The tokenization of Real-World Assets (RWAs) is transitioning very quickly from experimental to enterprise-level use. Many institutions today are examining RWAs in many areas, including real estate, private debt portfolios, commodities, carbon credits, revenue streams, etc. The market opportunity is enormous; however, the compliance environment surrounding RWAs is becoming increasingly complex. Every RWA has legal, regulatory, and operational risks associated with it that must be managed accurately.

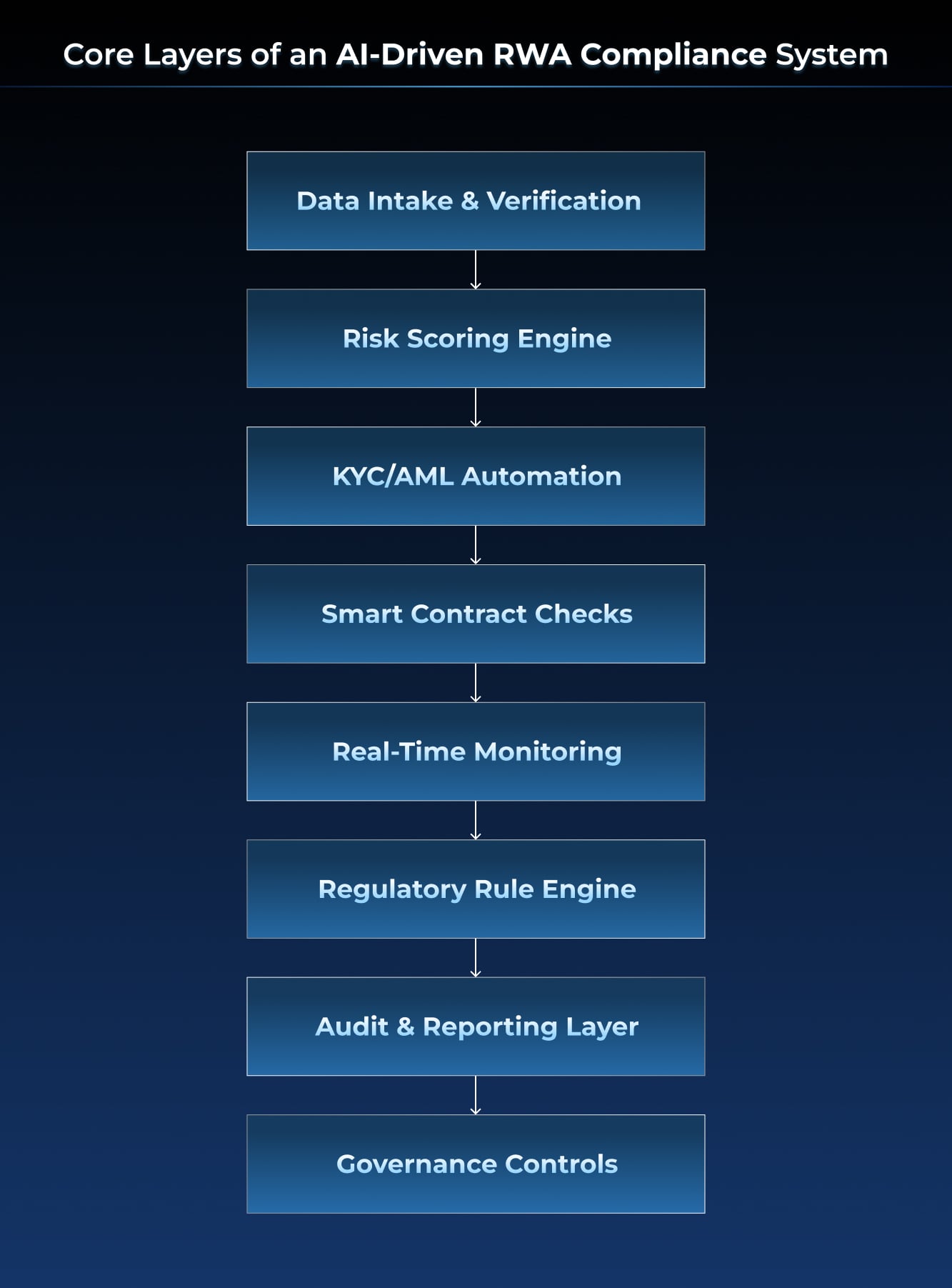

Furthermore, as more organizations partner with a leading RWA tokenization development company, one key takeaway has been that traditional compliance processes are inadequate for the new RWA operating environment due to the fact that the data associated with RWAs is now shared among diverse parties, while Lifecycle Events are instantaneous, and Jurisdictional Regulations are constantly changing based on how each U.S. state interprets them. Artificial Intelligence (AI) is filling this void; not only is it supporting organizations looking for RWA Compliance Solutions, but it also serves as the core provider of Compliance Solutions in the next generation of RWA Tokenization Compliance.

