Even though your users have already migrated on-chain, is your rewards infrastructure still running on antiquated rails?

Conventional loyalty programs are having difficulty surviving in the tokenized economy of today. Web3-native users prefer real-time, programmable, and wallet-integrated cashback models, so a new paradigm is emerging in which digital assets replace points and smart contracts replace spreadsheets. This change is real and rapidly growing; it is not merely theoretical.

The rise of cashback is already being incorporated into contemporary neo banking app development ecosystems, from L2-optimized transaction flows to DeFi-compatible reward engines. Serious players have a genuine opportunity to obtain early traction, increase user retention, and steer the next stage of crypto neo banking thanks to this article’s analysis of how crypto cashback is changing loyalty in the fintech industry.

Current Market Dynamics Of Crypto Cashbacks & Credit Cards

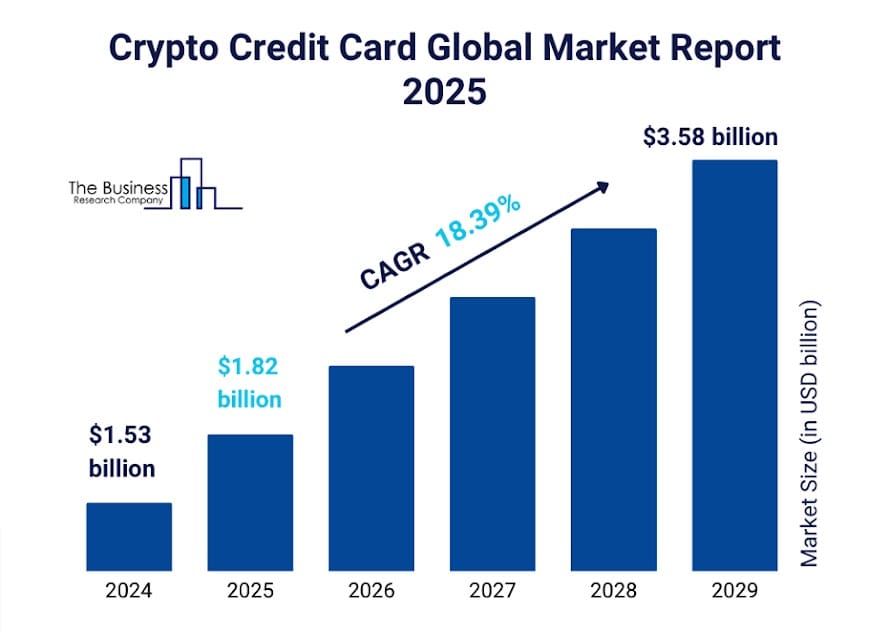

The world of credit cards is changing, and blockchain-powered crypto cashback is leading the charge. In 2024, the crypto credit card market hit $1.53 billion, and it’s on track to reach $1.82 billion by 2025, growing at an 18.8% CAGR. This boom has been driven by widespread blockchain adoption, a global push toward cashless payments, friendlier crypto regulations, and seamless integration of digital assets into everyday banking.

Source : crypto credit card global market report

At the same time, crypto-backed rebate models in crypto neo banking app development solutions are carving out their own niche. Over 5 million users worldwide now choose to earn Bitcoin or other tokens instead of traditional cash rewards, making up 3% of the entire cashback rewards market. In Asia-Pacific, 150 million people scan receipts and QR codes just to earn a few cents back, while 72% of top rewards apps combine branded loyalty points with direct cash back. Gamification and multi-tiered systems keep users engaged up to 22% longer, and 65% of new sign-ups come from word-of-mouth referrals.

For fintech investors, the opportunity is clear: platforms offering Bitcoin or Ethereum rewards have seen 400% user growth since 2022, and more than 45 providers now compete across North America and Europe. In 2024 alone, users earned 2,100 BTC in cashback, and 68% of them stayed active beyond a year—far outpacing traditional loyalty programs. As digital wallets and tokenized payments become the norm, integrating crypto cashback into your neo bank app development solutions with cards isn’t just an upgrade; it’s the future of customer loyalty and savings.

Neo Bank Cashback Crypto Cards vs. Traditional Crypto Cards

Why Should You Introduce Crypto Cashback in Your Neo Bank App Development With Cards?

Why Should You Introduce Crypto Cashback in Your Neo Bank App Development With Cards?

What if your customer rewards strategy could evolve from transactional to transformational?

