Developing a single drug costs billions. Most trials never make it past the first few stages. Patents gather dust on shelves because companies can’t raise enough capital to push them forward. Even when research breakthroughs happen, the money pipeline is clogged with inefficiency, gatekeeping, and outdated processes.

Enter the RWA tokenization platform development, introducing a new financial framework that’s starting to make a dent in one of the most capital-starved industries on earth: Biotech and Pharmaceutics.

With real-world asset tokenization, biotech patents, pharma supply chains, and clinical datasets are no longer static, illiquid assets. They can be transformed into fractional, tradable, and transparent tokens that bring in global capital.

This article unpacks how RWA in biotech and the pharmaceutical industry is reshaping healthcare. We’ll look at practical implementations, key risks, regulatory dynamics, and the role of a strong RWA tokenization platform development company in building systems that actually work.

Unlock Trillions: RWA in the Pharmaceutical Industry

With the RWA tokenization platform, pharmaceuticals can represent assets like patents, a clinical dataset, or even a manufacturing facility digitally on the blockchain. Each token acts as a digital certificate of ownership or participation. Instead of waiting for one big pharma to write a billion-dollar check, a research lab could tokenize its IP and sell fractional ownership to thousands of investors worldwide. These enable smaller investors to participate in high-value assets.

- Patent Tokenization: Gene therapies can be fractionalized on-chain, accelerating early-stage funding.

- Supply Chain Security: Hyperledger and similar stacks verify pharma ingredient provenance, reducing counterfeit risks.

- Data Monetization: Tokenized, GDPR-compliant datasets fuel predictive analytics, cutting costs and improving trial timelines.

Experts recommend hybrid token standards (e.g., ERC-721 + ERC-1155) for IP-NFTs and interoperable bridges for yield optimization. Healthcare tokenized assets also streamline claims management while preserving patient privacy through zero-knowledge proofs.

Why RWA Tokenization Fits Biotech and Pharma?

- Liquidity Where None Existed

Traditional IP is illiquid- you can’t trade fractions of a drug patent on the stock market. But with pharma tokenization, you can break it down into fractional tokens. A startup that once needed $100M from one VC can now raise the same amount from 100,000 investors worldwide.

- Democratization of Investment

RWA in biotech allows investors outside of elite funds to participate in breakthroughs. A medical student in Mumbai can buy $100 worth of tokens representing ownership in a promising Alzheimer’s therapy. A retiree in Berlin can hold a stake in a cancer drug trial.

- Trust and Traceability

Counterfeit drugs cost the healthcare industry upwards of $250B annually. By embedding tokenized assets in the healthcare industry with on-chain provenance, pharma companies can authenticate everything from raw ingredients to finished products.

- Incentivizing Data Sharing

Clinical data has always been hard to unlock because of privacy risks. By tokenizing anonymized datasets and compensating contributors with micropayments, hospitals and research institutions can finally monetize data responsibly.

Turn Patents, Data, and Assets into valuable Assets with the Tokenization Platform!

Pioneers Leading Biotech RWA Implementations

Real-world deployments show tokenization delivering tangible returns:

- HuaJian Medical: Tokenized oncology assets on Ethereum, automating royalties’ distribution.

- IVD Medical: Launched $900M in tokenized IP with DAO-governed expansion plans.

- Bio Protocol V2: Raised nearly $10 Million with veBIO stakers earning fees from on-chain licensing.

- MediMint Labs: Tokenized facilities to curb fraud and improve ROI transparency.

Other projects, like Verana Health, show that tokenized RWD can reduce bottlenecks and speed up trial recruitment.

Key Opportunities BioTech and Pharma to Unlock with RWA Tokenization Platform Development

A strong RWA Tokenization platform can help to identify which assets make sense to tokenize, design compliant frameworks, and build technology that works with healthcare’s strict rules. Here are the most promising opportunities today:

- IP Liquidity Boost

Biotech IP worth over $1.2 trillion is locked up in patents, waiting for licensing or acquisition. With RWA tokenization platform development services, these patents can be fractionalized and sold on-chain. On Polygon or Ethereum L2s, entry points can be as low as $50, enabling capital inflows that are much faster than waiting on traditional venture rounds.

- Supply Chain Efficiency

Embedding smart contracts into pharma logistics ensures that every batch of drugs is traceable. With oracle-verified provenance, counterfeit risk could drop significantly, saving billions and restoring trust in global supply chains.

- Data Monetization

Tokenized, HIPAA-compliant datasets create new revenue streams for hospitals and research centers. AI developers can access anonymized data via tokens, while patients remain in control of their contributions. This reduces acquisition costs by up to half and accelerates drug approval timelines.

- Claims and Billing

Tokenized assets in the healthcare industry don’t stop at drugs and patents. Medical billing and claims worth $1.7 trillion annually can be streamlined with blockchain, using zero-knowledge proofs to protect patient identity while eliminating fraud.

Step-by-Step Guide: Building Your RWA Tokenization Platform

If you’re a founder or developer eyeing this space, here’s a blueprint to launch an RWA for a biotech platform in under six months:

- Asset Inventory: Identify the patents, data, or equipment you’ll tokenize. Use tools like RDKit to prioritize high-value IP.

- Blockchain Stack: Opt for Ethereum L2s (e.g., Base) for low transaction costs and integrate advanced math libraries for ROI simulations.

- Token Design: Hybrid models work best: governance tokens for DAOs, utility tokens for access to datasets, and fractional tokens for IP.

