The European Commission’s Savings and Investment Union (SIU) are now resetting the EU banking and capital markets, with Tokenization Platform Development.

For banks, investment firms, and platform builders, this upgrade will determine how capital moves, compliance is enforced, and investors participate across Europe.

If you’re building a financial platform, you must understand its operational and ROI impact. This guide covers how the tokenization in EU banking will upgrade business operations under SUI.

Why Does the Traditional EU Model No Longer Work?

European capital markets look modern at a glance, but behind the scenes, they still rely on processes and infrastructure that belong to a different era. The cracks are obvious:

- Fragmented market infrastructure: Each member state has its own custodians, regulations, and reporting requirements. The result is duplicated compliance, higher costs, and inefficiencies.

- Slow settlement cycles: The reliance on T+2 settlement locks up capital for days, creates counterparty risk, and forces banks to over-collateralize.

- Operational overhead: Too many intermediaries, manual reconciliations, and disconnected reporting systems chip away at margins.

- Limited access: Retail investors face barriers, and cross-border investing is still a headache due to inconsistent national frameworks.

This makes the EU markets less liquid, less efficient, and less attractive compared to the US and parts of Asia. SIU aims to change that by embedding tokenization into the system’s DNA.

Build Your SIU-Ready Tokenization Platform Today

How SIU’s Tokenization Mandate Changes the Scenario?

The upcoming SIU legislative package integrates tokenization directly into EU financial markets. This is designed to eliminate structural weaknesses:

- Harmonization across member states: A tokenized bond, equity, or derivative will carry compliance logic that applies across the EU. No more duplicating onboarding for each jurisdiction.

- Faster settlement: Smart contracts bring near real-time settlement (T+0/T+1). That means less collateral frozen in the system and reduced counterparty exposure.

- Compliance built in: AML, KYC, and investor eligibility are coded into tokens, with automatic reporting to regulators. Compliance becomes part of the transaction, not a separate process.

- Greater market access: Fractional ownership opens up investment products to smaller investors, while secondary trading deepens liquidity pools.

Operational Impacts: What Banks and Platforms Will Actually See

It’s easy to talk about Tokenization Platform Development in abstract terms, but what does it look like on the ground for banks and platforms?

- Faster Investor Onboarding: Today, onboarding involves endless forms, document submissions, and back-and-forth checks that can take days. Under SIU, eIDAS-compliant digital identity frameworks can verify investors in minutes. This streamlines acquisition for firms and removes friction for clients.

- More Efficient Use of Capital: Under T+2, collateral sits locked while trades clear. Moving to T+0 frees that capital instantly, allowing firms to reinvest it into lending, structured products, or higher-yield assets. The result is stronger balance sheets and healthier margins.

- Automation of Core Workflows: Corporate actions, from dividends to coupon payments, are handled by smart contracts. Reconciliations happen automatically, with each transaction recorded immutably. Audits become simpler, errors are fewer, and compliance costs are lower.

- Real-Time Risk Management: Instead of compiling risk data after the fact, banks will have access to unified, real-time transaction data on-chain. Stress testing, exposure monitoring, and regulatory submissions become proactive rather than reactive.

ROI: What the Numbers Say

Skeptics often ask if tokenization is worth the investment. The evidence so far is compelling:

- 75%+ reduction in settlement time and failures → less risk and lower capital requirements.

- Up to 50% drop in operational costs → automation reduces manual processes and reliance on intermediaries.

- Liquidity boosts of 25–30% → fractional ownership and efficient secondary markets deepen capital availability.

- 20% increase in retail participation → tokenized funds and fractional assets broaden investor demographics.

These numbers are drawn from pilots and early implementations across global markets.

SUI Tokenization Platform Checklist

Use this checklist before launch to validate SIU across product, compliance, and operations.