Traditional cashback models seem out of date in a decentralized economy based on utility and engagement. Web3-native users expect real-time, wallet-integrated, token-based incentives that evolve with their financial behavior. Introducing crypto cashback into your crypto neo banking app isn’t just about attracting users; it’s about reengineering loyalty, unlocking programmable economics, and future-proofing your fintech product in a tokenized world. So the real question is, are you offering rewards that matter in the current market?

1. Accelerated User Growth & Retention – Investors see faster user acquisition as crypto-savvy consumers flock to platforms offering tokenized rewards and sustained retention—as on-chain cashback creates “locked-in” value, reducing churn by up to 25%.

2. Diversified, High-Margin Revenue – Beyond traditional interchange fees, platforms earn swap fees when users convert rewards, premium-tier subscription income, and partnership revenues from token campaigns—boosting overall margins.

3. Rich, On-Chain Behavioral Data – Every reward redemption on the blockchain neo bank app provides granular insights into spending patterns and loyalty triggers, enabling more accurate CAC modeling and informed decisions on product and marketing investments.

4. Automated, Compliant Operations – Smart contracts execute cashback logic instantly and error-free, slashing operational costs. Embedded KYC/AML wallet onboarding ensures regulatory alignment from launch, minimizing legal risk and compliance overhead.

5. Scalable, Future-Proof Architecture – Modular smart contracts allow adding new tokens or tweaking reward rates without full redeployment. Investors benefit from a tech stack that adapts to market trends and expands globally with minimal incremental cost.

6. Community-Driven Program Evolution – Token‑weighted governance lets your user base vote on reward structures and new features. This devolved model fosters engagement, reduces central management effort, and aligns platform evolution with user demand.

Core Features of a Blockchain Neo Bank App Development With Crypto Cashback Credit Card

“Design is not just what it looks like and feels like. Design is how it works.” — Steve Jobs

This quote couldn’t be more relevant to Web3-era financial products. A blockchain-powered neo cashback credit card isn’t just a novelty—it’s an engineered system of real-time smart contract triggers, gas-efficient transactions, and tokenized incentive flows. At its core, it merges Layer-2 scalability with secure custody mechanics and interoperable reward logic. What defines success here isn’t just issuing crypto rewards—it’s how modular, composable, and trust-minimized the entire cashback infrastructure truly is.

- On-Chain Reward Engine

A smart-contract module that calculates, mints, and distributes cashback tokens automatically for each qualifying transaction—ensuring instant, transparent reward settlement.

- Multi-Blockchain Compatibility

Native support for multiple networks (e.g., Ethereum, Polygon, BNB Chain, Solana) to issue and manage rewards on the chain best suited for cost, speed, or user preference.

- Integrated Crypto Wallet

An embedded MPC- or Account Abstraction (AA)-based wallet within the neobanking app that securely holds users’ cashback tokens and enables seamless on-app transactions.

- Tiered Reward Configuration

Flexible smart contract parameters allow you to define multiple cashback tiers (e.g., base, silver, gold) based on spend thresholds or token-holding criteria.

- Dynamic Category Boosts

On-chain rules to apply elevated cashback rates for specific spending categories (e.g., travel, dining) that can be updated via governance or admin dashboard.

- Instant Reward Redemption

In-app redemption flows enable users to swap, stake, or spend their cashback tokens immediately—powered by integrated DEX or swap aggregator APIs.

- Real-Time Analytics Dashboard

A back-office interface displaying live metrics on card usage, reward issuance, gas costs, and on-chain user behavior for operational monitoring and optimization.

- Built-In Compliance & KYC/AML

Wallet and card onboarding processes with embedded identity verification workflows, transaction monitoring, and smart contract checks to ensure regulatory adherence.

- Gas Optimization Mechanisms

Batch payout scheduling and meta-transaction relays (gas sponsorship) to minimize on-chain transaction fees and provide a smoother user experience.

- Upgradeable Contract Architecture

Modular contract design with proxy patterns or governance-controlled upgrades, allowing new features, tokens, or reward rules to be added without full redeployment.

Delivering seamless, real-time crypto rewards requires more than just plugging in a token; it demands precision-engineered features that align with Web3 standards. Partnering with a crypto neo-bank app development company ensures your platform is equipped with the core architecture needed to launch high-performing, scalable, and loyalty-driven blockchain cashback card solutions.

