In October 2025, France’s financial regulator- the Autorité des Marchés Financiers (AMF) made a historic move. Through its DLT Pilot Regime, France has officially approved a €6 billion experiment that allows the trading of tokenized equities entirely on blockchain infrastructure.

With the approval of LISE, for the first time, a business developing a Digital Asset Tokenization Platform can evolve into a licensed exchange, one capable of issuance, settlement, and trading within a unified, legally recognized environment.

This article explores how France’s DLT regime enables the Asset Tokenization Platform to execute exchange operations, and what technical, regulatory, and operational considerations define compliant success.

Understanding France’s DLT Pilot Regime

The DLT Pilot Regime, enacted through EU Regulation (2022/858), allows financial institutions and market operators to test the use of distributed ledger technology (DLT) for trading and settlement of traditional financial instruments. It temporarily exempts participants from certain MiFID II, MiFIR, and CSDR provisions, giving them space to design and test compliant tokenization infrastructure.

Under this regulation, France has emerged as the EU’s most active participant, with AMF approving the rulebook for LISE, a blockchain-based stock exchange designed specifically for SMEs.

The DLT Pilot Regime recognizes three new forms of regulated entities:

- DLT MTF (Multilateral Trading Facility) – a blockchain-based exchange.

- DLT SS (Settlement System) – for blockchain-based settlements.

- DLT TSS (Trading and Settlement System) – a combined exchange and settlement model.

This last category is especially important for businesses engaged in Digital Asset Tokenization Platform Development, as it legally allows a platform to operate both issuance and secondary market functions under one license.

Under the France DLT regime, a single infrastructure can handle:

- Issuance: Minting tokenized financial instruments.

- Trading: On-chain order matching with real-time price discovery.

Settlement: Atomic transfer of assets and payment within seconds. - Custody: Regulated digital wallets tied to investor identity.

With this, businesses can build a one-stop Asset Tokenization Platform structure where investors trade tokenized assets seamlessly, and businesses retain complete lifecycle control.

Build a DLT-Compliant Platform with Antier

How Tokenization Platforms Transition into Exchanges Under France’s DLT Regime

The modern tokenization platforms already cover a significant portion of the capital market value chain: asset onboarding, KYC/AML, token issuance, and lifecycle management. The missing link has been secondary liquidity, but under the DLT Pilot Regime, a platform engaged in Digital Asset Tokenization Platform Development can integrate trading and settlement functions, effectively becoming a DLT TSS (Trading and Settlement System).

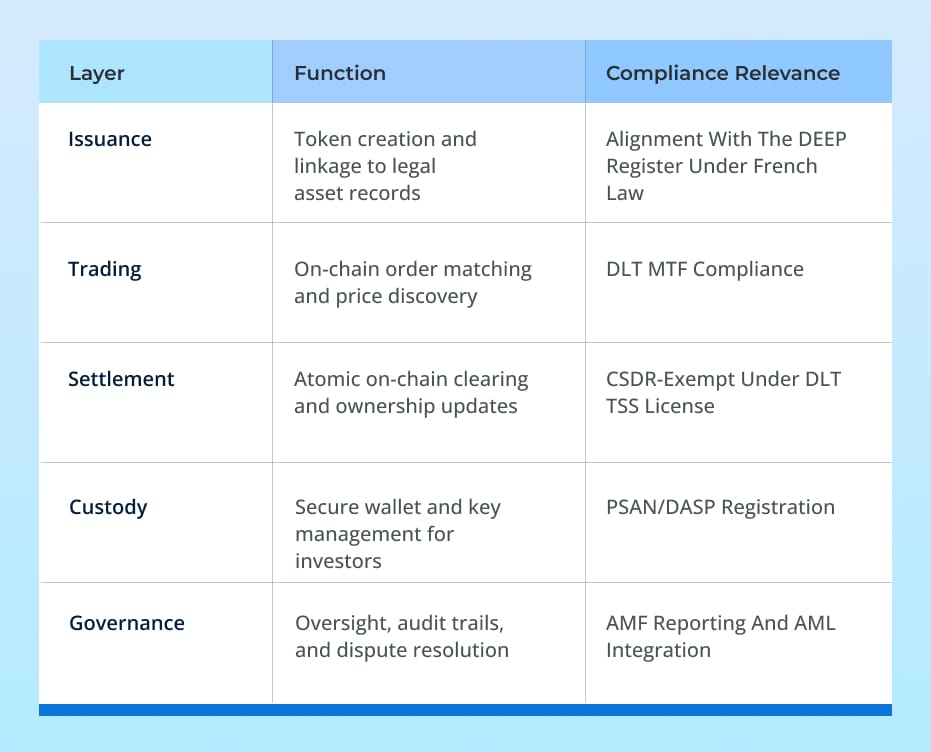

The integrated model includes the following layers:

When these layers function together under AMF supervision, businesses can launch a compliant tokenization exchange, a system that transforms digital assets into tradable financial instruments without leaving the blockchain.