Start Your Transition to Automated, Audit-Ready Compliance

What Is Driving the Compliance Pressure Around RWA Tokenization?

Due to the inherent complexity of RWA is a rise of compliance pressure related to RWA Tokenization because of the multi-dimensional nature of RWA and because RWAs must comply with strict regulatory requirements. Due to the nature of tokenized assets being placed on Blockchain Networks, Smart Contracts, and Custodial Systems and using Investor Platforms, regulators are demanding complete transparency and accountability for every step of the asset management process, making robust tokenization regulatory compliance and AI in real-world asset tokenization central to enterprise adoption.

1. Expanding Regulatory Frameworks

Regulatory bodies worldwide are actively refining policies related to asset-backed tokens, custody models, investor protection, and reporting obligations. These frameworks evolve frequently, requiring enterprises to continuously interpret new guidelines and update compliance logic accordingly.

Static rulebooks and periodic audits are no longer sufficient. Enterprises must track regulatory changes in real time and adapt operational workflows without disrupting tokenized asset operations. AI-driven regulatory intelligence enables automated interpretation of new rules and supports faster alignment across internal systems.

This growing complexity has also increased demand for advisory support from an RWA tokenization legal consulting company, particularly when navigating cross-border compliance obligations and asset-specific legal interpretations.

2. Multi-Jurisdictional Complexity

Tokenized RWAs often involve multiple jurisdictions simultaneously. Asset location, investor residency, custodial arrangements, and transaction execution may all fall under different regulatory authorities. Each jurisdiction introduces unique disclosure, reporting, and tax requirements.

Managing these overlapping obligations manually introduces significant risk. Enterprises must ensure that token issuance and transfers comply with regional regulations while maintaining consistent governance standards globally. Failure to do so can lead to enforcement actions, investor disputes, or operational shutdowns.

AI-enabled systems help enterprises normalize regulatory requirements across jurisdictions, reducing ambiguity and enabling scalable compliance operations aligned with tokenization regulatory compliance expectations.

3. Fragmented Data Sources

RWA tokenization depends on a wide range of data inputs, including legal agreements, asset valuations, ownership records, maintenance logs, insurance documents, and blockchain transactions. These datasets often exist in disconnected systems with varying formats and update cycles.

Fragmentation creates blind spots that undermine compliance accuracy. Without a unified view, enterprises struggle to verify data consistency or respond quickly to regulatory inquiries. AI-powered data orchestration consolidates fragmented information, enabling continuous validation and real-time compliance assurance through AI for RWA tokenization.

4. High Scrutiny on Asset Provenance

The regulation of tokenized assets requires transparency regarding ownership structures and a verified chain of custody. To achieve this, it will be necessary to validate the history of the asset, the identity of its owners and beneficiaries, and the method by which its ownership has changed. As regulators require this level of detail in their investigations, manual processes do not provide enough detail to meet those requirements. An enterprise-grade automated system is needed to verify an asset’s provenance accurately.

The requirements of regulators create an environment in which automation is essential for compliance, particularly for organizations pursuing enterprise-level tokenization of assets.

What Compliance Bottlenecks Are Slowing Down Tokenization Initiatives?

Although interest has increased, there are still many operational restrictions that come with running tokenization programs, causing delays or stoppages for a number of companies. Operational restrictions demonstrate the inadequacy of the old-fashioned approach when it comes to compliance for the rapid, high-volume, and high-value RWA ecosystem.

1. Manual Documentation Review Creates Inconsistencies

In order to tokenize an asset, a company needs to go through a large amount of documentation, including property deeds, asset register, loan agreements, certificate of title, compliance filings, and historical records. Human review of a document may lead to inconsistency due to human error, individual interpretation, or fatigue. Documentation errors typically emerge during the audit process, causing delays with deployment and increasing exposure to risk.

2. KYC/AML Processes Lack Real-Time Capabilities

Traditional onboarding systems are not designed for continuous monitoring. Investor risk profiles can change rapidly, yet many platforms rely on periodic checks rather than real-time validation.

This gap exposes enterprises to regulatory risk and slows transaction execution. AI-powered identity verification and transaction monitoring enable continuous oversight using advanced AI compliance tools, ensuring compliance without sacrificing speed.

3. Smart Contract Governance Is Difficult Without Automation

Smart contracts manage issuance, payments, redemption, transfer, lockup, and compliance management; this means to know which smart contract meets the compliance and regulatory requirements you will need both a technical and legal expert to verify the smart contract, their automation software cannot determine if a smart contract has compliant logic or not, so companies may deploy non-compliant logic into their systems without even realizing it, and if they try to fix the problems after the fact, they will usually have to pay expensive corrective fees.

