Enterprises handling 97% of global B2B cross-border payments are increasingly abandoning credit card infrastructure. Rising fees, slow settlements, and hidden intermediary costs are prompting businesses to seek faster and more efficient alternatives. With real-time payment systems now active in over 70 countries, enterprises have a clear opportunity to adopt stablecoin payment rails. These rails provide near-instant settlements, lower transaction costs, and complete transparency, enabling businesses to streamline operations, improve cash flow, and maintain strategic flexibility in an increasingly competitive global market.

In this guide, we explore why credit cards are losing ground, how stablecoin payment rails outpace traditional networks, and the strategic steps enterprises can take to transition to a modern, future-ready payment infrastructure.

Why Credit Cards Are Losing Ground in Cross-Border Payments

Credit cards have long been the default for global transactions, but their costs and inefficiencies are becoming increasingly burdensome for businesses and consumers alike.

“The global cross-border payments market, estimated at $206.5 billion in 2024 and expected to grow to $414.6 billion by 2034, is rapidly moving away from traditional credit card-based solutions in favor of advanced digital payment methods.”

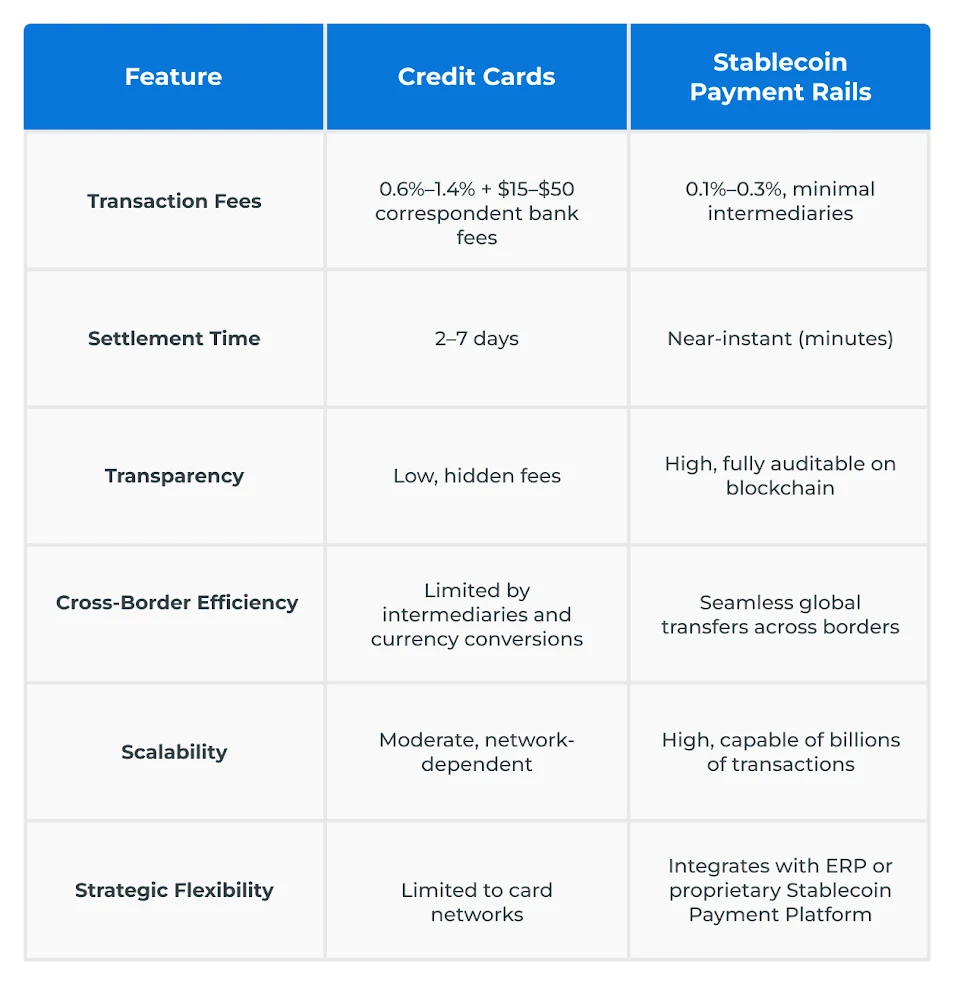

Mastercard’s cross-border fees range from 0.6% to 1% of the purchase amount, while Visa charges between 1% and 1.4% per transaction. In addition to this, correspondent bank fees typically range from $15 to $50 per transaction, with some cases reaching up to $40. These intermediary costs, combined with network fees, create a costly, slow, and opaque payment infrastructure that erodes margins and complicates cash flow management.

For enterprises executing frequent cross-border transactions, relying solely on credit cards can reduce operational efficiency and limit strategic flexibility. While traditional credit cards struggle with cost and speed, stablecoin payment rails are emerging as a faster, more transparent alternative. By leveraging a stablecoin payment platform, organizations can begin exploring ways to streamline global payments, reduce fees, and improve settlement times.

How Stablecoin Payment Rails Outpace Credit Cards?