The Architecture: How Exchange Integration Works in Tokenization Platforms

To comply with the France DLT regime and qualify as a regulated DLT market infrastructure, a tokenization platform must evolve beyond simple asset issuance. It needs to integrate exchange operations into a unified blockchain-driven system that meets both technical and legal benchmarks.

Below is a breakdown of the six foundational layers businesses must design to make Digital Asset Tokenization Platforms exchange-ready and compliant under the DLT pilot regime.

1. Issuance Layer

This layer forms the foundation of Digital Asset Tokenization, converting traditional financial instruments (like real estate, equities, or debt) into blockchain-based tokens.

Core Functions:

- Legal asset onboarding -validation of ownership, valuation, and regulatory documents.

- Token generation is mapped to off-chain asset records for audit traceability.

- Investor whitelisting and jurisdictional compliance logic.

Under France’s DLT regime, this layer must also connect to the DEEP (Dispositif d’Enregistrement Électronique Partagé) register. France’s official ledger for digital securities. This ensures legal recognition of every token as a valid financial instrument within the French securities code.

Outcome: A compliant token issuance process linking real-world assets to legally recognized digital securities.

2. Trading Layer (Exchange Engine)

Once assets are tokenized, they must become tradable. The trading layer turns a static token registry into a dynamic market venue by enabling direct on-chain exchange between verified participants.

Core Functions:

- On-chain order matching engine (limit, market, stop orders).

- Transparent price discovery for fair valuation.

- Liquidity management mechanisms (order books, market makers, or AMMs).

Under the DLT Pilot Regime, this layer can operate under a DLT MTF (Multilateral Trading Facility) or DLT TSS (Trading and Settlement System) license, effectively granting legal status to an exchange that operates entirely on blockchain.

Outcome: A regulated exchange mechanism integrated directly into the tokenization stack.

3. Settlement Layer (DLT Settlement Engine)

Settlement is where the DLT Regime’s efficiency becomes visible. Instead of relying on clearing houses or intermediaries, trades are settled atomically on-chain, meaning the payment and token transfer occur simultaneously.

Core Functions:

- Smart contracts automate trade settlement upon order confirmation.

- Atomic delivery-versus-payment (DvP) eliminates counterparty risk.

- Instant ownership transfer recorded on the distributed ledger.

This layer transforms the platform from a tokenization system into a full-fledged DLT market infrastructure, ensuring transparency, speed, and regulatory auditability.

Outcome: Zero settlement delays, full traceability, and compliance with AMF’s DLT settlement framework.

4. Custody and Wallet Layer

Investor trust depends on secure asset custody. Under AMF’s DASP/PSAN regulations, custody is a licensed function, whether provided directly or through third-party custodians.

Core Functions:

- Digital wallets to hold tokenized securities.

- Key management protocols, including recovery and access control.

- Segregation of investor holdings from platform reserves.

5. Custody may be offered as:

- Self-hosted wallets for advanced participants, or

- Regulated custodial services for retail and institutional investors.

Either way, AMF mandates strict recovery mechanisms and insurance against operational failure.

Outcome: Legally compliant custody architecture aligned with investor protection standards.

6. Compliance and Surveillance Layer

Compliance is the backbone of compliant tokenization in France. This layer enforces AML/KYC, monitors transaction behavior, and detects anomalies- all in real time.

Core Functions:

- KYC verification is integrated into onboarding.

- On-chain AML logic and blacklisted wallet detection.

- Automated transaction reporting to regulators via secure APIs.

- Trade surveillance to detect market manipulation.

These controls can be embedded directly into smart contracts or managed through off-chain compliance nodes connected to the AMF’s oversight infrastructure.

Outcome: Continuous compliance, real-time monitoring, and institutional-grade transparency.

7. Governance and Legal Firewall Layer

Core Functions:

- Role-based access control (issuer, operator, regulator).

- Internal audit and dispute resolution mechanisms.

- Governance firewalls to separate tokenization, exchange, and settlement functions.

- Transparent reporting for regulatory reviews and public assurance.

In essence, this layer ensures that efficiency never overrides legal accountability- a key principle of France’s regulatory framework.

Outcome: A transparent, well-governed, regulator-ready ecosystem that inspires trust among investors and authorities alike.

