Finance is not actively a Real-World Asset Tokenization Platform solution and turning its assets into digital tokens that can be traded quickly and shared more widely. This unlocks faster settlement, more liquidity, and access to investments, once closed off to most people. The numbers tell the story. The tokenization has already crossed $24 billion and is expected to grow in the trillions by 2030, depending on how regulators and institutions handle the transition.

This blog explores how RWA tokenization is bringing scalable and transparent change to the financial landscape to drive user adoption, and what it all means for the future.

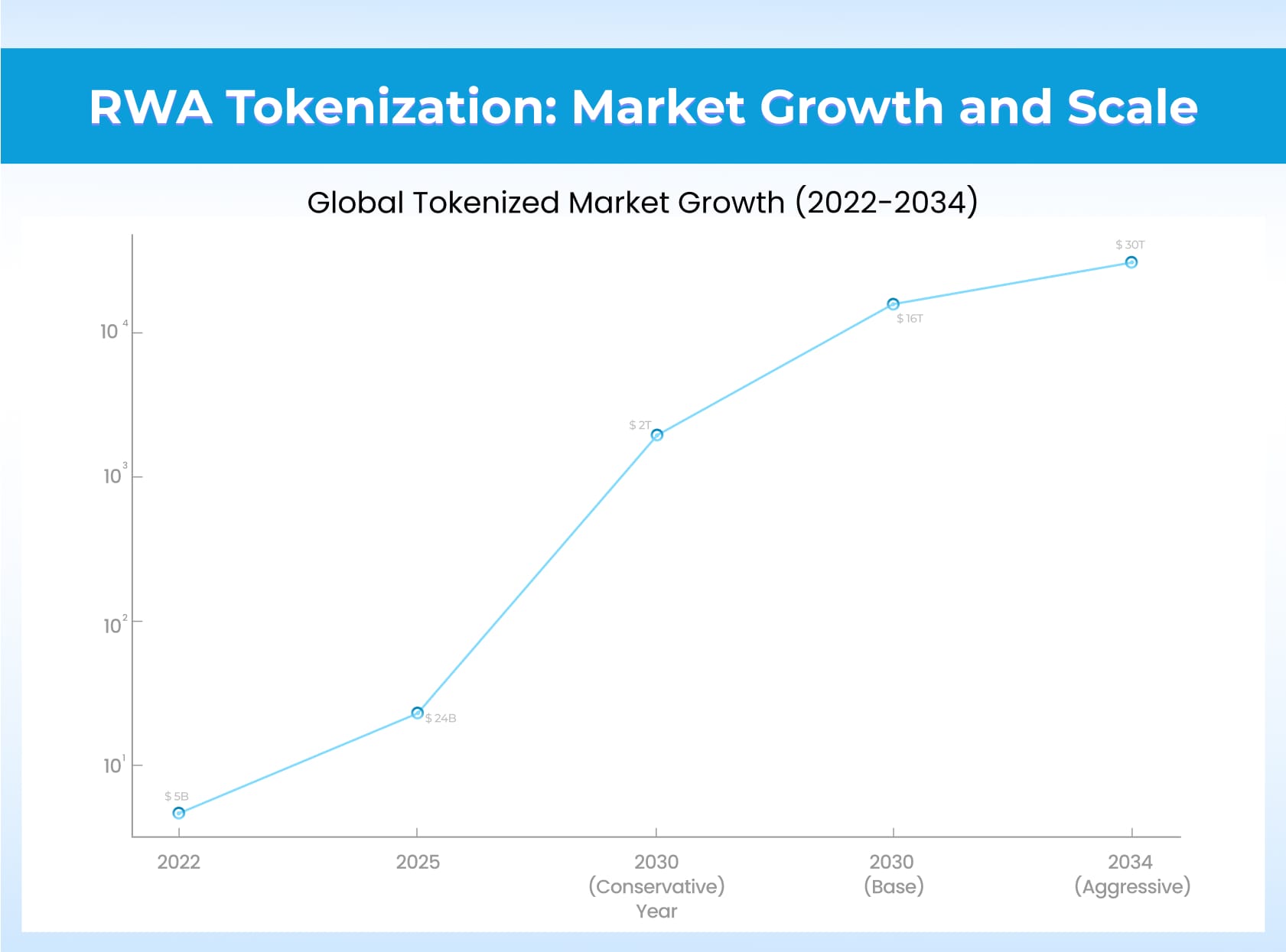

RWA Tokenization: Market Growth and Scale

With Asset Tokenization platforms, the financial institutions are already driving measurable growth. Here are the numbers:

- 2022: Global tokenized market ~ $5 billion.

- 2025: Surpassed $24 billion in less than a year.

- 2030 (Projected): $2 trillion (conservative) to, $16 trillion in 2030, and $30 trillion in 2034 (aggressive).

The distribution of tokenized value in 2025 highlights where adoption is concentrated:

- Private Credit – $8–9 billion: Dominates tokenization due to demand for yield-bearing assets.

- Tokenized Treasuries – $12- 15 billion: Attracting institutional liquidity as a safe, regulated product.

- Real Estate – $500 million to 1 billion: Fractional ownership models are gaining traction.

- Commodities (Gold, Oil) – $2.5 billion and $500 million respectively: Emerging as hedging and diversification instruments.

