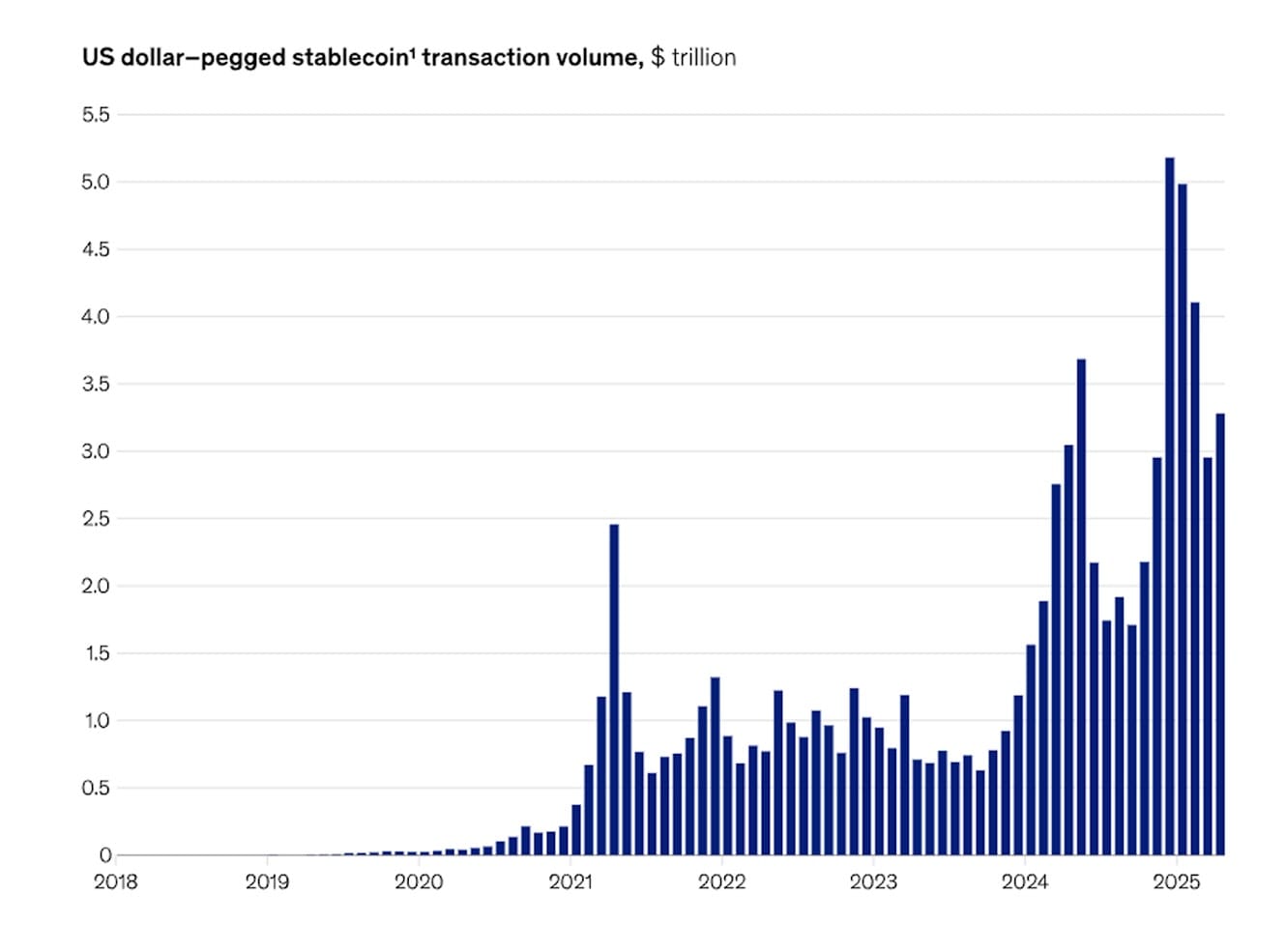

The way we think about money and payments is evolving faster than ever before, and stablecoins are at the heart of this transformation. Once a niche crypto concept, stablecoins now move more value every year than the combined networks of Visa and Mastercard, $27.6 trillion in 2024 alone. Backing this growth is the Genius Act, a proposed law that aims to enshrine 1:1 reserve requirements nationwide, offering businesses and consumers alike much-needed clarity and protection.

