Real Estate Tokenization Development on XRP Ledger is changing the dynamics of property ownership and investments. While XRP Ledger contributes to the speed, performance, and efficiency, Blockchain adds transparency and security to the tokenization platform, making it an ideal solution for real estate transactions.

In this guide, we have outlined the essential steps for Real Estate Tokenization Platform Development on XRPL. Find detailed insights on infrastructure planning and regulatory structure for platform design, investor acquisition, and scalability.

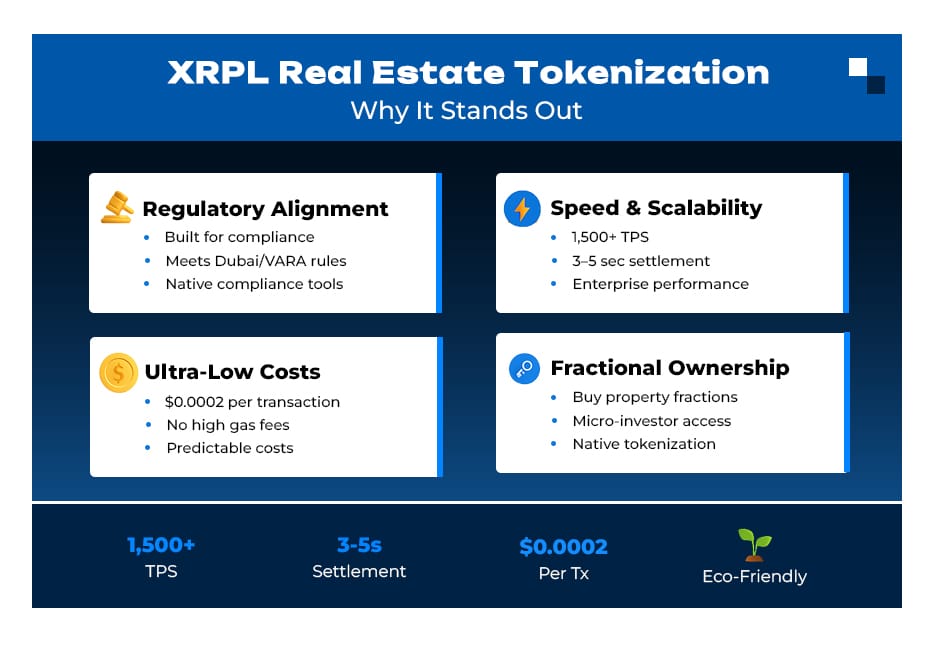

Why is the XRP Ledger an Ideal Platform for Real Estate Tokenization Platform Development?

XRP Ledger is long known for its minimal transaction cost and faster settlement time. This multi-purpose platform comes with a plethora of features, making it an ideal foundation for Real Estate Tokenization Platform Development. By converting Real Estate Properties into tradable digital tokens for higher liquidity and accessibility in property trading.

Here are the features that set XRPL real estate tokenization apart from the other blockchain platforms:

- Transaction Speed: With the XRPL tokenization platform, investors can complete the token transfers in 3 to 5 seconds, which is ideal for real-time trading.

- Low Fees: Transaction costs are minimal, enabling investors to make micro-investments and frequent trades.

- High Throughput: XRPL delivers up to 1,500 transactions per second, ensuring the network scales with demand.

- Security and Trust: The XRP Ledger is decentralized, transparent, and secure.

- Built-in Token Tools: XRPL includes native support for token creation, a decentralized exchange (DEX), and programmable features.

These benefits make XRPL an excellent foundation for any Real Estate Tokenization Development Company looking to serve both property owners and investors across borders.

Step-By-Step Guide to Launch and Scale a Real Estate Tokenization Platform on the XRP Ledger

Step 1: Build a Technical Foundation

1. Define Infrastructure and Development Strategy

Begin by choosing the right development approach, whether to build in-house or partner with a blockchain development firm specializing in XRPL real estate tokenization. XRPL offers several tools for integration:

- xrpl.js, xrpl-py, and JSON-RPC APIs for direct blockchain interaction

- SDKs for common programming languages to accelerate development

- Third-party services for compliance, KYC, wallet management, or legal automation

A modular infrastructure ensures that users can easily scale or adapt to regulatory changes.

2. Use XRPL Hooks for Custom Logic

While XRPL doesn’t offer traditional smart contracts, its “Hooks” framework enables on-chain logic such as:

- Automated rent payouts to token holders

- Compliance triggers (e.g., freezing tokens if flagged)

- Payment-based token transfers

This lightweight yet powerful logic allows a high level of customization without sacrificing speed or cost-efficiency.

3. Wallet Integration

Integrate user-friendly wallets for Cross-Border Real Estate Tokenization on XRPL. The multichain wallet enables you to store and manage XRPL-based assets. Features to prioritize include:

- Multi-signature wallets for institutional investors.

