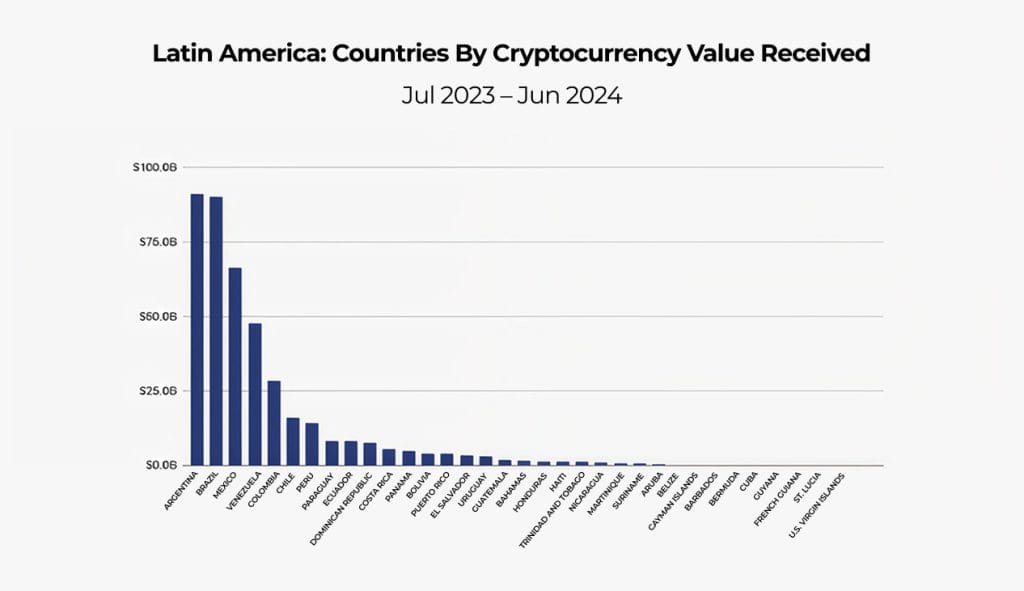

Ripple’s LATAM policy lead says that the region is “leading the world’s crypto discussion”. The regional annual crypto exchange flows also increased by 9X (800%) in 3 years, from $3 billion in 2021 to $27 billion in 2024. In July 2025, these inflows even reached $45.5 billion, positioning Latin America as one of the leading crypto-embracing regions.

Amidst the hype, launching a cryptocurrency exchange software will help you convert the hype into signups. With a white label cryptocurrency exchange, you can skip the time-consuming and expensive hassles of building a crypto exchange from the ground up.

Why Launch Your Crypto Exchange in LATAM now?

We’ve already discussed LATAM’s crypto adoption above, and it seems like enough of the reasons to fast-launch your trading platform using white label crypto exchange software development solutions. However, that’s not all. Here are some reasons why Latin America is the right move for your digital asset exchange business:

- The PIX nation Brazil

76.4% of Brazilians already use PIX. The instant payment system recorded 250.5 million transactions in a single day, indicating $124.3 billion worth of financial volume last year. Brazil’s central bank calls it the most-used payment method. For a market already trained on instant, low-cost payments, a cryptocurrency exchange is a natural business.

A Takeaway for Crypto Exchange Platform Development: PIX is beating cards and moving into e-commerce and subscription-based models with recurring payment options. By launching a PIX-integrated cryptocurrency exchange software, businesses can simplify the onboarding and on/off ramps, meeting users where they are.

- A remittance giant, Mexico:

Similar to Brazil’s PIX, SPEI processed 5.34 billion transfers worth MXN 219 trillion in 2024. Mexico also reported US$64.7B inflows in 2024. By launching a SPEI-integrated cryptocurrency exchange software, you’re not teaching new behavior but already plugging into the existing digital-first payment practice.

A Takeaway for Crypto Exchange Software Development: SPEI integration enables you to onboard people from real-time rails. However, the remittance market can also be tapped into with USDT exchange development. And it’s not the first time a cryptocurrency exchange does it in Latin America. Bitso did it already by handing US↔MX remittance corridor and facilitated more than $12 billion worth (roughly 10%) transfers in 2024.

