evaluating stablecoin adoption, the partner you choose determines your success. Antier, a globally recognized stablecoin development company, delivers end-to-end solutions to build secure, compliant, and scalable stablecoin infrastructure. Partner with us to modernize your payment systems, unlock measurable ROI, and position your enterprise at the forefront of digital finance.