The idea of a 0% crypto-payment fee model sounds too efficient to ignore, yet it’s not just a pricing structure; it’s a deeper shift in how Web3-native financial infrastructure is designed, deployed, and scaled. As digital assets continue to embed themselves into transactional rails, the rise of compliant, blockchain neo-banking app development solutions has sparked a new debate: can fee-free truly be functional, sustainable, and regulation-aligned? This blog cuts to the chase! Not by selling hype, but by breaking down the architecture, compliance dynamics, and investment signals behind zero-fee crypto neo-banking. If you are a founder, investor, or Web3 builder curious about where technology meets token economics under strict regulatory oversight, keep reading. You are about to build to settle fast, scale wide, and stay compliant.

Let’s Begin!

What are ‘0% Crypto‑Payment Fees’ in Blockchain Neo‑Banking?

In a crypto-friendly neobanking solution, “0% crypto-payment fees” means that the bank absorbs all on-chain transaction costs, such as blockchain gas fees and interchange charges, so end users never incur per-transfer commissions. Behind the scenes, the bank’s payment intelligence engine automatically net-settles digital-asset movements against pre-funded fiat pools, capturing value instead through float income on custodial balances and optimized foreign exchange spreads. This model is typically applied to high-liquidity stablecoins and leading tokens, ensuring sub-minute settlement times, transparent pricing, and enterprise-grade security via MPC custody and real-time monitoring. The result is a seamless, predictable experience for both retail customers and corporate clients, who gain frictionless access to crypto rails without hidden fees or unexpected costs.

How Big Is the “0% Fee” Crypto-Friendly Neo Banking Solution Opportunity in the UAE?

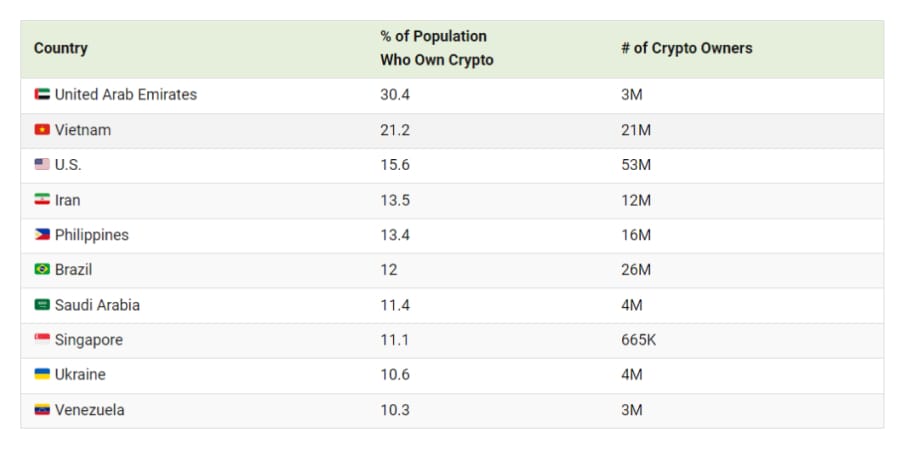

Dubai’s embrace of digital assets has created a sizable and rapidly expanding market for crypto-friendly neo-banking services. Today, over a quarter of the UAE’s population, approximately 30.4%, holds cryptocurrencies, placing the Emirates among the world’s leaders in blockchain penetration. In the first half of 2025 alone, digital-asset inflows into the UAE exceeded a billion dollars, underscoring both retail enthusiasm and institutional capital deployment. Equally compelling is the forecasted 42% compound annual growth rate (CAGR) for the UAE’s blockchain sector through 2030, which reflects mounting demand for on-chain payment rails and tokenized financial products.

Source link: https://socialcapitalmarkets.net/crypto-trading/cryptocurrency-statistics/

Regulatory bodies have matched this momentum: Dubai’s Virtual Assets Regulatory Authority (VARA) and the DIFC’s DFSA sandbox have collectively onboarded over 150 Virtual Asset Service Providers (VASPs) since early 2025, creating a robust compliance framework that legitimizes and protects zero-fee settlement models. Together, these dynamics paint a clear picture: the confluence of high crypto adoption, significant capital flows, and a supportive multi-jurisdictional regulatory environment makes the UAE one of the most attractive markets worldwide for 0% fee crypto processing in crypto-friendly neo-banking solutions.

Why Your Neo Banking App Development Needs 0% Crypto Payment Fee?

The Hidden Tax of Transaction Fees

Processing fees have historically been the stealth tax of digital finance. Traditional institutions and even first-generation crypto banks have baked in commissions, spread costs, and withdrawal levies, eroding profit margins for both consumers and institutional players.

✔ Fee Extraction : Typical crypto transaction commissions can run from 0.5% to over 2% per transfer.

✔ Opaque Schedules : Hidden costs often emerge only at the withdrawal or off-ramping stage.

Neo Banks’ Value Proposition

0% fee structures eliminate unnecessary friction and unleash operational efficiency for users who demand speed, global access, and transparency.