Real Success Stories of Neo Cashback Credit Cards

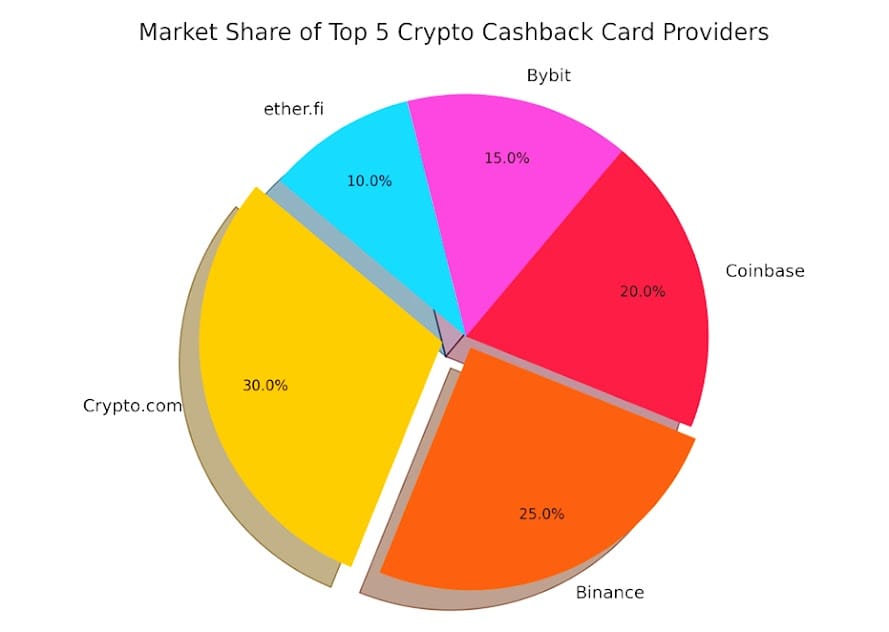

Before we look at the neo cashback credit card market share breakdown, it’s important to recognize the momentum already building in the Web3 financial landscape. Five leading platforms—Crypto.com, Binance, Coinbase, Bybit, and ether.fi—are actively offering blockchain-powered crypto cashback features through their credit or debit card ecosystems.

Apart from the aforementioned 5 major players who are offering crypto cashbacks in the Web3 industry, there are these two below-stated Japanese financial players who have already begun weaving crypto cashbacks and loyalty points into everyday crypto neo banking products:

- SBI Group’s APLUS Points → Crypto Conversion

In early 2025, SBI announced that holders of its APLUS credit card loyalty points can now convert up to 2,100 APLUS points into Bitcoin (BTC), Ethereum (ETH), or XRP—effectively turning traditional card rewards into on-chain assets. While not a direct “cashback” in crypto, this marks the first time a major Japanese bank lets customers redeem points for digital currencies, signaling institutional backing for token-based loyalty.

- Rakuten Wallet’s Rakuten Super Points → Crypto Assets

Rakuten Wallet—Rakuten Group’s regulated crypto exchange—has enabled users since December 2019 to swap their Rakuten Super Points (1 point = ¥1) directly for BTC, ETH, or BCH in the Wallet app. Although not tied to a credit card per se, this service allows Japan’s largest loyalty program to deliver “crypto-cashback” by converting widely used e-commerce points into spendable digital assets through Rakuten Pay and Rakuten’s retail network.

Together, these moves by SBI and Rakuten illustrate Japan’s cautious but clear shift toward crypto-enabled rewards—laying the groundwork for true blockchain-driven cashback credit cards in the country.

The Loyalty Game Has Begun: Launch Your Neo Cashback Card With Antier!

What if your next big fintech innovation isn’t a new card but rather a reconsideration of the way your neo banking crypto card rewards are given out?

Blockchain-driven neo cashback credit cards aren’t just about adding cryptocurrency; they are about creating more smart, interesting financial experiences that people want to use. The market currently rewards quick thinkers, early adopters, and those who look beyond conventional loyalty models. With modular, scalable, and Web3-native end-to-end crypto neo-banking app development, Antier assists you in doing just that. With features like smooth multi-chain wallet integrations and smart contract-driven cashback engines, our certified blockchain experts give you the tools you need to drive this change rather than follow it.

Contact us today to be the trendsetter!

Why Should You Introduce Crypto Cashback in Your Neo Bank App Development With Cards?

Why Should You Introduce Crypto Cashback in Your Neo Bank App Development With Cards?