The Central Bank of the Argentine Republic (BCRA) has been preparing to lift the long-standing ban that prohibited banking institutions from offering digital asset-related services. With Argentina’s regulatory authorities now greenlighting the cryptocurrency exchange software and custody services, banks and financial institutions have a clear path to enter the market.

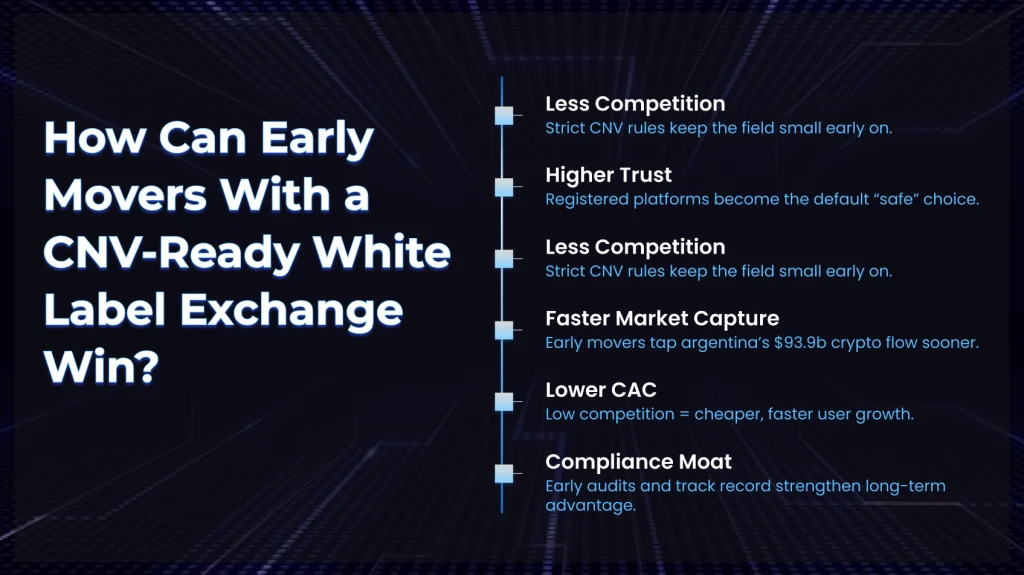

The real shift occurred when the CNV (Comisión Nacional de Valores) introduced its official VASP Registry, as outlined in Resolution 1058/2025, thereby establishing a regulated environment and a six-month “permission to operate” window. The early filer compliant crypto services providers gain 12-18 months of market dominance before the competition catches up. The structured, high-bar regulatory framework mandates transparency, capital adequacy (ARS 100M minimum), custody standards, and strict AML controls.

In case you’re still thinking why you should launch your crypto exchange software in Argentina in 2026, you’re late already.

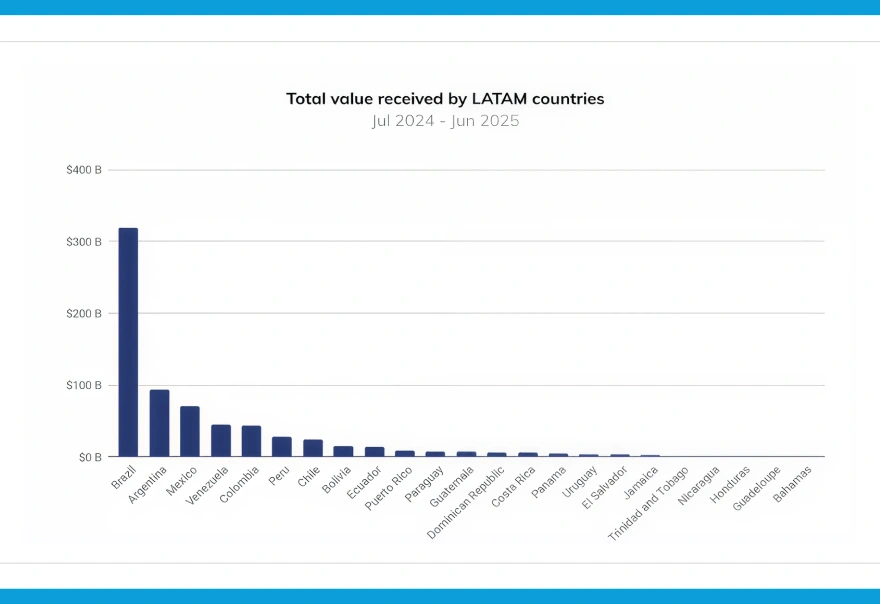

- The crypto economy in Argentina moved $93.9B, the second-largest in LATAM.

- 50+ VASPs submitted filings after the registry opened.

- Stablecoins, mainly Tether, dominate the total crypto transaction volume in Argentina by 60%. They’re a key tool to hedge inflation.

- 22.8% of Argentines already hold crypto, expected to reach 24.56% by 2026.

