Table of Contents

- Introduction: The Rise of Cold Wallet Cards

- Why 2025 Is the Year for Cold Crypto Wallet Cards

- Adoption Trends in Cold Wallets: A Global Surge in Self-Custodial

- Competitive Landscape

- Security, Portability & Compliance: Why They Matter

- Cold Wallet Card vs. Hot Wallet: What’s Best for You?

- White Label Cold Crypto Wallet Card: A Business Opportunity

- Crypto Wallet Card Development: Key Features to Build

- Final Thoughts & Market Forecast for Cold Wallet Cards

- Get Started: Build Your Own Wallet with Antier

Introduction: The Rise of Cold Wallet Cards

As the Web3 ecosystem matures, digital asset security has become non-negotiable. Cold crypto wallet cards, physical devices that store private keys offline, are seeing a dramatic rise in adoption due to their enhanced protection from cyber threats.

In 2025, these cards are no longer just a geeky gadget for Bitcoin maximalists. They’re evolving into sleek, bank-grade products with NFC support, PIN protection, and biometric integration, backed by both crypto-native startups and financial institutions.

Whether you’re an investor looking for security or a business exploring white label crypto wallet card development, this blog will walk you through the trends, top products, and market opportunities.

Why 2025 Is the Year for Cold Crypto Wallet Cards

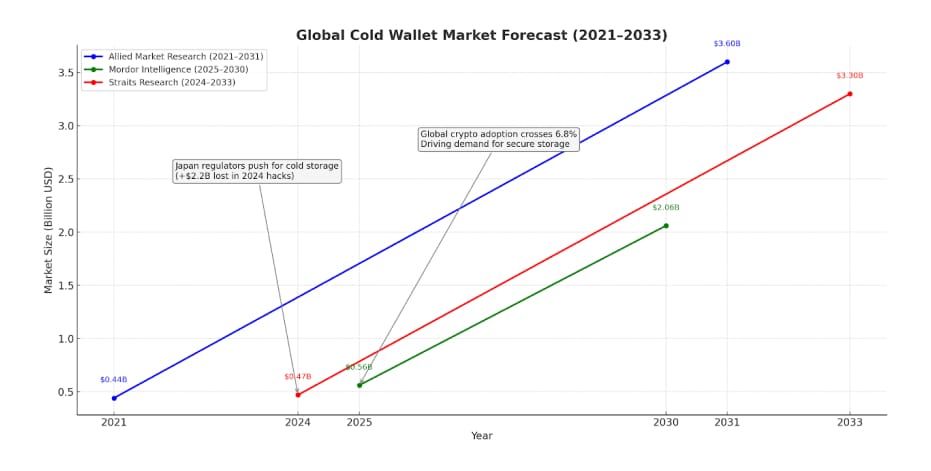

The market for offline (“cold”) crypto wallets including card-shaped wallets is booming. Analysts project double- or triple‑digit growth over the next decade.

Key Takeaways – Cold Wallet Market Trends (2025 & Beyond)

- Cold wallet market expected to grow from $0.44B (2021) to $3.6B (2031) – CAGR of ~23.7% (Allied Market Research).

- Hardware wallet segment projected to expand from $0.56B (2025) to $2.06B (2030) – CAGR of ~29.9% (Mordor Intelligence).

- Cold wallet market likely to reach $3.3B by 2033 from $469M in 2024 – CAGR of ~24.2% (Straits Research).

- Crypto adoption has reached ~6.8% of the global population, accelerating demand for self-custody and cold storage.

- Over $2.2B in crypto lost to exchange hacks in 2024 alone, pushing users toward safer cold wallet options.

- Japan’s Finance Ministry now recommends cold wallets for consumer fund storage on exchanges – hinting at future regulatory mandates globally.

More Insights :

- As of Q2 2025, over $3.8 billion worth of crypto assets are stored using hardware wallet solutions, with cold wallet card formats accounting for a 19% share.