- Cold wallet support for long-term token holders.

- Mobile-first UX to appeal to a global audience.

Step 2: Legal Structure and Compliance

For the success of any Real Estate Tokenization platform, it is crucial to have legal clarity. Integrating a compliant framework should be the utmost requirement. Here is what platform builders need to take care of:

1. Jurisdiction and Entity Formation

Start by choosing the jurisdiction with blockchain-forward regulations. Set up a Special Purpose Vehicle (SPV) on the tokenization platform to isolate asset ownership and liability from the token issuance process.

2. Regulatory Readiness

The Asset Tokenization Solutions must have:

- KYC and AML compliance through the trusted identity verification tools.

- Licensing for the platform to handle property sales or asset management.

To ensure ongoing compliance, Realtors can work with legal counsel familiar with cross-border real estate tokenization on XRPL.

3. Tokenholder Rights

The smart contracts in the tokenization platform should define investor rights clearly. These may include:

- Revenue sharing process from rental income.

- Governance participation (e.g., voting on asset sales).

- Transparency into property performance.

Step 3: Asset Preparation and Token Design

1. Fractionalized Properties

The XRPL Asset Tokenization Platform can support six decimal places, enabling investors to create tokens for micro-investments. This makes real estate investments accessible to more investors on a global scale.

2. Asset Vetting and Metadata

Before tokenizing any property, the platform owner needs to ensure assets are vetted and documented. This includes:

- Title verification with no disputes or liens.

- Independent valuations by certified professionals.

- Metadata embedding: Attach images, deeds, rental history, and geographic tags to each token for full transparency on-chain.

This contributes to building investor trust and improves the decision-making process.

Step 4: Platform Experience and Functional Design

The success of the Real Estate tokenization platform highly depends on its user experience. Investors expect intuitive, secure, and accessible interfaces. Real Estate owners can meet this goal with features like:

1. Dashboard Architecture

Consider developing two interfaces for your tokenization platform:

- Investor Dashboard 5o displays holdings, rental returns, and transaction history.

- Admin Dashboard to handle token issuance, asset analytics, and user management.

Mobile compatibility is non-negotiable. This helps to attract international users who may rely primarily on smartphones.

2. Trading and Liquidity

Leverage XRPL’s built-in Decentralized Exchange (DEX) to allow real-time token trading. To support liquidity, integrate Automated Market Makers (AMMs) and consider launching liquidity pools for major token offerings.

Step 5: Investor Onboarding and Marketing

For investors onboarding, begin by:

1. Building a community

Trust and clarity are the key to success. Start by educating your investor. The process includes running:

- LinkedIn and Twitter campaigns that target crypto-savvy investors and real estate enthusiasts.

- Webinars and demos to simplify complex concepts

- Partnerships with developers, brokerages, and crypto influencers to expand reach.

2. Token Distribution Strategy

- Whitelisting Phase: Limit early access to verified, accredited investors.

- Staged Sales: Release tokens in phases to manage price and demand.

- Referral Rewards: Encourage organic growth via community incentives.

Step 6: Scaling and Global Growth

1. Blockchain Interoperability

Once the platform gains traction, broaden its reach through:

- Bridges to Ethereum, Solana, or BNB Chain.

- Wrapped tokens (wXRP) to extend functionality across DeFi platforms.

2. Analytics and Intelligence

Integrate data tools that offer:

- Real-time Market Feeds for property prices and rental yields.

- AI-driven Insights to forecast investor behavior and optimize asset pricing.

Step 7: Institutional and Government Collaboration

Explore partnerships with:

- Land Registries to automate updates to property title records.

- Regulatory Agencies are to shape future policy and ensure long-term sustainability.

Step 8: Operational Continuity and Investor Relations

1. Reporting and Governance

Maintain trust with transparent investor communication through:

- Quarterly Reports covering asset performance, income distribution, and growth plans.

- Voting Systems to allow tokenholders to participate in strategic decisions.

2. Support Infrastructure

- 24/7 Investor Support: Establish a multilingual helpdesk for international users.

- Community Forums: Create open channels for feedback and engagement.

Takeaway

The future of real estate is digital, and the XRP Ledger is playing a leading role in that transformation. Its built-in features, speed, and low costs offer a powerful framework for those looking to build platforms that connect property assets with global capital.

For anyone exploring Real Estate Tokenization Development, this guide outlines not only the technical and regulatory blueprint but also the real-world potential of creating a more inclusive, efficient, and borderless real estate market.

Partner with Antier, an industry-leading Real Estate Tokenization Development Company. From concept to launch, we help you build compliant, scalable, and investor-ready platforms on XRPL. Let’s bring your real estate assets to the blockchain.