How France’s Legal Clarity Offers a Rare Operational Advantage to Exchange Integrated Tokenization Platform Owners?

1. Reduced Time-to-Market

Previously, launching a compliant tokenization platform required partnerships with external exchanges or intermediaries for secondary market access. Now, with the DLT TSS model, businesses can merge these functions — drastically cutting integration costs and deployment timelines.

2. Streamlined Compliance

Operating under the DLT Pilot Regime ensures automatic alignment with EU-level standards, including MiFID II and CSDR exemptions for DLT-based systems. That means fewer regulatory redundancies and more consistent cross-border acceptance, which is crucial for scaling asset tokenization in France and beyond.

3. New Revenue Models

Integrating an exchange layer transforms a Real-World Asset Tokenization Platform from a service provider into a market operator. Businesses can now capture:

- Issuance fees

- Trading commissions

- Settlement and custody charges- all under a single, compliant framework.

4. Competitive Differentiation

As institutional interest in compliant tokenization accelerates, platforms that combine issuance and liquidity provision will outpace traditional players relying on centralized intermediaries.

Benefits for Businesses and Investors

For Businesses Developing Platforms

- Regulatory Clarity: The DLT Pilot Regime provides a legal route to operate issuance and trading under one structure.

- Operational Efficiency: Reduced reliance on intermediaries cuts transaction times from days to seconds.

- Revenue Expansion: Combining Digital Asset Tokenization with exchange capabilities unlocks new income channels- listing, trading, and custody fees.

- Institutional Trust: Compliance with AMF and EU regulations builds confidence among institutional clients.

For Investors

- Direct Market Access: Retail and institutional investors can trade tokenized shares directly, without custodians or brokers.

- Transparency: Every trade, ownership record, and corporate action is verifiable on-chain.

- Lower Settlement Risk: Blockchain-based settlement eliminates counterparty delays.

- Regulatory Protection: Access is limited to verified participants under the France DLT regime, ensuring fair and secure participation.

This convergence of compliance and technology is setting new benchmarks for asset tokenization in France.

Use Cases: Where Tokenization + Exchange Integration Delivers Real Impact

- SME Equity Marketplaces: Small and mid-cap enterprises can tokenize shares, raise capital, and list directly on a DLT-powered exchange. Investors gain fractional ownership, liquidity, and transparent valuations.

- Real Estate Tokenization: A real estate issuer can tokenize property shares and instantly list them for peer-to-peer trading, removing liquidity barriers in traditionally illiquid asset classes.

- Tokenized Bonds and Treasuries: Businesses developing Asset Tokenization Development Services can enable governments or corporations to issue bonds directly on blockchain, reducing issuance costs while ensuring real-time settlement and reporting.

- Fund Tokenization and Secondary Trading: Tokenized funds can be traded seamlessly under the same infrastructure, providing investors with 24/7 access to compliant secondary liquidity.

This clearly shows that using DLT to build compliant digital asset platforms expands capital formation and democratizes investment access, within regulated boundaries.

Use Case Example: SME Exchange Tokenization Platform in France

Let’s talk about a business offering Asset Tokenization Development Services that builds a platform for small and mid-cap French companies to issue tokenized equity. Under the DLT Pilot Regime, this platform can apply for DLT TSS authorization, allowing both issuance and exchange in a unified environment.

- Issuers can tokenize their shares, linking each token to legal ownership records in the DEEP register.

- Investors can onboard through KYC modules and receive regulated digital wallets.

- Trading can occur through a blockchain-native order book; settlement is instantaneous.

- Regulators can monitor activity through controlled access nodes.

Such a platform enables capital formation, liquidity, and compliance- all under one legally sanctioned framework.

