In an era where raising capital via token issuance is no longer sufficient, the quality of your ICO development is judged by how well your project integrates fundamental DeFi protocols. For executives and decision-makers assessing partners for token development, knowing how DeFi works strategically can mean the difference between an ICO that merely raises funds and one that builds enduring value.

This blog examines the key factors that DeFi protocols impact on fundraising success, token stability, and investor trust. It also outlines actionable criteria leaders can use to evaluate partners and strategies for effective ICO development.

Why DeFi Protocols Are Central to ICO Success

The numbers now make the case even clearer. In 2025, finance projects, including DeFi, command 39 % of total ICO funding. This represents the single largest sector share, reflecting investor confidence in DeFi protocols and their utility-driven token models. The broader market is equally robust. Total ICO funding has reached USD 38.1 billion this year across 1,096 launches, with an average raise of USD 5.4 million per project. Roughly 75 percent of capital is allocated to ICO development and operations, 15 percent to legal contingency, and 10 percent to marketing and community outreach.

On the DeFi side, the underlying ecosystem continues to expand. While figures showed USD 123.6 billion in TVL, by mid-September that number had risen to USD 140.6 billion, a 13.8 percent increase in just a few months. Some sources even report peaks above USD 160 billion, the highest levels since May 2022. Success rates also tell an important story. Although granular verification is still ongoing, DeFi-oriented ICOs consistently outperform other sectors thanks to utility-driven token models, proven product-market fit, strong governance participation, and rising institutional adoption supported by new regulatory clarity such as the GENIUS Act and CLARITY Act.

These dynamics confirm your core thesis: ICO development without deep DeFi integration is no longer optional but a competitive disadvantage. The DeFi sector’s evolution from experimental code to essential financial infrastructure has created a virtuous cycle where proven utility attracts capital, which in turn funds further innovation and adoption.

See why some ICOs outperform others every single time

Key DeFi Protocol Elements That Drive ICO Development Success

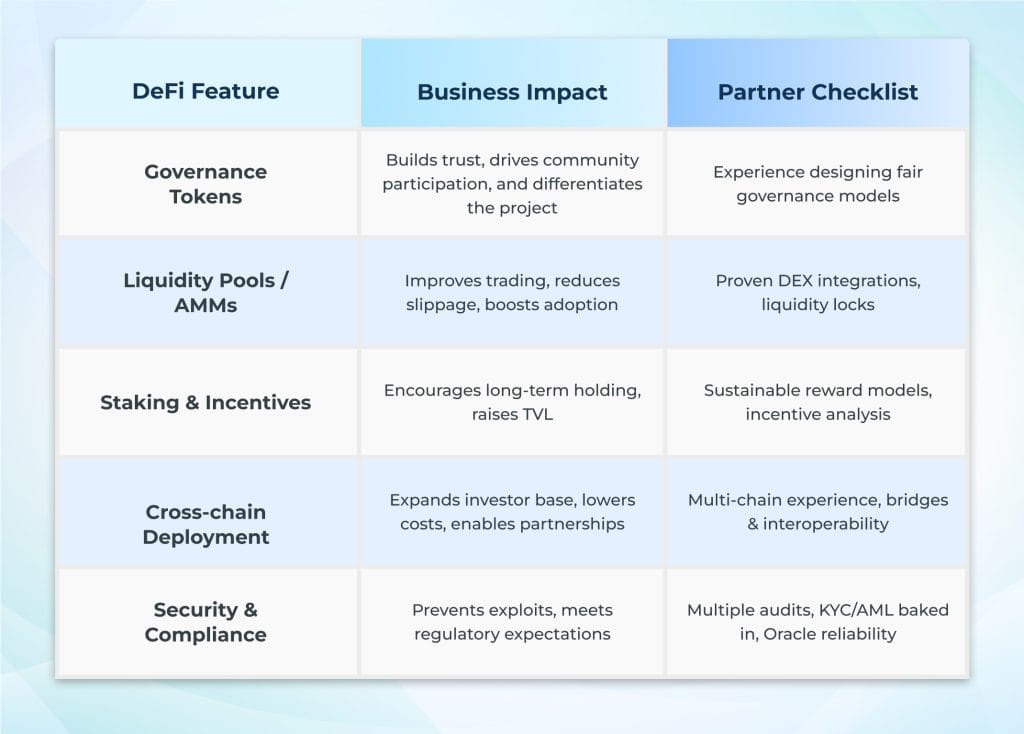

Below are the specific DeFi elements that executives should evaluate or require from an ICO development company when designing a token or raising capital.

