In 2025, real-world asset tokenization has reached a market size of $15.2 billion, with green asset tokenization projected to grow to $50 billion by the end of the year. Companies like Blubird and Arx Veritas have tokenized $32 billion in emission reduction assets (ERAs), preventing 394 million tons of CO2 emissions, equivalent to the annual output of 105 times Iceland’s emissions. By converting assets such as renewable energy projects and carbon credits into blockchain-based tokens, an RWA tokenization development company enables scalable, transparent, and verifiable investments aligned with net-zero goals, achieving a balance between greenhouse gas emissions and removals.

This article examines how ESG tokenization, supported by blockchain ESG platforms, advances global climate finance through efficient capital allocation and robust compliance.

Why Net-Zero Relies on Tokenization?

The Climate Finance Hurdle: The International Energy Agency projects $4–6 trillion in annual investments is needed to meet the Paris Agreement’s net-zero targets by 2050, totaling $125 trillion cumulatively. Traditional green bonds and loans, although critical, face liquidity constraints and high costs, which limit their ability to scale. Fragmented reporting standards further complicate corporate ESG compliance, slowing global decarbonization efforts.

Real-World Asset Tokenization as a Solution

An RWA tokenization platform development can transform assets into digital tokens, enabling:

- Liquidity: Tokenized ESG assets, like renewable energy certificates (RECs), trade on secondary markets, unlike rigid green bonds.

- Accessibility: Fractional ownership opens high-value projects to small investors, such as community funds.

- Automation: Smart contracts align with ISSB and TCFD standards, reducing errors and fraud risks.

By 2025, tokenized climate assets, including $32 billion ERAs, will prevent 394 million tons of CO2, setting a new standard for sustainable finance blockchain solutions.

Tokenization in ESG: Real-World Applications

- Scaling Renewable Energy

Green asset tokenization drives renewable energy growth. In 2025, tokenized renewables added 700 megawatts globally, reducing coal reliance in regions like Southeast Asia. IoT sensors tie tokens to real-time energy output, ensuring trust and transparency.

Institutional interest is surging, with $500 million in tokenized renewable deals in negotiation. Secondary market trading enhances liquidity, channeling capital to net-zero projects, a hallmark of RWA tokenization development.

- Carbon Credits and Emission Reduction Assets

ESG tokenization transforms carbon credits, each representing one ton of CO2 avoided. Blockchain tracks origins, like reforestation in Brazil, preventing double-counting. In 2025, $32 billion in tokenized ERAs, such as capped oil wells and coal mines, prevented tons of CO2. Tokenized RECs, linked to one megawatt-hour of clean energy, integrate into corporate ESG dashboards, ensuring ISSB and TCFD compliance.

- Green Bonds for Sustainable Infrastructure

Tokenized green bonds are unlocking capital for sustainable infrastructure projects, such as solar farms and energy-efficient buildings. In 2025, platforms like EDF’s tokenized bond issuance enabled real-time tracking of project impacts, raising $1.2 billion for renewable energy initiatives.

Blockchain streamlines bond issuance and automates lifecycle management, reducing administrative costs and enhancing investor access through fractional ownership, aligning with global decarbonization goals.

- Sustainable Agriculture Through Tokenization

Tokenization is transforming sustainable farming by connecting investments to eco-conscious practices. In 2025, tokenized farmland projects, like regenerative agriculture in Sub-Saharan Africa, drew $300 million in funding. Blockchain ensures transparency by tracking sustainable practices, like soil carbon storage, while IoT keeps tabs on crop yields and environmental benefits.

These tokens let smaller investors get involved through fractional ownership, helping fund climate-smart farming that boosts food security and supports net-zero goals.

Built ESG Platforms for Net-Zero Climate Finance

Benefits of Net-Zero Tokenization

Tokenization in ESG, powered by blockchain ESG platforms, offers transformative advantages:

- Unmatched Transparency: Blockchain ensures immutable records, addressing greenwashing risks noted in the 2024 UNEP Emissions Gap Report. A tokenized wind farm in India logs energy output on-chain, allowing real-time CO2 reduction audits, critical for ESG investing blockchain.

- Enhanced Liquidity: Tokenized ESG assets trade 24/7 on secondary markets, unlike static green bonds. In 2025, platforms report $18 billion in tokenized asset deals, set to prevent 230 million tons of CO2 by 2026, showcasing sustainable finance blockchain potential.

- Inclusive Investment: Fractional ownership enables small-scale investors to fund net-zero projects. A tokenized solar grid in Nigeria, backed by $1,000 investments, powers rural clinics, proving ESG tokenization’s equitable impact.

- Cost Savings: Smart contracts cut transaction costs by up to 90%, per EY’s 2023 Blockchain Report, speeding funding for assets like carbon removal systems, a focus of RWA tokenization development companies.

- Global Scalability: Standardized tokenization frameworks replicate across markets. A tokenized hydroelectric project in Colombia can inspire models in Africa, scaling renewable deployment globally.

- Streamlined ESG Reporting: Tokenized carbon credits and RECs provide verifiable data for TCFD and ISSB disclosures, simplifying net-zero reporting with real-time insights.