How Businesses Can Align with France’s DLT Regime

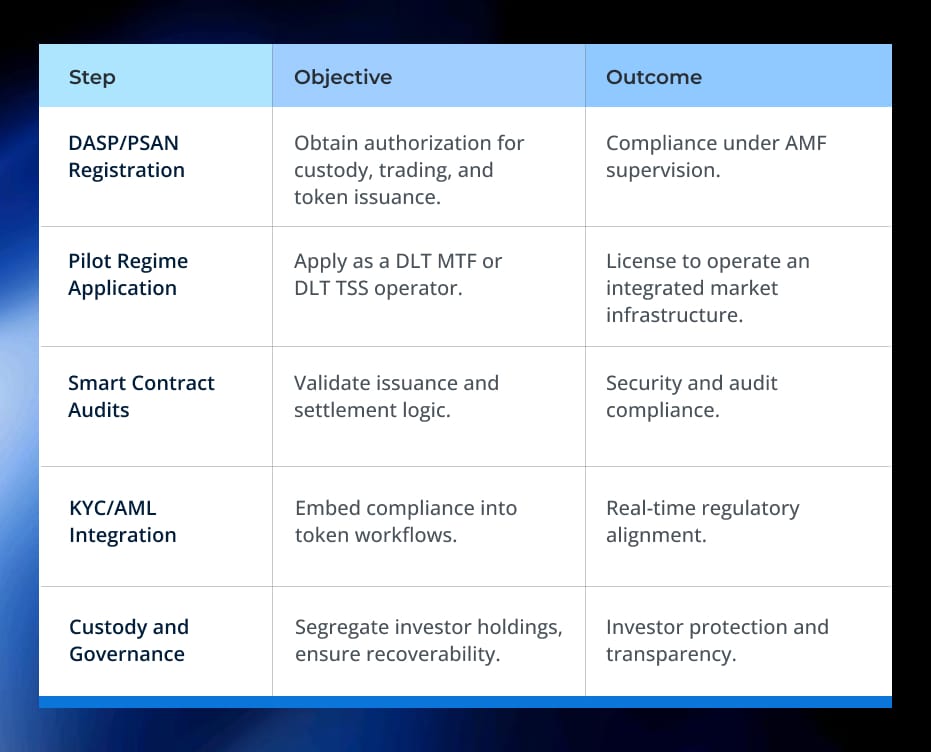

The path to building a compliant, exchange-integrated tokenization system involves several key milestones:

Each step reinforces the credibility and scalability of Digital Asset Tokenization under the France DLT regime.

France’s Role as Europe’s Tokenization Hub

The approval of LISE signals a broader European shift toward blockchain-native finance.

France’s DLT pilot regime serves as both an experiment and a blueprint for future EU-wide regulation.

With nearly €6 billion in tokenized assets permitted under the pilot, the country is positioning itself as Europe’s primary hub for compliant digital asset markets.

This will attract global capital, institutional partnerships, and a new wave of technology providers offering Asset Tokenization Development Services aligned with EU law.

Integrate Trading and Settlement Modules in Tokenization Platform!

Looking Ahead: What’s Next for Exchange Integrated Asset Tokenization Platform

As adoption accelerates, three trends are set to define the next phase of Digital Asset Tokenization Platform Development:

- Integration of Zero-Knowledge Proofs (ZKPs) for privacy-preserving compliance.

- Cross-border interoperability between DLT infrastructures across Europe.

- Institutional adoption, traditional exchanges integrating blockchain settlement rails.

By 2030, analysts project that tokenized financial assets could surpass $20 trillion globally, with Europe, led by France, capturing a significant share due to regulatory clarity.

Takeaway

France’s DLT Pilot Regime is a strategic reset for how financial markets function. By enabling tokenization platforms to act as exchanges, France has built the foundation for compliant, efficient, and inclusive capital markets.

Businesses leveraging Digital Asset Tokenization Platform Development can now deliver full lifecycle management. Investors, meanwhile, gain faster access, verifiable transparency, and regulated participation in Digital Asset Tokenization ecosystems. This framework is perfect to connect technology with trust and innovation with legality.

Choose Antier as your trusted partner to build a fully compliant, exchange-integrated Asset Tokenization Platform under France’s DLT Regime. With deep expertise in blockchain infrastructure, regulatory alignment, and financial systems design, our Asset Tokenization Development Company helps you go beyond basic tokenization for creating a unified ecosystem for issuance, trading, settlement, and custody, all on-chain and AMF-ready.

Whether you’re launching a DLT MTF, TSS, or hybrid exchange, Antier delivers the technical precision and compliance intelligence to get you licensed, live, and liquid fast. Build the future of regulated digital markets with the team that’s already doing it.

Frequently Asked Questions

01. What is France's DLT Pilot Regime?

France's DLT Pilot Regime, enacted through EU Regulation (2022/858), allows financial institutions to test the use of distributed ledger technology (DLT) for trading and settlement of traditional financial instruments, temporarily exempting participants from certain regulations.

02. What are the new regulated entities recognized under the DLT Pilot Regime?

The DLT Pilot Regime recognizes three new regulated entities: DLT MTF (Multilateral Trading Facility), DLT SS (Settlement System), and DLT TSS (Trading and Settlement System), which allows for combined exchange and settlement operations.

03. How does the DLT regime benefit businesses developing Digital Asset Tokenization Platforms?

The DLT regime enables businesses to operate a unified platform for issuance, trading, and settlement of tokenized assets, allowing for seamless transactions and lifecycle control within a legally recognized environment.