How DeFi Protocols Improve Key Success Criteria in ICO Development

For senior decision-makers evaluating ROI, risk, and market positioning, these are the critical advantages of weaving DeFi mechanisms directly into your ICO development strategy:

1. Accelerated and More Reliable Fundraising

Projects can draw in a wider and more diversified investor base by embedding incentive models such as staking, AMMs, or yield farming at launch. This not only speeds up capital acquisition but also enhances confidence among early backers. Studies show offerings supported by DeFi or specialized crypto funds consistently hit funding milestones more quickly.

2. Enhanced Token Valuation and Post-Launch Resilience

Tokens designed around genuine DeFi functionality exhibit stronger price stability after the offering. Built-in liquidity pools and decentralized governance mitigate sharp sell-offs, while metrics such as TVL and protocol revenues become positive signals for valuation growth.

3. Distinctive Market Positioning and Community Confidence

A well-architected DeFi layer signals that a token is a functioning component of financial infrastructure rather than a speculative instrument. This design approach differentiates a project in an increasingly crowded marketplace and cultivates long-term community trust.

4. Alignment with Regulatory and Institutional Standards

Institutional investors scrutinize governance models, audit trails, and risk controls before deploying capital. Integrating DeFi protocols with these elements during ICO development significantly improves a project’s ability to pass due diligence and attract blue-chip partners.

5. Built-In Scalability and Longevity

Modern DeFi protocols are engineered for modular upgrades, composability, and seamless cross-chain operations. Projects that adopt these principles from the outset are better equipped to adapt to market cycles, regulatory changes, and emerging technologies, ensuring greater durability over time.

Attract top investors with a DeFi-driven ICO launch today

Common Pitfalls & How to Avoid Them

1: Excessive Incentives Without Real Utility: Very high rewards can draw attention, but often collapse once incentives end. Design sustainable reward structures before launch.

2: Poorly Structured Token Allocation: Uneven allocations or rapid inflation erode credibility and price stability. Ensure transparent, balanced distribution and clear vesting schedules.

3: Inadequate Liquidity and Market Access: Tokens that are hard to trade or lack deep pools lose momentum fast. Build liquidity mechanisms and exchange access into the rollout plan.

4: Insufficient Security and Transparency: Unpatched vulnerabilities or opaque governance can destroy investor trust overnight. Independent audits, time-locks, and open reporting are essential safeguards.

5: Weak Compliance and Regulatory Planning: Rules vary across markets. Classify tokens correctly and integrate KYC/AML from the start to avoid costly setbacks.

Strategic Advice: DeFi-First Mindset for ICO Development

For organizations planning to launch a token or conduct a fundraising round through ICO:

- Map out the DeFi protocols and integrations your project truly needs before structuring the sale. This ensures your ICO development is built on real use-case value, trust, and market advantage.

- Overly generous yields invite inflation, while weak rewards fail to draw participants. Model different scenarios across one- to three-year horizons to calibrate sustainable growth.

- Clear data, thorough audits, and public token supply schedules cut investor friction and support premium valuations.

- Market conditions, regulatory rules, and chain ecosystems evolve quickly. Smart contracts and tokenomics that allow pivots or parameter changes add resilience.

- Conduct independent audits, set up upgrade paths, protect governance from capture, and plan for liquidity or market shocks well before launch.

Choosing a seasoned ICO development company that understands DeFi-first strategies will help translate these principles into a launch that is not only compliant but also market-ready and investor-focused.

Conclusion

In today’s global crypto economy, the difference between a token that fades after its ICO and one that becomes a market mainstay is not in the size of your whitepaper but in how fully DeFi is embedded into your strategy. ICO development without deep DeFi protocol integration is a risk you cannot ignore. The right ICO partner will bring tokenomics, governance, security, interoperability, and metrics to the table.

For leaders seeking a trusted service provider for ICO development that combines strategic foresight, technical excellence, DeFi protocol mastery, and post-launch support, our firm is ready to deliver. Elevate your token launch with a partner who knows not just how to build, but how to win. Contact us to explore how Antier, a leading ICO development company, can be that partner.