If you’re a bank, fintech, brokerage, retail financial services provider, or a global exchange, now is your moment to tap the largest market. A bank-grade CNV-ready white label cryptocurrency exchange development solution removes the biggest entry barrier, i.e., regulatory uncertainty. The ready-to-deploy backend and customizable frontend let you launch your branded crypto exchange superapp in just 7 days.

Who Can Benefit From CNV-Ready White Label Cryptocurrency Exchange Development?

| Segment | Key Stat Snapshot | 90-Day ROI Angle |

|---|---|---|

| Banks | $93.9B crypto volume driving deposit outflows | 15–20% retention via in-app crypto |

| Fintechs | 383 fintechs, 11.7% YoY growth | 25% user engagement lift |

| Brokerages | 5 major crypto integrations in 2025 | 10–15% AUM boost |

| Retailers | 100+ merchants accept crypto | 30% loyalty app usage spike |

| Global Exchanges | 5 major LATAM entries | 2× expansion speed |

| PSPs (Payment Service Providers) | Millions of daily transactions + rising crypto QR adoption | New fee revenue + instant merchant settlement |

| Lending Platforms | Stablecoins are used by 61.8% of Argentines for inflation hedging | Higher repayment reliability + crypto-backed loan demand |

| Remittance Providers | Crypto remittances are 70–90% cheaper than traditional rails | 2-3× margin improvement via USDT cross-border transfers |

Each of these segments faces immediate competitive pressure, and CNV-compliant white-label cryptocurrency exchange development solutions remove their biggest excuse for waiting.

1. Small & Mid-Sized Banks

The Reality

- 35.9% inflation in 2025 pushed Argentine customers to move funds into stablecoins.

- Banks lost 10-15% of deposits to offshore crypto exchanges.

- Customers want a hedge, but they’re forced to leave the banking ecosystem to get it.

Why Banks Need a White Label Crypto Exchange Integration Now

- Keeps users inside the mobile banking app

- Recovers lost spread, custody, and transaction revenue

- Builds competitive resilience against larger banks preparing CNV filings

Benefits of CNV-Aligned White Label Exchange Software

- Capital adequacy and AML frameworks are already included

- CNV reporting engine eliminates regulatory bottlenecks

- Local fiat rails retain deposit liquidity

If Argentina’s banks don’t offer crypto this year, they’ll lose another 10-20% of customer wallet share to fintechs and offshore platforms.

2. Fintechs & Neobanks

The Current Fintech Landscape

- Argentina has 383 fintechs, growing 11.7% YoY.

- Argentina’s BNPL market alone hit $2.15B, proving massive digital adoption.

- 22.8% of the population demands seamless crypto trading inside their financial apps.

Why Fintechs Can’t Wait For A White Label Cryptocurrency Exchange Integration?

- Banks entering crypto will erode fintech differentiation.

- Without crypto APIs, user retention will drop fast.

- Embedded crypto boosts retention by 25%.

Why CNV-Alligned White Label Cryptocurrency Exchange Development Works For Fintechs

- Crypto trading, yield, crypto payments, secure custody, etc., integrated with clean APIs

- Zero compliance burden, as CNV alignment is already covered

- Reliable white label cryptocurrency exchange development solutions offer deep liquidity and instant KYC synchronization integrations.

What are the Features that Banks and Fintechs Require in White Label Crypto Exchange Software?

- Crypto trading

- Secure digital asset custody

- Crypto Staking

- Lending and Borrowing

- Fiat/Crypto Ramps

- Crypto Swaps

- Embedded crypto buy/sell

- Savings in stablecoins

- Crypto Payments

Fintechs that add crypto now will widen their retention gap before banks catch up.

3. Brokerages & Wealth Managers

The Current Market Scenario

- LATAM brokerages saw 5 major crypto acquisitions/integrations in 2025.

- High Net-Worth Individuals already participate in the $93.9B Argentine crypto market.

- Adding a compliant crypto desk (spot, OTC, custody, yield) can add 10-15% AUM growth as clients can shift more of their portfolio into that platform.

What Features Do Brokerages & Wealth Managers Need In White Label Crypto Exchanges?

- Institutional-grade charts

- Pro trading dashboards

- Crypto trading and secure custody

- Crypto staking and yield generation

- Crypto swaps

- Segregated accounts

- Deep order book liquidity

- Built-in OTC desks, margin trading, and reporting tools

- CNV compliance modules

Brokers who wait will see HNIs shift assets to competitors offering unified crypto portfolios.

4. Large Retail Chains & E-commerce Platforms

The Consumer Reality

- 100+ merchants now accept crypto QR payments in Argentina.

- Crypto-backed rewards beat point-based programs.

- Retailers adding small crypto purchase options, such as “Buy $5 of Sol to get 5% off on your next fuel refill” inside their app, see their app usage grow by 30%.

- USDT is now a savings tool for consumers battling inflation in Argentina.

Why Retailers Should Implement Features From CNV-Aligned White Label Exchanges?

- The best CNV-compliant white label crypto exchange development company offers prebuilt crypto exchange solutions with crypto loyalty, QR-based micro purchases, staking, crypto swaps, tap trading, payments, etc. These are the features that Argentina’s retail chains and e-commerce can implement without deviating from their product lines.