Technical Blueprint for SIU-Ready Platforms

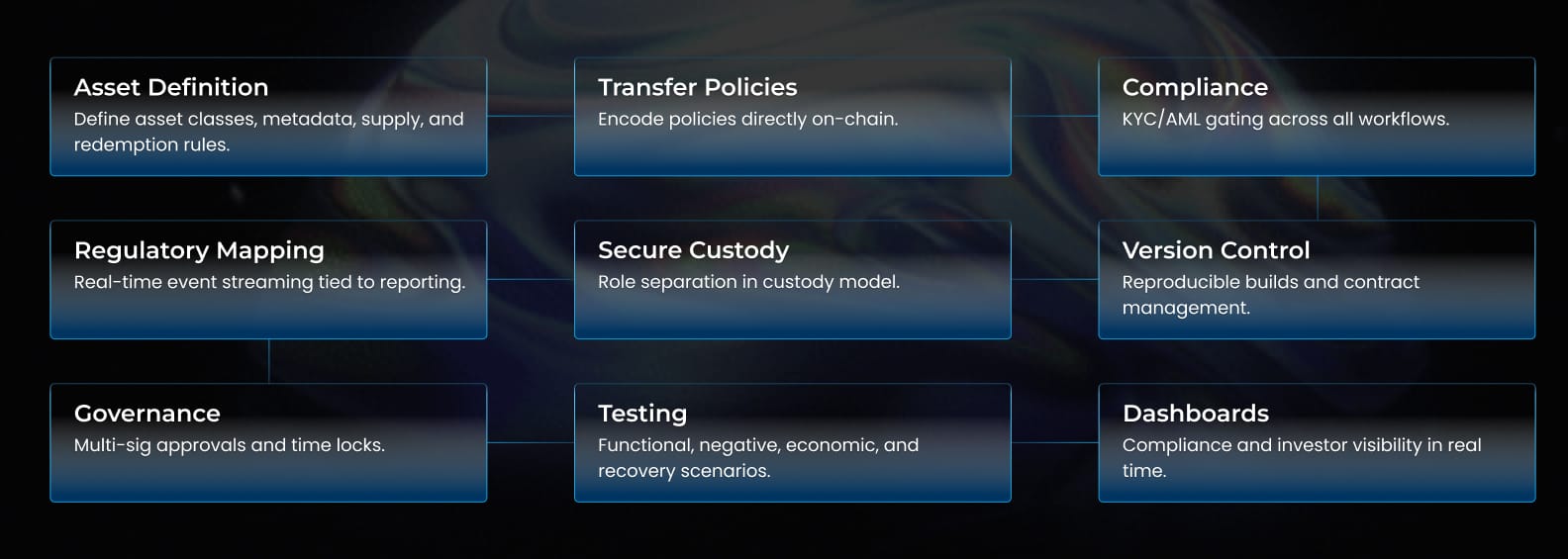

Building an SIU-compliant platform requires more than surface-level digitization. The architecture must be modular, scalable, and compliant by design.

1. Modular Architecture

- Issuance Layer: Tokenize securities with embedded regulatory logic.

- Onboarding/KYC Layer: eIDAS-aligned digital identity checks and layered risk scoring.

- Settlement Engine: Peer-to-peer workflows and smart contracts enabling T+0.

- Interoperability APIs: Bridges connecting tokenized systems with legacy infrastructure.

- Compliance Dashboard: Event-driven data pipelines feeding ESMA and ECB.

2. Security and Privacy

- Zero-Knowledge Proofs: Keep transactions private without limiting regulatory oversight.

- MPC wallets + HSMs: Secure custody without single points of failure.

- Compliance: Tokens that enforce rules directly.

3. Analytics and AI Integration

- Predictive liquidity models for treasury management.

- Real-time compliance alerts for supervisors.

- Investor profiling and recommendation engines for personalized services.

Challenges Institutions Must Navigate to Launch Tokenization Platform

The transition will not be without friction. Common hurdles include:

- Legacy integration: Many core banking systems were never designed to handle tokenized assets. Middleware token gateways will be essential.

- Regulatory uncertainty: Although SIU provides direction, details will evolve. Engaging regulators via sandbox programs is critical.

- Talent shortages: Few professionals today are fluent in both capital markets and blockchain. Firms will need to invest in training and partnerships.

- Adoption curve: The market may hesitate at first. A good strategy is to start with clear-value use cases like green bonds or SME financing.

Strategic Advantages for First Movers

- Regulatory credibility: Early adopters gain influence in shaping the framework.

- Client loyalty: Investors gravitate to platforms that offer faster settlement and transparent operations.

- Expanded investor base: Fractional ownership opens the door to a new demographic of retail investors.

- Cross-border scale: Harmonized tokenized assets make expansion across Europe simpler.

The longer firms wait, the harder it will be to catch up.

Practical Development Insights for Platform Builders

For those tasked with building SIU-ready platforms, some key considerations include:

- Fungible vs. non-fungible tokens: FT for standardized securities; NFT for unique instruments.

- Supply and burn policies: Define total supply, circulating supply, and redemption rights upfront.

- Transfer rules: Implement rules for pricing floors, lock-ups, and investor eligibility.

- Event logging: Every action (mint, burn, split, join) should generate standardized events for audit and analytics.

- Governance: Separate roles (issuance, platform management, compliance) and enforce multi-sig approvals for sensitive actions.

Testing Before Launch

No Tokenization Platform Development should go live without extensive testing. A minimum program should include:

- Functional: minting, settlement, reconciliation, transfers.

- Negative: blocked transfers, failed KYC, invalid trades.

- Economic: stress testing liquidity under policy rules.

- Interoperability: ensuring smooth integration with custody, OMS/EMS, and regulatory reporting.

- Recovery: drills for key rotation, incident response, and contract upgrades.

Building Trust Through Transparency

For adoption to scale, both investors and regulators need confidence:

- Investors should see eligibility status, supply data, and clear policy rules. A personal audit trail builds trust.

- Compliance teams need live dashboards showing cap tables, policy changes, exception reports, and one-click regulator exports.

Get a Custom SIU Tokenization Platform

SIU is More Than Compliance

The SIU tokenization mandate will be the infrastructure backbone for Europe’s next-generation financial markets. Banks and platforms that act early will cut costs, free capital, and expand their client base. If you’re building or modernizing a platform, treat SIU as your design brief: compliance, automation, and security by default.

Partner with Antier to Build SIU-Ready Platforms

At Antier, we specialize in designing and delivering tokenization platforms that align with SIU requirements. Our solutions:

- Embed EU compliance standards,

- Integrate seamlessly with legacy infrastructure,

- Scale to meet future market demand.

From token issuance to automated compliance workflows, our Tokenization Platform Development Company helps banks and investment firms move from planning to execution with confidence.

Don’t just meet SIU’s requirements, lead the transformation. Partner with Antier to modernize your infrastructure, improve ROI, and stay ahead in the tokenized era of European finance.