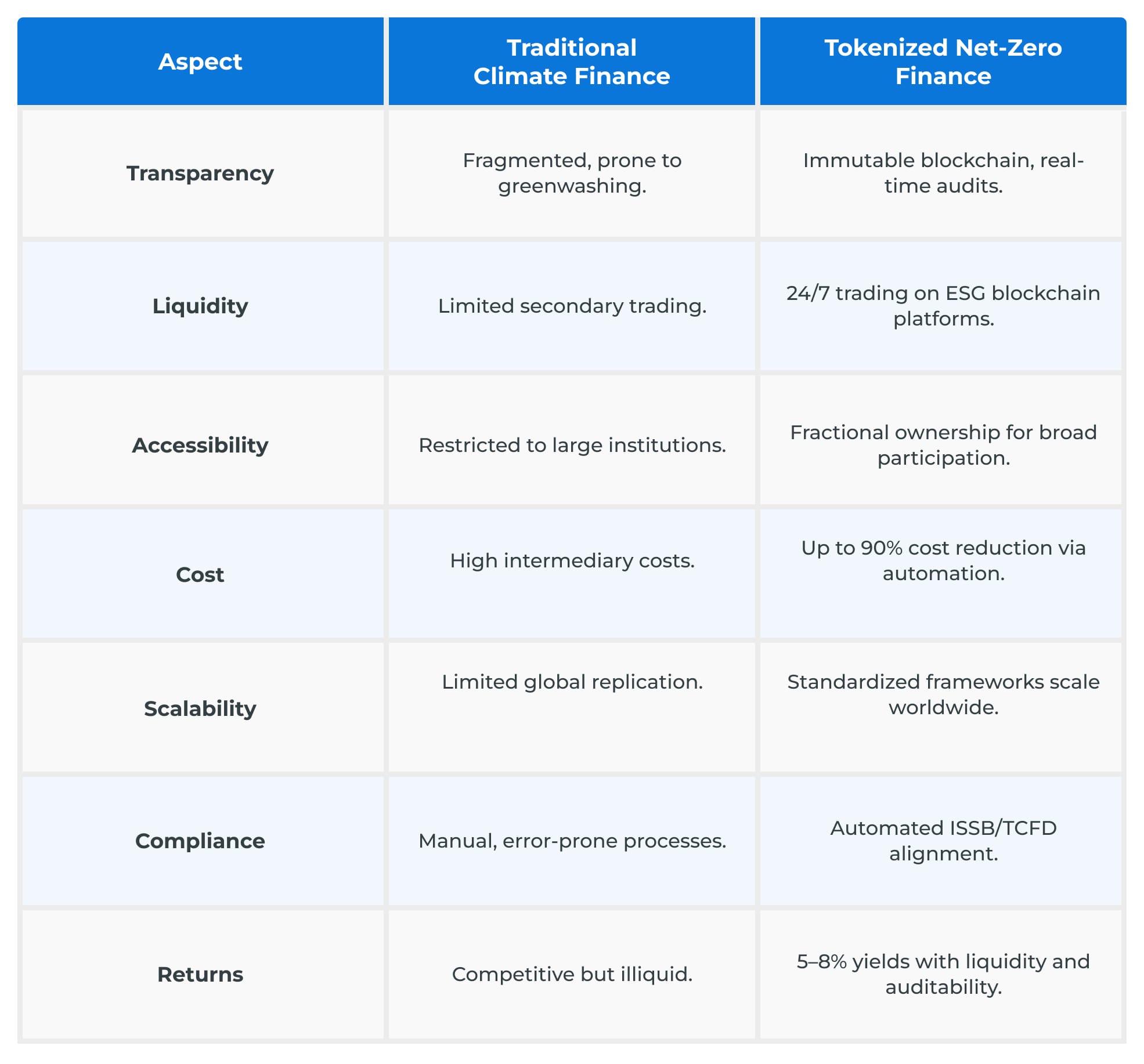

Traditional vs. Tokenized Climate Finance: Understanding The Difference

ESG Tokenization: Overcoming Implementation Challenges

- Scaling Efficiently: Blockchain congestion is addressed by layer-2 solutions, processing trades off-chain while settling securely. Hybrid models blending permissioned and public networks ensure performance for large-scale renewable projects.

- Regulatory Alignment: Singapore’s MAS and the UAE’s ADGM provide clear guidelines for tokenized ESG assets, while Europe integrates tokenization into the EU ETS. These frameworks support global compliance, a focus of RWA tokenization development.

- Data Integrity and Privacy: Oracles and IoT sensors verify renewable energy and carbon offset data, while zero-knowledge proofs protect sensitive information, ensuring blockchain ESG platforms are secure and compliant.

The Future of Net-Zero Tokenization

By 2033, the tokenized RWA market could reach $18.9 trillion, with green assets leading, per BCG’s forecast. AI-driven emissions forecasting and IoT-enabled data precision will enhance tokenization’s impact. Integration with the EU ETS will standardize tokenized carbon credits, scaling their role in net-zero.

With $18 billion in tokenized assets planned by 2026, preventing 230 million tons of CO2, RWA tokenization development companies are driving a seismic shift in climate finance, making net-zero investments as accessible as digital currencies.

Let’s work together to create a tailored ESG tokenization platform that aligns with your vision. Connect with our experts today!