Credit cards, though familiar, are increasingly ill-suited for modern cross-border commerce. High fees, delayed settlements, and hidden intermediary costs create friction that erodes margins, slows cash flow, and limits strategic flexibility. Forward-thinking enterprises are seeking alternatives that offer speed, transparency, and efficiency, and stablecoin payment rails deliver precisely that.

In 2024, the stablecoin market processed $5.7 trillion across 1.3 billion transactions, and adoption continues to surge. Experts predict that stablecoins could capture 20% of global cross-border payments by 2029, representing a $60 trillion opportunity for businesses willing to embrace digital-first payment infrastructure. The limitations of credit cards have created a pressing need for smarter, faster, and more transparent cross-border payment solutions, making stablecoin payment rails increasingly attractive to enterprises.

Key Advantages of Stablecoin Payment Rails

Adopting stablecoin payment rails provides enterprises with a strategic edge over traditional payment methods:

- Significantly Lower Costs: Leveraging a stablecoin payment platform and on-chain efficiency reduces intermediaries and cuts transaction fees dramatically.

- Instant Settlement: Funds are transferred in minutes, improving cash flow and operational efficiency across global operations.

- Full Transparency: Blockchain-based stablecoin remittance solutions ensure traceable, tamper-proof transactions, simplifying audits and regulatory compliance.

- Global Reach: Operates without correspondent banks, enabling seamless international transfers across multiple currencies.

- Scalable Infrastructure: Supports billions of transactions efficiently, ensuring enterprise growth without bottlenecks.

- Strategic Flexibility: Easily integrates with existing systems or proprietary platforms, providing operational control, customization, and long-term agility.

See how stablecoin rails can work for your enterprise.

Executive takeaway: By implementing stablecoin payment rails, enterprises gain faster, cheaper, and fully transparent cross-border payment capabilities, advantages that credit cards cannot match and that position businesses for long-term strategic growth.

Strategic Steps to Transition From Credit Cards to Stablecoin Payment Rails

Enterprises can follow these key steps:

1. Assess Current Payment Infrastructure

Evaluate transaction volumes, cross-border fees, settlement times, and operational bottlenecks caused by credit cards. Identify areas where digital rails can improve speed and reduce costs.

2. Define Objectives and ROI Metrics

Set clear goals such as faster settlements, improved cash flow, enhanced transparency, and overall operational efficiency.

3. Pilot Implementation

Begin with limited use cases or select cross-border corridors—track performance, speed, and integration efficiency before a full-scale rollout.

4. Platform Selection and Integration

Choose a reliable payment platform that offers security, scalability, and compliance. Integrate it seamlessly with ERP, POS, and financial systems.

5. Training and Stakeholder Alignment

Educate finance teams and operational managers on processes, reporting, and governance to ensure smooth adoption.

6. Scale and Optimize

Expand usage across business units or regions. Monitor performance metrics, optimize workflows, and refine processes for maximum efficiency.

7. Continuous Improvement

Stay updated on regulatory changes and market trends. Flexible platforms allow enterprises to adapt and maintain a competitive edge.

By following these structured steps, enterprises can move beyond credit cards to a faster, more cost-efficient payment infrastructure, improving transparency, cash flow, and strategic flexibility in global operations.

See how stablecoin rails improve cash flow instantly

Key Criteria for Choosing a Stablecoin Payment Platform for Enterprises

- Integration Flexibility: The platform should seamlessly connect with existing ERP, POS, and financial systems, allowing for smooth adoption without disrupting operations.

- Security and Compliance: Robust KYC/AML protocols, data protection, and adherence to regional regulations are essential to minimize risk and ensure regulatory alignment.

- Liquidity and Conversion Options: Access to multiple fiat-stablecoin pairs and reliable conversion mechanisms ensures uninterrupted transactions and efficient cash management.

- Scalability: The platform must support increasing transaction volumes and enterprise growth without latency or performance issues.

- Transparency and Auditability: Blockchain-enabled platforms offer traceable, tamper-proof records that simplify audits and strengthen financial reporting.

- Operational Efficiency: Evaluate transaction costs, settlement speed, and fee structures to ensure the platform delivers tangible business value.

A platform that allows for customization, integration with proprietary systems, or deployment of stablecoin remittance solutions provides long-term adaptability and competitive advantage.

The Future Belongs to Payment Rails, Not Plastic

For executives evaluating the future of payments, stablecoin payment rails present a clear strategic advantage over credit cards. Lower transaction costs, faster settlement, and full transparency are not just technical upgrades; they are boardroom-level priorities that improve margins, liquidity, and global reach.

Enterprises that act now position themselves ahead of competitors, while those that wait risk being locked into outdated and costly systems. This is where Antier, a global leader in blockchain-driven payment solutions, steps in. With proven expertise in building enterprise-grade stablecoin payment rails, we help businesses transition seamlessly from legacy card networks to scalable, transparent, and future-ready infrastructures.

If you’re an enterprise leader ready to future-proof your payment strategy, connect with us today and unlock measurable ROI through stablecoin payment rails.