- No financial expertise required, as the backend is entirely outsourced with these white label cryptocurrency exchange development solutions.

- Crypto loyalty programs boost in-store and online activity for e-commerce and retail chains.

Retailers hold massive user bases. Adding crypto means instant new revenue line with minimal risk.

5. PSPs, Lending Platforms & Remittance Companies

The Market Reality

- Argentina’s PSP ecosystem powers millions of micro-transactions daily, from bill payments to mobile top-ups.

- Cross-border remittances using crypto rails in Argentina have surged in 2025. They offered >1% fees, which saved 5-10% compared to traditional channels.

- Lending and credit apps are struggling with inflation and rising underwriting risk. Crypto lending modules in top white label exchange platforms offer a better alternative to these fintechs.

Why Should PSPs, Lending Platforms & Remittance Companies Integrate White Label Exchange Platforms?

- PSPs need new high-margin services to stay competitive as the CNV framework legitimizes crypto money movement. With white label crypto exchange development, they can add new revenue-generating features without breaking the bank.

- Remittance providers can slash FX and settlement costs using USDT/USDC rails.

- Lending companies can offer crypto-backed loans, savings in stablecoins, or treasury diversification for borrowers. This way, they can hedge inflation risk and expand product lines.

What Features Do PSPs, Lending Businesses, & Remittance Companies Require in White Label Exchanges?

- Instant crypto on-ramps/off-ramps for PSP wallets

- USDT-based remittances with same-day settlement

- Lending integrations: crypto collateral, automated liquidation engines, stablecoin yield products

- CNV-ready compliance: AML, transaction monitoring, VASP reporting, source-of-funds checks

6. Global Exchanges

Market Reality

- Nexo, WhiteBIT, and three others entered LATAM via VASP registrations or acquisitions in 2025. This strategy enabled 2× regional expansion speed.

- The CNV framework standardizes entry for any global exchange wanting to unlock Argentina’s $93.9B demand.

Get Your CNV-Alignment Checklist For White Label Crypto Exchange Selection

Why Should Global Exchanges Launch With CNV-Compliant White Label Crypto Exchanges?

- Skip the 12-month compliance overhead

- Plug into local fiat rails instantly

- Deploy a branded exchange in weeks

- Get AML, reporting, custody, and liquidity as per the CNV and BCRA requirements, ready from day one.

What are the White Label Exchange Features That Global Exchanges Require For Argentina Launch?

- Fully white-labeled UI

- Local compliance modules

- Integrated local banking rails

What are the Business Benefits of CNV-Ready White Label Crypto Exchange Development?

Banks and enterprises don’t have 12-24 months to build compliant exchanges from scratch. The CNV rules are strict, but the market is moving fast. Users are already expecting crypto payments, trading, custody, and a lot of other features inside their daily financial applications. A CNV-ready white-label cryptocurrency exchange development solution solves this problem. They come with:

- Compliance Baked In: KYC/AML, reporting engine, custody, audit trails, and more.

- Slashed Time-to-Market: Launch in just 4-8 weeks, not years.

- Cost Efficiency: Avoid multi-million-dollar R&D and regulatory overhead with a turnkey cryptocurrency exchange development solution that aligns with CNV and BCRA’s guidelines.

CNV-aligned white label crypto exchanges come with ready-to-deploy exchange architecture, compliance baked in, and local fiat rails, the trio required to win Argentina’s exploding digital asset market. Banks, fintechs, brokers, and retailers can, therefore, participate in Argentina’s officialized crypto economy almost immediately, without the operational risk.

Antier: Your CNV-Compliant, Bank-Grade White Label Crypto Exchange Provider

The CNV registry’s early filing period closes Q1 2026. If you delay your crypto exchange expansion in Argentina, it could mean a 20-30% loss in market share as banks and fintechs will go live first.

If you’re planning to enter Argentina’s regulated crypto market, you need a partner with execution history and technical depth.

What You Get With Antier

- 250+ live exchanges

- 700+ blockchain engineers

- Argentina-ready CNV compliance modules

- 4–8 week deployment cycles

- Crypto Exchange Legal Services

- Bank-grade custody + liquidity stack

Join enterprises building the next generation of regulated crypto services, without the regulatory drag. Schedule your call with Antier’s subject matter experts today.

Frequently Asked Questions

01. What recent changes have been made regarding cryptocurrency services in Argentina?

The Central Bank of the Argentine Republic (BCRA) is lifting the ban on banking institutions offering digital asset-related services, allowing banks and financial institutions to enter the cryptocurrency market following the introduction of the CNV's official VASP Registry.

02. What advantages do early filers of crypto services providers have in Argentina?

Early filers compliant with the VASP Registry gain a 12-18 month market dominance before competition increases, benefiting from a structured regulatory framework that ensures transparency and capital adequacy.

03. How significant is the cryptocurrency market in Argentina?

The crypto economy in Argentina moved $93.9 billion, making it the second-largest in LATAM, with 22.8% of Argentines already holding crypto, expected to rise to 24.56% by 2026.