The driver behind this growth is institutional credibility. When BlackRock launched its tokenized Treasury fund (BUIDL), billions in liquidity followed. J.P. Morgan’s Onyx network processed tokenized settlements for cross-border payments. Each milestone reduced skepticism and signaled that tokenization is a structural shift.

Why Tokenization Matters in Global Finance?

The global financial system still operates with inefficiencies that tokenization directly resolves.

- Liquidity in Illiquid Markets: Real estate, private equity, and infrastructure are traditionally locked. Tokenization fractionalizes ownership, allowing secondary trading that releases liquidity.

- Settlement Efficiency: Traditional markets operate on T+2 settlement cycles. Tokenized assets can settle near-instantly, drastically reducing counterparty and operational risk.

- 24/7 Global Market Access: Markets restricted by geography and banking hours become globally accessible around the clock.

- Cost Compression: Smart contracts automate issuance, redemption, and compliance, cutting intermediaries and reducing fees.

- Financial Inclusion: Tokenization lowers entry thresholds. A $10 million property can be fractionalized into $1,000 tokens, opening markets to investors traditionally excluded.

The convergence of these factors explains why tokenization is becoming a priority for capital markets infrastructure.

Launch Your Own RWA Tokenization Platform

Cross-Chain Competition: Beyond Ethereum

Ethereum continues to dominate tokenized finance with over 80% of market share. The supporting factors include an established DeFi ecosystem and robust infrastructure. But competition is growing:

- Solana – Over $550 million tokenized assets in 2025, rising in speed and low fees.

- Polygon and Avalanche – Favored for enterprise and real estate tokenization pilots.

- Permissioned Blockchains – Hyperledger, R3 Corda, and Quorum are being tested for compliance-heavy financial products.

This clearly indicates that tokenization is going to be multichain. Different chains will specialize in specific asset classes or regions, just as traditional finance has exchanges tailored to equities, commodities, or derivatives.

Real-World Use Cases Proving the Model

- Real Estate: Fractional Ownership in Minutes: Fractional ownership made the asset accessible to mid-tier investors, a process that would have taken weeks using conventional channels.

- U.S. Treasuries on Blockchain: Institutional players now use tokenized Treasuries as a yield-bearing instrument. These digital securities are integrated into DeFi protocols, providing both liquidity and collateral utility. BlackRock’s BUIDL fund has set the benchmark for institutional-grade tokenized products.

- Private Credit at Scale: Private lending is emerging as the single largest tokenized category. Tokenization makes private debt instruments easier to issue, trade, and manage. For institutions, it reduces operational friction while expanding access to yield.

- Commodities and Gold: Gold-backed tokens like PAXG are gaining traction as blockchain-native hedging assets. They combine the security of physical gold reserves with the transferability of digital assets.

Tokenized Equities in Emerging Markets

Tokenized stock offerings provide fractional exposure to listed companies, especially in regions where direct access to U.S. or European equity markets is restricted.

These examples demonstrate that tokenization is already generating measurable efficiency and liquidity benefits.

Enabling Trends Driving Real-World Asset Tokenization

- Institutional Adoption: Banks, insurers, and pension funds are moving beyond pilots. Asset managers see tokenized Treasuries and private credit as attractive yield sources, integrated into DeFi to enhance liquidity and collateralization.

- Regulatory Clarity (Gradual but Critical): The U.S. is advancing regulation around stablecoins and tokenized funds. The EU’s MiCA framework provides a structure for digital assets. Singapore and Hong Kong are emerging as regulatory leaders, offering clear guidelines for tokenized securities.

Technology Stack Maturity

- Custody Solutions: Institutional-grade custody has become reliable.

- Compliance Integration: On-chain KYC/AML tools are standardizing.

- Interoperability: Multi-chain infrastructure and cross-chain bridges are evolving.

- Smart Contract Security: Auditing standards are improving, though risks remain.

The Multi-Trillion-Dollar Outlook

Forecasts vary, but tokenization will scale into the trillions.

- Conservative Path: $2 trillion by 2030, limited by regulation.

- Base Case: $4–10 trillion, driven by private credit, Treasuries, and real estate.

- Aggressive Scenario: $30 trillion, if global regulatory clarity and institutional adoption accelerate.

The upside case depends on whether tokenization platforms can integrate seamlessly with existing financial systems while offering superior advantages over legacy infrastructure.

Strategic Impact on Global Finance of Asset Tokenization

- Banks are cutting settlement times from days to minutes, slashing operational costs, and creating entirely new revenue streams.

- Asset managers can now offer diversified portfolios that include tokenized funds and give their clients access to investments that were previously out of reach.

- Regulators face the challenge of encouraging innovation while protecting investors, which shapes the industry’s future.

- Investors can now buy into assets they never could before, sell them instantly when needed, and diversify beyond traditional stocks and bonds.

Transform Your Financial Products with Custom Tokenization Solutions

Takeaway

With Real-World Asset Tokenization, financial institutions can solve issues like slow settlements, locked capital, and limited access. Banks, funds, and regulators are already adjusting to it. By 2030, trillions of dollars in tokenized assets may be in circulation. That scale will make markets faster but change how money moves around the world.

Want to build asset tokenization infrastructure for your financial institutions? Partner with Antier for a custom solution.