✔ Instant Cost Advantage : Directly increases profit retention for businesses, traders, and Web3 projects.

✔ Transparent Yield Calculations : No hidden deductions, making DeFi yields and ROI easier to track.

✔ Market Differentiation : Positions UAE-based banks as global leaders in user-centric, programmable finance

Opportunities of 0%‑Fee Crypto Payments in a Crypto‑Friendly Neo‑Banking App

1. Retail & Expatriate Workers

- Eliminate remittance commissions (typically 3–7%) on cross-border transfers.

- Enable instant, cost-free sending and receiving of funds.

- Consolidate multiple assets (AED stablecoins, USDC, BTC, ETH) in a single wallet.

- Earn loyalty or reward tokens on each transaction without additional fees

2. SMEs & Corporate Treasuries

- Automate payroll disbursements in stablecoins, reducing manual processing time

- Conduct vendor and supplier payments without wire‑transfer or card‑interchange fees

- Hedge FX exposure by settling in AED-pegged stablecoins instantly

- Streamline reconciliation with real-time on-chain transaction reports

3. Merchants & E‑Commerce Platforms

- Offer a zero-cost crypto checkout to increase conversion rates

- Pass savings on to customers via dynamic pricing or loyalty programs

- Reduce chargebacks and disputes through immutable on-chain settlement

- Integrate seamlessly via API-driven payment modules

4. Payment Aggregators & Fintech Ecosystem

- Aggregate higher transaction volumes, enhancing network effects

- Create bundled service packages combining zero-fee rails with value-added features

- Strengthen competitive positioning by marketing “no-fee” as a core differentiator

- Accelerate market penetration in the UAE’s high-adoption, regulated environment

Each stakeholder, from individual remitters to large enterprises, captures tangible value through reduced costs, operational efficiency, and new revenue or engagement opportunities, making zero-fee crypto payments a transformative catalyst in the UAE’s neo-banking app development landscape.

How Does Regulatory Compliance Enable 0% Fee Crypto-Friendly Neo-Banking Solutions?

Dubai, backed by frameworks such as VARA and Abu Dhabi’s ADGM crypto policy stack, has provided clear regulatory guardrails for digital asset innovation. This has attracted global ventures, unicorns, and agile fintech disruptors to test, launch, and scale in a truly permissioned sandbox

VASPs & Licensing

- Federal Oversight : UAE Central Bank’s VASP framework mandates AML/KYC protocols, ensuring that zero-fee rails operate within secure guardrails.

- DFSA Crypto Token Regime : Since June 2024, the DFSA’s updated Crypto Token regime has formally recognized stablecoins like USDC and EURC, enabling licensed entities to process fiat-referenced tokens

VARA’s Rulebook

- Dubai’s VARA enforces stringent licensing, technology audits, and capital requirements for neo-banks offering crypto rails.

- By September 2025, all non-free-zone merchants must accept licensed Dirham payment tokens, formalizing the ecosystem for zero-fee merchant acquiring

A layered regulatory architecture, from federal VASP licenses to DIFC’s sandbox iterations—provides the compliance scaffold that legitimizes and protects zero‑fee crypto processing.

Investor’s Checklist Before Investing in 0% Fee Crypto Banking App Development

Before placing capital, here’s what every sharp investor must know to spot a future-ready, regulation-proof blockchain neo-banking solution.

✓ Proven experience in building and scaling compliant crypto neo-banking development.

✓ Deep understanding of UAE’s regulatory frameworks like VARA, DFSA, and VASP licensing.

✓ Transparent development and deployment costs with no hidden fees.

✓ Support for 0% fee transaction engine with real-time, on-chain settlement.

✓ Integration of multi-asset wallets with stablecoin support, especially AED-pegged tokens.

✓ Enterprise-grade security, including MPC custody and regulatory audit readiness.

✓ Built-in AML/KYC, compliance automation, and real-time monitoring tools.

✓ Scalable backend with advanced APIs for liquidity, FX, payments, and token modules.

✓ Strong post-development support, including maintenance, upgrades, and compliance tracking.

These are the non-negotiables every investor should demand before backing a 0% fee crypto banking app project. Thus, to ensure that as a visionary enterprise or investor you are investing in the right place, you must seek professional guidance from the best neobanking app development company that helps you launch business-tailored solutions.

Launch Smarter: Invest in a VARA-Compliant Neo-Banking Platform Today!

Developing a cryptocurrency neo banking app with 0% payment fees is not only a value-add but also a strategic necessity in a market as dynamic and regulated as the UAE. The success of your platform depends on who develops it, from scalable Web3 infrastructure to real-time settlements and AML-integrated architecture. To create solutions that are ready for the future and appealing to investors, Antier combines enterprise-grade technology, deep blockchain expertise, and compliance knowledge unique to the United Arab Emirates. We are the preferred crypto banking app development company for serious investors and founders due to our history of introducing regulated, successful crypto banking platforms. Are you prepared to spearhead digital finance’s zero-fee revolution? We will help you create your impactful neobank in a safe, legal, and scalable manner.

Connect with our experts today!