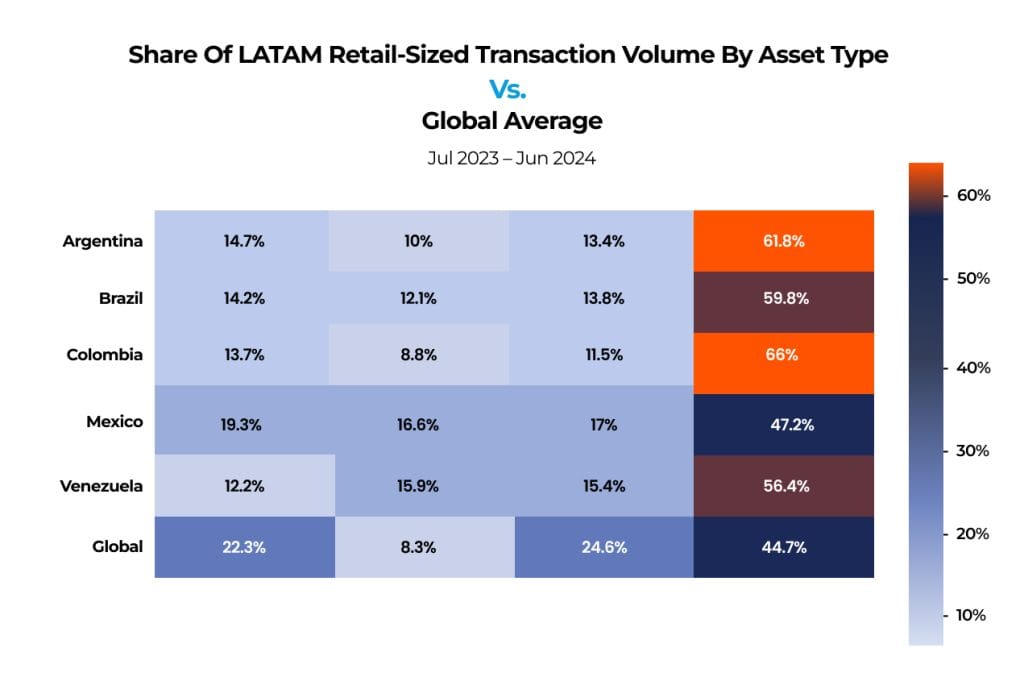

- Argentina’s stablecoin first behavior: Argentina’s long-time battle with devaluing native currency left people with no choice but to store their savings in stable assets. USD-pegged stablecoins already made a huge market with stablecoin transaction volumes surpassing 61.8% in 2024. Many Brazilian exchanges and brokerages already offer USD-pegged stablecoins, enhancing USD exposure as a store of value.

A Takeaway For Crypto Exchange Platform Development: Considering LATAM’s market, stablecoin listings must be a priority for anyone planning to launch their cryptocurrency exchange software. Earlier in 2024, the LATAM region already set a clear compliance path for Virtual Asset Service Providers VASPs, specifying the operational, IT, and security requirements.

- Regulatory Clarity:

Brazil’s 14,478/2022 + Decree 11,563/2023 law lays down rules and regulatory requirements for VASPs. Those seeking to launch their cryptocurrency exchange software must get regulated by BCB. Also if crypto tokens are a security, CVM’s rulebook applies to trading ventures. CVM’s Guidance Opinion 40/2022 explains how cryptoassets can fall under securities law.

Under the fintech law, Banxico authorizes and regulates financial technology institutions (FTIs). Argentina’s CNV VASP registry (GR 994/2024) and GR 1058/2025 finalize the operational framework.

A Takeaway for Crypto Exchange Software Development: LATAM’s regulatory clarity and high adoption rates make the region the best choice for those planning to launch their trading platforms.

The 7-Day Launch Plan for LATAM Exchange Rollout

If you’re now thinking about how you can launch your LATAM-aligned trading platform in just 7 days with a white label cryptocurrency exchange software. You must look for a pre-vetted white label crypto exchange vendor like Antier that can help you stand up a functional pilot in 7 days, enabling you to start closed-beta onboarding until the compliance finalizes.

Day 0: Scope & Stack

- Even before you collaborate with your crypto exchange development services provider, you’ll need to pick your preferred country (Brazil/Mexico/Argentina) for v1 launch and then your coin set or trading pairs and fee schedules.

- Consider CEX or DEX development. Latin America ranks among the top countries using CEXs with 68.7% market penetration. It is primarily driven by institutional and professional investors.

Partner with a reliable white label crypto exchange software development company offering a robust, feature-rich trading platform with PIX/SPE integrations.

Day 1: Payments & Wallets

- Connect PIX (BR) or SPEI (MX) sandbox while you build your cryptocurrency exchange software.

- You’ll also need to plug into market makers or OTC to stream executable digital asset prices against BRL and MXN.

- Collaborate with your crypto exchange development services to implement wallet orchestration with HSM or MPC keys, a strict hot-wallet float cap, withdrawal limits, velocity checks, and address allow-/deny-lists.

- Pre-fund local accounts and prove that same-day reconciliation matches bank and system ledgers.

Day 2: Compliance Fast-Track

- Collaborate with your crypto exchange development company to enable tiered KYC (view-only, basic, and enhanced) and route flagged cases to manual review.

- Run real-time sanctions and PEP screening and attach Travel Rule messages to eligible external transfers.

- Apply local thresholds that mirror Pix and SPEI norms and trigger additional checks past those limits.

- Keep immutable audit logs and exportable case files with clear data-retention rules.