- Ledger, Trezor, and Keystone are leading brands, but newer players like Tangem and CoolWallet Pro are rapidly gaining ground.

- The crypto wallet hardware market is expected to grow at a CAGR of 24.2% between 2024–2028, reaching $8.1 billion by 2028.

The surge is driven by rising hacks in hot wallets, institutional onboarding of crypto, and growing interest in self-custody solutions.

Adoption Trends in Cold Wallets: A Global Surge in Self-Custody

As the global crypto ecosystem matures, both retail and institutional participants are shifting toward secure self-custody solutions, with cold wallets gaining significant traction. The collapse of centralized exchanges, regulatory scrutiny, and increasing financial literacy have driven users to take control of their assets. Hardware-based crypto wallets—especially card-style and white-label solutions—are emerging as the preferred option due to their portability, tamper-proof design, and enhanced security protocols. These trends are not only reshaping user behavior but also creating immense opportunities for developers and wallet solution providers worldwide.

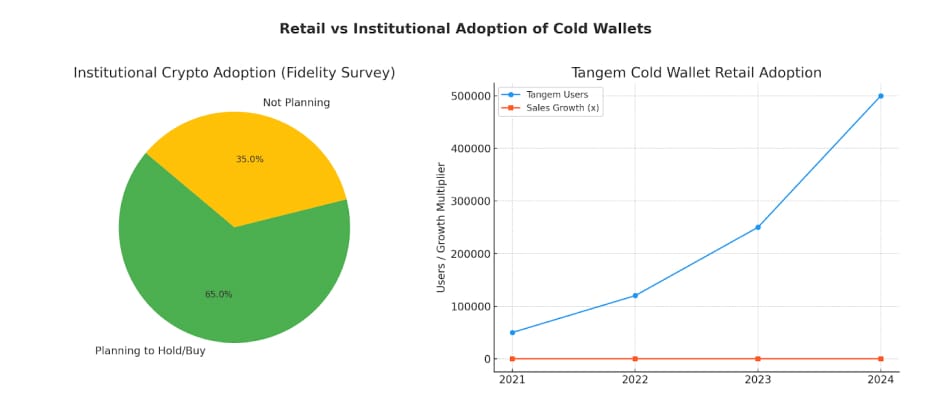

1. Retail vs Institutional Adoption

- 65% of institutional investors (Fidelity Digital Assets) plan to buy/hold crypto, signaling strong need for secure cold storage.

- Tangem card wallets (retail cold wallets) now serve 500,000+ users in just 3 years with 5× sales growth in late 2024—especially in North America and Europe.

2. Regional Growth Highlights

- Asia-Pacific leads in adoption due to rising digital payments.

- North America & Europe show high retail demand (e.g. US, Germany, France, UK, Australia).

- Emerging markets like Latin America & Africa grow due to inflation/currency instability.

3. Regulatory Drivers

- Japan’s financial regulator mandates cold wallet usage for exchanges.

- Crypto-friendly nations offer guidelines supporting self-custody.

- However, strict KYC/AML rules in some jurisdictions may hamper hardware wallet expansion.

Competitive Landscape

Key cold‑wallet cards and devices vie for market share. For example :