Source: McKinsey & Company

The stakes are high because stablecoins blend the speed and transparency of blockchain with the reliability of traditional currency, and that combination is rewriting the rules of payments and finance. If your business is still sleeping on stablecoins, you’re missing out on what could be the biggest wave of digital money since the internet went mainstream. From cross-border transactions to Stablecoin Payment Platform development that powers next-generation e-commerce and B2B solutions, the opportunities are expanding at lightning speed.

In this blog, we’ll break down the real business use cases of stablecoins in 2025 and show you why companies that move early gain a competitive edge. If you’re considering adopting stablecoins, the insights below will help you connect the dots between technology and measurable ROI.

Why Are Stablecoins Becoming Mission-Critical for Businesses in 2025?

Once seen as a niche corner of the crypto market, stablecoins are now surging to the forefront of global finance. Their ability to combine price stability with blockchain efficiency is attracting unprecedented adoption from both institutions and everyday users.

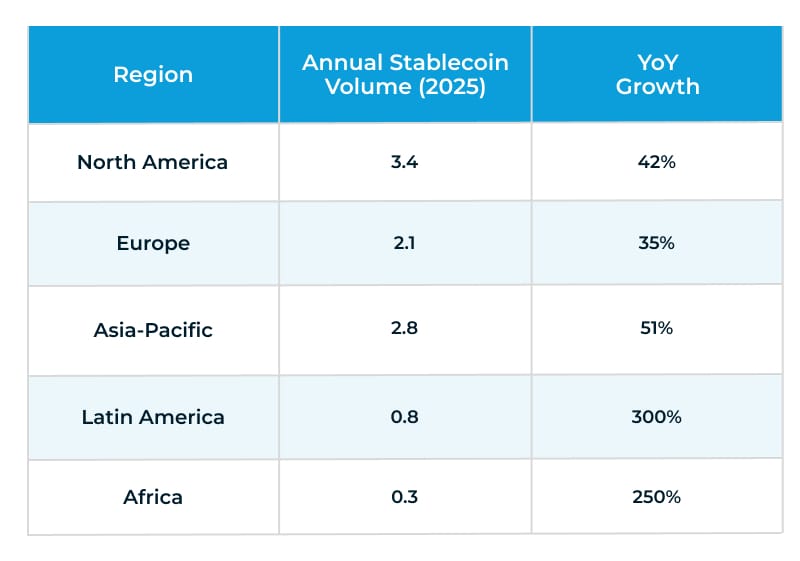

Stablecoins have regained strong momentum in 2025, with global market capitalization climbing to $252 billion. In emerging markets like Latin America and Africa, stablecoin payment volume grew by over 200% YoY, driven largely by cross-border trade and e-commerce penetration.

Source: Perplexity

This growth is not just consumer-driven; Fortune 500 companies are piloting stablecoin-based vendor payments, government agencies are trialing stablecoin tax settlements, and institutional investors are launching stablecoin-denominated funds. 58% of European financial institutions are using or planning to use stablecoin payments, reflecting a broader shift toward blockchain-powered settlement systems that reduce transaction costs, enhance transparency, and enable near-instant cross-border transfers. Public sector adoption is also rising, with nine countries currently running stablecoin-enabled tax or subsidy pilots. Institutional interest is accelerating as well.

The convergence of corporate, governmental, and institutional adoption signals that stablecoin development is no longer an experimental technology. They are becoming a core component of financial infrastructure, reducing settlement times from days to seconds, cutting transaction costs by up to 70%, and enabling programmable features that traditional fiat systems cannot match. For decision-makers, this means faster settlements, reduced costs, and access to new opportunities in the digital economy.

Top Stablecoin Use Cases in 2025 at a Glance

1. Cross-Border Payments and Remittances

Why it matters: International money transfers through traditional channels can take several days, incur fees of up to 7%, and involve multiple intermediaries. These delays can disrupt supply chains, payroll cycles, and family remittances.