Day 3: Listings & Risk

- Join forces with your crypto exchange development company to list USDT/USDC against BRL, MXN, or ARS first. You can add BTC/ETH once depth forms.

- Connect at least two liquidity partners so you can fail over if spreads widen or a feed stalls, and auto-hedge larger tickets to avoid inventory and FX risk.

- Integrate anomaly detection for withdrawals during crypto exchange software development, require device binding for higher limits, and enforce cool-offs after first funding.

- After you launch, you must reconcile bank and exchange ledgers every day and open tickets automatically for mismatches.

Day 4,5: UX & Localisation

- Use local account fields and validations—CPF/CNPJ in Brazil, CLABE in Mexico, and CUIL/CVU in Argentina, so users get through forms without guesswork. You must also offer Portuguese-BR and Spanish-MX language options and keep help text local and clear.

- For deposits, show a PIX QR code or a SPEI reference, display the ETA and a clean fee breakdown, and confirm with a countdown on the locked quote.

- Always show the final delivered amount (for example, “Recipient gets 2,958 MXN”) and explain refund logic in one line.

- You can also check the UX of the top crypto exchanges in Latin America (Binance, BTCC, PrimeXBT, Mercado Bitcoin, FOXBIT, Bitget, KuCoin) before you build your own. At this stage, you’ll also have to eliminate or add any features that you might find relevant as per the competition and market demand.

Day 6: Plan A Closed Beta Onboarding

- Invite 100–300 real users across your target cohorts (remitters, freelancers, and merchants) and give a few power users higher limits to stress the system.

- Collaborate with your crypto exchange development services provider to run a live support channel and ship macros for the top issues, such as KYC failures, pending deposits, and name mismatches.

- You must also track on-ramp success rate, settlement SLA, reasons for KYC failure, cost per funded user, and drop-off at each step. Apart from that, ensure to keep instant kill switches for withdrawals, pair halts, liquidity-partner switching, and banner alerts.

Day 7: Security & Go-Live

- Run tabletop drills for key loss, liquidity-partner outages, bank delays, and phishing waves, and verify that rollback and customer communications work without drama.

- Coordinate closely with your crypto exchange development company to audit role-based access, rotate keys, and require two-person approval for large withdrawals. You must also move to invite-only production with conservative limits and start with a single corridor, such as BRL↔USDT or a US→MX remittance path.

- Hold a daily operations stand-up, reconcile accounts, and push one UX polish every day while monitoring live KPIs.

White Label Cryptocurrency Exchange Software Must-Haves for Latin America Exchange Launch

- Rails: PIX (BR), SPEI (MX), bank payouts, card top-ups (as fallback).

- Assets: USDT/USDC as core; BTC/ETH as liquidity drivers; local FX quotes (BRL/MXN/ARS).

- A feature-rich white label crypto exchange software development solution with stablecoin pairs, launchpad, staking, derivatives, etc.

- Compliance: KYC tiers, geofencing, Travel Rule compliance, suspicious-activity workflows, and immutable logs. Also, you would need the CNV VASP registry for Argentina and Banxico asset authorisation for Mexico.

- Risk: Wallet orchestration, withdrawal rules, velocity alerts, and address-risk scores.

- Ops: Bank-ledger reconciliation, proof-of-reserves (custodial view), incident runbooks.

- Data: Implement KPIs that matter during your crypto exchange software development launch. These may include on-ramp success %, settlement SLA, stablecoin % of volume, etc.

Built in a week. Scale for years.

Antier’s white label crypto exchange software development stack ships with PIX/SPEI, stablecoin rails, custody, and compliance workflows. So you can pilot in 7 days and grow with confidence. Want a LATAM-ready crypto exchange demo?

Get A Feature-Rich White Label Exchange For LATAM Rollout

FAQ’s

Q1. Can I really launch in 7 days?

Yes, after you settle on your requirements, your crypto exchange development services provider will only need 7 days to build using their ready-to-deploy white label exchange solutions. You can, therefore, stand up an invite-only pilot in 7 days with a white label core and pre-approved vendors. Full public launch depends on bank contracts and regulator interactions that may require another week or maybe months.

Q2. Which country first: Brazil, Mexico, or Argentina?

Pick where your on-ramp is strongest: PIX for Brazil, SPEI for Mexico, or stablecoin savings in Argentina. Expand to the other two once KPIs (on-ramp success %, SLA, churn), and your cryptocurrency exchange software looks healthy.

Q3. What integrations are non-negotiable?

PIX/SPEI, KYC/AML, Travel Rule compliance, address-risk, proof-of-reserves (custody view), and automated reconciliation. Your crypto exchange development company can help you with the rest.

Q4. What should I list first?

USDT/USDC against local currencies (BRL/MXN/ARS) and BTC/ETH/SOL. It matches real usage and liquidity depth. You can expand later on.