Security, Portability & Compliance: Why They Matter

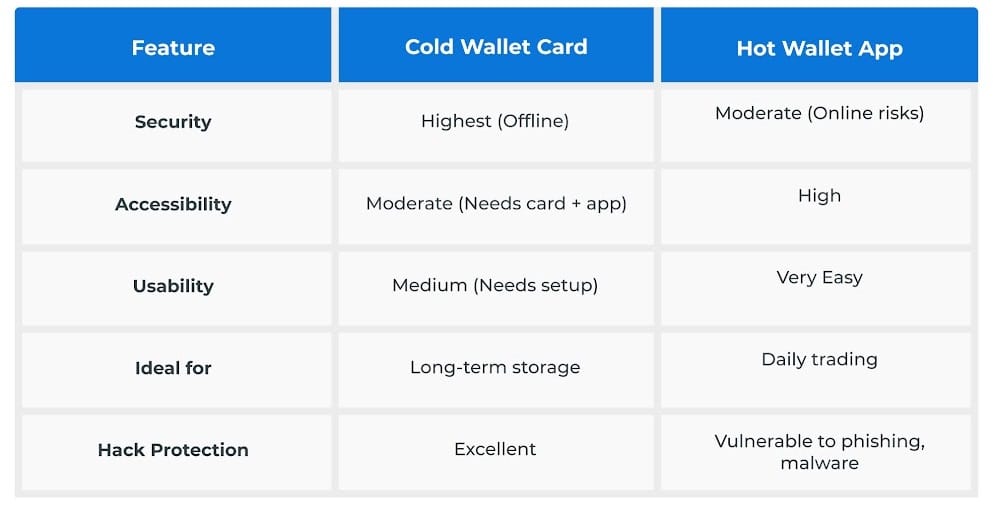

Cold wallet cards eliminate internet-based attack surfaces by ensuring private keys never leave the device or touch online systems. This makes them immune to:

- Phishing

- SIM swap attacks

- Malware-based keyloggers

With NFC support, these cards can be used directly with mobile devices, while advanced models allow for multi-sig authentication, self-destruct mechanisms, and regulatory compliance features like KYC linkage.

In 2025, several countries, including UAE, Singapore, and Switzerland, have proposed frameworks that encourage self-custody options with compliance layers, making cold wallet cards a future-proof choice.

Cold Wallet Card vs. Hot Wallet: What’s Best for You?

Verdict : Use a cold wallet card for high-value, long-term storage and compliance needs. Keep a hot wallet for low-value, daily trading purposes.

White Label Cold Crypto Wallet Card: A Business Opportunity

With the rise in demand, businesses are now looking to offer branded wallet cards as part of their Web3 product line.

Antier’s White Label Crypto Wallet Card Solution includes :

- Custom NFC-enabled wallet card manufacturing

- Brand customization with your logo/design

- Backend wallet infrastructure (multi-chain support)

- Mobile app integration for user access

- KYC/AML and compliance module

- User onboarding, PIN/biometric security

Use Cases :

- Crypto exchanges offering secure user wallets

- Web3 projects issuing branded hardware wallets

- DeFi platforms enhancing user security

This is not just a tech solution—it’s a marketing tool, brand asset, and revenue stream.

Crypto Wallet Card Development: Key Features to Build

When building your own wallet card system, here are features you must include in 2025:

- ✅ NFC and Mobile App Support

- ✅ Biometric Authentication (linked to app/device)

- ✅ Multi-Chain Asset Support

- ✅ Seedless Recovery using multiple cards or PINs

- ✅ Tamper-Proof Hardware with secure chip certification

- ✅ Regulatory Modules for KYC/AML

Antier provides end-to-end crypto wallet development services, including firmware, UI/UX, compliance integration, testing, and mass card deployment.

Final Thoughts & Market Forecast for Cold Wallet Cards

The cold wallet card market is no longer niche—it’s the future of mainstream crypto storage.

Final 2025 Forecast :

- Cold wallet card adoption expected to cross 15 million users by end of 2025

- Institutional clients (hedge funds, DAOs, Web3 enterprises) forming 35% of demand

- More than 40 new white-label wallet card projects are estimated to launch this year alone

Whether you’re a startup, exchange, or Web3 innovator—this is the time to secure your users and elevate your brand with a cold wallet card solution.

Get Started: Build Your Own Wallet with Antier

Looking to offer a secure, stylish, and compliant cold wallet card under your brand?

✅ Talk to our experts today and discover how Antier’s white-label crypto wallet card development can give you a first-mover advantage in 2025’s most secure trend.