- Compliance Layer: Integrate KYC/AML, HIPAA de-identification, and FATF modules from day one.

- Prototype & Iterate: Work with partners, experts of the RWA Tokenization platform development services, to launch an MVP with high uptime and measurable yield models.

This can turn a $12M patent into $1.8M annual royalty flows or reduce $650B worth of disputes in healthcare billing.

The Role of Compliance in Pharma Tokenization

The RWA tokenization platform development company that survives in healthcare will be the one that gets regulation right.

- Securities Laws: Many IPTs fall under securities classification via the Howey Test. The GENIUS Act in the U.S. has carved out exemptions for certain assets, but compliance layers like KYC remain mandatory.

- Cross-Border IP: With WIPO reporting cross-border revocation risks, global enforcement is messy. MiCA in Europe adds new licensing burdens.

- Data Standards: HIPAA in the U.S. and GDPR in Europe demand privacy-first tokenization. Platforms without zk integrations are playing with fire.

Investors cite regulatory ambiguity as their biggest hesitation. But the trendline is positive: ISO 20022 and global harmonization efforts in 2025 are reducing friction and legitimizing pharma tokenization.

RWA Trends Defining 2025 and Beyond

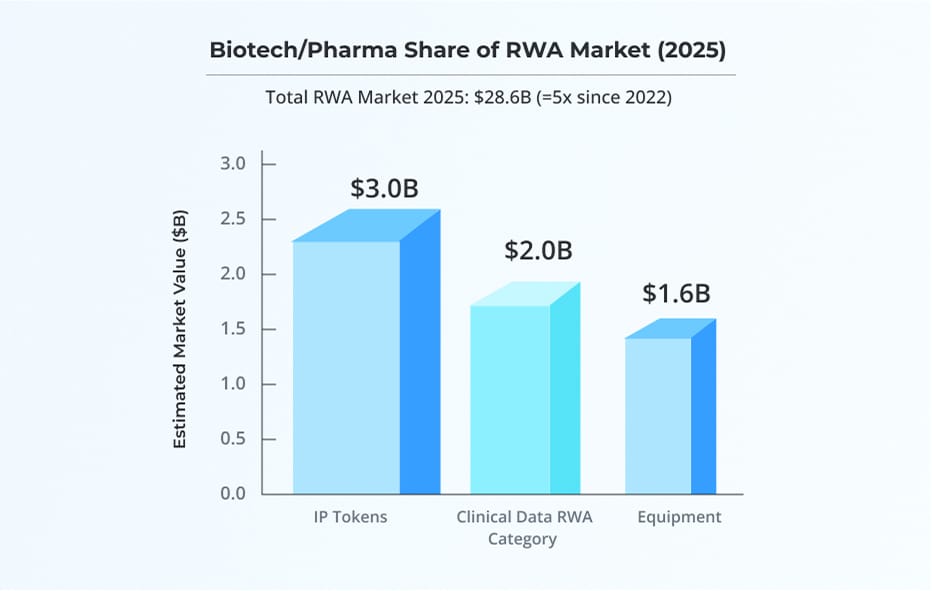

The growth trajectory is undeniable. Analysts project trillions in tokenized assets by 2030, and healthcare will be one of the biggest slices.

- AI + Tokenization: AI agents will validate hypotheses and connect them to tokenized fundraising.

- DAO-Led Research: Decentralized science (DeSci) DAOs will raise and allocate billions in research capital.

- Cross-Border Standardization: Global frameworks will simplify compliance and make it easier for tokenized assets to move freely.

- Institutional Influx: Big funds are already circling. Expect more BlackRock-style tokenized healthcare funds.

For biotech startups, pharma giants, and investors, this isn’t optional anymore. RWA for the biotech and pharmaceutical industry is about to become standard practice.

The healthcare slice of the RWA market is already worth billions and growing. The opportunity is massive: tokenization brings liquidity to the illiquid, transparency to the opaque, and speed to the painfully slow world of biotech funding. If you’re considering this path, look for a partner that:

- Has domain expertise in healthcare and compliance.

- Provides end-to-end RWA tokenization platform development services (from asset structuring to smart contract deployment).

- Offers modular, scalable architecture (to start small and grow).

- Integrates advanced compliance layers (AML, HIPAA, FDA-ready).

- Supports multi-chain interoperability (Ethereum, Base, Hyperledger, Solana).

And the leaders who embrace it early, backed by the right RWA tokenization platform development company, will own the next decade of biotech and pharma.

Develop your Pharma Tokenization Platform Today!

Choose Antier as your strategic partner in RWA Tokenization. Together, we can unlock liquidity from dormant healthcare assets, accelerate research timelines, and establish leadership in the future of biotech and pharma funding.

Frequently Asked Questions

01. What is the RWA tokenization platform and how does it benefit the biotech and pharmaceutical industries?

The RWA tokenization platform transforms static, illiquid assets like biotech patents and clinical datasets into fractional, tradable tokens, enabling global capital investment and improving funding opportunities for research labs.

02. How does patent tokenization work in the context of gene therapies?

Patent tokenization allows gene therapies to be fractionalized on-chain, enabling early-stage funding by allowing multiple investors to purchase shares of a patent, rather than relying on a single large investment.

03. What are the advantages of using tokenized datasets in clinical trials?

Tokenized datasets are GDPR-compliant and can be monetized to fuel predictive analytics, which helps cut costs and improve trial timelines while ensuring patient privacy through advanced technologies like zero-knowledge proofs.