The Edge:

- Instant global transactions with settlement in seconds

- Lower transfer fees compared to SWIFT or correspondent banking

- No dependency on overlapping bank networks

Example: Migrant workers can now send money home via a stablecoin remittance platform, ensuring families receive funds instantly. Corporations paying overseas contractors can reduce transfer costs significantly while maintaining compliance through built-in KYC and AML checks.

For fintechs and enterprises involved in global transactions, stablecoins offer a direct means to reduce costs and mitigate currency volatility.

2. Merchant and Retail Payments

Why it matters: Merchants lose revenue to payment processing fees, chargebacks, and currency conversion costs. These inefficiencies reduce margins, especially for global businesses.

The Edge

- Accept payments worldwide without exchange rate volatility.

- Faster settlements improve cash flow.

- Chargeback risks are eliminated through the blockchain’s immutable nature.

Example: By utilizing a stablecoin payment platform for development, an e-commerce brand can offer checkout options in stablecoins alongside traditional methods.

3. Corporate Treasury and Liquidity Management

Why it matters: Treasury teams need secure, real-time control over working capital while optimizing returns on idle funds. Traditional instruments often lock capital away or involve settlement delays.

The Edge

- Instant access to funds for operational needs

- Ability to earn yields through blockchain-based money markets

- Full transaction transparency for auditing and compliance

Example: Stablecoin development services empower banks and fintechs to design treasury solutions where CFOs can shift funds into yield-bearing stablecoin products overnight, then access them instantly for payroll or vendor payments the next day.

4. E-commerce and Airline Settlement Systems

Why it matters: Global merchants and service providers face delays and high costs when settling international transactions. This slows down revenue recognition and creates working capital strain.

The Edge

- Near-instant settlement of high-volume transactions

- Reduced reliance on intermediaries that take a percentage of revenue

- Seamless integration with ERP and booking systems

Example: Airlines can process ticket payments instantly and avoid the settlement delays common in travel industry payment clearinghouses. E-commerce platforms using custom stablecoin payment solutions can manage vendor payouts instantly, improving supplier relationships and reducing disputes.

5. Government and Institutional Programs

Why it matters: Public sector transactions require secure, transparent systems for disbursement, taxation, and compliance. Manual processes increase administrative overhead and delays.

The Edge

- Transparent, traceable transactions for auditing

- Faster distribution of subsidies, grants, or benefits

- Reduced leakage of funds through corruption or inefficiency

Example: A stablecoin development company can design a tax payment platform where citizens pay in stablecoins, enabling real-time settlement into government accounts with complete audit trails.

6. Tokenized Loyalty and Rewards

Why it matters: Traditional loyalty points are restricted to specific brands and often expire unused. This limits their perceived value.

The Edge

- Rewards can be redeemed across multiple merchants.

- Customers can transfer or trade rewards, increasing engagement.

- Tokens can generate returns if staked or held.

Example: Businesses can launch branded loyalty programs powered by stablecoins, giving customers flexible, valuable rewards and fostering deeper brand loyalty.

Understanding the possibilities is step one; turning them into reality starts with the right stablecoin development company.

Why Waiting Could Cost You More Than You Think

In 2025, stablecoins aren’t a “future trend” anymore. They’re here, they’re working, and they’re quietly giving early adopters a serious edge. Every month you hold back, your competitors could be moving faster, cutting payment costs, and reaching customers in places you haven’t even explored yet. The danger with waiting? You won’t notice the gap until it’s too late. First movers will have secured the best partners, built brand trust in the digital payment space, and fine-tuned their operations while you’re still in the planning phase. By then, catching up will take more effort, more money, and more time.

The smart move is getting your strategy in place now, with a leading stablecoin development company that knows how to take you from concept to launch without the usual roadblocks. Whether it’s stablecoin payment platform development, treasury integration, or custom cross-border payment solutions, Antier will put you ahead of the curve. In this market, waiting isn’t “playing it safe.” It’s handing the advantage to someone else. The key to staying ahead lies in choosing a partner who understands both the technology and the business, and that partner is Antier.