4. On-Chain and Off-Chain Systems Do Not Sync Smoothly

Blockchain records must align with off-chain legal and financial documentation. Discrepancies between these systems complicate audits and weaken compliance confidence.

AI-based reconciliation bridges this gap by maintaining synchronized records and generating unified compliance reports, supporting scalable RWA compliance automation.

5. Inconsistent Audit Trails Increase Long-Term Risk

An Auditor must have complete visibility of all token creation, ownership changes, custodial transactions, investor participation, and governance transactions before making a final decision on whether the organization has adhered to compliance requirements. A significant limitation of traditional compliance systems is the inability to construct audit trails of the transactions and processes utilized.

These bottlenecks are indicative of why organizations need a future-proof compliance solution for RWA tokenization that are built on AI to streamline the process and improve time to market.

How Should Enterprises Move Toward AI-Enabled Compliance?

Moving to compliance-based AI for RWA tokenization will take organized change management, systematic integration, and a framework for long-term governance.

Step 1 – Conduct a Compliance Gap Assessment

Organizations must identify where existing manual processes increase the time and risk associated with meeting regulatory obligations by mapping their current processes to regulatory requirements. The gap assessment is the starting point of the transformation to an AI-driven organization

Step 2 – Automate the Workflows that Pose the Most Risk

Automating the workflows with the greatest risk—onboarding, documentation, verification, and risk scoring—should occur first since they will provide a positive ROI as well as enhance an organization’s compliance posture.

Step 3 – Integrate AI Modules into Existing Tokenization Systems

AI for RWA tokenization modules must seamlessly integrate with an organization’s custody systems, Blockchain nodes, token creation engines, Enterprise Resource Planning (ERP) systems, and data storage systems to enable the smooth flow of data and to eliminate errors due to human intervention.

Step 4 – Standardize Data Via Structured Data Pipelines

AI provides optimal performance when the data on which it is used is of a uniform, well-categorised format. Organizations should develop structured data pipelines to enable the collection of high-quality datasets and subsequently provide the ability to automate the comparison of that data.

Step 5 – Create a Governance Structure and Oversight Processes

Governance will provide the needed assurances for explainability, transparency, and ethical decisions made via AI. Therefore, all AI-based systems must be subject to defined and documented oversight processes to ensure that they continue to be trusted and auditable.

Organizations that follow this phased approach can implement bold applications of AI as they complete the full range of capabilities needed for tokenization of real-world assets while having the potential for future growth and the capacity for compliance resilience.

Talk to Our RWA Compliance & AI Experts!

Next Step Toward Automated, Audit-Ready Compliance

Organizations implementing the AI-RWA tokenization strategy benefit from enhanced means of complying with complex regulatory requirements while successfully scaling their asset activities. Additionally, by selecting the right robust RWA Token Development Partner and Compliance Advisor, organizations can create a streamlined AI governance transition.

AI is now an essential component of compliance for the Digital Asset Market. Companies that implement automated audit-ready frameworks will dominate future RWA Tokenization implementations.

Antier’s AI-Driven RWA Expertise

Antier has expert knowledge in blockchain technology, AI-assisted automated compliance solutions, and real estate asset tokenization solutions. Antier has established an extensive history of developing enterprise-grade tokenization technology and provides end-to-end support to companies that tokenize assets across different asset classes. Antier’s expertise includes:

- Designing and building architecture for enterprise-grade tokenization platforms

- Creating and implementing smart contracts for enterprise-grade tokenization platforms

- Providing AI-assisted compliance orchestration tools that provide regulatory alignment for enterprise-grade tokenization businesses.

To support companies that are developing enterprise-grade tokenization capabilities, our RWA tokenization development company has created new AI-assisted compliance tools, structured governance, and operational resilience through the creation of an advanced AI governance framework (GAIGF), as well as the ability to create and maintain long-term compliance with the regulatory authority.

Frequently Asked Questions

01. What are Real-World Assets (RWAs) and why are they important?

Real-World Assets (RWAs) are tangible or intangible assets like real estate, commodities, and carbon credits that are being tokenized for easier management and trading. They are important because they represent a significant market opportunity and require compliance with complex legal and regulatory frameworks.

02. How is compliance evolving in the context of RWA tokenization?

Compliance is evolving due to the increasing complexity of RWAs, which must adhere to strict regulatory requirements. Traditional compliance processes are inadequate, leading to a reliance on AI to provide real-time regulatory intelligence and support for compliance solutions in RWA tokenization.

03. What role does AI play in RWA tokenization compliance?

AI plays a crucial role in RWA tokenization compliance by helping organizations manage the complexities of regulatory changes, ensuring transparency and accountability, and providing automated solutions that adapt to evolving compliance requirements in real-time.